Advanced Parimutuel Options

Advanced Parimutuel Options(APO)

A decentralized platform for cryptocurrency derivatives based on parimutuel betting.

Currently the market does not offer instruments for insuring against the risk of extreme price fluctuations. Though there are futures and options available on centralized exchanges, there are more minuses than pluses.

For example, high option premiums or margin requirements for futures in the range of 80-100%. The reason - inability to insure the risk of sellers which results in high cost of options for buyers.

How it Works

Auction

The date of the auction is appointed one week before expiration. The frequency and duration of the auction will be determined during Beta testing.

We intended to use the standard expiration dates for options:

2 weeks

1 month

3 months

Based on this, the frequency of the auctions will depend on the nearest expiring contract, such as 1 week before the expiration of 2-week options, monthly options, or 3-month options. The main purpose of the auction - calculation of premiums and payments based on submitted bids. Each participant constructs the desired option or chooses one from a template, and enters the strike price of the underlying asset (BTC or ETH). After that, the participant chooses the type of order - market or limit and transfers the amount required to buy the option to the account of the smart contract.

Announcement of the date and time of the auction

Start of the auction

Collection of orders (limit and market)

End of the auction

Calculation of commission and payments for each trade

Trades

After the auction is over and all the submitted bids are counted, a pool is formed. After the completion of the transaction, each participant using their own account through a website or mobile application, can see the options that accrued (along with their parameters) and monitor their value until expiration.

Filling market orders and filling/rejecting limit orders

Calculation of commission and recording into the pool

Recording of option buyers

Expiration

Expiration is the moment when the contract expires, and is the date of settlement. The option execution date is indicated in advance during the auction, for example, 12 am on January 12, 2018.

At the time of expiration, the price of the underlying asset is locked in (the price of BTC or ETH index is taken from several major exchanges for determination). Based on that price, payments are made to option holders. After the execution, each participant can check the status of their account.

Locking-in the price of the underlying (Bitcoin/USD or Ethereum/USD)

Publishing cut-off price

Payout to participants who s options are profitable

ICO Details

Token Name : APO

Token Type: ERC20

ICO Starts : April 25th, 2018 at 10:00:00 AM UTC

ICO Ends : May 23rd, 2018 at 09:59:59 AM UTC

Soft Cap: 6,000 ETH

Hard Cap: 14,000 ETH

Token Rate : 1 ETH = 15,000 APO

Min Transaction Amount : 0.1 ETH

Bounty: Yes

Token Distribution

ICO Sale : 40%

Reserve : 25%

Private Investor : 10%

Team : 20%

Bounty : 5%

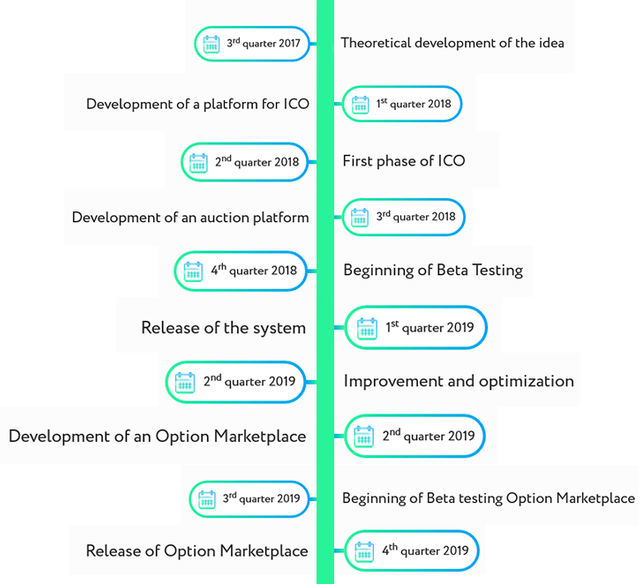

RoadMap

Official Website :

https://apofinance.io/

White Paper :

https://apofinance.io/files/whitepaper.pdf

Join Us on Telegram :

https://t.me/apofinance

Social Media Links :

Twitter : https://twitter.com/apofinanceico

Bitcointalk Thread :

https://bitcointalk.org/index.php?topic=3207939.0