Sunmoney Solar Group - Turning Sunlight into Green Profits on a Global Scale

The deregulation of the energy market in numerous countries around the world has led to an influx of private investment in recent years, particularly in the green energy sectors, and more specifically, solar energy.

The solar power market is presently about 1% of marketshare, but expected to grow to 30% within the next 20 years, so has a favourable long-term outlook. Power prices are expected to double within the next 20 years, and quadruple within the next 40 years, due to global growth in demand for electricity.

This is a rapidly growing market and there are more players entering the game every year. This has led to a very competitive marketplace, and companies are always looking for the next opportunity to access new markets, increase output and consumption, and generally build a bigger and better business for themselves.

A key factor in increasing customer numbers is being able to access investment globally, and the recently technological advances in blockchain technology has allowed many businesses to tap in to fresh funding sources in the world of cryptocurrency. For those uninitiated with the concept of a blockchain, it is the underlying technology that allows cryptocurrencies to function and record information. Blockchain technology is proving to be a popular method for mainstream businesses who are looking to expand their wings, as it opens up investment from new financial markets that would otherwise be unavailable. Blockchain technology also allows for transparency of business practices, as the records contained on the blockchain are verifiable, accessible and immutable.

The Sunmoney Solar Group (SSG) (http://www.sunmoney.solar) is one such company looking to tap into the world of cryptocurrency funds and blockchain functionality.

Established in 2013 with a 2 million Euro investment from private investors, SSG is an international group based in Fujairah, UAE (contracts and payments), Munchen, Germany (realization, management and maintenance of physical assets) and Singapore (marketing and sales in the Asian region), and currently boasts more than 10,000 members throughout 28 countries.

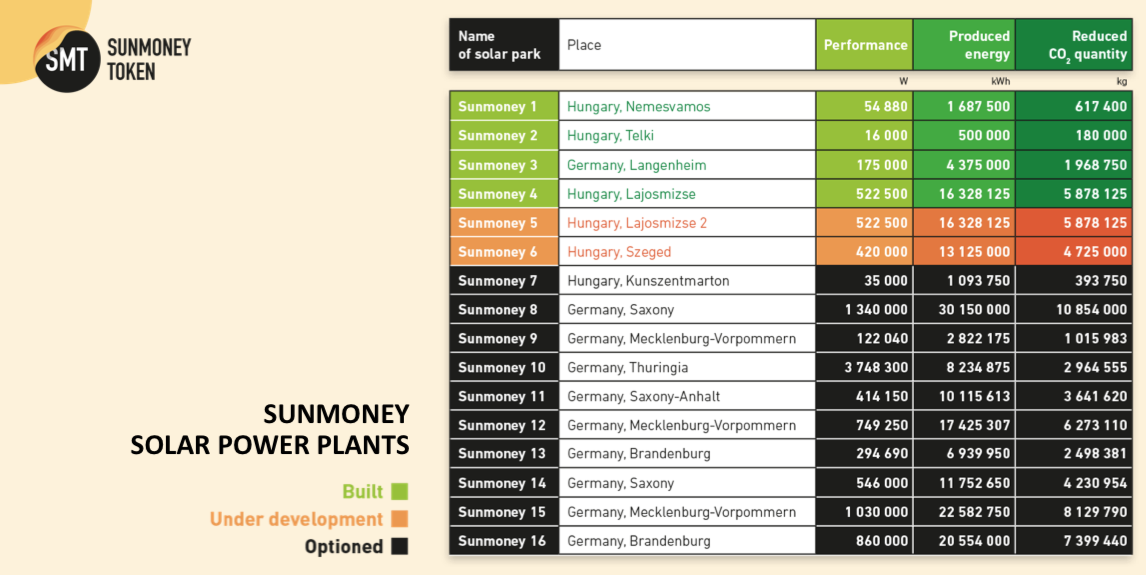

SSG currently own, operate, or have optioned an active capacity of 20MW of solar power plant output, and have launched an ICO with a view to raising sufficient funds to build 30MW of solar power capacity in Germany and Hungary before the end of 2018.

The Tokensale:

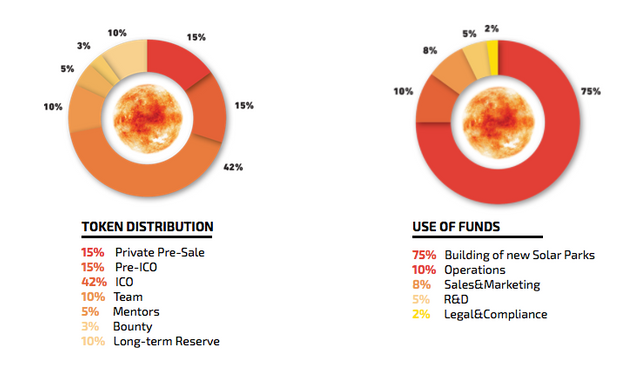

With 10,000,000 SMT tokens generated and 7,200,000 offered for sale during the ICO, the team is keeping a reasonably small 10% for internal distribution, which is a lot less than many other ICOs in recent times.

The SMT Tokens are priced at 150SMT per 1 ETH, with early buyer bonuses and volume bonuses available.

The Token Sale ends on 15 April 2018.

Token Use:

While holding the Tokens won’t pay dividends like some other energy-sector ICOs, there are some attractive perks on offer for Tokenholders, such as special discounts on Sunmoney Business Packages.

The Sunmoney Roadmap includes some other interesting opportunities for token holders in the future, including the opportunity to have priority access in the event of a future IPO, and the ability to use the SMTs to buy 25-year (from plant commencement) Commission Rights once the new investment platform is launched.

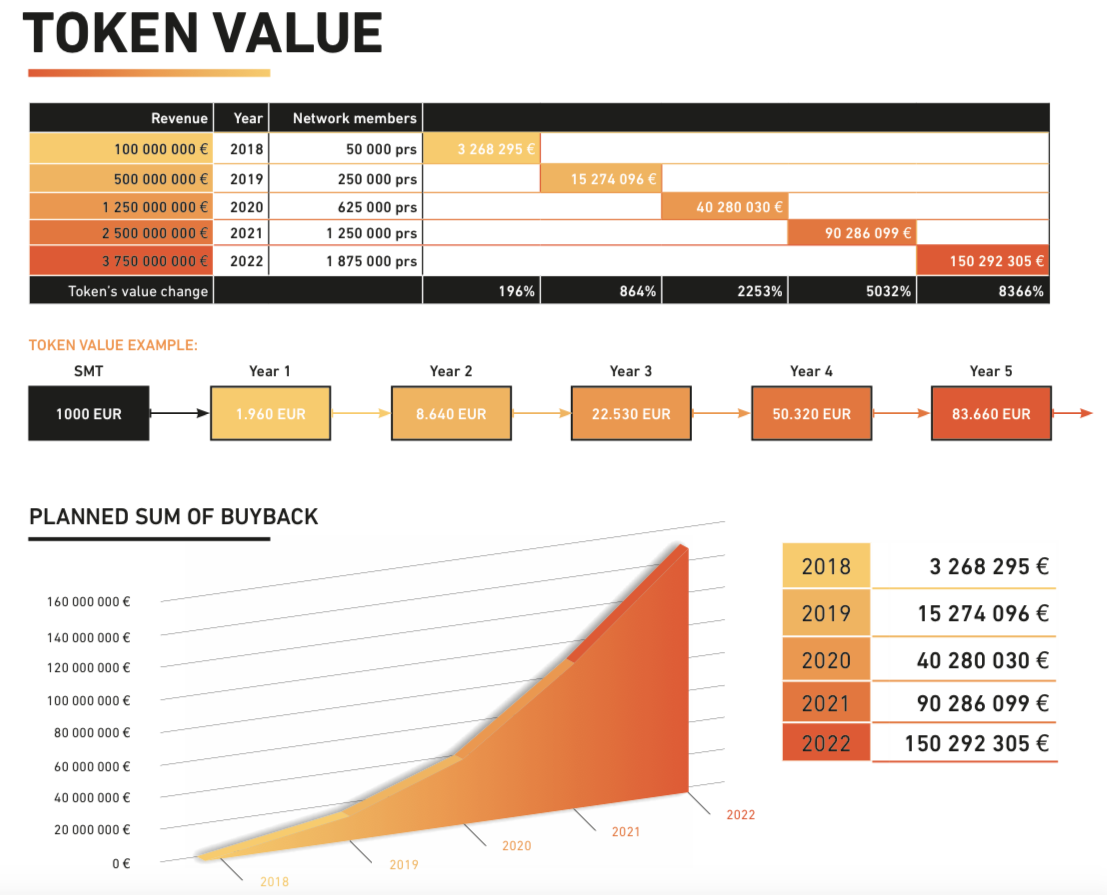

However, the biggest attraction, at least for me, is the structure of the SMT token buyback program. SSG have committed to use 20% of their yearly profits or 3% of yearly turnover (whichever is higher) to buy back and destroy SMT tokens. Therefore, the longer you hold onto your tokens, the less number of tokens will exist, and the greater the value share each subsequent year of the buy back programme. The graph provided in the White paper shows some very attractive forecasts for the long-term.

Other SSG Business Aspects:

Other revenue streams are also discussed in the SSG offering, including a Community Building/Network Marketing Program, Crypto-Mining, and future Expansion Plans.

SSG have membership in the following:

Global Compact Network UAE (United Nations)

Caring for Climate (United Nations)

International Solar Energy Society

Renewable Energy Alliance

The Team:

The SSG team comprises 8 core members.

They also have 5 Energy Sector Advisors and 4 ICO/Blockchain Advisors who appear well-qualified to bring the ICO to a successful completion.

Relevant Links:

I am not a financial analyst. The above information should not be construed as financial advice and is not intended as financial advice. Always do your own research before investing in anything. The price of SMT tokens may be volatile once listed on any exchange, and purchasing cryptocurrencies can be a high risk activity.

If you’re looking for other article reviews by this author, please check out this Telegram channel: https://t.me/aussiesloth_ico

Proof of ownership - ETH address: 0xcE497066921f8aE00d1128d8B9cA105f025DF210