Why Def-fi? - Trying the Commonwealth Savings Contract

Why De-Fi?

It seems everywhere I turn these days Def-fi (aka Decentralized Finance) is the topic Du Jour! The idea of shedding our lives of banks and centralized services that have huge fee's and enrich the worlds 1% is gaining traction. Prior to the invention and adoption of Blockchain Technology the hope of one day living a bank free life seemed impossible.

As a teen looking to open a bank account I was surprised to see how every bank was offering a free gift, if I would open an account. I can recall being offered by a bank a free cordless drill, a $100 gift certificate, and the winner was one that offered free groceries. I asked the banker as I filled out the paperwork how they could afford this? He replied that in their training class they were told "Every new customer that could be acquired and retained would give the bank $1 000 000 in services charges/revenue through a lifetime". The free perks they gave me was nothing in comparison to what I would the bank . I still have that account and even had a mortgage with them. So I now see and understand how much economic energy is lost from our lives and handed over to banks.

What is De-Fi?

Banks do provide necessary financial services to us all. This includes, sending/receiving funds, savings accounts, loans and investments (speculative and guaranteed). While we need these things to have a healthy and functioning economy the question is do we need to overpay these huge fees? De-Fi short for decentralized finance is the idea that we try to replace the services of the bank with math & smart contracts on an immutable secure blockchain. This rids us of corruption, fee gouging and waste. With the added benefit of conducting banking anytime, anywhere not just 9 to 5. Think of De-Fi as Digital Cameras vs Film, Kodak was once one of the 12 largest companies on earth! Now is just a memory. When digital cameras first came out they where used by computer hobbyists. After the digital camera became part of the cellphone, it now is the bulk of all photography, with traditional film being used as novelty or is special cases.

I believe this pattern will be the same for De-Fi vs Banking. However it won't be as smooth a transition as photography as banks hold huge sway over governments. They will attempt to legislate their position in the economy.

Where is the De-Fi action?

The bulk of De-Fi is on the Ethereum blockchain with $675 million USD on chain in the ecosystem (ref 1). Ethereum Classic (ETC) is another popular blockchain where De-Fi economic activity is gaining traction in terms of use and development. There are many other blockchain projects trying to enter the space such as Tron, Neo and BNB but the Solidity based blockchain of ETH and ETC have first mover advantage. There are even plans to allow cross-chain asset transfers between the protocols (ref 2).

What is Commonwealth?

Commonwealth is a De-Fi Savings Account on ETC. When ETC is deposited into the Smart Contract 10% of the funds are paid as a Dividend to all Commonwealth points holders. Conversely when money is withdrawn the value of the points you hold drops slightly. As the with the traditional banking sector which has FDIC (USA) or CDIC (Canada) insurance on savings the Commonwealth Smart Contract has the "Rainmaker". Rainmaker contains 60,000 points and collects a portion of all dividends to act as backer in case of mass withdraws.

Want to read about it in more detail?

Check out their site: https://p3c.io/index.html?ref=0x4921429260123677Eb8440382Db3f4F13B4586f0 .

)

)

How much has been deposited in the savings program?

At the time of writing (Dec 27 2019) 13,106 ETC are in the contract. This works out to $60,816.16 USD (@ $4.64/ETC). This is a small project in comparison to some of the other De-Fi projects in the space, but I am intrigued by savings nature of the project. Savings are a huge reason many of us use banks! It would be great to have a De-Fi alternative.

See the current status of the contract: https://blockscout.com/etc/mainnet/address/0xde6fb6a5adbe6415cdaf143f8d90eb01883e42ac/contracts

Has there been an independent audit?

Yes this was done by the Callisto Network which are experts in Ethereum Classic as they forked ETC to create and experiment on their own clone of the chain.

What is my Goal?

I have wanted to participate in the De-Fi space for awhile however many of the services in the space such as lending, stable coins, gambling, synthetic token and derivatives aren't of interest to me. This project caught my eye as it's simple to understand, the service is one I already use in my life (Saving Accounts).

I am getting my feet wet in De-Fi using Commonwealth. I have ETC laying around that I mined through 2018, doing nothing other than dropping in value. I like the idea of collecting a dividend on my coins while I wait for the price of ETC to gain traction. ETC is at a low point under $5 USD at the moment with ATH at around $40 USD.

After reading the whitepaper I excitedly check my old Jazz Wallet and saw I had close to 10 ETC just sitting there for a year. I installed the Saturn Wallet in my Brave Browser. Saturn is similar to Metamask and allows you to interact with smart contracts through your web browser.

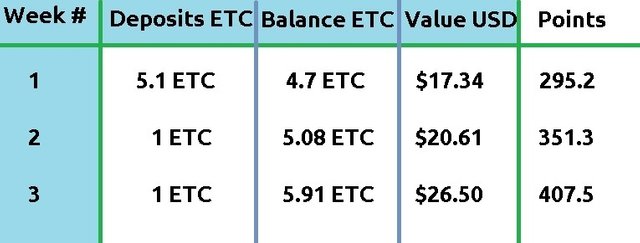

I began my journey by sending 0.1 ETC to the contract. I had never used the Saturn Wallet and being burned in the past with other crypto projects and exchanges I have a habit of always send a small amount first as a test. Once the transaction worked I deposited 5 ETC. My goal is to average in over time, the value of points you hold and dividends received. I will be depositing 1 ETC per week for 3 months which is under $0.75 per day, a very modest savings regime. For the first three months I will compound all dividends. After 3 months I will asses the gains/losses and decided what I will do going forward.

To date my deposits and points are:

As you can see I am up in real USD terms, however in terms of hard ETC I am down. I have compounded my dividends at the end of each week and it will take awhile for the dividends to out pace the 10% that gets used by the contract to pay dividends and fund the "Rainmaker".

Follow me and my journey into De-Fi and let's see if I can turn a profit!

Here are some helpful links on this topic:

Commonwealth : https://p3c.io/index.html?ref=0x4921429260123677Eb8440382Db3f4F13B4586f0

How big is De-Fi? : https://defipulse.com/

Want to buy ETC on Exchange?

CREX24 (Non-USA): https://crex24.com/?refid=96ss5mdft2j16k17dpw7

#Commonwealth on #Twitter: https://twitter.com/commonwealthgg

References / Sources

1 - De-fi Usage on Eth : https://thedailychain.com/ethereum-is-leading-the-defi-ecosystem/

2 - Chain Bridging Eth-ETC : https://cointelegraph.com/news/etc-labs-unveils-etc-eth-interoperability-solution-backed-by-metronome

The preceding is not financial advice nor am I a financial adviser.

the future is DeFi.

Much interesting