BIG Cryptocurrencies guide for Beginners - How to trade

Cryptocurrencies, Bitcoin, Blockchain, Crazy Earnings, Potential Bubble, Business of the Future and a few more expressions today are heard at just about every step. But the entry of the cryptocurrencies into the world is still very difficult, especially for people who are not very technologically educated.

At the time of writing this article, almost every person, from the children in kindergarten to the market readers, has heard about cryptocurrencies and Bitcoin. But in fact, only a small percentage of people actually own cryptocurrencies. The reason is probably that people are already leaving at the start, for one of the following reasons:

- It seems to them that they are already too late for this (although statistics say completely different, as well as peasant wit - they all talk about cryptocurrencies, but only a few have actually bought them. But this applies only to smaller countries in europe, which is slightly specific - where everyone knows each other, and at the same time they are very advanced in the field of cryptocurrencies, if not because of one of the world's major BitStamp stocks set up by the Slovenian and one of the more successful projects among cryptocurrencies - ICONOMI. Fear is therefore superfluous; in 2018 many experts predict much more growth than before.

- When trying to open different accounts, they encounter many limitations and unclear instructions, so they soon give up because they do not have enough technical knowledge. This is a good reason, because the actual market is still at the beginning, it is necessary to be a little technically advanced, to know English, to know the background, etc., but among other things, we also prepared this guide.

- They simply do not understand what the cryptocurrencies are. You surely know such people. They talk about the balloon, compare the cryptocurrencies with many things, but the simple question "what are cryptocurrencies" actually do not even know the answer.

That's why we decided not to spend a lot of time, but we will make one very simplified guide for beginners, the purpose of which is, above all, that you will eventually be able to start dealing with cryptocurrencies and you will at least know what you are doing.

ATTENTION - before any money transfer, we suggest that you read the article to the end, since you need to take care of a few things that you do not want to do later before you start trading, when you have money in the exchange.

1. What is Blockchain?

You can represent Blockchain as a public book in which all transactions are recorded. All users have access to the blockchain, which prevents fraud and allows easy tracking of transactions. When compared with money - in money, in the course of making payments, the trail of money is often lost (you get a salary, you raise bank notes at the ATM, and as soon as you buy a couple of things in the store, the "trail" of this money is lost, or it is no longer possible to know where they are these banknotes came to the store's store).

This allows for abuse - e.g. someone steals them from your store and it's very difficult to prove that this money is "yours") and how their journey went on. In the blockchain, all transactions are recorded so that even if someone steals your payment method, you could not help much with it, because it could be easily detected.

A medical record can also be given as a good example. Currently, this is a block that records your health status, medicines, restrictions, etc. In the event of a natural disaster, medical negligence or robbery, this information may be completely lost or even given to a person who is not authorized and can harm you.

In the case of blockchain technology, all this information would be recorded in the "data block chain", so each entry would be dated, it would be known who wrote it (your doctor's code) and to whom it refers, and we would have access only to those who are empowered (eg your doctor who could also add information), a patient (who could view information but could not change it) and potentially a third person (eg a surgeon would received this information before the operation, the insurance company would have received it upon your injury, etc.).

It is therefore a decentralized way system from which all unnecessary intermediate members (eg banks) are eliminated, as this system enables the direct operation of all participants.

2. What are cryptocurrencies?

Cryptocurrencies are simply said - digital money, which operates in a digital money system without a central system (banks). In order to establish such a decentralized system, they had to solve the main problem that prevented all such attempts in the past - how to resolve the reconciliation of records (for example, the same user does not pay twice with the same money and abuses it, etc.).

Satoshi Nakamoto, known as the inventor of Bitcoin, currently the most widely known and widespread cryptocurrency, has solved this problem by reaching consensus among users without a central system.

Source: Ranked Boost

In reality, this works like this - John decides to send 0.5 Bitcoin to Jack. Jack tells him his digital address, and John starts the process of transferring money by entering his private key (simplified: the password he only knows). At that moment, this transaction is triggered and visible to the whole network (of course, not with names and surnames, but in codes), and then a key moment occurs - confirmation of the transaction.

Transactions are confirmed by you. "Miners" are individuals who are dealing with the crypto network and check transactions, and for their work they are rewarded with a certain amount of cryptocurrency (you can regulate the sum on your own - if you are in a hurry, you can offer a miner a bigger prize and you will be treated as a priority (that is, the transaction can be arranged practically in a couple of seconds) or offer a small prize and wait a little longer (usually no more than 10 minutes).

This type of business primarily ensures the speed at the global level (no more waiting for banks that "do not work during the weekends" or "run the transaction only the next business day", while the money transfer to foreign countries is calculated by the real few assets), security (you are solely responsible for your money and you can not lose it because of external influences such as politics, bank robberies, bank ruin, etc.), pseudonymity (your transactions are on the one hand visible to all but at the same time coded and do not issue your identity in the public) and the elimination of unnecessary costs (account management, commissions that you can not control, etc.).

3. What is Bitcoin?

Bitcoin is a payment system without a central authority or brokers. Simply put, Bitcoin can give you an example of Internet cash or currency. What matters is that nobody owns the Bitcoin network - is controlled and managed by all users worldwide.

More and more people around the world use Bitcoin as a means of payment online, as payment is even easier than with credit cards or cash - payment can be made with any smartphone; it is enough to just enter the recipient's address (which can be scanned by phones, for example, on cash register), the entry of the amount and the entry of the private key / password.

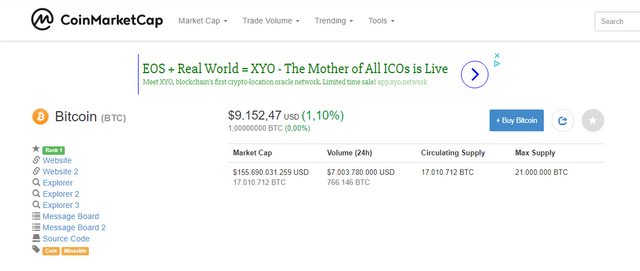

Source: CoinMarketCap

It is a currency that is the same everywhere in the world and therefore it does not need to be converted, exchanged in a local currency, carried on the pockets, and the most important thing - to lose it. Fees are much lower than card payments, while at the same time reducing the risks for traders (there is no chance someone pays with a stolen card, does not have enough balance on the account, etc.).

The weaknesses of Bitcoin are, in particular, that the degree of acceptance at present (despite the fact that it is spoken on every corner) is still quite low and in development, which also influences the fluctuation of its value, but pure statistics show that the use of Bitcoin is dizzy it increases with every minute and that it is actually the currency of the future.

What do other cryptocurrencies represent except Bitcoin?

On the market there are more and more types of (alternative) cryptocurrencies, known as altcoins. They represent an alternative to Bitcoin, but they differ in particular from the purpose, transaction speed, distribution method, algorithms and other characteristics.

A list of all the cryptocurrencies is available at CoinMarketCap

Through this website, you can also check the current value of cryptocurrencies (say in comparison with the dollar) and decide whether to buy the currency for the long term ("HODL") or because you believe in it's idea (open the official website of the cryptocurrency and read the problem and if so, consider whether this decentralization can help in this case).

Source: SeoClerk

You can, of course, also decide on a short-term (speculative) purchase of the currency and you are hunting for the fall of this currency to create a plus for you shortly, because you believe that it will grow again (which is always happening with cryptocurrencies). In this case, it is advisable to track trends and analyzes that can be found online as well.

In any case, yields with cryptocurrencies (short-term or long-term) are the same as anywhere else. However, they are currently using only a small part of the population and there is still a "real rush" that is expected to occur somewhere between 2018 and 2020 (the middle and the older population is currently not technically well-trained to enter the market massively, therefore Simplification of entry is also expected.

The total "Market Cap" of all cryptocurrencies in January 2017 amounts to 682 trillion dollars, a small drop in the global sea, where Apple's value is higher than that. So you can think how much room for progress still exists in this area. At the same time, it is necessary to emphasize that in the world the crypto-activates are mostly advanced countries, while quite a lot of people have not even heard about the crypts.

OK, I understand, I have some money that I would like to invest in cryptocurrencies, but everything is so complex - what do I have to do?

Let's go trough step by step - you need the following to buy (and store) cryptocurrencies:

- Dollars on your Bank account or credit card,

- A certified account at the cryptocurrencyy exchange where you will load the Dollars and buy your first cryptocurrency,

- "Wallet" in which you will store your cryptocurrencies (more about this below)

Let's start:

Open an account on the exchange:

To add Dollars into your "Crypto account," we recommend that you use "exchanges" that accept Dollars, while offering the option of purchasing different cryptocurrencies and not limited to only the largest ones. Because it often happens that due to a big wave of people it is not possible to register at some exchanges at all, we advise you to open your account in pairs (and you hope to receive it as soon as possible, since in some places it will take several weeks). We recommend that you register at:

CoinBase (click here) in combination with GDAX (CoinBase accepts USD, EUR, GDAX serves as a currency exchange in crypto. Plus, the fastest approval of new members is probably the worst, while the worse is the bit rate than BitStamp and the only conversion to BitCoin, Litecoin, Ethereum and BitCoin Cash ).

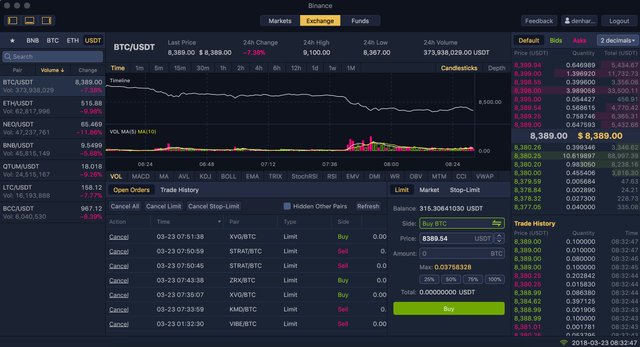

Binance (click here) are one of the most renowned exchange offices with a huge selection of cryptocurrencies, but for the time being they do not receive EUR, so you need to load EUR into one of the previous exchanges, convert them to one of the cryptocurrencies, and later transfer the crypto to your Binance account. Due to the enormous demand, the reception of new members is occasionally disabled.

Kraken (click here) (one of the first known currency exchanges, which has a lot of problems with unavailability at this time. The verification is shorter than at BitStamp, but longer than CoinBase, and the course is also somewhere between them, usually for EUR favorable).

BitStamp (click here) (the exchange office set up by the Slovenian and currently has the best exchange rate for the EUR and the first conversion into cryptocurrencies. The minus of the exchange is that it enables conversion to Bitcoin, Ethereum, Litecoin, Ripple and Bitcoin Cash only) . An even greater drawback is that at the time of writing this article, the verification of new users lasts for 2-3 weeks or more, so if you are in a hurry, you want to start trading as soon as possible, you will probably prefer to choose one of the options below.

Once you register with the exchange (and you get "Tier 1"), we advise you to instantly submit a "verification" request, that is, to upgrade your account, as this will only become real liquid and you can load money on it money back to your bank account).

The verification procedures are similar in all exchanges, most of which is to enter all your information and upload and record your personal document. Please note that you will enter information that is visible on your documents.

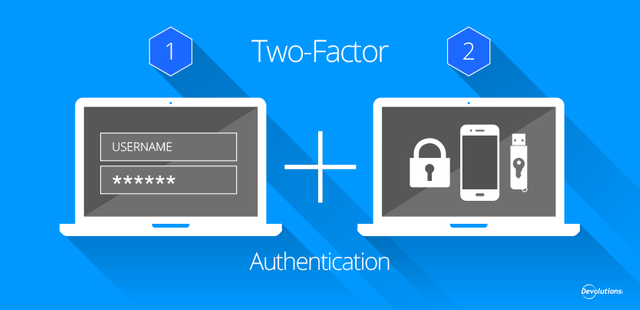

Source: Devolutions

Most of the exchanges, along with a personal document, also require a copy of another document proving the correctness of your permanent residence, the easiest way to send a copy of a bank statement, a credit card statement, and some also accept ordinary accounts (for telephone, electricity, etc.).

In order to protect your account, we strongly recommend that you consider the "2 step verification" offered by all exchanges. It's about downloading an mobile application that will also allow you to add additional code in addition to your personal password for different accesses, which will be different on each entry. The installation is quick and easy.

Next, when you sign up at the exchange, you will then enter your username, password, and then the system will ask you for this additional code, which you will find in your application on the phone. By doing this, disable (or at least complicate, harden the work) for those who would like to break into your account because they would somewhere gain information about your password.

When you do all of the above, equip yourself with good nerves, as you know about confirmation of the verification can take up to 2-3 weeks, depending on the demand. Therefore, we recommend that you sign up at all of the exchanges at once, because it is not good to put everything on one, because you will miss a lot of opportunities with waiting for approval.

Adding money and buying cryptocurrency

The happy day will come when you receive a notification that your verification is successful and you can upload your first deposit. Try to calm down and remember the following:

- Only add money that you can miss and which you can completely forget in case anything doesn't go as planned. Do not take loans, child funds for schooling or borrowed money.

- When sending money (EUR), use SEPA transactions as you will pay the minimum fees (usually around 30 cents), but make sure that the exchange on which you receive the admission is EUR.

- In most of the exchanges it is necessary to "announce" a transfer - open the "Deposit" tab, mark the currency (EUR) and follow the instructions. It is very important that you enter the unique code that you receive, for the purpose of the message. This code is the only link between your transfer and your account on the exchange.

Source: Coinsutra

Check all the information entered at least three times. You've been waiting for a verification for at least 3 weeks, if you take 3 minutes now, nothing will go wrong in between, but you can save a lot of money and extra time losses.

In most exchanges, you will see your assets within 1-5 business days. We recommend that you check the situation yourself, as it happens occasionally that there are some "hold" assets for which you need to contact support and send some additional explanations (but don't worry - this is more an exception than the rule).

Money is loaded, but now ...

... it's time to learn again. Frustrated?

Many people, when entering the world of cryptocurrencies, think that everything is actually very simple - you turn money into a pair of cryptocurrencies, wait and earn money. With experienced "traders", this may actually work like that. A hand on the heart, football also plays a very simple game when looking at Barcelona,

and while cooking shows, we feel that we could easily become a top chef. But the problem arises when we do it ourselves ...

There is no magic button. The Internet is full of false tips, the only point being to bring water to your mill. Unfortunately, here we must say the following - you can trust practically just yourself. Now you will probably be wondering how, because you do not know much about cyberbullying and trading. Trust primarily your sense of who you can follow on the web and who you are not.

But the best way to get this feeling is to first follow the cryptocurrency of the world for a while. Participate in a debates (groups on Telegram, Slack, Reddit, forums, Facebook groups, etc.). Ask the acquaintances who have been in this for a long time as much as you, who they trust, who has given them good advice so far on trading. If you find someone who makes analyzes that you find meaningful and understandable, you can do the following:

- Find out his old analysis. Old 1 month, half a year, a year ... In fact, as long as you do it at the time when all currencies grow, there are many "good and smart forecasters", the problem arises at the moment when the currency is falling. Were these same predictors able to predict such a trend in the past? Be vigilant - many predict the jump 10 different cryptocurrencies and then they cheerfully cheer with those who actually did it.

- Take time and initially follow some advice with a minimum amount, or do not at all - write down what you would have filed at this time and monitor what would happen. Do not lose your nerves if the next day you find that "you would get 100 usd if you really did." You did not lose them - you invested them in your education.

- Learn to fish. So - if you forever just follow the predictions of other people, you will forever depend on them, and you will trade forever as you are grazing them and not as good as you are (none of the predictors of trends will speak in their own damages). The samples on the cryptocurrency market are repeated and you will soon see that trend forecasters are actually using only 2-3 different methods, which you can actually learn from yourself. And then you get the power to catch the fish yourself and you are no longer dependent on a local fisherman who will leave you just what he no longer needs.

OK, Now Action!

There are only a few interpretations of terms from the Crypto-World left now:

- HODL - actually means HOLD. When a currency (or a whole market) begins to fall suddenly, do not panic. You will almost certainly end up in a minus by hastily exchanging currencies or even trying to make payments on bank account. If you are going to "HODL", you probably know the next day to wake up in green numbers.

- BTFD - Buy The Fucki * g Dip or "buy when they are at the bottom". Attention - we all always think "it needs to be bought when the currency is at the bottom and sold as it grows." But you will probably need a few mistakes to learn this, because you will be given "FOMO" (Fear Of Missing Out), and you will buy cryptos on the rise, or you will experience it on the other side "FUD" (Fear, Uncertainty and Doubt, or fear, uncertainty, and doubt) when some currency starts to turn into red numbers, and you will just come across an article by an unknown author who will predict the fracture of this currency, which will lead you to panic sale. It is very often that the original currency is soon picking up and starting to grow, and the currency in which you have "fled" starts to fall, thus making a double minus, while still paying a commission.

- WHALE - Our advice is to avoid the currencies that are known to be in the majority ownership of "whales". These are multimillionaires who buy bigger shares of a currency and then have the power to manipulate the price - in case such a person suddenly decides to sell their stake, it can be very promising and worth the currency completely in the pair of seconds at the bottom, but only in your hands worthless coins.

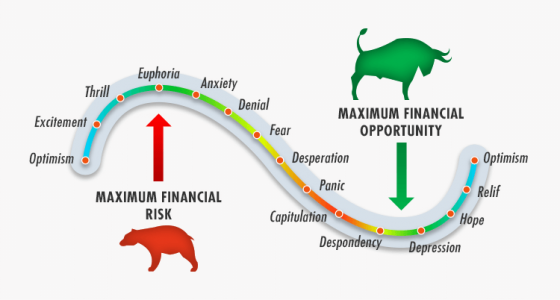

Check this Psychology of trading chart

Source: InvestingInBlockchain

So, blind follow-up is not advised, and learning is absolutely advised. And there are a couple of things you can think about:

- Divide your budget into:

a) Budget for "long-term" (long-term investments, stable currencies, perhaps crypto-exchanges that will disperse your roles themselves. It is a lower risk and lower yields, but much larger than you are used anywhere else)

b) Budget for "short-term" (short-term investments, according to daily forecasts and opportunities. Greater risk and higher returns). For daily trading, you will need a Coinigy web application (click here), which will cost you around $ 20 / month, but without that, you can not even go about any serious trading and price monitoring. If you do not want to invest $ 20 in trading, then it's better not to go at all, as your losses will be much higher.

c) Budget for ICO "Initial Coin Offer". ICOs are projects that are largely not yet in startup and invite "investors" to market, for which you can also sign up yourself to support their project. It is usually supported by one of the cryptocurrencies, and in return you get their coins that have a small value at that time. If you like their idea, you think that the real team stands behind the idea and that with their idea you can solve the actual problem, you can invest your funds and hope that the idea actually comes to life, and with that, then, the value of their coins is also greatly increases. Many successful ICO projects have not only adjusted their value, but even turned it down. Of course, this is the most risky investment (if a large number of companies can be considered as some kind of "start-ups" that already have a product but have not yet come to life in reality, the ICO is actually one step backwards - mostly just some idea and plan how they will put it into life).

If you are a beginner, you are absolutely obligated to sign up for OceanPool on this link - it is a group of verified experts who will help you and advise you on joint investments in ICO projects. For now, you just have to do it by signing in with an email address and waiting for you to take on the next round of acceptance - so sign up already because people in the "queue" are more and more likely to see this project as one of those without which in the future you will not have any chance of investing in ICO projects.

I did the research, I waited for the fall of the currency that I liked and bought it. Now what?

First of all, congratulations, you have become a proud owner of a small share of the company. In the world of cryptocurrencies, the belief is that it is not wise to leave this stake (coins) on the cryptoexchange, as at the time the coins on your crpyto exchange account are actually not owned by you, but owned by the crypto exchange (and if there is something wrong with the crypto exchange, you can also stay without them). Imagine replacing the Euro in Dollars in a local exchange office and then leave them in the envelope in the exchange for a few months until you are using them. In the case of a currency swap, a human error, or something else in this way, you risk losing your money without your knowledge.

Therefore, it is highly recommended to use "Wallet". A wallet is a digital wallet where you can store your cryptocurrencies and only you can access them. Since the opening of wallets in a browser is a rather complex matter (and at the same time not completely safe), we recommend that you buy one of the two most secure and well-known crypto-wallets:

Trezor (click here)

Ledger Nano S (click here)

Do not hesitate to buy a wallet, as it will take some time to get it. If you enter the "crypto world" or you have decided to buy any kind of crypto, this is one of your first steps. Namely, if at the time you buy your first Wallet and wait for it, you will have to do exactly what we described above - let your assets be on the crypto exchange for that time. Buying a Wallet is advised at the time of registering on crypto exchanges, as you will wait for it approximately as long as the crypto exchanges need to approve you.

CAUTION! You must order the wallet on these official product pages (the top 2 links), any orders from other online stores, or even worse - ordering used wallets from Classifieds ads (etc.) poses a high risk - as you would order a Mastercard card via Classifieds and you would not be sure whether the seller still has access to it, and you would upgrade your assets.

When ordering a wallet you will also receive instructions for use that will help you transfer your purchased crypto into your wallet and keep it safe - until the next possible trading or conversion into USD (if necessary).

In exchanges, leave only those cryptocurrencies you intend to trade daily. Send everything else as soon as possible to your safe wallet.

Since they send out wallets from abroad, we suggest that you order them before the first trading, so that you do not expose your cryptocurrencies to unnecessary risk.

Please also note the following: The information we gave is only available for educational and informational purposes, without any explicit or implicit warranty of any kind, including guarantee of accuracy, completeness for any particular purpose. The information contained or offered by us is not intended for financial advice, investment advice, trade advice or any other advice. The information is of a general nature and is not specific to you, the user or anyone else. We should not take any decisions, financial, investment, trade or other information on the basis of any information provided by us, without being able to exercise due diligence and consultation with a professional intermediary or financial advice. You understand that you use all the information available at your own risk. Trading with Bitcoins or alternative cryptocurrencies has potential benefits and also has potential risks. Trading may not be appropriate for all people. Anyone who wants to invest should seek out their own independent financial or professional advice.

Tags: #steemitisbeautiful #news #steemit #blog #life , #busy ,#smokenetwork #jerrybanfield #OCD-Resteem #acidyo #sndbox#slowwalker #brian-rhodes #eveuncovered #vcelier #UpvoteForUpvote#TrevonJB #CraigRant

Special thanks and support to: @hr1 , @bue , @welcoming , @surpassinggoogle , @gaman , @minnowpond , @trevonjb , @jerrybanfield , @craig-grant , @knozaki2015 , @gavvet , @papa-pepper , @curie , @stellabelle , @sweetsssj , @kevinwong , @kingscrown , @officialfuzzy , @steemtrail , @kaylinart . Keep up the great work, without you Steemit would not be the same.

important tips

This comment has received a 0.64 % upvote from @booster thanks to: @amirul.

yes, it's a bit long article but everything is explained in detail.

DISCLAIMER: dropahead Curation Team does not necessarily share opinions expressed in this article, but find author's effort and/or contribution deserves better reward and visibility.

to maximize your curation rewards!

with SteemConnect

12.5SP, 25SP, 50SP, 100SP, 250SP, 500SP, 1000SP

Do the above and we'll have more STEEM POWER to give YOU bigger rewards next time!

News from dropahead: How to give back to the dropahead Project in 15 seconds or less

Quality review by the dropahead Curation Team

According to our quality standards(1), your publication has reached an score of 85%.

Well said Gabriel García Marquez: "You learn to write by writing" Keep trying, you will soon achieve excellence!

(1) dropahead Witness' quality standards:

- Graphic relation to the text (Choice of images according to the text)

- Order and coherence

- Style and uniqueness (Personal touch, logic, complexity, what makes it interesting and easy to understand for the reader)

- Images source and their usage license

Thank you very much I appreciate your support

Im very grateful that you appreciate my work.

Wow... I'm speechless as this piece has really given a huge knowledge to help others....

Thank you

You are welcome ma

hi @jerrybanfield , I have sent 3.000 SBD with memo: https://steemit.com/dlive/@sudutpandang/509c7d2d-5084-11e8-b1e0-0242ac110002 , but do not get upvote from the purchase, please return my SBD .

Hi @jerrybanfield ... please response my comment ... Please...

excellent friend You have my support. I hope to count on your support to keep growing. regards

Thank you miguelitro for your support. i appreciate it.

Good information is useful. I like it bitcoin as well as others in Steemit

Thank you friend

Will My friend 👍🙋

In-depth I need to send this to my friend

Great, i hope it helps him.

Nice article. Never run after train is basic rule here too :)

Thank you friend

Resteem bot Service! Promote Your New Post.Find New Freinds - Followers - Upvotes. Send 0.400 SBD and your post url in memo and we will resteem your post to 9000+ followers from two different account.@stoneboy and @vimal-gautam.

I was silent because this piece actually gave a huge sense to help others

Thank you, im always happy to help others.