Crypto is making PC parts so expensive

( )

)

If you've got a gaming PC, I hope you like the one you've got. Because upgrading it - or even buying a pre-built one - is going to cost you a veritable fortune right now.

Bitcoins and cryptocurrency mining have been around for years, and it's not like this is the first time thirsty investors have driven the price of PC tech up. But over the last couple of months, the growth in all kinds of cryptocurrencies has resulted in an explosion of interest around mining - as well as the PC hardware required to make it work.

Like graphics cards.

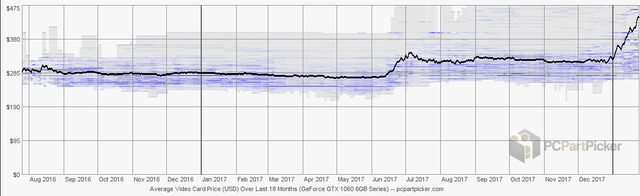

The above comes courtesy of PC Part Picker, and it shows the average price for a NVIDIA GTX 1060 (6GB model) over the last year. For the most part, prices were fairly stable - and then they took off towards the end of the year.

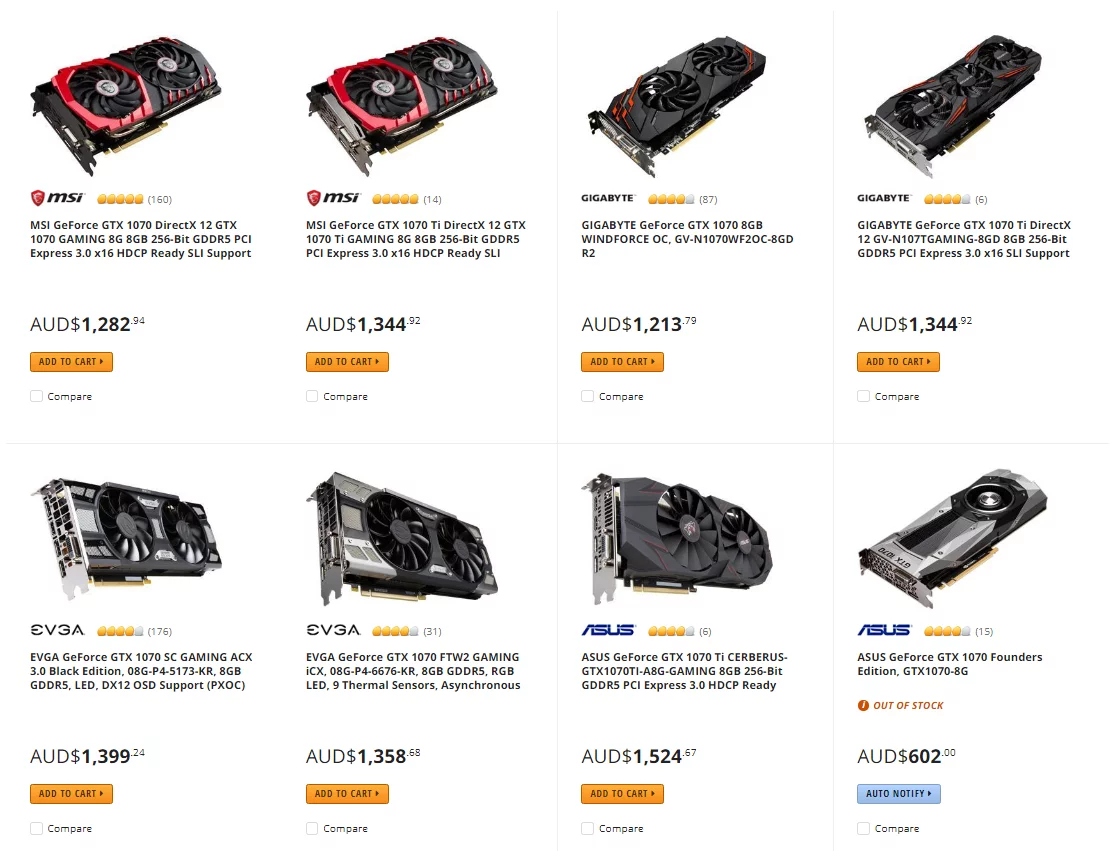

Take the top of the line gaming card, the GTX 1080 Ti. When it first launched, Founders Edition models retailed at a hefty $1099. Those prices dropped a bit once third-party cards came out, and around the middle of last year cards were popping up for closer to $900.

But now, you'll be lucky to get a 1080 Ti for its original MSRP. At the time of writing, ASUS, EVGA, MSI or Gigabyte-branded 1080 Ti boards were selling for $1150 or more. Some overclocked editions were retailing for closer to $1300, while ASUS's crown jewel, the ROG Poseidon 1080 Ti, selling for $1495 at a minimum.

It's insane, and retailers told Kotaku Australia that the situation isn't likely to get better any time soon.

"This crypto stuff is driving up prices like crazy," one vendor, who wished to remain anonymous, said. According to them, prices for some GPUs have risen by as much as 50% in some instances. It's even worse elsewhere, like at Newegg, where overclocked GTX 1070 cards are selling for $1200 or more.

Another representative from a major Australian vendor, who asked to remain anonymous, added that they're expecting prices to continue rising. Gamers end up competing directly with cryptocurrency miners for the same hardware, but it's a difficult position because gamers often only want to buy one or two cards, while miners are buying five, six, sometimes up to ten cards in a single hit.

"The people I feel most for are our customer service representatives," the vendor said. "[The miners'] argument is that what does it matter if we sell 10 to them or 10 to 10 different people, which of course we all know 10 happy gamers is better for the industry than 1 miner acquiring those cards."

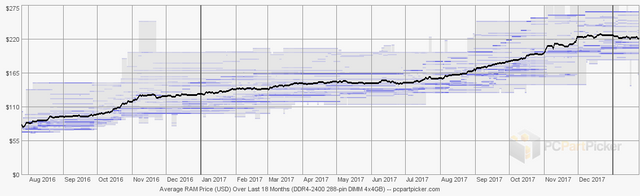

And it's not just NVIDIA and AMD gear, either. A shortage in DRAM and NAND shortages has impacted RAM and SSD prices worldwide over the last year, with RAM prices doubling over the last 18 months in some instances.

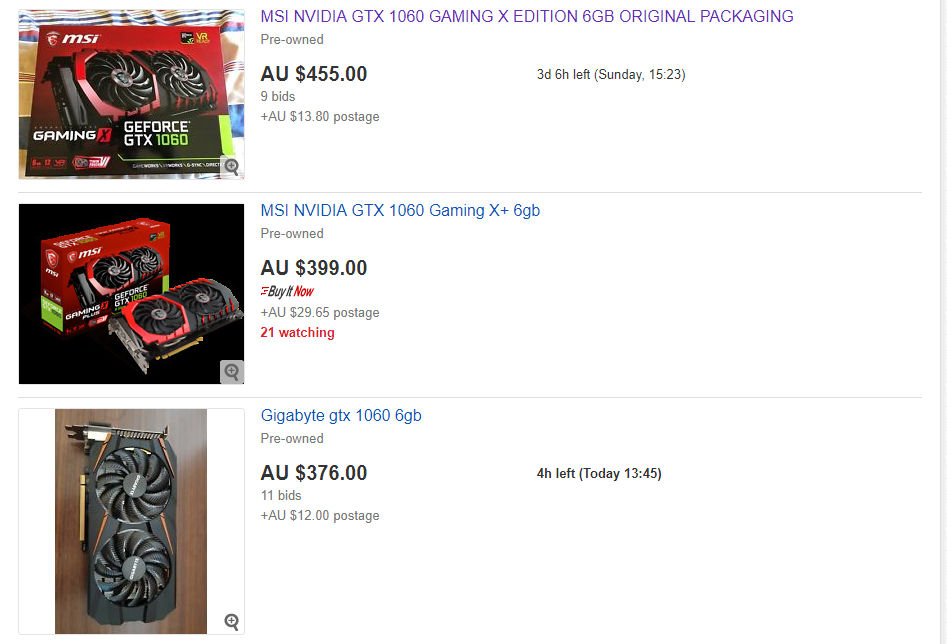

One positive is that some retailers have negated the impact on prebuilt PCs by maintaining a separate stock of components. That's of little comfort if you're just looking to upgrade an aging GPU, or you need a quick RAM upgrade. It's especially rough if you were looking to get into PC gaming at all, as prices for second hand cards have soared through the roof too.

Bids for second hand GTX 1060's on eBay have pushed prices beyond $400; some overclocked models are selling for $500 or more

Put simply: if you had dreams of "true" 4K gaming this year, then you'd better win the Lotto. The price-to-performance ratio is completely beyond any realm of sanity right now, and no-one in the industry is expecting it to get better any time soon.![]

I lucked out that Australia seems to be relatively untouched by this, and bought a second 1060 6GB for rendering. They still look ok pricewise here, but it might change. Then again Nvidia is making moves to dissuade miners, but frankly they can't really restrict it effectively either. Besides, Ethereum is moving to proof of stake which makes the whole mining operation completely moot, so we might see extra cheap 1080 Ti's later in the year :^)