GPU Mining Isn't Dead: Life after Ethereum

Introduction

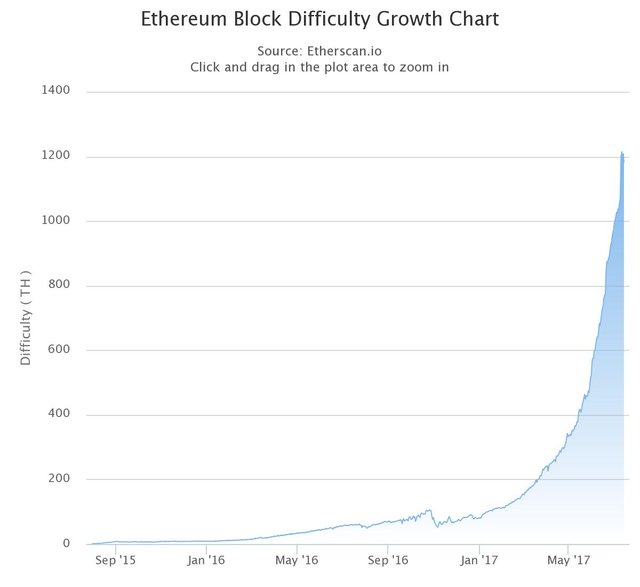

There seems to be a growing consensus among many cryptominers that their mining rigs will be close to valueless in another few weeks. This is because of the incredible growth in the mining difficulty of Ethereum and Zcash, which has lowered the profitability of mining across the board. I have heard many miners say all summer that there is "no sense in investing in a rig that won't pay itself off (in Eth)". And their math is correct. The amount of Eth mined at current prices will not be sufficient to pay off the initial investment into a mining rig. The issue with this point of view is that it ignores the entire purpose of mining which is to be a hedge against the volatility of crypto. It also bases the entire outlook of mining solely on the Ethereum ecosystem, and does not take into account the broad possibilities for the future.

The Unknowns of Crypto Mining

When the RX470 and 480 first launched in late 2016, I seriously considered building myself an Eth mining rig. However, the Eth price was relatively depressed at that point in time, and many people were saying that it was pointless to build a new mining rig. I weighed the argument, and ultimately decided against getting into mining. A few months later, the price of Eth skyrocketed and I regretted that decision. A simple $1500 investment into a mining rig would have turned into $30K worth of Ether! Of course, hindsight is 20/20 and I had no way of knowing that at the time. The price could have also continued to plummet, and I would have barely broken even on my electrical costs and on the depreciation of my hardware. The point of this example is to illustrate the unpredictability of GPU mining.

The Early Bird Catches the Worm

This unpredictability is the fundamental problem that many people run into when they first start mining. In order to be a successful miner, you have to be in it for more than just a quick buck. Or put more simply, mining is usually most profitable when it is least profitable. As an example, those who held onto their Litecoin mining rigs from 2013 were all set up to be able to mine Ethereum at the genesis block in 2015. In the early days of the ETH blockchain it was possible for a single mining rig to earn anywhere from 20-40 Eth a day. At the time, the profitability margin wasn't that high, but the total amount of Eth mined in those early days would be a truly staggering amount in today's dollars.

The Investment Argument

But what about investing in ETH instead of mining? Doesn't that make more sense from a purely financial standpoint? In my case, purchasing and holding ETH with the funds that I would have used to purchase a mining rig would have netted me a final total of anywhere from $30-$100K depending on when I bought and sold. So on paper, this theory is correct. For maximum profits, buying and holding crypto can definitely be a more lucrative investment than mining. However, because of the volatile nature of crypto I believe that it is wise to hedge your assets and diversify your potential losses. Even if the price of ETH were to drop to $0 tomorrow, I would still have my mining equipment which I could sell to recoup a lot of my mining costs. Whereas if I had invested all of that money into ETH, I would have absolutely nothing to show for it.

Post-Ethereum GPU Mining

After Ethereum switches to Proof of Stake, there will be a massive shakeup in the GPU mining world. There are currently about 2.5 million GPUs mining Eth . This estimate is a rough one that I have created by dividing the hashrate of the network (62.5 Th/s) by the average hashrate of a mining card, which I pegged at about 24-25 Mh/s to include older mining rigs that still might be operating. Many hobbyist miners believe that there is not enough demand for all of this hashrate in other coins, resulting in a glut that will drive profitability down and make GPU mining pointless for everyone. However, this popular prediction really falls apart once put under basic economic scrutiny. If this scenario were to play out, large mining corporations that depend on steady payouts in order to stay afloat would have to sell off enough of their hashpower to keep their mining profitability in the black. This would also ensure that there would at least be a profitability margin where the average hobbyist/part-time miner like myself could pay for power and even make a little bit of profit.

My personal belief is that the need for GPU processing power will only increase in the near future. Not only will there be new mineable coins in the future, but there are also many up-and-coming projects that will offer new ways of earning compensation for GPU computation. A few select examples include SONM and Golem, which will both use the Ether blockchain as a method of distributing decentralized processing power to paying customers. Despite all this, I still believe that there will be many people selling their mining rigs off cheap over the next few months in the hopes that they will "recoup their mining investment". My strategy will be to take advantage of the glut of cheap GPUs and stock up for the long-term. If you are looking for a way to get into hobbyist mining, these next few months may be the best chance in recent years to do it. Happy mining!

Make sure to follow me on Steem and resteem if you liked this guide! Your comments and helpful criticism is greatly valued. :)

I think mining is better than investment.

A really good article ignored. I feel sad.

Although you could put in more statistics and numbers!

This is a great article. I'm running into this issue right now. You deserve more upvotes.

Congratulations @apianist16! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPYou captured the moment pretty well when you posted this, but I think the moment is upon us again with analysts stirring up fears that AMD and Nvidia will suffer because Ethereum is going to go proof of stake. Golem, nicehash, gridcoin, etc... there are many projects out there that can soak up the processing power. The world is getting more technological, not less. There will be increasing demand for GPUs in all areas, blockchain technologies will enable one of many avenues to use a GPU farm. Good post. :)