Cryptokitties – The stories behind bubble explosion

CryptoKitties has become a hot trend in virtual money community in November and December 2017. CryptoKitties is an application on the Ethereum platform that gamers can buy, sell, trade and produce virtual cats based on blockchain technology. Each virtual cat is represented by a code on the blockchain network and transformed into an image on the interface of the game. Each code specifies the characteristics of the cat. Cats with rare characteristics being the most hunted in the game.

After a few weeks of launch, the product has made a big fever on the cryptocurrency market. A lot of mainstream newspapers, including Quartz, Motherboard, Techcrunch, and CBS, publish articles about the application, making it even hotter.

Everyone in a race to buy, exchange and produce cats for profit. Cats with rare characteristics are quickly hunted and traded in the market for exorbitant prices. On the first day, the average price of a cat was 0.02 ETH, which was pushed to 0.4 ETH some days later. One of the most expensive cats was sold for 247 ETH on December 2.

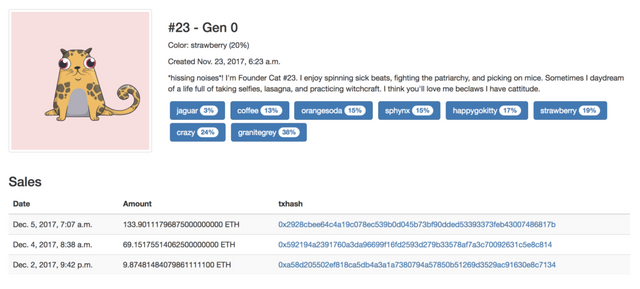

The game was so popular that it clogged Ethereum's system with average daily trading up to 11,000 transactions, accounting for 25% of Ethereum's transaction volume. As of December 12, 2017, the game has produced 260,000 cats, 15 million $ traded, and 150,000 players. One of the most profitable kittens was KITTY 23, when its buyer made a profit of 70 ETH in 4 days. First, it was bought by 10 ETH, then being sold to the next owner for 70 ETH and finally for 133.9 ETH.

But, the game quickly went into oblivion when the bubble burst in late December, the price of cats fell to 0.02 ETH, the number of transactions drop from 4833 at December 12 to only 0 transactions at the day 02/01/2018.

Cryptokitties buble has exploded, apparently many people have made a lot of money from it, while many others have to suffer from the big hole. We can see in the hot market, there are always big opportunities and risks. Top sellers always be cautious of the worst situations. The story of cryptokitties can give new cryptocurrency investors some lessons:

1. Do not trust social networking or the media, most projects have a heated period, marketers often spend money to hire celebrities to write reviews, hire marketing staff to blow up the project, or even spend money on articles in mainstream newspapers such as bloomberg, CNN ... to write promotional articles to create fever.

2. Study the suitability of the investment. The cryptocurrency market is a new market and it is hard to quantify. However, when you feel the price of any cryptocurrency has risen excessively, it is not the time to buy. Electronic market has many opportunities, you miss a chance, there are still many other chance ahead. FOMO or hot fever coin only burns your account.

3. Learn how to capitalize, overcome greed and become mastered in the hot market. Small profit still better than cut-loss.

There are bubbles (fads) in the cryptoworld just as there are bubbles (fads) in the real world. People are pay a premium at the height of the craze and well, it dies down eventually. Same with a certain collectible mobile game that caught the world's imagination just last year.

Looks like this game is dead.