Coinbase loses legal battle in the United States and will deliver user database

Coinbase has recently been embroiled in a legal discussion in the United States in which a taxing body in that country, the Internal Revenue Service (IRS), is required to provide information concerning registered US citizens on its platform Would be taxpayers to the state.

Following a number of allegations filed by both parties, a court in the Northern District of California has ruled in favor of the taxing body, requiring Coinbase to submit the US user database required by the IRS for review.

This petition sows an unattractive precedent in the community of cryptomones because of its invasive nature in the privacy of the data of the users who use this platform for the sale of bitcoins. This request submitted by the IRS refers specifically to activities in the tax sector, since this agency seeks to assert the interests of the US state regarding the taxes that US users of Coinbase must declare for their operations with criptomonedas.

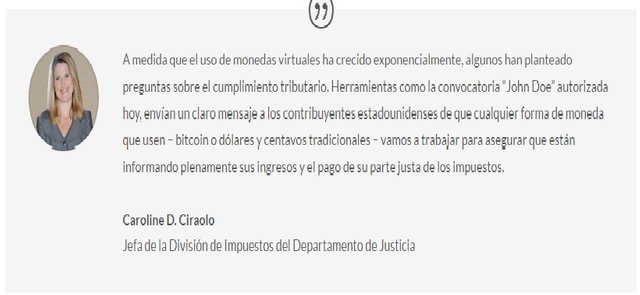

Requests called "John Doe" refer to requests made where the identity of the persons involved is kept anonymous for privacy reasons. In the present case, the petition was made to demand information concerning a certain group of individuals who might be dodging their tax liabilities through the purchase of Cryptones in Coinbase, for which the IRS wishes to investigate in the database of users of the exchange house.

Due to the advantages of privacy and anonymity that the transactions with Bitcoin and other Cryptomonedas offer, tracking the real identities of the people who perform operations with these currencies is quite difficult to achieve; A disadvantage that state taxpayers currently suffer. However, with the current regulation of cryptomonedas in several countries, the United States among them, bureaux de change are the main sources of data collection of users that government agencies can access to connect real identities to transactions made in Bitcoins and other cryptones.

Although Coinbase had publicly reported its opposition to the US government's petition, for reasons of privacy to its users, it also made clear that it would collaborate with the competent authorities at all times. Now with the approval of such a request by a court, there is no doubt that the exchange house will have to deliver the information requested by the US state authorities.

THE PREVIOUS IRS / COINBASE CASE IN THE BITCOIN COMMUNITY

Bitcoin's technology and cryptomonedas are politically flagrant libertarian ideals in which state interference of any kind is not well received, this case where a government agency demands real identity data is clearly a rather uncomfortable precedent for the average bitcoiner it wishes Conduct transactions in the greatest possible privacy and anonymity.

However, it is the centralized nature of bureaux that makes it possible to collect information concerning the real identities of users, thus allowing agencies such as the IRS to access these databases using any reason Legal protection of the state, the company and / or even the users themselves.

But it is the peer-to-peer nature of Bitcoin technology that must be kept in mind at all times, if we want to balance the privacy and anonymity of the amenities and advantages offered by the use of these platforms Regulated and subject to the legal norms of states and nations. While regulations have provided a layer of legitimacy and confidence to the use of cryptones, several of the ideals and advantages that these technologies bring have been forced to be sacrificed by users when using the bureaux de change.

On the other hand, the legal figure owned by Bitcoin and the Cryptomonedas in the United States as commodities or commodities obliges that the transactions made with these virtual currencies are subject to the tax charge. Therefore both users and companies are legally obliged to collaborate with the competent bodies when it comes to filing taxes related to the sale of bitcoins and other cryptones.

This case of Coinbase and the Internal Revenue Service (IRS) is until now the most relevant of the ecosystem of the criptomonedas, since this type of requests are more frequent in the traditional banking institutions that sometimes reveal cases of offshore companies like those of the Famous Panama Papers. Even with the privacy and anonymity characteristics of the cryptones, we can not rule out that this type of request from government agencies to exchange houses and other services becomes more frequent in the future.

Please folks, do not sleep on the http://BitSquare.io decentralized exchange that is available to you RIGHT NOW. It has TOR built in. It is run by NO ONE! It supports alt coins! The only thing I believe it needs is more volume.

Centralized exchanges are soon going to be obsolete. The whole point of bitcoin is so the fed doesnt get involved.

followed, upvoted.