Thank You, USD, for Teaching us Bitcoin Isn’t a Bubble

Recently, I’ve been ecstatic. Normal people are starting to hear the words “Bitcoin,” “Cryptocurrency,” and “Blockchain” in their everyday life. Our community has been waiting for these times for so long. However, this step in the right direction is weighed down by the ankle weights of a negative clarifier; namely, the “Bitcoin Bubble.”

Every morning over a cup of coffee and some Beethoven I browse through relevant cryptocurrency news articles. And every morning for the past several weeks, the word “bubble” has found its way into nearly every headline. Why?

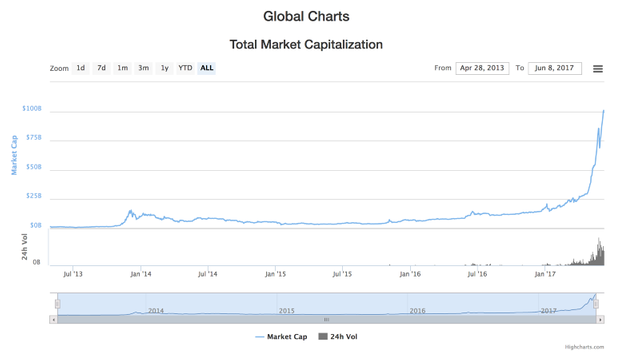

That is why. The cryptocurrency world is seeing enormous growth, and no one outside of the community can wrap their head around it. They simply can’t understand how this astronomical growth in Bitcoin and cryptocurrency is possible without being a bubble. And I believe this mentality is all thanks to the US Dollar.

Ever since the US left the gold standard in 1971, the green stuff that lines your wallet has had nothing to give it value, other than your faith that it’s valuable. Every day we spend cash, we are just trading a green piece of paper that we choose to believe is valuable. We work 40–60 hours a week for these sheets of cotton fiber. We religiously save it, and we trust that when we retire at 70 it will still be worth something.

This is why people are having a hard time believing that any form of currency can have value outside of simple belief. Currently, very few people understand why they should believe Bitcoin is valuable. People have bought the lie for so long that money only has value simply because we believe it has value, that they’ve forgotten the fundamentals of economics.

Bitcoin has worth that is independent of your belief in it. Computing power, electricity, and “work” (to put the concept absurdly simply) give the currency innate value. On top of that, Bitcoin also boasts two economic advantages that the USD will never be able to obtain:

There is a finite supply of Bitcoin, and we are rapidly approaching its cap

Bitcoin is impossible to inflate

Taken together, these two truths add up to an amazing reality — very soon, Bitcoin’s scarcity will go up because its supply is limited. We also know that demand for Bitcoin and other cryptocurrency is going up exponentially. Common sense economics tells us when scarcity and demand both go up, value (and thereby price) goes up as well.

As a firm believer in Warren Buffett investment philosophy, I admit that I believe no one, especially me, can predict the market. If I could, I would be ridiculously wealthy and I would be charging exorbitant fees for my advice, instead of giving it out for free on Medium. However, I also believe that more people inside the crypto-community and outside it need to wake up to the fact that we have bought into the lie of the US Dollar for far too long.

Things are going to change in the world of cryptocurrency. Things will change soon, and they will change drastically. Governments will get involved, prices will fluctuate, and scandal and scams will come and go. Such is the nature of Mr. Market.

Everything may not work out as we predict, but I believe Bitcoin, in some form or another, will be with us for a long time to come, because it represents value. The market always rewards the work of solid companies, good people, and hard work. In the end, that’s what I’m putting my faith in.