Bitcoin ‘Like Gold’ but Not Ideal as Medium of Exchange: CFTC Chairman

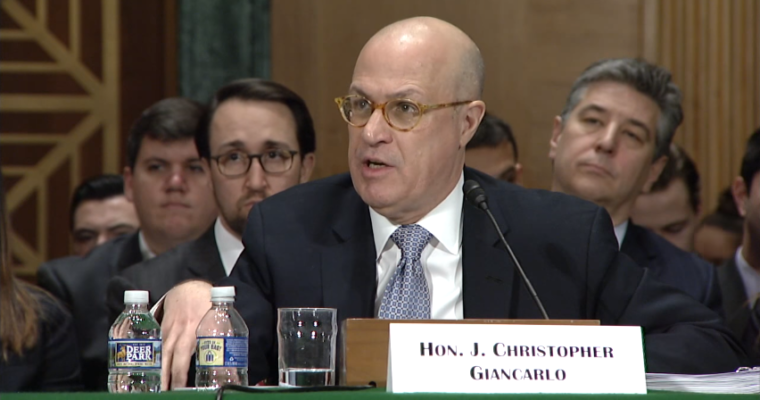

Commodity Futures Trading Commission (CFTC) Chairman J. Christopher Giancarlo said that bitcoin bears several similarities to gold, although it has elements of many different asset classes.

Giancarlo, to whom many cryptocurrency enthusiasts affectionately refer as “Cryptodad” due to his willingness to engage with the nascent industry with an open mind, said during an interview with CNBC that bitcoin is not ideal as a medium of exchange but has characteristics that make it akin to virtual gold.

“There are certainly aspects of this that you might call a virtual asset like gold, only it’s virtual, it’s digital,” he said. “But it is an asset that many find worthy of holding for a long time and that has aspects to it that might not be ideal as a medium of exchange, that might be more suited as a buy and hold strategy.”

The markets regulator, who was speaking with the network from the annual Milken Conference in Los Angeles, added that it’s difficult to neatly fit bitcoin and many other cryptocurrencies into current regulatory classifications, most of which date back to the 1930s.

“Bitcoin and a lot of its other virtual currency counterparts really have elements of all of the different asset classes, whether they’re meeting payment, whether it’s a long-term asset,” he said. “We see elements of commodities in [bitcoin] that are subject to our regulations, but depending on which regulatory regime you’re looking at, it has different aspects of all of that.”

Regulators and lawmakers have discussed whether the CFTC and the Securities and Exchange Commission (SEC) should have more authority to oversee the cryptocurrency markets, but Giancarlo has stressed that any such determinations must be made at the legislative — not the regulatory — level.

At present, the CFTC supervises the trading of bitcoin futures, which are classified as commodities and are currently listed on US exchanges CBOE and CME.

The CFTC also investigates cryptocurrency-related fraud and market manipulation, though it does not have the authority to supervise trading platforms on a day-to-day basis.

Recently, the agency published an investor warning on cryptocurrency pump-and-dump schemes, through which traders coordinate to manipulate the price of an asset. It also offered cash rewards to whistleblowers who alert officials to these plots.

A bounty of 0.001 STEEM has been set on this post by @amudayusuff2015! You can read how they work here.

Greetings!!