Bitcoin Speculators Added To Their Bearish Net Positions This Week

Large cryptocurrency speculators increased their bearish net positions in the Bitcoin Futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Monday due to the 4th of July holiday.

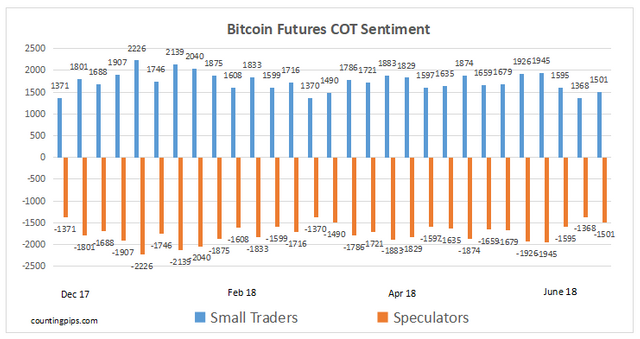

The non-commercial futures contracts of Bitcoin futures, traded by large speculators and hedge funds, totaled a net position of -1,501 contracts in the data reported through Tuesday July 3rd. This was a weekly reduction of -133 contracts from the previous week which had a total of -1,368 net contracts.

Speculative contracts had improved the previous two weeks before an increase in bearish positions in the latest data.

Small traders, meanwhile, raised their existing bullish positions this week by an equally offsetting 113 contracts to the current level of 1,501 net contracts.

Bitcoin Futures COT Data: Speculators vs Small Traders

The Bitcoin futures data is in its twenty-ninth week since the beginning of the cryptocurrency futures data releases on December 19th. The data includes trader classifications of only speculators and small traders and without commercial traders (typically business hedgers or producers of a commodity).

Speculators continue to be on the bearish side since the start of the bitcoin data releases while the small traders have been on the other side of this market.

Bitcoin per USD:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Bitcoin Cryptocurrency Futures closed at approximately $6609.39 which was a rise of $386.61 from the previous close of $6222.78, according to unofficial market data.

Kuch purchase karke rakhe deta hu future ke liye Lekin konsa coin

Super good that we have a future market for cryptos, it makes pricing easier. You know that the future market for stocks is bigger then the actual stock market?