New China FUD: How hard will BITCOIN CRASH if China bans mining? - CEO of Chinese exchange says we are fu*ked - OTC trading banned! - Is Japanese volume temporary?

As Bitcoin has just started recovering from the huge dip it suffered last week after news broke that China will ban all exchanges, there is more bad news on the horizon. And again, it is coming from China.

China bans peer to peer and OTC trading

According to new reports by the Wall Street Journal, Chinese officials stated that peer-to-peer trading would not be tolerated, therefore also banning the OTC (over the counter) trading market. Last week it was assumed that OTC trading will continue.

China may block foreign exchanges - will Japanese volume decrease?

Additionally, there are unconfirmed reports claiming that China is planning to block websites of foreign exchanges and OTC platforms (which would only make sense if they want to stop the money outflow).

After the Chinese exchange ban, we have seen a huge increase in Japanese trading volume, making BTC to JPY the second largest Bitcoin trading pair. This created a sense of relief in the Bitcoin community, because many people believed that Japan can compensate the lost volume from China.

But it is rumored, that due to the Chinese exchange ban, many Chinese traders moved to the Japanese exchange bitFlyer. If that is true, then the volume might just be temporary. With China blocking foreign exchanges, most traders will lose access to exchanges entirely. Especially since China is cracking down on VPN technology, which can be used to circumvent the internet censorship.

Will China ban mining? Would a mining ban cause an epic crash?

After reports of the continuing crackdown on Bitcoin, there are speculations whether China may also ban mining. This would be a serious problem for Bitcoin. While Chinese Exchanges only make up around 10-15% of the overall trading volume, they account for somewhere around 60 to 70% of the total bitcoin hashrate. If news would break that mining will be banned in China, it could throw Bitcoin in a huge crisis. The news of banning exchanges brought down Bitcoin price over 30% while their exchange volume only makes up 10-15%. Now just imagine how the prices would react, if about two thirds of the mining power is under threat of being banned.

One of the reasons why mining is so big in China is based on the low energy prices. Chinese energy prices in China are about 33% less than in the US and almost 80% less than in Germany. This is mainly caused by the large amount of coal, which is China's main energy source.

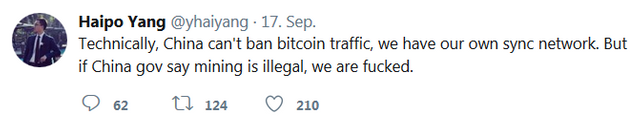

Here is what Haipo Yang, the founder and CEO of now closed Chinese exchange ViaBTC tweeted regarding this topic:

This would be a serious crisis for Bitcoin... let's hope this will not become reality!

I lived in China for 9 years, based on my experience I don't think they'll ban mining. China is much more relaxed on what it produces for export than what it sells domestically. Have a look where most of the world's steroids are produced. The govt will turn a blind eye to that, as long as it's for export. So I'd apply the same to mining. Make it, sell it, but don't use it.

That's an interesting perspective! You might be right... let's hope you are right.

This post recieved an upvote from minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond

hope, China's government won't prohibited bitcoins. Just we're going to start a new messenger project (Tlind-vtssenger of connections) and we would like invite Chinese to our ICO

This post recieved an upvote from minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond

It won't.

Not actually a bad thing it makes mining profitable for people in other countries with a lot of "cheap" used ASIC miners going for the taken, if China bans mining. On top of that they won't ban producing the mining equipment (that is just electronics) so prices will drop for equipment as they want to ramp up exporting them from China (China has been guilty of making sure production of ASIC miners stays mostly in China).

It will be into the 22nd century (I know long time) before the last BitCoin is mined so I can think of a few countries, those who have strong renewables, that would jump at this opportunity to have no competition from China in mining.

I don't think China will ban using BitCoin so the Chinese will still demand it and use it via Macau and Hong Kong to get funds out of China. That is inevitable.

Either way BitCoin wins when you think about it. China just can't break BitCoin. It is not that simple. So don't worry about it. I am not.

Caveat is BitCoin cash will be destroyed if it happens as all their operations are in China and need China. I don't think they will find it easy to restart mining in other countries becasue of their fugazi nature (something China embraces but the rest of world finds deplorable).