Things you should know about Petro, Venezuela's oil-backed cryptocurrency. Part I

Venezuela's oil-backed cryptocurrency is a sophisticated scam set up in a world where scammers are abundant, the corrupt political elite has brought the country to an economic collapse, with a cumulative gross domestic drop of 50% since 2013, the International Monetary Fund projects a 18,000% inflation rate for 2018.

The causes of this decline are a combination of strict forex controls, price caps, corruption and mismanagement of the world's biggest oil reserves on the planet.

Public unrest and disapproval of chavismo is giant, and in several occasions Venezuelans have turned to the streets to demonstrate against the government only to be met by the most brutal state repression, according to the Penal Forum, an NGO dedicated to the aspects of human rights in the Venezuelan Justice system, over 13,000 people have been unlawfully incarcerated since 2017.

Image by Beto

Faced with disapproval, public unrest and a failing economy, on the first week of december, the chavista administration, led by Nicolás Maduro made the annoucement that Venezuela will launch a cryptocurrency called "Petro", in televised broadcast, government officials boasted about how this was Hugo Chavez's idea back in 2009:

The Maduro administration didn't resort to the "internet of value" model out of a good will, but to bypass and avoid the heavy international sanctions that the European Union and the United States of America have imposed upon a select group of government officials for money laundering, racketeering, drug-trafficking, terrorism funding and human rights violations.

So Maduro and his cronies came up with the idea of developing a cryptoasset pegged to the value of Venezuelan oil, gas, gold and diamond reserves. This unprecedented announcement would have made big news if it weren't because of the fact that chavismo's reputation in the world is, for a lack of a better word, shady.

With cryptocurrencies being on the crosshairs of every financial regulations agency of every developed country, the potential of blockchain technology assets for money laundering and avoiding controls is of interest for ill-intentioned folk like chavistas to hide their actions. So instead of using bitcoin, dogecoin, ethereum or iota they came up with the idea of making their own cryptocurrency.

Cryptocurrency hasn't been legal in Venezuela up until a few months ago. The government's secret police has raided, incarcerated and prosecuted a lot of crypto dealers in Venezuela, seizing their assets and using them to mine bitcoin and now mine their own Petros.

As many crypto freaks out there know, launching a new cryptocurrency isn't difficult, the tough part of the job is convincing others that the cryptocurrency you launched actually has value in exchange. For a country like Venezuela, fueled by 20 years of socialist-castro-communist dialectic, markets are the devil. But with communism being the epitome of ideological hypocrisy, the chavista administration is hellbent on saving every last precious, ill-gotten dollar from the evil capilast hands that wants to take them away from them, even if it means delving into the most capitalist business in our time: Crypto-trading.

The right ones for the job: Shady guys for a shady enterprise.

Image by Beto

The chavista regime has always improvised when it comes to governship, having almost nobody in their ranks with the education and know-how to actually guide a project of such magnitude as the Petro, Nicolás Maduro had no other choice but to appoint Carlos Vargas, a former student opposition leader-turned into hardcore chavista after the 2012 presidential election, whom according to my sources, his only expertise on cryptocurrencies was opening a bitcoin wallet on his own. A complete incompetent on crypto-assets (or public affairs, for that matter) is leading the newly created Cryptoasset Superintendency of Venezuela.

Pretty soon, Carlos Vargas and his team of incompetent friends found themselves with a big project and no knowledge whatsoever to carry it on, so they went to google and with the help of some friends from the chavista Intelligentsia they found in their rolodex the son of a corrupt banker charged with laundering money for Diego Salazar, the Colombian cartels and the Sicilian Mafia in the Dominican Republic willing to make some quick, easy cash, so they found Gabriel Jiménez, a denim-sneakers-and thick glasses- wearing nerd, former opposer to the chavista government and former intern to Congresswoman Ileana Ros-Lehtinen was running an online marketing agency disguised as a tech startup, "The Social Us" in no time, with a no-bid contract, he was hired by chavismo to set up everything related to the Petro.

How is it possible to run a startup tech biz worth millions in a country with tight forex controls and where power blackouts are served on a daily basis by the failed state energy company?

As if staffing the Petro enterprise with entrepreneur wannabe kids that are holding 7.6% of all Petros and dodgy russians with a dark background wasn't enough, Maduro and his cronies also called their old-time friends the russians to assist them in developing this complex cryptoasset.

So he joined forces with "one of the biggest companies in the blockchain space": Aerotrading, a company so big and so famous it's barely listed by google, their corporate website leads you nowhere, their twitter account only has three tweets since october 2015 and whose owner is an unknown man living in Uruguay.

The other russian involved is Denis Druzhkov, a man sanctioned by the Chicago Mercantile Exchange for fraud and whose company Zeus Trading uses some technology developed by the Nem Foundation.

To gain some credibility, the Nem technological platform was advertised by chavista regime as though the whole Nem foundation was involved in the Petro enterprise, but this was clarified by Nem via twitter stating that Druzhkov and his team were present in Caracas as the Zeus team and not them, thus marking distance with some shady deals.

So you have a team of scammers trying to scam the crypto market.

So what's Petro anyway?

The Petro is a blockchain project with a distinct peculiarity: All the coins are already mined. Ripple is already mined as well, and is sure has a nice market cap, but it isn't being pushed forward by a narco-terrorist-dictatorship regime.

Filled with inconsistencies and grammatical errors in its whitepaper, the Petro claims to be backed by oil barrels and its value pegged at sixty US dollars per Petro but it isn't. It's pegged to the price of unextracted oil located in the Orinoco River basin.

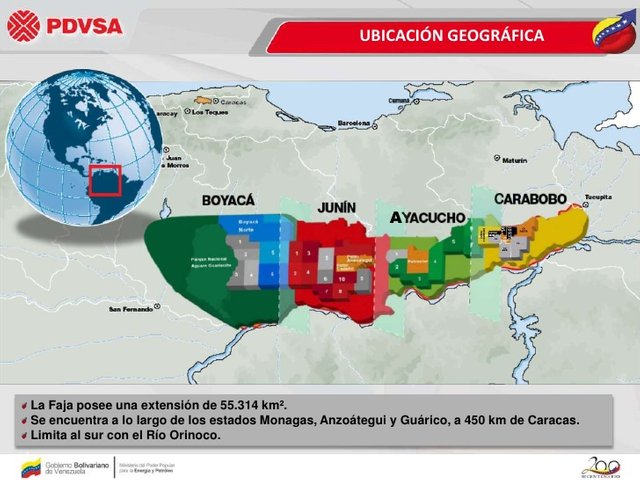

Image by Petróleos de Venezuela S.A.

The oil in the Ayacucho Field is underground, it hasn't been developed and there isn't even a development plan on that lot of land. The state oil PDVSA hasn't developed the required infrastructure, pipes, and transport. Even if the infrastructure was readily available, the extracting and refining would need to pay 33% in royalties, taxes and special contributions to the Venezuelan coffers.

If you're not familiar with Venezuelan oil industry business, in order for any company to extract oil from the subsoil, the state oil company PDVSA must own 51% or more of the business. The crude oil is sold at a discount, so it's price is lower than the price of the Venezuelan oil barrel and the price structure of all these things combined would make each barrel from the Ayacucho field be worth around 10 dollars.

Ten bucks out of the sixty promised to you by the government if you ever bought a single Petro token from them.

The reserves on this oil field aren't certified, what's certified is the original oil on site, a fancy phrase used in the oil industry to refer to how big the oil deposits are. Also the Ayacucho block is one of the lowest expected productivity fields in the entire Orinoco basin.

Also, the Petro is masquerading a non-congressional sanctioned public debt offering to bypass international financial regulations.

Why would you buy a cryptocurrency that relies on the value of a low-productivity oil field with little to no infrastructure developed for oil extraction, from a collapsing industry?

Even if you do, you have to give your personal data to the Venezuelan government, making yourself susceptible to extortion.

So let's say you dont care about buying something that doesn't have the value it's sellers are saying, and you don't care about giving away your personal information in a country where extortion is an everyday thing. You should know that you're also in violation of the Venezuelan Constitution which according to article 318, makes the Central Bank the only one capable of exercising national monetary competence.

The complex wording of the Petro buying contract forces the buyer to assume all obligations while the Cryptoasset superintendency assumes none. So you're required to commit quo acquire Petro without any piece of information on the mechanism by which the price will be determined.

So if you sign that contract and the Cryptoasset Superintendency decides to change the value of a Petro, you're committing to buy it at any price. This would make any trader run away because the contract is intended for the buyer to miss out on the opportunity to engage in speculation.

Petros can only be bought with fiat currency

With the US administration blocking every single transaction that has to do anything even remotely related to the Petro, it's very hard for you to risk your fiat money bank account to get some shady tokens and get sanctioned by US and EU regulators for doing it so.

This concludes part one of this series, thank you for reading, and if you're interested in knowing more about Petro, please feel free to comment.

Que viva Venezuela

interesante, yo igual ¡estoy en contra!

el petro es una estafa para que los chavistas laven su dinero sucio

Disclaimer: I am just a bot trying to be helpful.

nice post man; thanks for sharing the info on this coin...

thanks, be sure to check part II