The dichotomy of extortion and financial freedom: “bail in” or decentralised currency?

Back in 2011, my uncle who is an economist suggested that fiat currencies are intrinsically worthless. I didn’t understand the reason behind his words. But slowly referring back to the past probably he was right, “Fiat currencies are not safe.”. After all November 8, 2016, was a turning point with long queues outside banks after the Indian government decided to demonetize Rs1000 and Rs500 as legal tender. A shocking turn as 86% of its hard cash was legally wiped out in a cash based economy. Years 1946 and 1978 had something similar to the demonetisation move last year. The reason stated to this brash move was to curb “Black Money” a terminology used for the unaccounted money which has created its own reputation. Now with the introduction of GST as the next move to prevent leakages in the system on the indirect front. Soon possible “no income tax?” (hope so) – end of state propagated extortion scheme of the citizens hard earned income which they convert into “black” to just to evade at the first place which ultimately gets spent. Whereas the biggest cash cow of revenue comes from indirect taxes. Probably citizens do pay their accountants and lawyers well or is the system inherently complex.

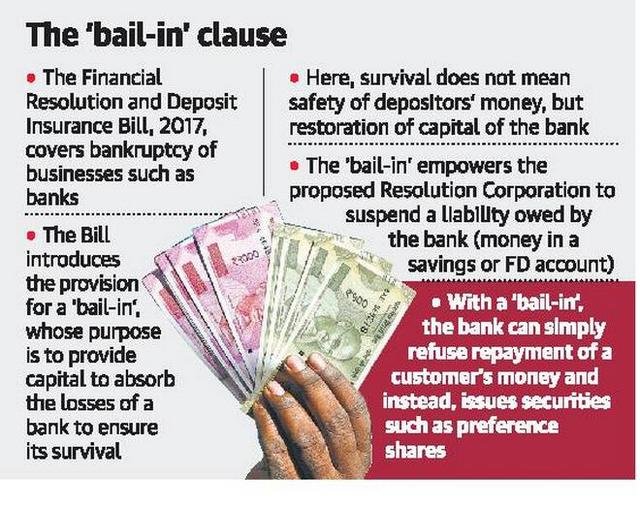

With the past events to add to the broth now comes the latest trigger cocked with the introduction of the Financial Resolution and Deposit Insurance Bill, 2017 which includes the introduction of “bail-in” provision tabled before the Indian Parliament in the monsoon session this year. Presently the bill has created a wave of opposition from petitions being signed to discard the bail-in provision.

What is bail-in?

The Bill specifies various tools to resolve a failing financial firm which include transferring its assets and liabilities, merging it with another firm, or liquidating it. One of these methods allows for a financial firm on the verge of failure to be rescued by internally restructuring its debt. This method is known as bail-in.

How does it work?

Under bail-in, the Resolution Corporation can internally restructure the firm’s debt by: (i) cancelling liabilities that the firm owes to its creditors, or (ii) converting its liabilities into any other instrument (e.g., converting debt into equity), among others.[3] Bail-in may be used in cases where it is necessary to continue the services of the firm, but the option of selling it is not feasible.[4] This method allows for losses to be absorbed and consequently enables the firm to carry on business for a reasonable time period while maintaining market confidence.3 The Bill allows the Resolution Corporation to either resolve a firm by only using bail-in, or use bail-in as part of a larger resolution scheme in combination with other resolution methods like a merger or acquisition.

However, in case of bank deposits, amounts up to one lakh rupees are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC). In the absence of the bank having sufficient resources to repay deposits above this amount, depositors will lose their money. Gaining trust by financial inclusion of all citizens to deposit savings in banks, and move digital all to reduce leaks in the accounting. Now comes the biggest threat to peoples sweat and toil all for the pieces of rag so dear to all of us, the backbone for everyone’s survival pleasures. This is aimed at preventing another crisis and sought to strengthen mechanisms for monitoring and resolving sick financial firms.

Is there a way out for the common man? With the latest developments in the crypto market with introduction Bitcoin futures, there is a lot of chaos to deal starting today. Are cryptocurrencies the future or a move towards anarchy, probably time will take its course.

Do let me know what do you think do you support Bank "bail-in"?

If you like my work do share it with your friends. You may also read my other works which might interest you:

- The End of Indian Cryptocurrency Dream? Government to Discourage Use of Crypto’s

- SCOPE OF BITCOIN AND ALTCOINS IN INDIA

- What Does It Take to Be a Cryptocurrency Investor in India?: My Story

- Indian states to Embark on New Era of E-Governance: Blockchain Technology to Secure Public Information

Follow Me: @adityavijayr