Crypto Prices Slide as New Week Begins

The world’s top cryptocurrencies declined at the start of Monday trading, with bitcoin, Ethereum and Stellar falling by at least 4%. Each currency in the top 20 was down following a weekend rally that fizzled out on Sunday.

Crypto Price Levels

Bitcoin briefly traded below $7,900 on Monday, where it was off more than $1,000 from weekend highs. The world’s largest and most active cryptocurrency was last down nearly 6% at $8,069.

The world’s top cryptocurrencies declined at the start of Monday trading, with bitcoin, Ethereum and Stellar falling by at least 4%. Each currency in the top 20 was down following a weekend rally that fizzled out on Sunday.

// -- Discuss and ask questions in our community on Workplace.

Crypto Price Levels

Bitcoin briefly traded below $7,900 on Monday, where it was off more than $1,000 from weekend highs. The world’s largest and most active cryptocurrency was last down nearly 6% at $8,069.

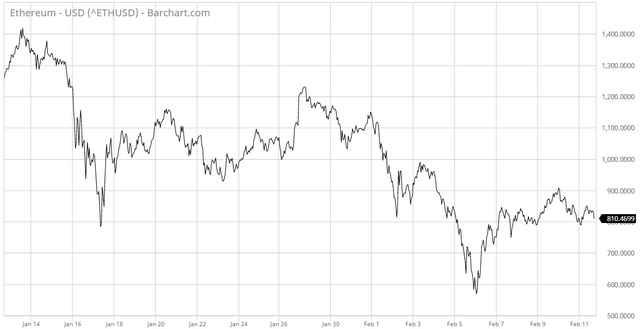

After showing considerable poise amid a chaotic market, Ethereum followed the general downtrend Monday. Ether price levels touched a low of $780 but later recovered at $810 for a loss of 6%.

Ripple’s XRP token recovered from earlier losses, but continued to trade below the $1 mark. Altcoins Cardano, Stellar, NEO, Dash and IOTA were each down more than 7%, according to data provider CoinMarketCap.

The only major outlier was a lesser known coin called U.CASH, which gained more than 1,000% on Sunday. The coin was last valued near $0.21 for a total market cap of $1.8 billion.

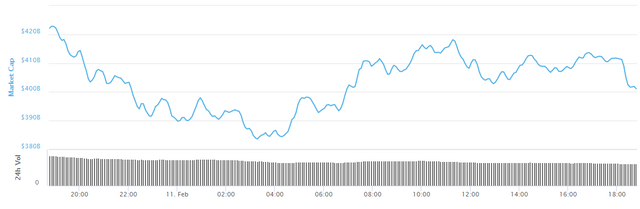

The combined market cap for all 1,500+ coins in circulation was $406 billion, based on latest available data. The market briefly dipped below $400 billion at the start of Monday’s session.

Cautious Outlook

Despite their recent slide, cryptocurrencies are trekking firmly higher from last week’s lows. Small gains followed by brief dips are expected to continue as investors move past recent controversies involving regulation.

As Hacked has reported numerous times, the regulatory outlook isn’t nearly as perilous as mainstream media sources have indicated. U.S. regulators last week gave a more or less favorable outlook on cryptocurrencies, but outlined a need to counteract ICO fraud and ensure that domestic exchanges are held accountable.

One of the main takeaways from last Tuesday’s Senate Banking Committee meeting was a call for inter-agency coordination to address safety concerns on unregulated exchanges. That being said, Christopher Giancarlo of the Commodity Futures Trading Commission (CFTC) expressed genuine optimism and excitement about the future of the market.

Although regulatory concerns in jurisdictions like the U.S. and South Korea have been blown out of proportion, those pessimistic about the market still have legitimate grievances. Accusations over price manipulation involving Tether and Bitfinex and the continued vulnerability of online exchanges continue to influence investor sentiment. This could get worse before it gets better if it is proven that Bitfinex and Tether are unauditable.

According to Bloomberg, both companies were subpoenaed by U.S. regulators in December, although the nature of the court order remains unclear.