cryptocurrencies transforming the remittance market

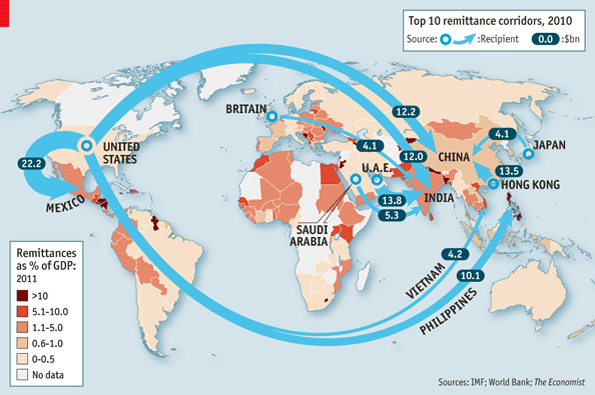

The World Bank Group’s Global Knowledge Partnership on Migration and Development initiative revealed that for year 2015 international migrants sent around US $601 billion to their families around the world. Approximately 74% of the amount went to developing countries.

Migrants from developing regions move to another country for different reasons. Usually poverty, cultural, political and economic circumstances are the most probable. No matter the goal - moving somewhere for a better quality of life, finding work or following a particular career path, migrant workers contribute to growth and development not only in the counties of destination but also in their country of origin. As a consequence, the continued growth of international migration and the structural reliance on migrant labour form a billion dollar remittance market, expected to rise.

Traditionally the remittance market was dominated by banks and players like Western Union and MoneyGram. As technology is rapidly developing and shaping nearly every aspect of our daily life, it is time to take into consideration faster, cheaper and more efficient methods of payments and money transfers.

According to Forbes, in 2015 the global economy spent around US $44 billion on fees for remittances. The money sent from one country to another often go to low-income households, so high transaction rates and long transfer time are discouraging and repressing people who are trying to survive and deal with hard living conditions.

The main reasons for expensive money transfers are the restricted and inefficient connections between financial institutions and systems. Remittances move across borders, currencies and institutions, which leads to time consuming and high cost transfers. Fees may reach up to 10% or higher of the total amount, which is extremely expensive for low-income households that, in most cases, rely entirely on remittances to survive.

All these issues have led to the launch of competitive, low cost solutions based on the blockchain. Startups located in countries like the Philippines have offered alternative solutions in a market, where money transfers from overseas workers equal US $26 billion.

The head of business operation of Coins, one of the first blockchain-based platform that provides its users with cheaper and easier money transfer solutions, as well bill payments and mobile airtime top-ups, believes that the blockchain is a growing area that will manage to lead to a positive change not only on the remittances market, but also to financial inclusion of the low income workers in general.

The financial inclusion by facilitating purely cash-based workers has increased in the past few years. With the new developments, it is easier to access your account, pay online and make transfers with peer-to-peer cryptocurrencies. The fact that transfers become much cheaper, because middlemen like banks and escrow agents are omitted, changes dramatically the way the remittance market operates and at the same time opens multiple opportunities for its future development.

In line with its vision - to improve the lives of all people worldwide by giving instant access to financial services, OneCoin has presented an alternative to the way remittances have been offered traditionally. With its low cost cross-border payments and remittances, the Company aims to increase financial inclusion of low income families, to save time by offering instant money transfers and providing more transparency related to its services.

Applying New Technologies To Make Remittances Work (Forbes, June 2015

Get Hashes from a Mining Pool from Iowa

You can mine there Bitcoin, Ethereum, Dash, Litecoin and ZCash

I thought everyone hated the USA?

“The main reasons for expensive money transfers are the restricted and inefficient connections between financial institutions and systems”

Worldwide in 2018, 2 billion of people are unbanked and are suffering of high remittances cost to send money internationally from the existing providers.

In developing countries, for expatriates sending money home is vital. It is often found that a single remittance is then used for several payments which are a necessity for the household. For example food, housing, education and so on… It’s also very dangerous for a country that the GDP depends so much on the remittance system, that’s why it’s crucial that the cost of remittances should be lowered.

The blockchain technology allows people to p2p transfer money without bank accounts and the cryptocurrency is more and more helping these unbanked through different projects.

Bitspark company is running through cryptocurrency and in partnership with the UNDP a test in Tajikistan to develop cash in cash out international remittance without banks.

This technology is disrupting the traditional remittance industry and will helps the poorest save more money.