Trading Tips for Confused Crypto Traders.

Hi traders, let's talk about... trading.

With Bitcoin stuck in a tight range (see our latest analysis), I believe it's a great time to reflect on trading and address the pitfalls that many new retail traders fall into.

Tip n.1 - TA should be done on the most liquid market available.

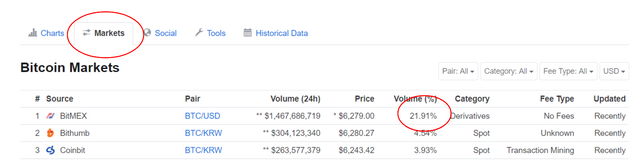

It's best practice when charting a trade to do so on the most liquid market available. Liquidity can be easily gauged by going on CoinMarketCap and clicking on the Market tab for the asset you're charting.

For example, BITMEX has been moving the Bitcoin market for months now and should be your first choice for charting a trade.

The ticker for this market is XBT / US Dollar Index:

Now that you've picked a market, it's time to pick a time-frame.

Tip n.2 - Pick a time-frame that's right for you.

Your strategy should determine the time-frame and not the other way around.

If like me you're a long term value investor or swing-trader then you should not bother looking at anything smaller than a weekly or monthly time frame.

On the other hand, if you consider yourself a day-trader then the minute, 15 min or hourly charts are your friends but can you handle the lifestyle of a day-trader?

Typically, the smaller your trading time-frame the more you will experience stress (because you're probably trading on leverage to squeeze a few % out of the market) and the more time you'll need to spend in front of your computer obsessing over charts and getting drown in the noise.

Conversely, the longer the time-frame, the less stress and micro-management you need doing.

Identify an entry, get in and let your trade cruise on auto-pilot to your target.

For example: if your investment strategy is to buy Ether and hold it for a couple of years, don't even bother looking at a something smaller than the weekly chart, in fact, don't even bother looking at the daily price at all, instead, keep monthly tabs on the price, cost average into the trade then "hodl".

This brings me to my third tip.

Tip n.3 - Refrain from day-trading.

There's been plenty of studies that have shown that most day-traders do nothing but lose money in the long run.

Sure there's the odd exception to the rule but you need to understand that day-trading is a nightmarish play-field for whales and algo-traders and, as a retail trader, you have no edge and will likely get squeezed dried by stop-order hunting and trading fees.

Day-trading also comes with a very time consuming and stressful lifestyle that will likely isolate you from your friends and family, develop poor hygiene and make you poorer so do yourself a favor and don't day trade.

Instead, chart your trades on a larger time frame (daily or weekly), identify a price you're comfortable getting in at and hold the trade for as long as you are comfortable doing it.

Tip n.4 - Don't put in more money than you are ready to lose.

This one is the most fundamental 101 risk management rule.

Trade only with play money.

If you start playing with money you need to pay the bills, you'll probably never be able to win in the market because you'll be constantly worried of losing it all.

A scared trader is a losing trader.

You'll start making mistakes, get in and out of trades incessantly and slowly lose all your money on trading fees.

As your capital grow so will your risk tolerance but if you're a new trader you should definitely control your positions so you don't start sweating bullets every time the market goes a few % against you.

Tip n.5 - Don't drink the Kool-Aid.

Crypto is an extremely risky market and the underlying technology is still a long way off from becoming mainstream... if it ever becomes that.

The worst thing you can do as a trader is to become emotionally attached to your bags of coins and hold a losing position to the bottom just because you "believe in the technology".

This is particularly true for ICO tokens which are, in my opinion, way more risky than mined coins like Bitcoin or Ethereum.

Being a token holder not only grants you absolutely no power over the project but it also exposes you to considerable third party risks like a hack or the developers deciding to dump their reserve of token to fund the project... or buy themselves a house with a swimming pool.

As a trader, the worst thing you can do is lose your objectivity and become a devoted community member or an evangelist for a project.

You need to find that sweet spot between keeping up with the fundamentals of the assets you're trading while maintaining a healthy skepticism towards them so your emotions won't get in the way if you ever need to dump your bags to take profit or because the trade is going against you.

All my losses as a trader came because I got emotionally involved into the stuff I was trading. I started to read up everything about a particular asset, keep up with their blog and read things that would confirm my bullish bias.

In other terms I lost my objectivity more than a few times and I paid the price for it.

So that's it for today traders.

Do you have any tips that you'd like to share?

Until then,

FØx.

This content is for informational purposes only and does not constitute financial advice.

If you liked this article, make sure to show some love by up-voting or following the blog. You can also follow us on Twitter at F0xSociety.

Buy Digital Assets on Coinbase

Buy Digital Assets on Coinbase

Keep your Crypto Safe from Hackers in a LEDGER NANO S

Keep your Crypto Safe from Hackers in a LEDGER NANO S

Published on

by FØx

Great article, I initiated my first swing trade yesterday after a long period of time!

Posted using Partiko Android

Thanks, good luck with your trade @chesatoshi :)

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by FØx from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.