Ripple $300 in 2018?

Ripple (payment network) has been at the centerpiece of the overarching Cryptocurrencies market for about a year now and currently sits at number 3 behind Ethereum (ETH) — not far behind either. Ripple is aiming to bridge the remittance cost-gap between institutions across the globe — Financial Institutions. something that has torn the cryptocurrency community due to the decentralized nature /ideals of the markets.

Why has Ripple been such a major topic in the cryptocurrency community?

Well, take a look at the image below. I don’t have a clue when this picture was created, but Bitcoin fees and Credit Card Processing fees continue to take center-stage topic as more and more retail consumers enroll in the markets. Why fees? I thought the magic of Bitcoin was in it’s Decentralised Organisational Structure? It is, still. Bitcoin will not be regulated by any government and cannot be shut down unless governments in every country across the globe shutdown electricity to every individual supporting the network via Bitcoin Mining.

One of the pictures above displays that Ripple already has a much, much lower fee than the distributed Bitcoin network and Visa’s current fee schedule. Even Bitcoin’s currently inefficient network beats Visa’s payment processing fees. Ripple has a highly-dedicated team of Finance and experienced technology professionals fueling their growth and they are either aiming to integrate with credit card processors like Visa OR simply take their market-share. Either way, it should be interesting to watch Ripple’s price in the process!

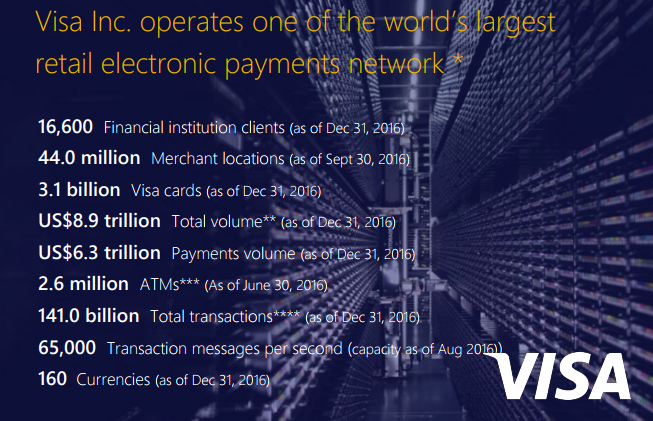

The sheer statistical figures below give us some interesting potential scenarios that I will have fun projecting below

Okay so 16,600 Financial institution clients…do we really need to go through every single stat? I don’t think so…we all know Visa owns a significant portion of the market so let’s have fun diving into potential Ripple projections!

According to CoinMarketCap’s Ripple profile, there are currently 38,739,144,847 XRP in circulation with a total of 100 billion XRP in max supply, held by Ripple leadership and a fund of XRP used to ease the price growth of XRP as the company increases the volume and attention on their products. I will keep all figures the same as they are now in the projections below:

38,739,144,847 XRP.

$8,900,000,000,000 is Visa’s yearly total payment processing volume.

Now, keep in mind that Ripple will be used for payment PROCESSING. Meaning, Ripple will not always be held for the entire time it is being used to send value, right? For example, you or I might send U.S. Dollar to somebody in Europe where the USD is instantly converted into XRP, sent to the final destination at a bank in Europe, and then settled in Euro (currency) or the proper tender in the country sent to. However, Visa will not be the only provider that would use Ripple, it would be major financial institutions like Goldman Sachs or JP Morgan and other behemoths.

Since Ripple is a Digital Currency/Virtual Currencies, financial institutions and especially Assets Under Management institutions can add it as an Asset Diversification strategy in their client Portfolios. So we don’t know how much volume will be transacted in XRP by these institutions, so let’s have some fun!

$8,900,000,000,000 ÷ 38,739,144,847 XRP

= $229.742 XRP.

Kind of cool to think about, heh? The equation above is IF Ripple’s XRP captured ALL of the value of the Visa payment network, something unlikely to occur. However, as mentioned, Visa isn’t the only company Ripple can serve. What about Mastercard?

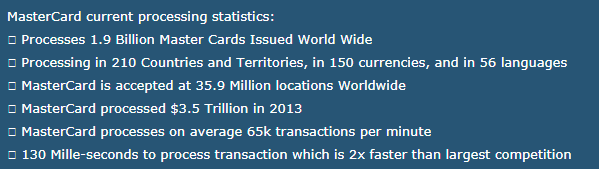

Interestingly, I could not find a single number that made sense to include in this article because one source says that Mastercard was processing $5.5 trillion in transactions as of 2003 and another source (image above) says 10–years later, in 2013, Mastercard is processing $3.5 trillion — companies do not usually shrink over time, but maybe Visa or other payment processors took some Mastercard volume? I don’t know, but let’s use the $3.5 trillion figure from the image above.

$3,500,000,000,000 ÷ 38,739,144,847 XRP

= $90.35 XRP

If, somehow, Ripple was able to capture all of the value of both Mastercard and Visa processing volume, XRP price might look something like below:

$3,500,000,000,000 + $8,900,000,000,000

= 12,400,000,000,000 ÷ 38,739,144,847 XRP

= $320.09 XRP

Keep in mind, the Assets Under Management (AUM) market is currently a $71 trillion market as per PricewaterhouseCoopers (PwC)’s Assets Under Management 2020: A Brave New World report, and expected to grow to $101 trillion by 2020. Considering Mastercard and Visa’s payment processing equates to something like $12.4 trillion in annual volume, that’s just a drop in the bucket compared to the large and separate $71 trillion AUM market.

What if, say, all major asset funds used the ‘5% rule’ to diversify into 5 different major currencies, one of them being Ripple’s XRP? This assumption means that 1% of the overarching $71 trillion AUM market share would go to Ripple’s XRP.

0.01 x $71,000,000,000,000

= $710,000,000,000 ($710 billion)

Just the $710 billion would increase the $320.90 XRP price by:

$710,000,000,000 ÷ 38,739,144,847 XRP

= $18.33 XRP

$320.90 + 18.33

= $339.23 XRP

Remember, PwC projects the AUM market to reach $101 trillion by 2020, just 2-years away. What might this $18.33 price increase be if it were 1% of a $101 trillion market?

0.01 x $101,000,000,000,000

= $1,010,000,000,000 ÷ 38,739,144,847 XRP

= 26.07 XRP

$320.90 + 26.07

= 346.97 XRP

These are some pretty ‘brave’ and potentially over-zealous projections to make for Ripple’s XRP price and is not meant to be taken as a forecast of what will happen or advice for that matter. You, me, nor anybody else truly knows what will happen in the future of this financial revolution we are currently in the process of experiencing and are an integral part of. However, the dynamics discussed in this article are potential forces that will affect the price of XRP in the potentially near-future.

This is not meant to be Investment Advice and is just a fun display at speculation/forecasting what could happen with this revolutionary new cryptocurrency that aims to disrupt the payment processing space. Do your own Due Diligence before making an Investment Decisions.