This is not how Bitcoin was supposed to work.

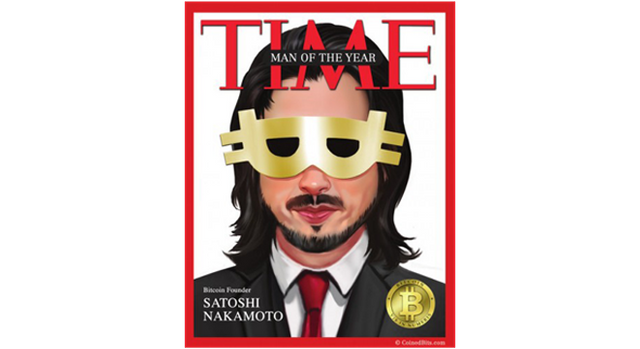

Let’s go back to the beginning of Bitcoin. The first stop for anyone seriously interested in Bitcoin is the Bitcoin white paper: the canonical document written by Bitcoin’s pseudonymous creator, Satoshi Nakamoto, in 2008. “I've been working on a new electronic cash system that's fully peer-to-peer, with no trusted third party,” Nakamoto wrote when he posted the proposal to a cryptocurrency mailing list. This sentence describes everything Bitcoin was intended to be, and the qualities that first got people excited about it, the key terms being “cash,” “peer-to-peer,” and “no trusted third party.”

Bitcoin, at its core, was supposed to be a way to pay for goods and services online — in Nakamoto’s words, Bitcoin would replace existing systems for “commerce on the internet.” In the early days of Bitcoin, evangelists tried to use it for everything, including salaries, pizza, and Bitcoin swag. This was in the spirit of Nakamoto’s proposal, but the network effects were not there. There simply weren’t enough merchants accepting Bitcoin, or enough customers holding the currency.

This led to the rise of startups like BitPay, which facilitated Bitcoin payment for merchants like Microsoft and Overstock. BitPay was part of the early crop of Bitcoin’s finance industry, and while it and similar startups increased the usefulness of Bitcoin, they represented the sort of middleman Bitcoin was supposed to disintermediate.

After nearly nine years in existence, the closest thing to the kind of Bitcoin-powered payments Nakamoto envisioned is on dark-web markets: the websites like Valhalla or the now-defunct Silk Road that can only be accessed through the anonymizing network Tor. Bitcoin is the default currency on the dark web — but the speculators driving the current bubble are making it difficult to use Bitcoin for actual transactions. “Fuck you Bitcoin,” one buyer commented on the dark-web subreddit. “Went to do a direct deal today with a vendor, realized my $250 purchase would end up costing me $315 or so with fees and would still take probably 24 hours to get to him.” “I personally think there needs to be a grand movement on markets and vendors... to move to an alternative crypto, one that is not so god damn volatile and that can actually be viable,” wrote another.

What about Bitcoin as a peer-to-peer network with no trusted third parties? “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without the burdens of going through a financial institution,” the Nakamoto wrote. This system very quickly fell apart.

In theory, you should be able to get your hands on Bitcoin without having to trade it for any real- world currency or interact with any financial institution. The function of the financial institutions is replaced by elegant cryptography and the distributed network of Bitcoin users’ computers. All you need to acquire Bitcoin is a computer connected to the internet. You download the Bitcoin client and either have someone send you Bitcoin in exchange for a good or service, or use your computer’s processing power to maintain the network and get rewarded in Bitcoin. Once you have Bitcoin, you can use the same tools to store and spend it.

But only the earliest, most dedicated Bitcoin users adopted this system; almost immediately, middlemen starting showing up. In October 2009, New Liberty Standard published a Bitcoin exchange rate based on the cost of electricity for a computer to mine Bitcoin, which established that one U.S. dollar was worth 1,309.03 BTC. In February 2010, The Bitcoin Market, the first of many Bitcoin exchanges, popped up. The notorious Mt. Gox exchange was established later that year. Even the dark-web markets, home to the purest use of Bitcoin, were middlemen, delivering messages between buyers and sellers and serving as an escrow service.

Bitcoin was designed so that users had to take care of their private cryptographic keys for every address they used, and Nakamoto advised making a new address for every transaction. This proved too confusing and burdensome, so along came wallet services, which stored users’ Bitcoins like a bank account and substituted a password for the private key. (The first wallet I used was MyBitcoin.com. It was “hacked” and I lost half my Bitcoins.) There are many, many other types of middlemen in the Bitcoin system now, including sellers of Bitcoin-specific hardware and server farms that have monopolized the creation of new Bitcoins.

The existence of these middlemen also obviates another one of Bitcoin’s features: privacy. Middlemen like Coinbase are bound by know-your-customer laws and collect extensive information on their users.

The Bitcoin network is still technically peer-to-peer, but with so many middlemen, it might as well not be. This is not entirely the fault of the greedy middlemen; Bitcoin is simply too intimidating for most non-programmers to use without the help of apps like Coinbase.

Back to the current bubble. Remember how Coinbase, the San Francisco-based startup which raised more than $200 million in venture capital, put a freeze on my money? Whether it was out of incompetence or an attempt to save itself from selling at an inflated price (at one point, the price of Bitcoin was $3,000 higher on Coinbase than on other exchanges), this was exactly the kind of thing Bitcoin was supposed to prevent.

Bitcoin was supposed to disintermediate the finance industry — the system of banks and middlemen and transaction fees in which a single entity can hold your money hostage. Instead, it replicated this system and made it worse. Ordinary users all trust third parties to verify transactions and hold their money. The price is so volatile that no one wants to use Bitcoin for payments. And thanks to the current bubble, the electricity required to maintain the Bitcoin network is skyrocketing.

“Bitcoin was supposed to demonstrate the power of a true free market,” the developer Adam Chalmers tweeted on Wednesday afternoon, when the average price of Bitcoin was around $13,000. “Instead it's full of scams, rent-seekers, theft, useless for real purchases and accelerates climate change. Mission accomplished.”

When Nakamoto created the first Bitcoins, he included a bit of text: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” The line served as a precise way to date the start of the blockchain, but it also seemed to be a reference to the ongoing financial crisis. In his other writings on forums and mailing lists — hundreds of posts before he mysteriously disappeared in April 2011 — Nakamoto expressed anger at the financial system that had precipitated the crisis. “He wanted to create a currency that was impervious to unpredictable monetary policies as well as to the predations of bankers and politicians,” wrote The New Yorker.

Nakamoto was a libertarian who wanted to create a system for payments that would circumvent governments, bankers, and corporations. Instead, Bitcoin is now a get-rich-quick scheme that retains none of the exciting, anarchist features it proposed and has created a secondary economy with financial shenanigans that mirror the ones that led to the global financial crisis. Goldman Sachs says it is “exploring” a Bitcoin trading operation, and on Monday, two finance companies will launch Bitcoin futures contracts so that even more betting on the price can take place. It’s as if we invented the internet and then turned it over to AT&T to operate with switchboards.

In an email to the Metzdowd cryptography mailing list in January 2009, shortly after Bitcoin launched, Nakamoto wrote about his vision for the currency. At first it would start “in a narrow niche like reward points, donation tokens, currency for a game or micropayments for adult sites,” he wrote. “Once it gets bootstrapped, there are so many applications if you could effortlessly pay a few cents to a website as easily as dropping coins in a vending machine.” Instead, it got Wall Streeted.

i will not tell you what you should do if you like my post the corrupt fear us the honest support us the heroic join us