Bitcoin is Dead! Long Live Crypto-Economies!

This article looks at the future of Bitcoin and its off-shoots through the lens of its underlying technology -- NOT the fluctuating value the market assigns to crypto-currencies. I'm not trying to predict the rise and fall of the crypto-markets. If you want advice on how to place winning bets in the casino of speculative crypto-investing, you will have to look elsewhere.

But what is really happening here is far more fundamental than just another boom-bust investment bubble. Bitcoin rightfully holds a hallowed place in history. It loosened the shackles of our group mind as it relates to what money is or could be: disintermediating banks’ role in money creation, enabling banking for the unbanked, no 3rd party seizure, a secure money for the internet, etc.

In so doing, it has unleashed a wave of creative energy that is rapidly building in force, yet has not even scratched the surface of what is possible. What Bitcoin launched is just in its infancy, but it holds transformational promise.

Like any piece of software, Bitcoin’s implementation reflects a series of interdependent design decisions. The initial design choices that were made account for Bitcoin’s astonishing success. But design decisions involve tradeoffs and over time, the right choice can become the wrong choice. Bitcoin’s very success is exposing weaknesses in some of these decisions. And they are severe enough to put Bitcoin’s future in doubt. However, each of these design points represent places where alternative decisions can be considered and this is exactly what is happening. This is why I believe the future is bright for crypto-economies.

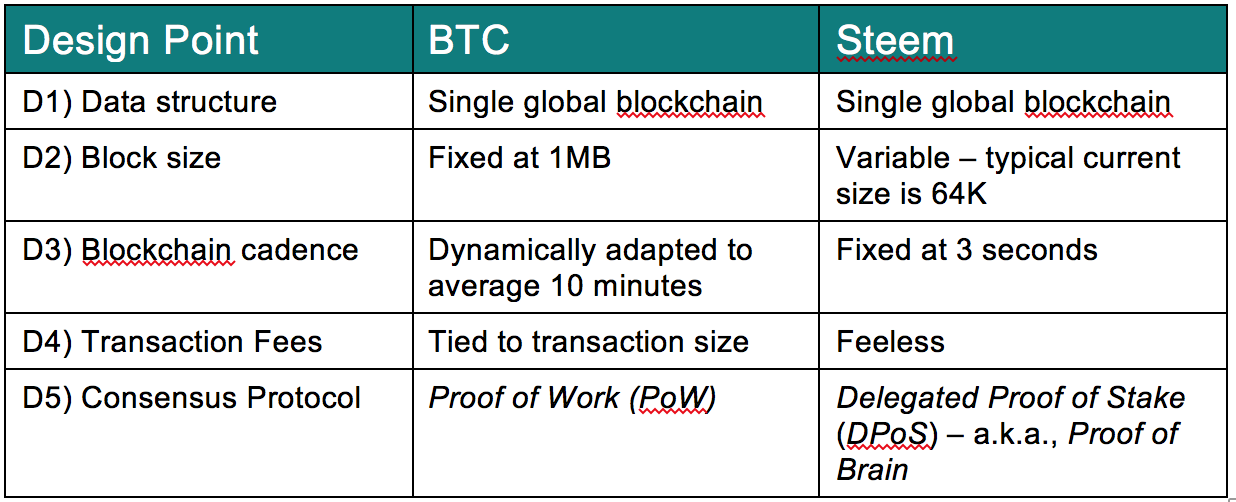

Some Salient Bitcoin Design Choices (this is NOT an exhaustive list!):

- D1: Single Global Blockchain as core data structure

- D2: Fixed block size (1 MB)

- D3: Fixed blockchain cadence (10 minutes)

- D4: Transaction fees tied to physical transaction size (bytes) – not transaction value.

- D5: Proof of Work (PoW) Consensus Protocol

The Scalability Challenge

Following from decision D1, Bitcoin consists of single global database (replicated across thousands of nodes) that is organized as a monotonically growing chain of blocks each of which records a set of transactions. Every transaction since the introduction of bitcoin is recorded in its global blockchain.

Bitcoin is encountering significant barriers to scalability arising from the combination of decisions D2 Fixed Block Size and D3 Fixed blockchain cadence. The fixed block size constrains the number of transactions that can be stored per block. The fixed cadence constrains the number of blocks (6) that can be added to the chain per hour. The combination of the two places a fixed limit on the number of transactions that can be processed per hour. The exact limit isn’t a specific number because the transaction sizes (in bytes/transaction) are somewhat variable (based on how many inputs and outputs the transaction has). But it is approximately 15,000 per hour. Period. Ever.

Note that this is a design limit, NOT a performance barrier. By design, the difficulty of the mining problem is dynamically adapted to preserve the 10 minute cadence. In other words, it doesn’t matter how fast or how many computers are thrown at mining, the transaction limit cannot be exceeded.

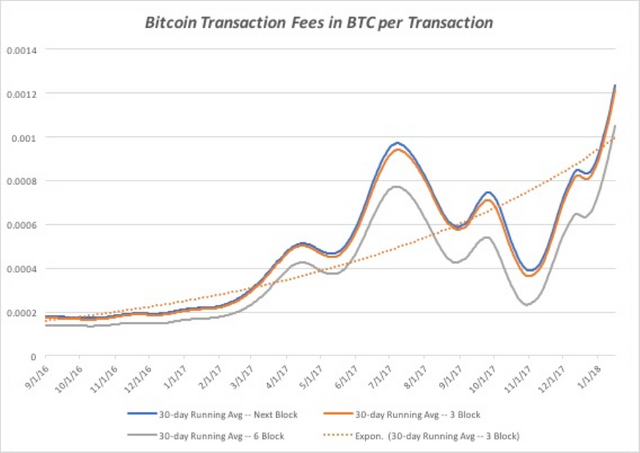

Under high demand, this limit on transaction rate leaves transactions competing for block space. Your transaction is competing with every other transaction for limited block space. To incent miners to add your transaction to the blockchain, you must offer them higher transaction fees. Thus, as Bitcoin’s popularity grows, so must its transaction fees. Until late 2012, BTC transaction fees were less than a penny. By mid-2016 they had grown to a dime. By May, 2017, fees consistently exceeded $1. In the month of December, 2017, fees averaged around $25/transaction, with a peak of $55/transaction. (Source: bitinfocharts). Of course, expressing these fees in USD obscures the picture a bit, because the price of Bitcoin against the dollar has also been soaring. But as the following chart shows, Bitcoin fees as measured in Bitcoin (instead of USD) have risen nearly 5-fold in the last year.

Source: bitcoinfees.info -- Assumes average transaction size = 250 bytes

Per design choice D4, the fee is based on the size of your transaction (in bytes) NOT the value of your transaction. Sending 100 Bitcoin in a single transaction incurs the same fee as sending .001 Bitcoin. But a fee of .001BTC/transaction wipes out the entire value of the .001 BTC transaction, while constituting only %0.001 of the value of the 100 BTC transaction.

The net effect of the above design decisions:

- Prohibits small value transactions (micropayments) due to high fees

- Undermines the goal of banking the unbanked – fees in the $25 per transaction range preclude participation by the vast majority of people on the planet.

- Undermines utility of BTC as a medium of exchange – only very large transactions are cost-effective.

In summary, as the popularity of Bitcoin grows, design decisions D1 thru D4 yield an effect which is virtually the opposite of the touted benefits of Bitcoin.

None of the above is breaking news. The Bitcoin community has been well aware of these issues for some time and, as you would expect, a variety of proposals have been made (and some implemented) aimed at addressing these issues by favoring different tradeoffs.

BTC’s support for the Segregated Witness (SegWit) protocol effectively shrinks the space required per transaction (by a factor of ~16). You can think of it as increasing the transaction density per block – which translates to greater transaction throughput per hour. So far, however, adoption of this protocol has been languishing around 10%-12% of transactions for a variety of reasons. Thus, SegWit’s impact on transaction fees has been limited to date.

The most visible change was the hard-fork of BTC into Bitcoin Cash (BCH). BCH extended the block size (D2) from 1MB to 8MB, increasing the transaction throughput capacity. This has succeeded in significantly lowering transaction fees, but detractors say this approach comes with a risk of centralizing the mining activity. As block size grows only those with the biggest mining rigs can win the mining rewards.

Neither approach fundamentally solves the scalability issue. They just kick it down the road, postponing but not eliminating the point at which transaction fees once again become prohibitive. This was brought into clear focus by Poon & Dryja in their video introducing Bitcoin Lightning. They demonstrate that to handle 14B transactions per day (i.e., every person doing 2 transactions per day), the blocksize would have to grow to 24GB (i.e., 24,000 times bigger than today’s BTC). This will cause the blockchain to grow by 3.5TB per day. Bandwidth and storage costs become prohibitive. Couple that with Design Decision D5 (Proof of Work), and the energy costs of the computation required to solve the PoW problem for each block become disastrous to the environment.

So it appears Bitcoin’s days are numbered. Right?

Not so fast. Because the innovation hasn’t stopped. Groups are exploring alternative solutions to virtually every one of the Bitcoin design decisions. For example, Bitcoin Lightning offers an alternative to decision D1 through the use of Payment Channels. Lightning offers a solution to the scalability solution, not by “fixing” the blockchain weaknesses, but by employing a different algorithm altogether. It relegates blockchain to a background role as a “fall-back” mechanism. The vast majority of commercial transactions will never even hit the blockchain. Poon & Dryja predict that Bitcoin Lightning will be able handle a global population of 7B people each doing virtually unlimited transactions with a Bitcoin block size of just 133MB.

And that is just in the Bitcoin space. There are literally hundreds of crypto-currencies now available exploring a dizzyingly diverse design space. Ethereum is re-working D2 by using gas-limited instead of size-limited block sizes and reducing the blockchain cadence (D3) from Bitcoin’s 10 minutes to 15 seconds. Decred uses:

- a hybrid Proof of Work/Proof of Stake (D5 alternative) approach to mitigate the environmental footprint issues,

- Lightning Protocol - for scalability and

- has a specific focus on improving Bitcoin’s governance processes (which have become rancorous, divisive and painfully slow).

Some, like IOTA and Holochain, are exploring alternatives to blockchain itself. Holochain challenges the assumption (D1) that a single global database is desirable, offering scalable consensus mechanisms that bypass a host of blockchain issues. IOTA aims to bring crypto-currency to the Internet of Things with tangle, their alternative to blockchain that brings with it the promise of fee-less transactions.

The real potential of crypto-currencies lies beyond their use as simply an alternative store of value within the traditional economy. In other words, despite the current enthusiastic speculation in Bitcoins and altcoins as a better gold, their real disruptive potential lies in their utility as a medium of exchange and an enabler of de-centralized value flows.

I will elaborate on both of these aspects in a later post, but as a quick example, let’s examine Steem. Steem offers two currencies: STEEM and STEEM Dollars (Steem Power is not a separate currency per se, but an unvested form of Steem). However, the currencies themselves are actually secondary to Steem’s primary purpose. As noted in the Steem Bluepaper:

Steem stands out as the first publicly accessible database for immutably stored content in the form of plain text, along with an in-built incentivization mechanism. This makes Steem a public publishing platform from which any Internet application may pull and share data while rewarding those who contribute the most valuable content.” (emphasis added).

In other words, Steem’s purpose is to be a public publishing platform. It is true that the Steem currencies play an important role in enabling a reward system that doesn’t depend on a centralized authority (this is an example of what I mean by de-centralized value flow). Furthermore, it is important for the Steem currencies to have value as a medium of exchange for the rewards to be meaningful. In other words, if you couldn’t exchange Steem for something of value, the rewards earned for content creation or curation would be worthless. But clearly, the creation of the Steem currencies was secondary to the overall purpose of creating a public publishing platform.

That said, it is still instructive to look at how Steem addresses the five Bitcoin design points we discussed earlier.

The collective effect of these decisions is profound as Steem has essentially solved the Bitcoin scalability issue. On December 19, 2017 both Ethereum and Steem topped the 1M transactions per day threshold for the first time. And, as noted in Steem blockchain breaks 1,000,000 transaction barrier, doing so required 60% of Ethereum's entire processing capacity while only consuming ~1% of Steem's processing capacity!

And Steem managed this throughput while also eliminating transaction fees entirely, effectively removing the barriers to usage. Pretty impressive, right?

And the innovation continues apace with literally hundreds of other crypto-innovators. So… while Bitcoin 1.0 may be running up against some hard limits, I’m bullish on the emergence of crypto-economies.

Congratulations @evomimic, you have decided to take the next big step with your first post! The Steem Network Team wishes you a great time among this awesome community.

The proven road to boost your personal success in this amazing Steem Network

Do you already know that awesome content will get great profits by following these simple steps, that have been worked out by experts?