Digital Currency Mining May Look Much Different in 2025

Hello guys how are you all? I hope you all are be fine and comfort as usual.Guys my main work is to provide you people every cryptocurrancies news each and every time from different sources but nowadays I am busy at my business work so please don't mind it i will give you best news every day.so friends let's take a look today's main key points are.

The Key points (about Digital Currency Mining May Look Much Different in 2025)are:

(1)Higher mining difficulty

(2)More centralized

(3)Green alternatives

(4)Proof of stake

SUMMARY:

(1)Higher mining difficulty:

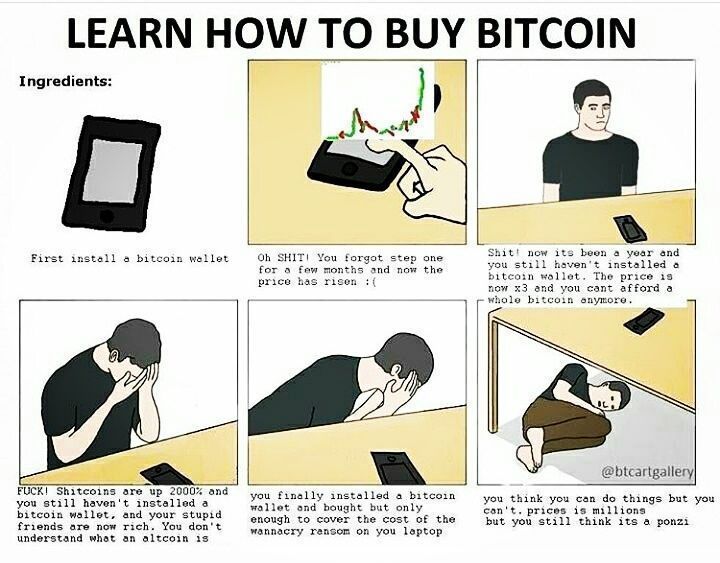

Bitcoin mining difficulty is adjusted every 2016 blocks to remain at roughly 10 minutes per block. As more mining capacity is brought online, the difficulty increases accordingly. Thus difficulty increases proportionally to the increase in computing power of the network.

The mining difficulty of both Ether and Bitcoin has increased exponentially since their respective genesis blocks. This trend will likely continue as adoption keeps increasing. Therefore, digital currency miners will have to constantly acquire more powerful mining equipment. The times where everyone could mine Bitcoin with his/her personal computer are long over.

(2)More centralized:

The rising mining difficulty has forced miners to keep buying new and more powerful mining equipment. The problem is that these super-computers are also very expensive, creating a significant barrier to entry that only those with deep pockets can overcome. Mining benefits greatly from economies of scale, which further limits the ability of small-time miners to be competitive.

Because of this, mining has become heavily centralized. AntPool claims to be the largest cryptocurrency cloud mining company in the world, controlling 17.82 percent of the hashpower of the Bitcoin network. Most mining companies are located in China due to the low cost of electricity and labor.

(3)Green alternatives:

As the hashrate of Blockchain networks keeps increasing, the amount of mining hardware will continue to grow. These mining computers consume vast amounts of energy, and this is with the entire cryptocurrency market being relatively miniscule in size.

One can only imagine how much electricity will be used for mining if digital currency becomes mainstream. Unfortunately, the electricity that powers these machines usually comes from non-renewable sources of energy, which contributes to climate change.

Austrian company HydroMiner is one of the few mining companies that are planning to make mining more sustainable and profitable by using renewable energies. Nadine Damblon, CEO at HydroMiner, pointed out in an interview for CoinNoob that there already are companies using solar energy for mining, but that hydroelectric power is probably the better solution since it’s more consistent and because the water can then be used to cool down the mining equipment.

(4)Proof of stake:

In a proof of stake (PoS) network, every validator owns a portion of the network. This is much different from Proof of Work (PoW) where every validator needs to own expensive mining equipment. PoS also encourages greater decentralization of the network, since all the currency holders are involved in securing the network in proportion to the amount of currency they own. Additionally, PoS is extremely energy efficient, since there is no need to make computationally difficult calculations. It also enables much faster validations.

Proof of stake does have a couple of drawbacks, with the most serious being the “nothing at stake” problem. Imagine that a network which uses PoS is under attack by a hostile actor who is trying to supplant the valid Blockchain with one of his own. It makes economic sense to “mine” on both Blockchains, since it costs you nothing to do so.

In fact, that’s the smart thing to do, just in case the attacker succeeds. With Proof of Work, a miner must instead decide to mine on one chain or the other, since mining equipment can only be used on one network at a time, and burns expensive electricity doing it.

Blocks on the Bitcoin Blockchain will always be verified through PoW. However, Ethereum is moving towards PoS with its new “Casper” protocol. If successful, this will enable Ether holders to stake their coins in a smart-contract in exchange for transaction fees. Many are eyeing Ethereum to see if they can in fact solve the heretofore intractable problems with Proof of Stake.

SOURCE:

https://cointelegraph.com/news/digital-currency-mining-may-look-much-different-in-2025

MY OTHER POSTS ABOUT BITCOINS ARE:

https://steemit.com/cryptocurrancy/@funandmoney/did-china-actually-ban-bitcoin