MY HOMEWORK TASK:// SCALP TRADING USING FINGER-TRAP STRATEGY//#YOHAN2ON-S2WEEK5//14/05/2021

I must begin by commending our professor @yohan2on on his lesson on scalping trading strategy; the lessons are easy to master and straight to the point. I hope you will be doing lessons like this making it easy for us the students to benefit. Meanwhile the homework task is to explain scalping trading using finger- trap scalp trading strategy. I hereby present my homework task below:

WHAT IS SCALP TRADING

Scalp trading is a process whereby a trader intends to take profit at small changes in price of an asset. A trader may hope to make huge profit for changes in price of an asset over a period of time, like hours, days, weeks or even months. In the other hand a scalp trader is interested in small variance in price in minutes to make small profit. At the same time, a scalp trader has a good loss management strategy since a certain loss may result in the loss of all the small profits he may have made.

There are various styles of scalp trading, but because of our assignment, we will focus on finger-trap strategy.

FINGER- TRAP SCALP TRADING STRATEGY

Having understood the concept of scalp trading, now we want to focus on finger- trap scalp strategy and how we can trade with this strategy.

In finger-trap strategy a trader's hand is on the trigger so to say, in other to execute trade or exit the trade. A trader does this by identifying the strongest trend in an asset pair and he follows the trend to execute his trade.

HOW TO TRADE USING FINGER-TRAP STRATEGY

first we need to identify the trend of an asset.

To identify trend in an asset, we will use trading indicators. The indicators we use for this purpose are moving averages. We will use exponential moving averages or EMA. We will set two periods, the period of 8 and the period of 34. See how to do this below:

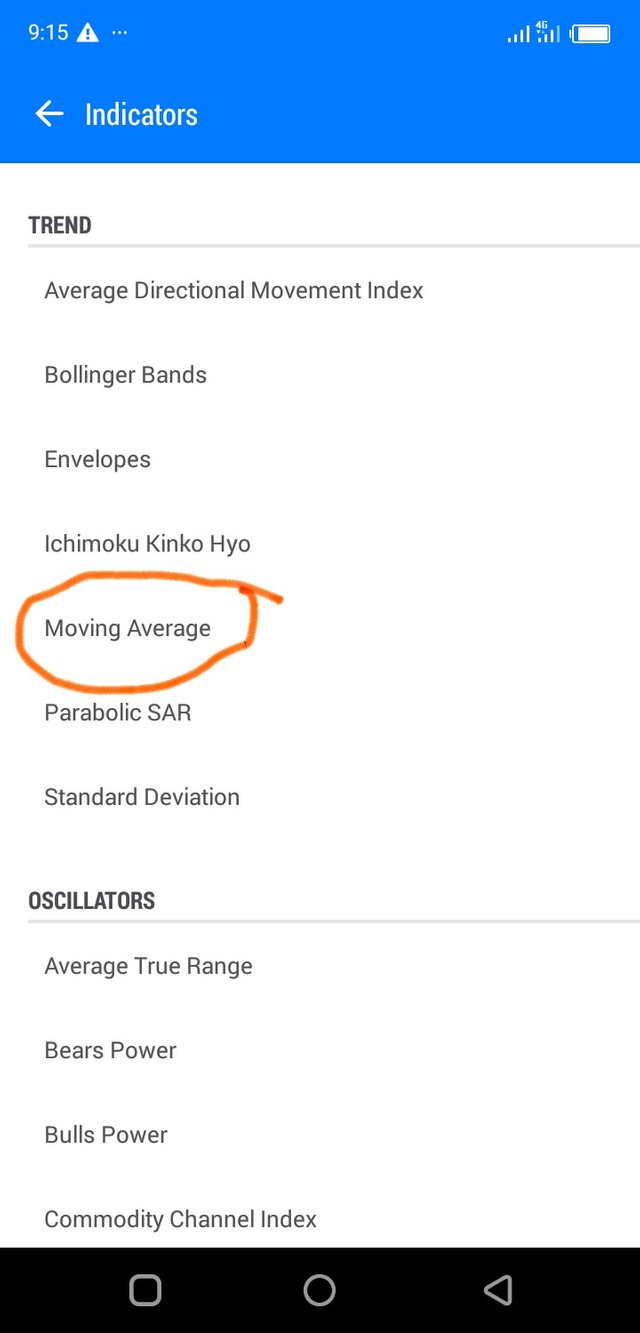

The marked area shows where to get our indicators using metatrader 5 demo account.

We need to select moving averages.

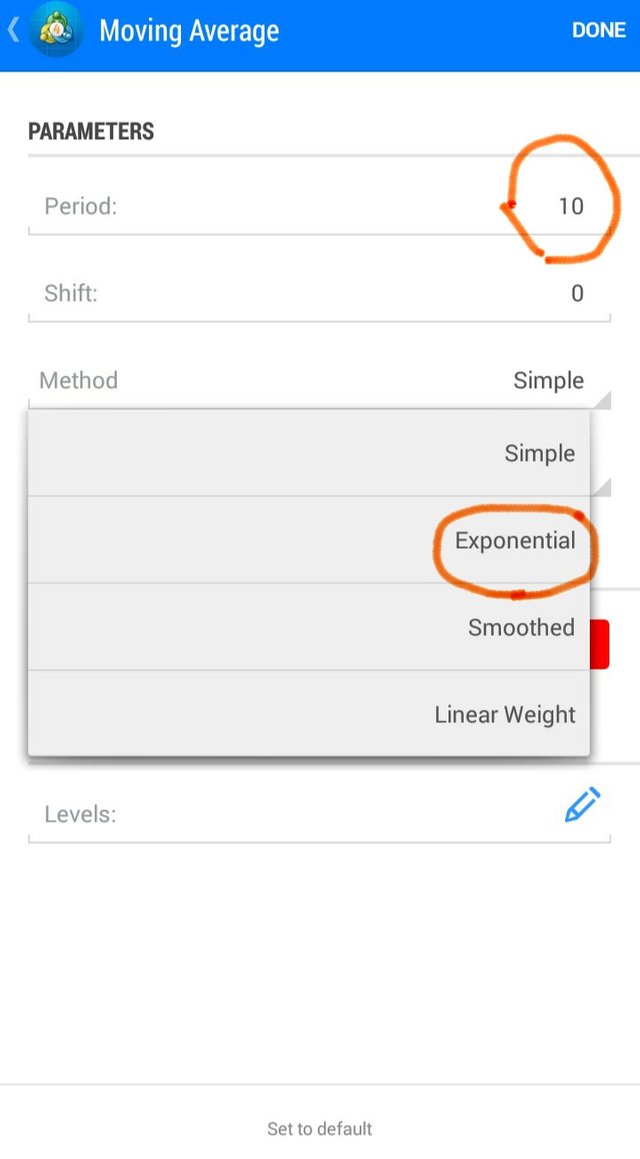

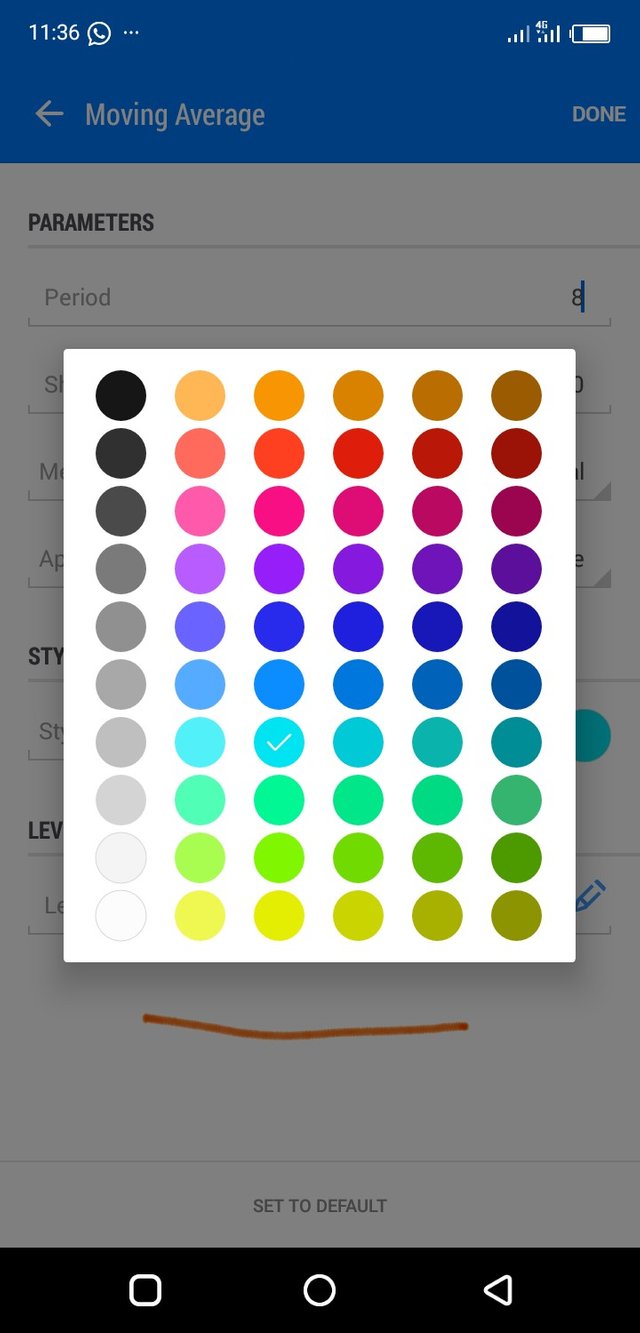

We then choose exponential moving averages and change the period to 8. We should colour it to distinguish it from the 34 period EMA that we are about to create.

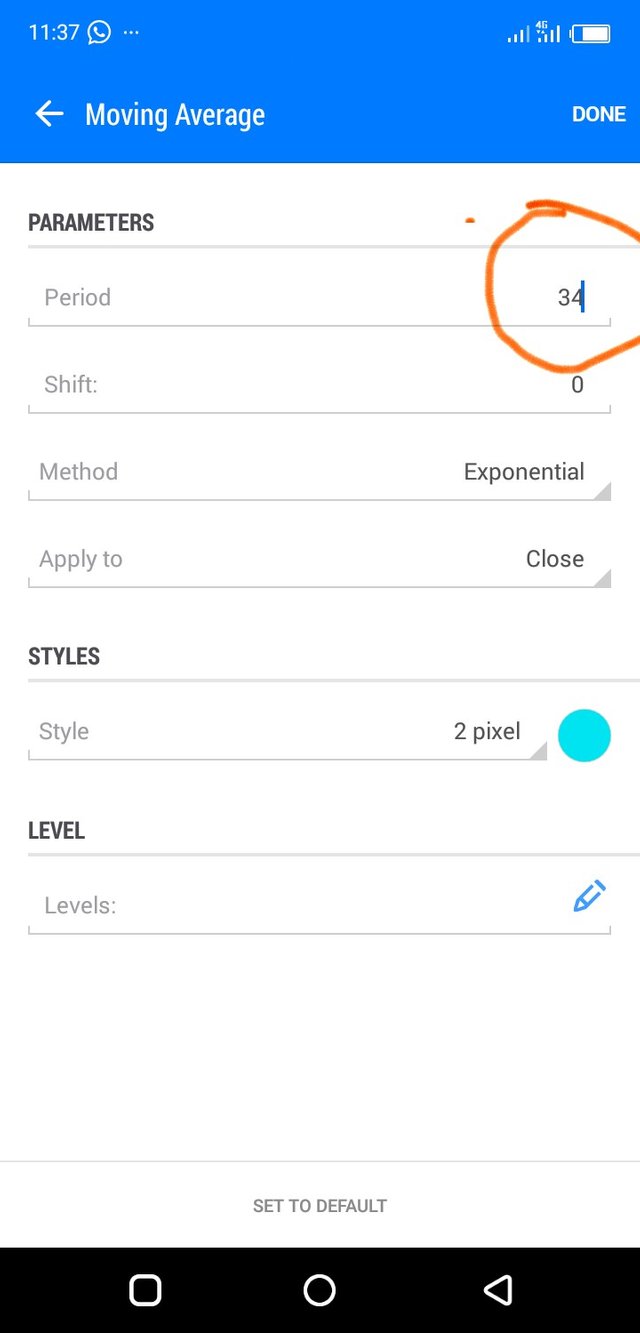

Then we need to apply. We will go back and follow same process for the EMMA 34 period.

Now we will have our chart like this:

What have we created? The blue line shows our fast EMA moving average with the period of 8 while the pink line shows the EMA 34 period. Remember we want to know how to identify the trend. Now as you can see in the selected crypto pair ETC vs BTC, the EMA 8 is below the EMA 34; when this happens that means we are on a down trend. In this case we will focus on sells. For those trading reversals, they may be willing to wait for a possible indication of an uptrend and then they will trade against the trend.

On the other hand, the photo below shows an uptrend:

In this case, the 8 period EMA is above the slower period 34 EMA indicating an uptrend.

TIPS TO KNOW WHILE TRADING WITH THIS STRATEGY

1: make good analysis. In other to get good results good analysis is vital. We need to weigh a pair on how it has behaved over a period of time, let's say an hour or more. It will help us make a good decision on best entry and exit time. It will equally help us speculate when there could be possible change in trend.

2: consider the price at the point of entry. Most people add RSI indicator to this strategy to know when a pair is overbought or oversold a good indication of possible reversal. Because price fluctuates, there is no doubt that we would want the price to jump up a little in case we on a down trend and drop a little in case we are on an uptrend before we enter the trade. This will enable us be on a better chance of profitable trade.

3: set a stop loss limit. We may make a good prediction and the market still goes against us. In other cases the price may have a huge jump to the opposite direction before returning to the trend. Waiting for the market to harmonise with our prediction when we have executed a trade is not a finger-trap strategy. One's finger need to be on the trigger so to say. Nobody enjoy loses. Therefore we will set a stop loss limit that jumps us out of a bad trade.

CONCLUSION

In finger- trap strategy, we tend to take profit at every small variance in price movement. Because we are working with short time frame we need fast indicators. That is why exponential moving averages EMA are better than simple moving averages SMA, because the later lags in its indication. We have to use EMA 8 and EMA 34. We equally need to make good analysis, checking the prices at the point of entry, and very importantly set our stop loss limit.

Thank you once again professor for the lecture so far.

#all images are from my personal metatrader 5 demo account

Hi @mobibliss

Thanks for participating in the Steemit Crypto Academy

Feedback

This is good work. Well done with your research and the practical demonstration of the scalp trading style using the finger trap strategy.

You did not clearly demonstrate the trade management element of the finger trap strategy. The Stop loss is set 5 or 10 pips above the recent swing high if you are going short on an asset and the reverse is true.

There is also an element of trailing your stop in order to continue making profits from a continuously profitable trade.

Homework task

7

Thanks prof. @yohan2on for pointing those out.