SLC S21W5 : Advanced Strategies Using On-Chain Data and Sentiment Indicators

Hello everyone! I hope you will be good. Today I am here to participate in the contest of Steemit Crypto Academy about the Advanced Strategies Using On-Chain Data and Sentiment Indicators. It is really an interesting and knowledgeable contest. There is a lot to explore. If you want to join then:

.png)

Question 1: Understanding On-Chain Data Metrics

Explain the importance of on-chain data metrics like wallet activity, exchange inflows/outflows, and token holding distribution. How can these metrics indicate market sentiment during a bull run?

On chain data metrics are the important tools to get the real time data of the blockchain activity. On chain data is very important. This on chain data allow the investors to take a better decision based on this data. This data also helps the analysts and developers to understand the trends in the market. It helps to drive the market.

They are especially useful during a bull run. Actually during the bull run the prices increases and decreases at a great rate and ultimately going in the upward direction but with the corrections. And in this phase timely decision is very important and on chain data helps in this way. So by analyzing the on chain data we can assess the user behaviour and the confidence of the market. So we can make more authentic choices for the investment.

On Chain Data Metrics

On chain data metrics provide transparent and reliable information by analyzing blockchain activities directly from the ledger. As we get all the data from the ledger that is the reason it is known as on chain data where each transaction is verified and validated. This on chain data is immutable.

Moreover this on chain data in the ledger is also decentralized. It means it is transparent and anyone can access this data without any restrictions with the help of the transaction id. And this is the reason on chain data is one of the most accurate sources for the analysis of the market. These metrics are different from the traditional charts and indicators such as moving averages. This focuses on the real activities of the network. On chain data metrics include:

- Transaction volumes: This tracks the frequency and size of the transactions on the blockchain network.

- Wallet activity: This measures the user participation through the active and newly created addresses.

- Token flows: This monitors the movement of tokens between the wallets and the exchanges.

On chain data is very important for understanding the market sentiment. It shows the actual behaviour rather than the speculative reactions of the market.

Key On Chain Metrics

A. Wallet Activity (Active and New Addresses)

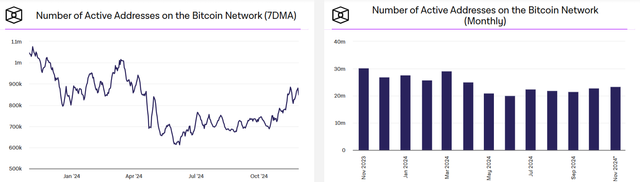

Wallet activity is an important on chain metric and it represents the number of active addresses. It also counts the new created wallet addresses. It tracks the number of wallets which are performing the transactions. This data provides the sending or receiving transactions.

Why It Matters

There are several reasons from which we can calculate the the importance of the wallet activity on chain metrics. These reasons are given below:

- Active addresses: An increase in the active addresses indicates more participants are transacting. It signals the greater adoption of the specific assets. It is also crucial to understand the utility of the cryptocurrency.

|

|---|

- New addresses: Growth in the new wallets shows the entrance of the new investors. It is often driven by the news or the market hype. By seeing this data the investors and the retailers can take good decision before the breakout.

|

|---|

Bull Run Impact:

Wallet activity is an important metrics which helps during the bull run. The increase in the activity of the wallets shows the confidence in the market. It shows that the trend of the market is changing. Because the more active addresses the more chance is to change in the market. It shows the adoption of the cryptocurrency during the bull run which is the positive sign about the cryptocurrency. So in the bull run when the activity of the addresses increases then the investors and the retailers can consider them key data to take a decision about their investment.

Example: During the 2021 bull run of Bitcoin the increase in the active addresses highlighted the growing interest of the of the people in Bitcoin. It also suggested the mass adoption and it drove the prices higher than expected.

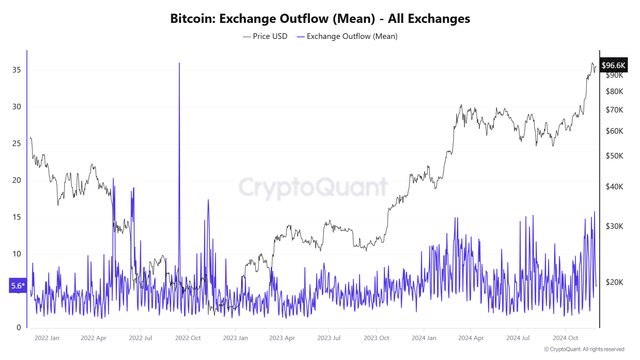

B. Exchange Inflows and Outflows

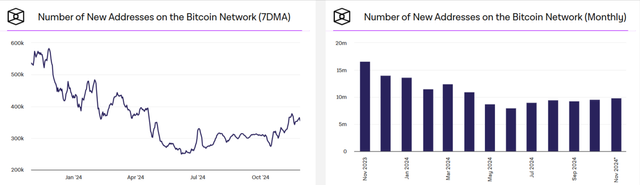

The flow of the assets is another important on chain metrics. It helps to track the flow of the assets in the exchanges and from the exchanges.

|

|---|

Why It Matters

There are many reasons that the flow of money in exchanges matters a lot. Some reasons are given below with classification:

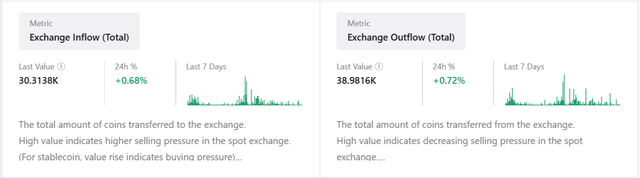

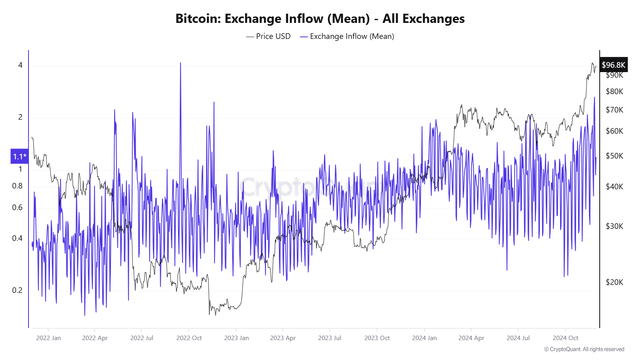

- Inflows: The inflows of money in the exchanges represent the selling pressure. The large inflows indicate the potential selling pressure. Because the users start transferring their assets to the exchanges for the liquidity.

|

|---|

- Outflows: Outflows of the assets from the exchanges shows that the investors are moving their funds from the exchanges. Large outflows of the assets suggest that the investors are moving their tokens to private wallets. It signals confidence in the long term price appreciation.

|

|---|

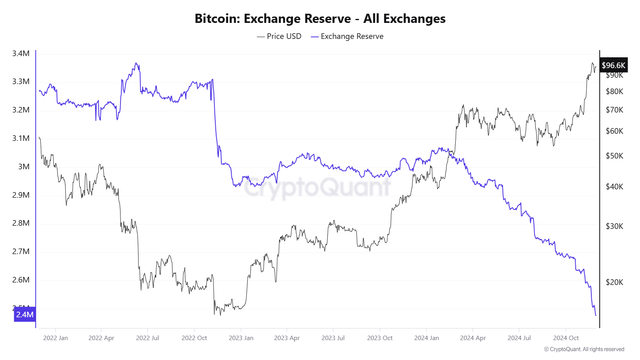

- Exchange reserves: This is also important to watch. A decline in the reserves suggests that the selling pressure has reduced and it represents the bullish market sentiment.

|

|---|

Bull Run Impact:

The flow of the money is the only thing which determines the market in the traditional as well as in the crypto market. So the flow of the assets in the exchanges in the form of the inflow and flow of the assets from the exchanges in the form of the outflow is really important in the bull run market conditions.

Dominant outflows during the bull runs indicate investors are holding rather than selling. It suggests that the price will continue to increase. Actually the investors get out their assets from the exchanges for the long term holdings.

Example:

The significant outflow of Ethereum in 2020 to 2021 was driven by the staking for the Ethereum 2.0. It showed optimism and make the bullish momentum more strong.

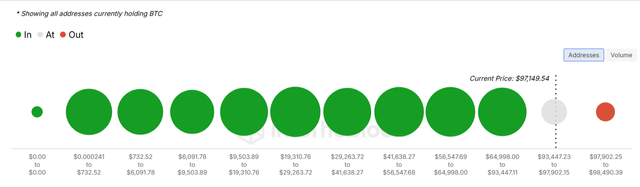

C. Token Holding Distribution (Whale and Retail Activity)

Token holding distribution is another important on chain metric which helps to take a decision especially in the bull run market. This on chain data helps us to analyze the distribution of the assets among the wallets. We can identify the wallet sizes and their holdings and the tokens distributed to the wallets. This on chain data helps us to identify the largest transactions.

|

|---|

Why It Matters:

There are a number of reasons that token holding distribution is important in the market analysis. Some of them are given below:

- Whale accumulation: Indicates confidence from institutional investors or high-net-worth individuals who can influence market trends.

|

|---|

- Retail participation: Reflects the interest and involvement of smaller, individual investors, often driving mass adoption.

|

|---|

Bull Run Impact:

Token holding and distribution plays an important role in the trading decisions in the bull run. A rise in whale activity suggests the accumulation of the assets by the large players. It often precede significant price rallies. The balance of the holdings between whales and retail participants create a healthier market ecosystem.

- Example: Previous bull markets saw whale accumulation followed by the retail participation. It led to the gradual growth of price.

How On Chain Metrics Indicate Market Sentiment in a Bull Run

On chain metrics can indicate the market sentiment in a bull run by showing network activity, investor sentiment, and market cycles. Some examples of the on chain metrics in a bull run are given below:

Bullish Indicators:

The on chain data is very useful for the indication of the rise in the prices during the bull run such as :

Surging active addresses: The increase in the active addresses in the on chain data shows the bullish momentum. It shows the adoption of the crypto assets and the growth in the network.

Exchange outflows dominating: When the outflows of the exchanges dominate then it suggests bull run. It also indicates the confidence in the long term holdings. It causes to increase in the prices. Actually the outflows happen when the people consider that the prices will go up and then they will sell their assets.

Whale accumulation: When the whales starts accumulating the assets then this on chain data shows the start of the bull run. It is believed that when the whales start accumulating assets then it is the sign that a rise in the price is coming that is the reason they are accumulating the assets. It shows the optimism from the influential market participants.

Bearish Indicators During a Bull Run:

The on chain data of the assets also helps to understand the bearish signals during the bull run such as:

Spikes in exchange inflows: The inflow of the assets in the exchanges represents the bearish momentum of the market. We know that when the inflows to the exchanges are increased it means that the holders are going to sell their assets. This will lead to selling pressure and the market will go down.So it suggests the profit taking or liquidation.

Whale sell offs: When the large transactions happen of the assets towards the exchanges then it also suggests the pending correction in the market during the bull run.

Declining network activity: When the on chain data shows the decline in the network activity then it means there are no investors or the interested people in the market. And it leads to the bearish trend in the market. Reduced transaction volumes or wallet activity suggest waning momentum.

Real World Examples of On Chain Metrics in Bull Runs

Bitcoin (2021)

- Wallet activity surged, with active addresses reaching new highs.

- Exchange reserves dropped as whales accumulated, driving Bitcoin’s price above $60,000.

Ethereum (2020–2021)

- Massive outflows to staking contracts indicated confidence in Ethereum 2.0.

- Transaction volumes and active wallets hit record levels, propelling ETH prices to all-time highs.

Benefits of Utilizing On Chain Metrics

- Transparency: Provides verifiable insights directly from blockchain data.

- Early Warnings: Detect potential market reversals or corrections before they happen.

- Informed Decision-Making: Allows investors to align strategies with adoption trends and market sentiment.

- Real-Time Data: Offers timely updates during rapidly changing market conditions, especially in a bull run.

- Macro and Micro Views: Helps assess both individual network health and broader market trends.

Question 2: Using Sentiment Indicators to Analyze Market Trends

Discuss how sentiment indicators, such as the Fear & Greed Index or social media sentiment, provide insights into bullish or bearish market conditions. Provide examples of how these indicators have historically predicted reversals.

Sentiment indicators are the tools which check the emotions and psychological level of market participants. They guide the investors and traders. They inform them about the fear and greed index. The shows whether the fear is dominating the market or greed or optimism or pessimism. Their analysis indicate the probable market trend reversal or the corrections in the market.

Key Sentiment Indicators

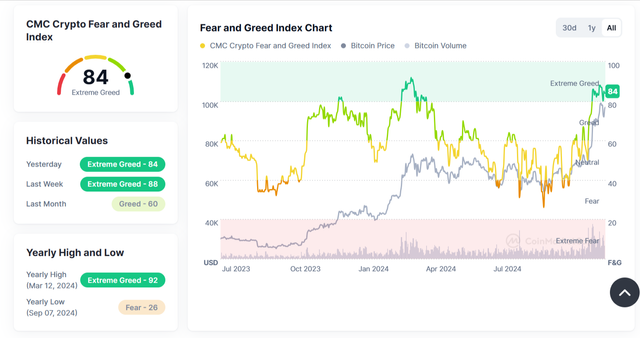

A. Fear & Greed Index

The Fear & Greed Index is one of the most widely followed sentiment indicators in cryptocurrency and financial markets. It is very famous and many traders and investors use this indicator. It aggregates multiple data sources to provide a single score (0 to 100). This represents the current emotional state of the market.

|

|---|

We can see that at the time of writing this post the fear and greed index is surviving at the 84 which is representing the bullish momentum.

Components of the Fear & Greed Index:

1. Volatility (25% Weight):

High volatility indicates fear as investors expect market downturns.

- Example: At the time of Terra Luna collapse (May 2022) the volatility part rose an indication of high fear as its price plunged. It is the greatest example in the history of crypto.

2. Market Momentum/Volume (25% Weight):

Price rallies and associated rising volumes are signs of greed. Because at this situation the investors jump in on a momentum trade.

- Example: The surge of the Bitcoin to $64,000 in April 2021 was accompanied by massive volume surges. It showed the euphoria of the market.

3. Social Media Sentiment (15% Weight):

Social media is another important indicator which can drive the market. We can track the mentions, hashtags and engagement related to key cryptocurrencies. Positive spikes in sentiment often indicate market optimism.

- For example: The rally in 2021 of Dogecoin was driven by virality on Twitter, Reddit, and TikTok. Actually it was hyped by Elon Musk. So the social media is the most important factor in the sentiment indicators.

4. Surveys (15% Weight): The sentiment indicators also include the public surveys. Sentiment surveys directly measure the levels of investor confidence and fear.

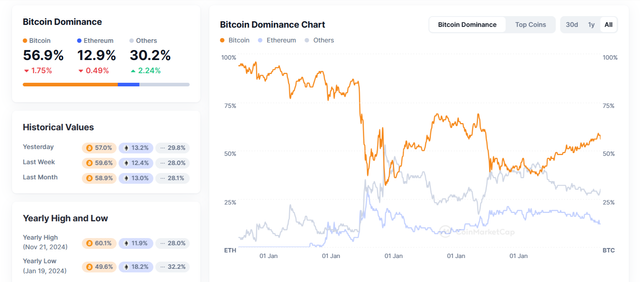

5. Bitcoin Dominance (10% Weight):

|

|---|

A growing Bitcoin dominance could indicate fear as investors retreat into Bitcoin which is the "haven of crypto." In point of fact Bitcoin dominance really exploded during the 2018 bear market as all alternative coins lost the trust of the investors.

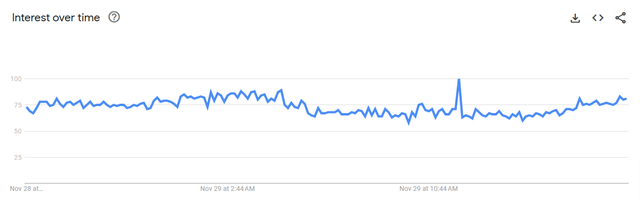

6. Google Trends (10% Weight):

|  |

|---|---|

| BTC search volume over time by Google Trends | World wide interest of people in BTC by Google Trends |

Measures search interest in terms like "cryptocurrency" or "Bitcoin price." Higher search interest typically corresponds with increasing retail enthusiasm.

Example: The Google Trends score for "Bitcoin" skyrocketed in December 2017. It indicated extreme greed as it reached $20,000.

Bullish Signals:

- Scores above 60 tend to indicate bullish sentiment where optimism rules the market.

Example: During the 2020 Bitcoin run up the index remained in the greed zone throughout the rally. It indicated positive market momentum.

Bearish Signals:

- Scores below 30 indicate bearish sentiment where the fear is dominant and may signal a market bottom.

- Example: The index hit 10 in March 2020 which was right before Bitcoin's massive recovery.

B. Social Media Sentiment

Social media platforms are essential in determining how the public feels. It is counted especially if the market is highly decentralized such as in cryptocurrencies. Using tools like NLP (Natural Language Processing) sentiment analysis determines if the discussions are mostly positive, negative or neutral.

- Components of Social Media Sentiment:

There are different components of the social media sentiments. These are given below:

- Volume of Mentions: High volumes of mention indicate growing interest.

- Example: During the January 2021 GameStop stock frenzy and Reddit mentions shot up leading to a price increase in its shares. Similarly when in the cryptocurrency the big companies such as black rock mentions the coins they also skyrocket.

- Sentiment Polarity: It tracks if the mentions are positive or negative. This means positive mentions can have buying pressure while the negatives mean people are afraid and uncertain.

- Example: FTX collapse in November 2022 triggered a sudden increase in negative mentions on Twitter and Reddit.

- Influencers and Trends: A tweet or post from influencers can be highly influential in changing the trend.

Example: Elon Musk's tweets on Dogecoin had created sharp price surges due to positive sentiment among retail investors.

Bullish Signals:

A sudden surge in positive opinion toward a particular asset or the market generally tends to be seen as a strong bullish indicator.

Example: A wave of positive mentions associated with Ethereum's transition toward Ethereum 2.0 boosted ETH prices.

Bearish SignalsNegative sentiment spikes indicate panic selling or fear.

Example: In May 2022 the growing social media concerns regarding Terra Luna's UST de-pegging preceded a large crash.

How Sentiment Indicators Give Market Insights

A. Determining Extreme Market Conditions

Overbought Conditions:

- Greed levels are extremely high, which usually indicates market euphoria and often results in overvaluation.

- Example: Bitcoin's price at $20,000 in 2017 marked extreme greed on the Fear & Greed Index.

Oversold Conditions:

- Extreme fear levels suggest undervaluation, presenting buying opportunities.

- Example: Ethereum's price drop to $90 in 2018 occurred when sentiment was deeply negative.

B. Measuring Retail vs. Institutional Behavior

- Positive sentiment often reflects retail activity, while institutional players rely more on technical/fundamental analysis.

- Example: In the bull run of Bitcoin in 2020, increased retail enthusiasm had high scores of sentiment, whereas institutions were quietly accumulating.

C. Market Reversal Predictions

- Tops are often accompanied by the extreme greed while bottoms are marked by extreme fear.

- Example: March 2020 was a time of extreme fear that coincided with Bitcoin's bottom at $3,800, only to recover to $10,000 by June.

Historical Examples of Sentiment Predicting Reversals

A. Bitcoin's 2021 Rally and Crash

The Fear & Greed Index remained above 70 when Bitcoin skyrocketed to $64,000 in April 2021. It was because of the high greed index value.

At 15 on the index, in May 2021, Bitcoin had fallen to nearly $30,000, which it later recovered from.

B. Meme Coin Frenzy (2021)

- Retail interest and overall positivity on Twitter and Reddit were behind Dogecoin's rally to $0.70.

- Sentiment being negative, however, had Dogecoin retreating sharply, demonstrating that even in speculative markets, it is sentiment that dominates.

C. FTX Collapse (2022)

- Prior to FTX filing bankruptcy the social media had started to turn extremely negative. This was at a time when major cryptocurrencies like Bitcoin and Ethereum were seeing substantial sell offs.

Benefits of Sentiment Indicators

- Real-Time Insights: Reflects the latest market trends.

- Early Reversal Signals: Identifies extremes in market psychology.

- Broad Scope: Captures retail and institutional sentiment across platforms.

- Decision Support: Complements technical and fundamental analysis.

Limitations of Sentiment Indicators

- Short-Term Focus: May not account for long-term fundamentals.

- Manipulation: Vulnerable to coordinated campaigns or influential figures.

- False Signals: Extreme greed or fear can persist during strong trends.

The Fear & Greed Index and social media sentiment are among the important sentiment indicators that show market trends and emotions. Such tools can be useful in anticipating bullish or bearish reversals by identifying extreme periods of fear or greed. Historical examples include Bitcoin's 2020 recovery and Dogecoin's speculative rally. They show the predictive power of sentiment indicators. Of course such tools are not infallible but remain useful when combined with technical and fundamental analysis.

Question 3: Integrating On-Chain Data with Sentiment Indicators

Describe how on-chain data and sentiment indicators complement each other to provide a holistic view of market sentiment. Use examples from Steem/USDT to illustrate their combined application.

In order to make the reasonable decisions in the crypto market we can combine the on chain data and the sentiment indicators. Their combination provides a great understanding of the market sentiments.

We know that the on chain data provides information about the activities of the network. It offers information about the behaviour of the wallets. It also suggests the movement of the assets such as in the form of the inflows and outflows of assets. On the other hand the sentiment indicators help us to measure the emotional and psychological condition of the users who are engaging in the market.

So if we combine the on chain data and the sentiment indicators then they enable a more reliable and comprehensive approach for the identification of the trends. We can predict the reversals. Moreover we can make investment decisions driven by the data.

On Chain Data: Objective Metrics for Blockchain Analysis

On chain data focuses on the real time blockchain activity. It provides measurable insights into how users interact with the network. We have discussed its factors in the previous questions but here I am just summarizing the previous concept to relate the explanations and examples.

- Wallet Activity: Tracks the number of active and new wallets interacting with the blockchain.

- Exchange Flows: Monitors token transfers to and from exchanges to identify selling or holding behaviours.

- Token Distribution: Analyzes whale accumulation, retail activity and supply concentration to understand market structure.

Example:

For Steem/USDT if whale wallets are actively accumulating Steem then it suggests confidence in the project. It signals a potential bullish trend in the STEEM. On the other hand if the large inflows of Steem to exchanges is happening then it may indicate the selling pressure. And this inflow of Steem to exchanges reflects bearish sentiment.

Sentiment Indicators: The Market’s Emotional Pulse

Sentiment indicators reveal the emotional state of the market by using the social media trends, search volumes and investor behaviour. We have also discussed the sentiment indicators previously but here is the summary of them to relate them with this discussion.

- Social Media Sentiment: Tracks positivity and negativity on platforms like Twitter and Reddit.

- Fear & Greed Index: Measures the risk of the market.

- Search Trends: Evaluates interest via search engine data (e.g., Google Trends).

Example:

An increase in the Steem related hashtags and positive mentions on social media suggests the growing interest of the people in this coin. It suggests the adoption of Steem. And it causes the increase in the price. Similarly the rising Fear & Greed Index scores the overall crypto market and it reflects the broader optimism.

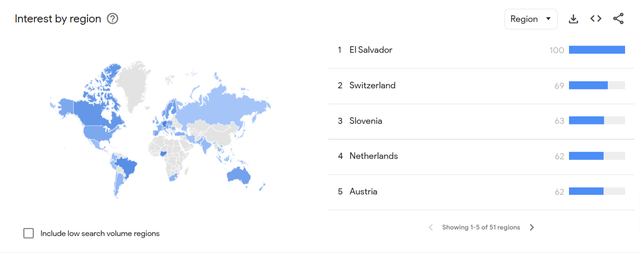

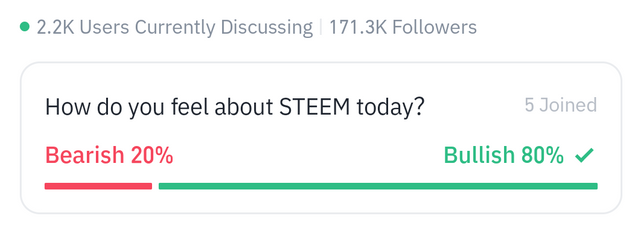

Here is the current data of the Steem token about the sentiment analysis by the community. I am a follower of the Steem token and I have also voted Steem as bullish. The market sentiment is saying that the market is bullish and it will go up. I have taken this from Coinmarketcap. In this way we can get the sentiment from the community.

How On Chain Data and Sentiment Indicators Complement Each Other

A. Confirming Trends with Objective Data and Emotional Insights

- On Chain Data provides the hard evidence of the network activity of the assets.

- Sentiment Indicators validate whether the emotions of the market participants align with the data of the market or not.

So if the market on chain data of the assets and the emotions of the people associated with the assets are positive then it helps in the confirmation of the bullish trend and similarly for the bearish trend.

Example (Steem/USDT):

If the on chain data of Steem shows an increasing wallet activity and the declining exchange inflows which shows accumulation while the social media sentiment about the Steem is highly positive then this alignment strengthens the bullish outlook for the Steem/USDT trading pair.

B. Identifying Divergences for Reversals

- A mismatch between the on chain data and the sentiment indicators can signal potential reversals.

Example (Steem/USDT):

- On-chain metrics: Whale wallets are offloading Steem to exchanges.

- Sentiment indicators: Social media buzz remains highly positive.

In this situation the retail enthusiasm may be misguided as whales prepare to sell. It suggests suggesting a bearish reversal for the Steem/USDT trading pair.

C. Enhanced Timing for Entry and Exit Points

- Sentiment indicators help identify when the market is overly optimistic (greed) or fearful.

- On chain data confirms whether these emotions are supported by tangible activity.

Example (Steem/USDT):

If the Fear & Greed Index shows extreme fear while the on chain data reflects whale accumulation then it provides a strong buying opportunity for the retailers and the investors.

Combined Application in Steem/USDT

A. Bullish Case Study

On Chain Data:

- Active wallet count for Steem spikes. It reflects the increased network usage.

- Exchange outflows dominate as investors move Steem to private wallets. It indicates the long term holding sentiment.

Sentiment Indicators:

- Social media mentions of Steem increase with hashtags like

#SteemRally,#steemtrending on Twitter. - Fear & Greed Index climbs into the "Greed" zone by showing growing optimism in the market.

- Social media mentions of Steem increase with hashtags like

Outcome:

This alignment indicates strong bullish momentum. Steem’s price could rally as adoption grows and investor confidence increases.

B. Bearish Case Study

On Chain Data:

- Whale wallets transfer significant amounts of Steem to exchanges. It signals the potential sell offs.

- If the exchange inflows spike it suggests the increased selling pressure.

Sentiment Indicators:

- Social media sentiment shows a decline with negative posts about Steem’s utility and future.

- Google Trends data for "Buy Steem" drops by reflecting reduced retail interest.

Outcome:

The combined data suggests a bearish trend. Investors should be cautious of potential price drops.

5. Real-World Historical Applications

A. Steem’s 2020 Recovery

- During the Steem blockchain hard fork the on chain data revealed a surge in active wallets as the community rallied behind the ecosystem.

- Sentiment indicators showed positive social media engagement as the community voiced optimism about the new direction.

- Result: Steem/USDT recovered by aligning with increased on chain activity and positive sentiment.

Benefits of Combining On Chain Data and Sentiment Indicators

- Comprehensive Analysis: Provides both objective and emotional insights into market behavior.

- Reduced False Signals: Cross-referencing metrics minimizes reliance on a single data source.

- Early Reversal Detection: Identifies discrepancies between actual activity and market perception.

- Informed Decision-Making: Enhances timing for entry and exit points, maximizing gains and minimizing risks.

Integrating on chain data and sentiment indicators offers a holistic approach to analyzing market sentiment. For Steem/USDT combining the insights from wallet activity, exchange flows and whale accumulation with social media sentiment and Fear & Greed scores allows investors to predict trends and reversals more effectively. By leveraging these complementary tools the market participants can make informed decisions, navigating volatile markets with greater confidence.

Question 4: Developing a Sentiment-Based Trading Strategy

Create a sentiment-based trading strategy for Steem, incorporating both on-chain data and sentiment indicators. Outline entry, exit, and risk management criteria tailored to bullish and bearish sentiment phases.

A sentiment based trading strategy combines the analysis of on-chain data which includes the wallet activity, exchange flows, token distribution with sentiment indicators which includes Fear & Greed Index and social media trends to make data driven trading decisions. For Steem, this dual approach provides a deeper understanding of market conditions. It enables precise entry, exit and risk management during bullish and bearish sentiment phases.

Trading Strategy for Bullish Sentiment Phases

A. Entry Criteria

To take an entry in the market we need to look at the following things both in the on chain data as well as in the sentiment indicators.

1. On Chain Indicators:

On chain data is very important for the trading decisions. Some key points are given below:

- Increasing active wallet count and new wallet creation.

- Declining exchange inflows and rising outflows. It suggests the accumulation of the Steem token.

- Whale accumulation of the Steem token represents the positive signs for the upcoming bullish market trend.

2. Sentiment Indicators:

Sentiment indicators also play an important role in the determination of the entry time. Some important points to be considered for the Steem token are given below:

- Increase in the social media positivity such as the trend of the Steem token.

- When the Fear & Greed Index moves into the "Greed" zone (60+).

- Search volume for Steem related terms spikes.

By seeing this on chain data and the market sentiment indicators we can say that the Steem is giving positive signs for the bullish momentum. We can consider this point as an entry point. So when the inflow of the Steem to the exchanges is less but the outflow is greater and on the other hand the sentiment analysis are also positive and in the bullish side then it is the point which can be considered as an entry point. If we see the current situation then Steem is in the entry zone and in the bullish sentiments.

B. Exit Criteria

For the exit criteria of the trade on chain data is again important. We need to consider the following points.

1. On Chain Indicators:

- Significant increase in exchange inflows (whale liquidations).

- Declining active wallets, indicating reduced network activity.

So if the on chain data suggests that the activity of the wallets has decreased and the inflow of the Steem is increasing then it means that the selling pressure is increasing. And in order to lock your profits you can consider selling your Steems. Because it is the high probability that the Steem market will take a correction before the next movement.

2. Sentiment Indicators:

The sentiment indicators play another great role in the determination of the exit point in the market. Some important points to be considered are given below:

- Social media sentiment turns mixed or negative.

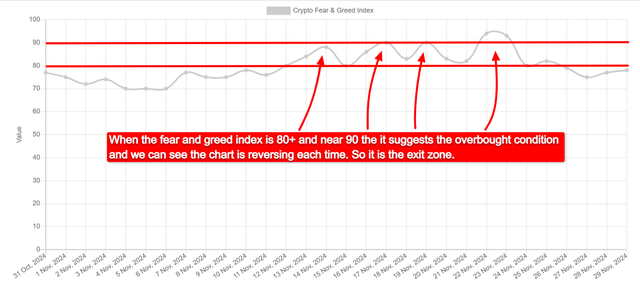

- Fear & Greed Index reaches extreme greed levels (80+), signaling potential overbought conditions.

|

|---|

We need to check the fear and greed index for the sentiment analysis if the fear and greed index is 80+ then it suggests the overbought situation and we know that after the overbought it is usual that the market take a correction. So we can exit our trade when the fear and greed index has the value of 80+ which represents the overbought.

C. Risk Management

Risk management is very important in the trading because crypto market is very volatile and no once can predict the exact movement of the market. So for the risk management here are some key points:

- Use stop loss orders at 5-10% below entry price to protect capital.

- Avoid over leveraging. Allocate only a portion such as 5-10% of your portfolio to Steem.

- Set a trailing stop loss to lock in profits as prices rise.

Example (Steem/USDT):

- Entry: If the on chain data shows declining exchange reserves but the Fear & Greed Index reaches 65 then we can consider taking an entry in the Steem market.

- Exit: For the risk management and to lock the profits we need to be more active. When the whale wallets transfer significant Steem to the exchanges and the social media sentiment weakens then we should exit our trade.

Trading Strategy for Bearish Sentiment Phases

A. Entry Criteria (Short or Defensive Positions)

1. On-Chain Indicators:

Similarly for the bearish phase we need to analyse the the on chain indicators such as inflow, outflow and reserve of the Steem in the market and exchanges. Here are some important points to be kept in mind:

- Rising exchange inflows suggests that the selling pressure on Steem is increasing and it will lead to the reversal in the trend.

- Declining active wallets and whale holdings of Steem suggests bearish signal.

So when we see that the inflow of the Steem is increasing to the exchanges then it is obvious that it is the selling pressure on the Steem at that point in order to take an entry in the market we can consider short entry against the market. In this way it is high probability that when the market will break down then we will still make profit because of the short entry.

2. Sentiment Indicators:

In the bearish phase the sentiment indicators are of great use. Because one bad news can ruin the market. Here are some important points to be considered for taking a short entry in the bearish market:

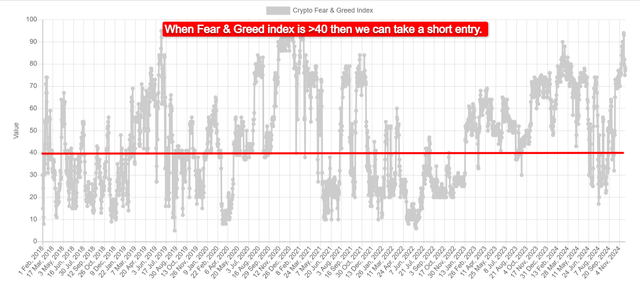

- Social media sentiment becomes overwhelmingly negative.

- Fear & Greed Index drops into the "Fear" zone (below 40).

- Search volume for "Sell Steem" or "Steem crash" increases.

|

|---|

B. Exit Criteria

Here are the important points for the exit of the short entrty during the bearish phase by using the on chain data and sentiment indicators:

1. On Chain Indicators:

We need to carefully look these points for the exit of the short entry in the bearish market:

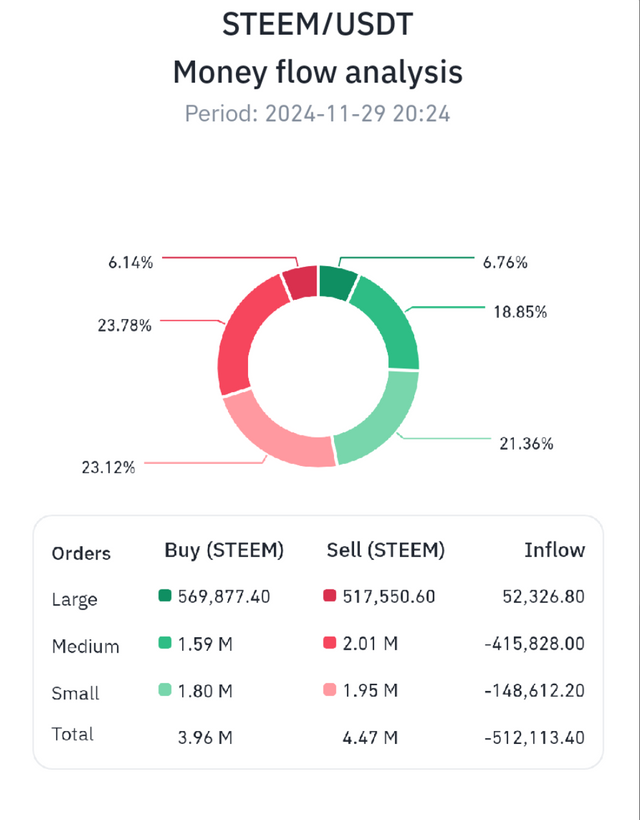

- Exchange outflows rise indicating accumulation.

- Whale wallets show renewed accumulation.

It means that the market is going to be green again because the whales and the retailers are accumulating Steem so at this point we can close our short entry and can become ready for the long entry - Image taken from Binance. Currently in the on chain data of Binanace oif we see then we can say that the selling pressure is high than the buying pressure. Because the inflow of the Steem is high. The people are taking advantage of the market and they are selling their Steems.

2. Sentiment Indicators:

Sentiment indicators also drive the market with great pace. Here are some points to be considered for the exit criteria of the short trade in the bearish phase:

- Social media sentiment improves with increasing positive mentions.

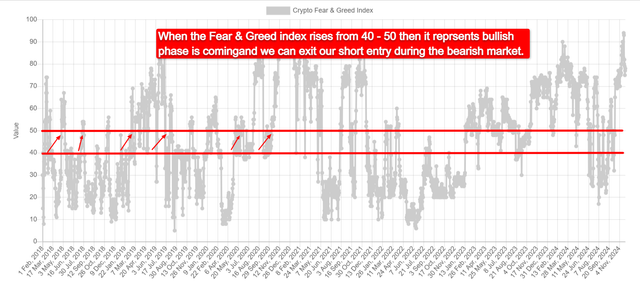

- Fear & Greed Index rises from extreme fear to neutral (40–50).

|

|---|

Here I have highlighted the key areas when the Fear & Greed index rose from 40 - 50 then it went in the upward direction so it is better the quit short trade in this zone.

Risk Management

In order to manage the risk in the bearish phase we need to follow the following criteria:

- Set a stop loss order above the entry point such 3-5% to limit losses in case of reversals.

- Monitor the short squeeze risks during bearish phases and avoid overexposure.

- Use conservative leverage to minimize the liquidation risks.

Example (Steem/USDT):

Entry: Whale wallets transfer large amounts of Steem to exchanges while Fear & Greed Index falls to 35. It indicates the bearish phase is ahead and the price will move downward by taking a correction due to the selling pressure. So it is the good time for Steem to take a short entry in it.

Exit: When the exchange reserves decline it signals the reduced selling pressure and the sentiment indicators show recovery. Then it is the best time to exit the short entry and prepare yourself for the long entry.

Combined Risk Management Techniques

A. Diversification

- Avoid allocating all funds to a single trade. Diversify across other assets or trading pairs.

B. Real-Time Monitoring

- Use tools like Glassnode for on-chain data and LunarCrush for social media sentiment to stay updated.

C. Emotion Management

- Avoid trading based solely on hype or fear. Always validate sentiment with on-chain metrics.

Historical Example: Applying the Strategy to Steem/USDT

Bullish Phase (2020 Recovery):

- On-Chain Data: Steem saw rising wallet activity and significant exchange outflows as investors moved tokens to private wallets for long term holding.

- Sentiment Indicators: Positive sentiment dominated social media as the community rallied behind Steem's future.

Outcome:

Traders who entered during this phase benefited from price rallies as the alignment of metrics indicated strong bullish momentum.

Bearish Phase (Market Correction):

- On-Chain Data: Whale wallets began transferring Steem to exchanges and the exchange inflows spiked.

- Sentiment Indicators: Social media turned negative with growing mentions of uncertainty around Steem.

Outcome:

Traders who exited early avoided significant losses as the bearish alignment signaled a sharp correction.

Advantages of This Strategy

- Holistic View: Combines objective data with market sentiment for balanced decisions.

- Early Signals: Identifies bullish and bearish trends before they fully unfold.

- Improved Risk Management: Offers clear entry, exit, and stop-loss criteria.

A sentiment based trading strategy for Steem that integrates on chain data and sentiment indicators offers a comprehensive approach to navigating volatile markets. By aligning tangible metrics like wallet activity and token flows with emotional insights from social media and the Fear & Greed Index the traders can make informed decisions. This dual perspective minimizes risks and maximizes opportunities whether the market sentiment is bullish or bearish.

Question 5: Limitations and Best Practices in Sentiment Analysis

Discuss limitations of market sentiment analysis, including delays in reaction or false signals. Provide tips for improvement of reliability of sentiment-based trading strategies.

Sentiment analysis is a potent tool for analyzing market trends, as it uses emotional and psychological clues from sources like social media, on chain metrics, and even indices such as the Fear & Greed Index. Effective, it has challenges that traders have to deal with to get the best out of its reliability.

Challenges and Limitations in Market Sentiment Analysis

Delayed Reactions

- Description: Sentiment indicators often reflect past or current emotional states, lagging behind real-time market events.

- Impact: Traders may enter or exit positions too late, missing the optimal timing for trades.

- Example: A bullish social media sentiment surge may only surface after a significant price rally, making it difficult to capitalize on the trend.

Misleading Signals

- Description: Manipulation, noise, or sources of irrelevant data could make the sentiment indicators send out false signals.

- Impact: Traders may take positions based on incorrect assumptions.

- Example: A sudden boost in social media positivity due to bots or coordinated campaigns rather than actual market interest.

Overreliance on Specific Indicators

- Description: Overemphasis on one sentiment indicator provides a narrow view of what is going on in markets.

- Effect: Traders miss the overall market environment and make bad decisions.

- Example: The Fear & Greed Index could be signaling greed, but on chain data is showing heavy inflows into exchanges, a sign of profit-taking.

Volatility in Crypto Markets

- Nature: Cryptocurrency markets are inherently volatile, and sentiment can turn on a dime.

- Effect: Sentiment indicators may miss sudden reversals or sharp corrections.

- Example: During a rally, a bullish sentiment can easily become bearish after a regulatory news.

Inadequate Data Sources

- Description: Poor or biased data sources can lead to an inaccurate sentiment analysis.

- Impact: Traders make decisions based on incomplete or non-representative information.

- Example: Monitoring only Twitter activity can miss significant sentiment shifts in other platforms such as Telegram or Reddit.

Herd Mentality

- Description: The herd mentality can exaggerate the trends in sentiment analysis.

- Effect: FOMO or panic selling can take prices significantly away from intrinsic values.

- Illustration: Retail investors may buy into an overbought market based on overly positive sentiment, only to be caught off guard by sudden corrections.

Best Practices for Enhancing Reliability

Use Sentiment in Conjunction with On Chain Data

- Why It Is Helpful: On chain data provides objective insights that reduce the noise in sentiment indicators.

- Tip: Utilize wallet activity and exchange inflows in conjunction with sentiment indicators to confirm trends.

- Example: Social media sentiment is bullish, yet exchange inflows are increasing. This may be an indicator of profit-taking rather than actual buying pressure.

Use Diverse Sources of Sentiment Data

- Why It Helps: Avoids bias and captures a broader view of the market.

- Tip: Monitor a variety of platforms, including Twitter, Reddit, Telegram, and use tools like LunarCrush or Google Trends.

- Example: Compare positivity patterns between various platforms to maintain the uniformity.

Real-Time Sentiment Tracking

- Why It Helps: Alerts of sudden changes in sentiment, which may indicate trend reversal.

- Tip: Utilize real-time-updated sentiment analysis tools like machine learning algorithms or natural language processing (NLP) tools.

- Example: A sudden increase in negative sentiment during a rally could be a sign of profit-taking or emerging FUD (Fear, Uncertainty, and Doubt).

Avoid Overreaction to Extremes

- Why It Helps: Sentiment extremes are often a sign of a market turning point.

- Tip: Be careful during extreme greed or fear since they often precede a reversal.

- Example: In the 2021 Bitcoin rally, the Fear & Greed Index peaked at extreme greed levels right before major corrections.

Use Quantitative Filters

- Why It Helps: Reduces emotional bias in decision-making.

- Tip: Use predetermined thresholds for sentiment gauges as a trade trigger.

- Example: Enter long only if the Fear & Greed Index is higher than 60 and the number of active wallets increase by 10% over the same period.

Add Risk Management

- Why It Helps: Reduces losses from incorrect signals or wild markets.

- Tip: Set stop-loss and take-profit levels according to market sentiment and price movement history.

- Example: In a bullish trend, place a stop-loss 5% below the entry and a trailing stop to secure the profits made.

Backtest with Historical Data

Why It's Useful: It verifies if strategies that are sentiment-based indeed work.

Tip: Do backtesting with historical sentiments coupled with historical price data.

Example: Try to analyze the manner in which the Fear & Greed Index corresponded to the movement of the Steem's price history for the bull and the bear phases.

Example: Sentiment and On Chain Data for Steem/USDT

Bullish Signal:

- On chain data: active wallets are growing, and exchange reserves are shrinking.

- Sentiment indicators: social media positivity is up; Fear & Greed Index at 70. Go long with a trailing stop-loss to take profits.

Bearish Signal:

- On chain data: Whale wallets are moving large amounts of coins to exchanges.

- Sentiment Indicators: Negative sentiment explodes on social media; Fear & Greed Index drops to 35. .

- Action: Close longs and short at the resistance with stop-loss.

Sentiment analysis is an excellent tool for navigating cryptocurrency markets but should be used with care. When combined with on chain data, diversified sources, and robust risk management, the limitations of the tool can be mitigated. Following best practices will ensure that the reliability of strategies based on sentiment is increased, and thus, become a cornerstone of successful trading.