SLC S21W5: Estrategias avanzadas que utilizan datos en cadena e indicadores de sentimiento

Question 1: Understanding On-Chain Data Metrics

What is on-chain data?

On-chain data is the amount of data stored on the network for each interaction with the blockchain. On-chain data includes information related to all transactions that occur on the public blockchain network. For example, transaction details such as sending and receiving addresses, transfer tokens, and transaction amounts, but also block data such as time, mining fees, and smart contract code.

So what can we do with on-chain data?

Because on-chain data is public and transparent and cannot be altered or falsified - i.e., it provides us with the most accurate information available - we can understand the flow of funds, the activity level of projects, the level of transaction costs, and many other key metrics. Combined with this information, investors can more fully assess a project's health, future potential and potential risks.

1.1 Rich on-chain signals

On-chain data reveals how the crypto ecosystem works, so let's take a look at some of these indicators and implications:

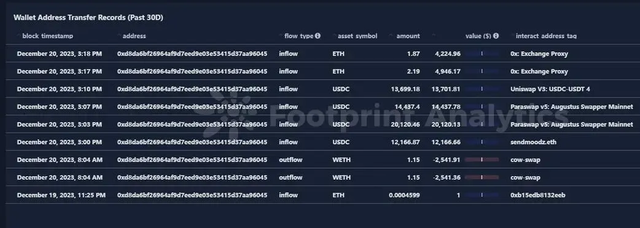

Net inflows: tracking the flow of funds between different agreements/projects to assess operational stability.

Active Addresses: Evaluating dApps and User Adoption on Different Chains

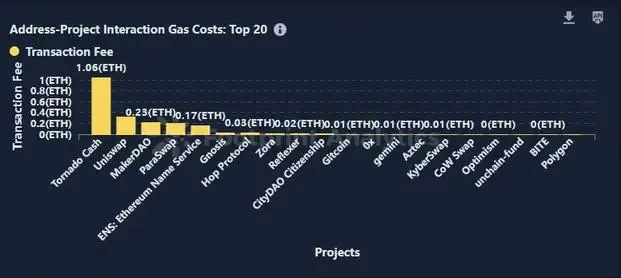

Transaction Costs: Measure the interaction costs of the blockchain network

Transaction liquidity: monitoring large transactions and quantifying token accumulation and concentration

Combining this data with developer activity, socialization volumes, and other fundamentals, we can get a 360-degree view of the health of the ecosystem.

Question 2: Using Sentiment Indicators to Analyze Market Trends

Trying to get a sense of what your current sentiment is towards the cryptocurrency market? Is it fear, greed, or both? All of these emotions can affect your investment decisions. Maybe you know technical and fundamental analysis, but often, when prices fluctuate, your emotions are already in control without you realizing it. Next I will explain how to use sentiment analysis and provide some free indicators and tools for sentiment analysis.

2.1 How to perform sentiment analysis

In a sentence, sentiment analysis focuses on analyzing whether the text expresses a positive, negative or neutral .

- Best - 5

- Worst - 0

- Amazing - 7

- Can't Wait - 6

- Sucks - 2

Assign each text a score based on how negative or positive it is, and then add all the scores together to see the overall mood of a sentence. Typically, this score is between -1 and +1. A -1 indicates a very negative sentiment and a +1 indicates a very positive sentiment.

Now let's say I want to use sentiment analysis to understand my audience's attitude towards my post, I don't have to read every single comment. What I'm going to do is just create a sentiment analysis tool that looks at all the comments that mention the relevant word, gives it a sentiment score, and then adds them together to see what the average sentiment score is.

The next thing the sentiment analysis tool does is remove any words or phrases that don't carry a sentiment score, so after that, all that's left is “great” and “could be better”. In order to identify sentiment words and assign them a positive or negative sentiment score, most sentiment analysis tools will refer to a “lexicon”. This is a huge database of words and phrases that are manually coded by humans as positive or negative on a scale of -1 to +1.

For simplicity, let's say that the word “great” has a sentiment score of +1 and the phrase “could be better” has a sentiment score of -0.25. The sentiment score for this comment would be +0.75.

Now suppose that there are only two other comments that mention text or letters with sentiment scores of -0.5 and +0.75. The total Sentiment Score of all the comments related to the text will be added by 1. This is a positive comment.

So how is sentiment analysis used in cryptocurrency trading?

2.2 Sentiment Analysis in Cryptocurrencies

Know why sentiment analysis is so important for cryptocurrencies? You have to realize that what ultimately drives the price of cryptocurrencies up or down is the perception of investors.

In other words, market sentiment is the first step and reflecting it on the price is the second. What this means is that if you can know investor sentiment ahead of time through sentiment analysis on social media outlets like Twitter and Reddit, you can theoretically predict the price movement of any cryptocurrency.

There are even studies that have backed this up, but there are some caveats that I'll explain in a moment. As you may have guessed, most smart organizations use sentiment analysis, especially funds. Some believe this is why they always seem to stay ahead of crypto market operations.

Typically, institutional investors use sentiment analysis tools that cost thousands or even millions of dollars per year, something most of us can't afford. Thankfully, there are also plenty of free sentiment analysis tools that can be just as effective as the overpriced ones you can buy if used properly.

2.3 Fear and Greed Index

One of the most popular free sentiment analysis indicators in cryptocurrencies is the Fear and Greed Index. The Fear & Greed Index for cryptocurrencies is modeled after the CNN Financial Sector Stock Market Fear & Greed Index.

Like the Fear and Greed Index for the stock market, the Fear and Greed Index for cryptocurrencies was created using a series of metrics that are also worth looking at individually: market volatility, trading volume, social media sentiment, Bitcoin dominance and Google search trends.

When market volatility is high, trading volume is low, social media sentiment is negative, Bitcoin dominance is high, and Google search trends are low, you would want to present fear as you do now. Conversely, if market volatility is relatively low, trading volume is high, social media sentiment is positive, Bitcoin dominance is low, and Google search trends are high, the crypto market is showing a greed sentiment. Of course, that's a thing of the past.

Now, the Fear and Greed Index can be used for trading over longer periods. A longer cycle here is a day or more. This is because the Fear and Greed Index is only updated once a day. In terms of how to trade using this indicator, in the words of Warren Buffett, be greedy when others are fearful and fearful when others are greedy.

NOTE: Remember to pay attention to how the Fear & Greed Index affects the stock market as it may affect the cryptocurrency market. The stock market gives you a better idea of how the rest of the market is feeling, and if investors start to feel anxious, they may pull out of risky assets like cryptocurrencies first.

2.4 Bull/Bear Index

Another useful free sentiment analysis indicator in cryptocurrencies is the Bull and Bear Index. In contrast to the Fear and Greed Index, the Bulls and Bears Index focuses only on Bitcoin sentiment on social media platforms, specifically Bitcointalk.org, Reddit, and Twitter.

What's more, the Bull & Bear Index is updated hourly, which makes it more suitable for short-period day trading. It ultimately depends on what the market is doing and which cryptocurrencies you are trading, if you see sentiment is turning positive but the price hasn't moved yet this could be an opportunity to get in early before the spike, if you see sentiment still increasing but the price has begun to fall then it may be time to sell. If sentiment is mixed but the trend is strong, follow the trend, as the old saying goes, trend is king. If the market is moving sideways and sentiment continues to fall, it suggests that a reversal may be imminent.

Now this may sound a bit counter-intuitive, but it has to do with the fact that institutions also use sentiment analysis indicators in their trading. If they see low market sentiment and prices are moving sideways, it means everyone is expecting another decline. If sentiment is rising and prices are moving sideways, the opposite is true.

In my experience, this counter-trend sentiment analysis technique works best for mainstream cryptocurrencies like Bitcoin and Ether. When and whereas this strategy is less suitable for torrents.

Not yet finished due to time constraints, yet to be continued...