Crypto Speculating Justified

Today I would like to cover 3 aspects that a typical crypto speculator might want to consider when looking to invest:

1. Bitcoin

2. Ripple XRP

3. 3rd generation crypto currencies and what it means

Typically, all 3 of these items have some or other appeal to them, and I would like to unpack them with you.

Bitcoin

Bitcoin was a first market mover that captured the imagination of many. In many ways Bitcoin resembles Airbnb and uber, market disruptors to centralized industries designed to strip them of their monopolies. Being able to snub the banks high fees and slow turnaround time have their appeals too. This translates into demand for the digital commodity that is Bitcoin, which in turn drives up the price.

What else is it that creates value then for Bitcoin?

One of the parallels I like to draw is the one between Bitcoin and buying rare gold coins.

When you look at buying a rare gold coin for example, you are not merely investing in a piece of gold tethered to the price of gold bullion, but rather you are diversifying your investment across 3 aspects of risk:

- Bullion value

a. Goes without saying, gold has always been considered valuable, and is a safe haven in times of economic turbulence - Sentimentality

a. Think of a Nelson Mandela gold coin, what he represents ito peace and equality, these qualities are endearing to coin collectors - Scarcity

a. This occurs when there is a limited mintage on the coin, after which the dyes are physically broken to prevent further minting of that coin. Rarity/scarcity are drivers long known to drive demand.

When you have all 3 of those aspects together, they add to the overall value. Rare gold coins can appreciate in value quite quickly on these aspects!

In the world of Bitcoin, we can draw similar parallels:

- Demand/adoption driven value

a. Speculation, adoption by vendors, cheaper and faster international transfers, are all examples of what drive the value of Bitcoin - Sentimentality

a. Not only is Bitcoin the first market mover in the crypto currency realm, but

b. it is also the online currency held most widely (see market cap table below), which makes it the de facto global online currency, even though it doesn't hold an official global title. These are appealing qualities.

c. Brand recognition is also a contributor here. Brand loyalty can help ensure that Bitcoin has an edge over its competitors for a while yet. - Scarcity

a. The “mintage” of Bitcoin is limited to 21 million. On a planet of billions of people, that is a small number, and can quickly drive demand.

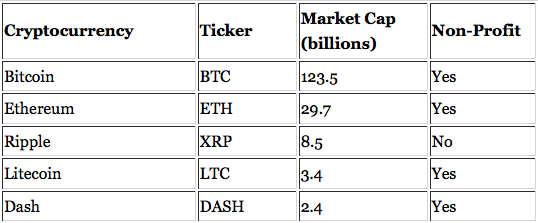

Market cap of top 5 crypto currencies Nov 2017:

A noteworthy example of adoption of the Bitcoin currency goes out to Australia, who, due to popularity of the crypto, are installing ATM’s across the country:

https://www.cryptocoinsnews.com/2900-two-way-bitcoin-atms-set-launch-australia/

Holding Bitcoin is like holding gold, minus the bulkiness and safes necessary to hold them at home!

Ripple

Rather than seeking to supplant centralized banks, ripple have an interesting slant regarding those institutions: collaboration.

Looking at their website, Ripple are keen on helping out the banks especially in the global payments arena. According to them, the current cons of global payments include aspects such as

- Being slow

a. 3 – 5 days to settle - Being expensive

a. Costs of international transfers can be quite high - Being unreliable

a. There are many incidents of failure of the transactions - Being unacceptable

a. Typically people demand a better experience

To this end, RippleNet was developed to connect banks, payment providers, digital asset exchanges and corporates to provide one frictionless experience to send money globally.

They boast:

- Access

a. Connectivity across payments networks - Speed

a. Instant, on-demand settlement - Certainty

a. Real-time traceability of funds - Cost

a. Low operational and liquidity costs

I suppose that if banks/payment providers etc… lowered fees and sped up the transfers, that these would be very appealing factors to the public.

It would be hard to justify moving away from the centralized stability and safety of such an institution in favor of a more volatile crypto wallet, where the onus is on you to keep your passkey safe and unhacked.

3rd gen

In ‘Pioneer advantage: Marketing logic or marketing legend?’ (http://www-bcf.usc.edu/~tellis/pioneering.pdf), the first thing you learn is that it is not always advantageous to be a first market mover.

One of the reasons is that you have to make all the learning’s yourself as opposed to having someone to learn from. According to the study, failure rates were at 47% for first market movers compared to only 8% for settlers (companies coming in after the market has been established).

Slow speed and high fees currently hamper Bitcoin, and 3rd gen cryptocurrencies are positioning themselves to solve these items and more. They would be equivalent to ‘settlers’, competitors joining the scene of a well-established market, thanks to the likes of Bitcoin.

An example of a 3rd gen crypto currency is Cardano.

While there are similarities between Bitcoin and Cardano, there are also many differences between these two cryptocurrencies. The most significant difference is that Bitcoin is a proof of work type cryptocurrency, while Cardano makes use of a proof of stake approach to reach consensus. This encourages honesty and long term participation. It also solves Bitcoins problem of scaling for speed as well as the problem of hardforking.

Read more here:

https://briandcolwell.com/2017/10/cardano-the-hot-new-crypto-that-accepts-its-social-nature/.html

A good sign that Cardano has serious firepower behind its conceptual plans is the fact that the CEO (Charles Hoskinson) is non other than the ex-CEO of Ethereum.

There are a few other examples of 3rd gen cryto currencies, like IOTA and SkyCoin. Be sure to check them out for their pros and cons.

Conclusion

We covered a few interesting items when it comes to crypto speculating. The 3 items I have covered today all merit some thought.

If you can conceive of a portfolio where you diversify your risk across a multitude of assets, then surely you can diversify your speculation across the 3 items above: Bitcoin, Ripple XRP (or equivalent) and Cardano (or equivalent). At least, that is my honest opinion.

Disclaimer: This post should not be taken as, and is not intended to provide, investment advice. Please conduct your own thorough research before investing in any cryptocurrency.

Congratulations @trevornell! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIn spite of more and more detractors, Bitcoin continues its frantic race to new heights. After a week rich in emotions, a new $ 8,100 ATH was reached this Sunday.

The little beast that goes up ...

Between Wednesday and Sunday last week, the price of bitcoin fell sharply from $ 7,700 to under $ 6,000. Since then, we have witnessed a rise that becomes usual. We had been waiting for a while to see the price exceed $ 8,000, and the week proved us right.

So this Sunday, Bitcoin reached a new ATH placed at $ 8,100. This is a gain of more than 30% in 7 days, a common lot for Bitcoin. Its capitalization now exceeds $ 134 billion (for the prospect, it is double the total capitalization of Airbus)