What Pro Crypto Traders Get About Social Media That Novice Traders Don’t

The internet is a strange place. Social media gives every view point, no matter how fringe or mainstream, revolutionary or inconsequential, right or wrong, the same platform it needs to reach its desired audience.

Social media is the new information distribution mechanism. It is where ideas and opportunities can be shared faster, more freely, and with less scrutiny. It is where playing fields are leveled and all have the same platform to present, discuss, and challenge new ideas. This ethos, of decentralizing the exchange of information and giving influence to the community instead of the entity, shares many of the same underlying concepts as blockchain and Digital Assets.

But, a recent survey from Overbit.com that aimed to nuance the state of crypto adoption indicates that many crypto traders don’t really “get” this. Even more mysterious is that this lack of understanding seems to be concentrated in the newest entrants to cryptocurrency space.

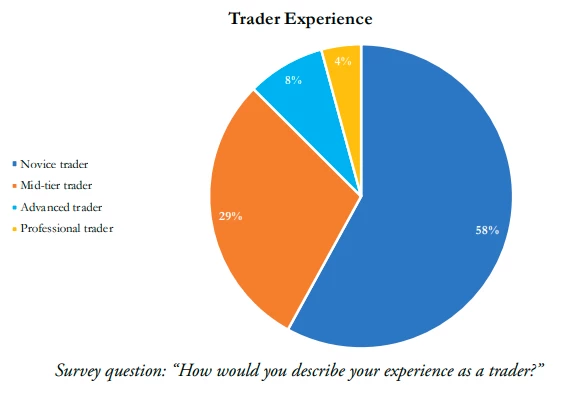

In their 2020 Crypto Traders Survey, Overbit first asked more than 2,500 crypto traders from 90 different countries to describe their level of experience as a trader as novice, mid tier, advanced or professional. The results are shown below:

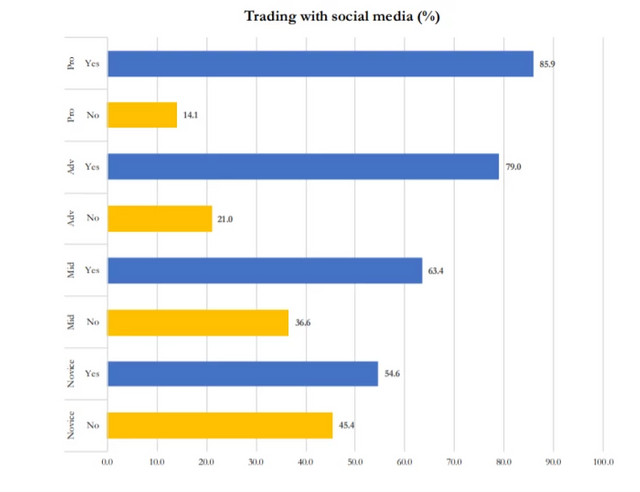

Later in the study, they asked these same traders if “being a part of a social media trading group influence your trading.” The results are shown below:

Unsurprisingly, the majority of traders are influenced by social media. But the surprising result here is how vastly different the distribution of results are across self stated experience levels. Why are the results so close for inexperienced trader, yet so far apart for experienced traders?

What do pro traders gain from social media that novice traders do not? Why do so many more pro traders indicate that social media influences their trading decisions than novice traders? More fundamentally, what is this correlation between experience, influence, and social media?

Pro traders appreciate the unquantifiable, at time irrational, but always unpredictable human side of trading. The highly emotional side of new assets in growing markets. Pro traders have embedded themselves in the social media communities where these conversations are taking place, actively collaborating with others while drawing their own informed conclusions. They have developed their crypto vocabulary and know how to interpret the purely subjective nuance of sentiment data.

Pro traders are influenced by social media because they have seen the influence social media has within crypto markets. Natively digital communities have risen around the natively digital currencies that are shaping the increasingly digital world. Pro traders realize that the participants of these social media platforms are the same decision makers influencing the market. They put their sentiment out on display across social media channels for all to interpret and act upon. Pro traders see the value of this transparency (even when it is a meme) and understand that there is a direct correlation between market sentiment and asset price movements., Communities such as r/AltStreetBets and r/SatoshiStreetBets are the latest evolution of the same social media constructs that have influenced the markets for years.

Though many traders are first introduced to Digital Assets through social media, pro traders understand the lasting impact social media has on their trading decisions. They have seen that a tweet can be just as influential of a market signal as a reversal of a moving average. Pro traders closely follow the social media influencers that break the these sentiment data points because they have seen how impactful these data points can be.

TradingBull has recognized the power of these market sentiment data points while building the first one stop Digital Asset aggregation platform. Once a trader has all of their exchanges and assets existing together in the unified TradingBull platform, they also need a complete view that will inform how they utilize these assets and services. TradingBull understands the uniquely powerful influence of social media on Digital Asset markets and has made aggregating these real time market signals in a single view a top priority.

Having all of your assets and technical platforms within one place on TradingBull is not enough. Traders need access to the data points that will influence their portfolio, sentiment data from social media included. With TradingBull, traders take back control of their Digital Assets and surround themselves with the resources they need to manage their Digital Assets portfolio.

Check out our website, ask us about our platform, stay tuned about our upcoming IBCO!

Daniel Pinto - Market Analyst @ TradingBull.io

More info:

Website: TradingBull.io

Pitch Deck / Whitepaper / Tokenomics

BCOs in the past: DeFi Prime: “Bonding Curves Explained”

Contact: [email protected]

Twitter: @_Digital_Assets

Telegram: https://t.me/TradingBull_DA