The World Bank Treasury Raised $110 million AUD For The First Blockchain Bond

The World Bank has announced that today they have raised $110 million AUD for their new blockchain operated debt instrument, bond-i. Bond-i is the first bond to be created, allocated, transferred, and managed through its life cycle using distributed ledger technology. The large amount raised in such a short amount of time shows undeniable support of developments and transactions using blockchain technology.

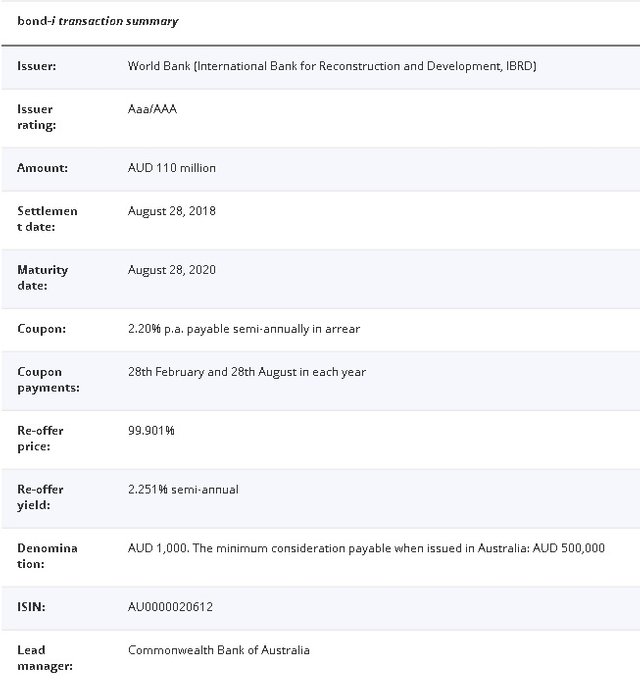

The World Bank appointed Commonwealth Bank of Australia to be the arranger for the bond. Some of the main investors include Commonwealth Bank of Australia, First State Super, NSW Treasury Corportable, Northern Trust, QBE, SAFA, and Treasury of Victoria. The World Bank and CBA are still looking to obtain new investors as well as welcoming inquiries from other market participants.

The World Bank has been working to stay on top of disruptive technologies and launched the Blockchain Innovation Lab in 2017.

“I am delighted that this pioneer bond transaction using the distributed ledger technology, bond-i, was extremely well received by investors. We are particularly impressed with the breath of interest from official institutions, fund managers, government institutions, and banks. We were no doubt successful in moving from concept to reality because these high-quality investors understood the value of leveraging technology for innovation in capital markets."Arunma Oteh, World Bank Treasurer

Service providers to the bond’s platform include TD Securities as market maker, IHS Markit as independent valuation provider, Microsoft as independent code reviewer, and King & Wood Mallesons as deal counsel. The World Bank has a 70 year long track record of innovation in the capital markets. They issue between $50-60 billion USD annually in bonds for sustainable development.

From The World Bank press release.

More crypto news, views, and gossip The Crypto Tea