Bitcoin Price Slump Merely “Growing Pains”: Cryptocurrency Brokerage Executive explains

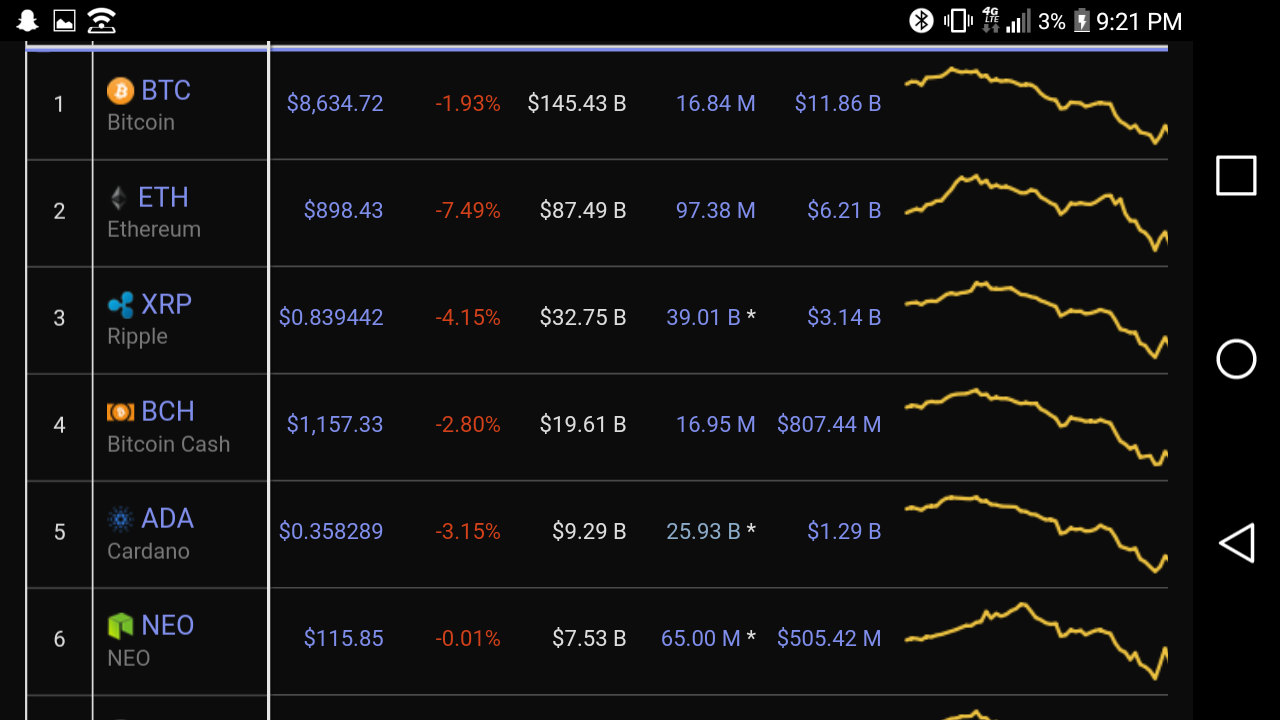

It’s been raining on bitcoin in 2018, but one London-based broker is taking the pullback in stride. BitcoinBro CEO Oliver von Landsberg-Sadie told Bloomberg that despite bitcoin shedding nearly 50% of its value in the past four weeks, he’s not worried. Instead, he pointed to “growing pains,” saying that he remains “very bullish over the long term, seeming to suggest that in the end, the cryptocurrency market will be better for it.

“It’s a healthy correction. It’s a sign that the market is growing up. It’s recognizing that cryptocurrencies are not a tool for money laundering or illicit use,” he said.

KYC / AML

Part of the reason for the pullback, the BitcoinBro chief said, has been the regulatory environment, pointing to South Korea, for example. South Korean regulators uncovered $600 million in illicit trades in cryptocurrencies, even as the country is crafting regulation for cryptocurrency exchanges. South Korea has been instrumental in the rise of bitcoin and other digital coins, comprising about one-fifth of cryptocurrency trading activity across 12-plus exchanges in the country.

But their steps toward a more regulated cryptocurrency industry, more specifically KYC and AML protocols, are moving bitcoin forward, von Landsberg-Sadie said, not backward, despite the toll it’s taken on the bitcoin price.

While the bitcoin price is getting punished amid the regulatory clampdown, von Landsberg-Sadie pointed out that bitcoin itself is not a proper choice for money laundering activities, despite what critics think. If you recall, BlackRock’s CEO Larry Fink famously said that bitcoin was a reflection of the “demand for money laundering … in the world.”

Meanwhile, von Landsberg-Sadie said bitcoin is a “terrible choice” for hackers such as Wanna Cry ransomware attacks because the funds are traceable along the blockchain. More privacy-focused coins such as Monero or Zcash, for example, have the anonymity feature in money laundering, but not bitcoin.

One of BitcoinBro’s own clients who had bitcoin stolen and said the funds were “easy to trace” back to the wallet.

“The on ramps and off ramps key points. How is a money launderer actually going to convert that money into something useful today. They’re going to need an off ramp like an exchange. But now that regulation is stepping and those exchanges are locking down on knowing their customer and having the proper money laundering controls, it’s a use case that will dwindle.” — von Landsberg-Sadie

Biggest Buying Opp of the Year?

Meanwhile, Fundstrat Global Advisors co-founder Tom Lee in recent weeks suggested putting in a buy order for bitcoin at $9,000, as the low presented “the biggest buying opportunity in 2018.” He has a $25,000 price target on bitcoin in 2018 and has been known to revise those forecasts to the upside.

Something to keep in mind is that the bitcoin price is still trading higher by approximately 800% since January 2017