Crypto market lacks of professional trading services

The point is that there are not so many companies which can provide professional trading services for the market right now. Trading in crypto markets requires 24/7 fundamental and technical analysis. Majority of people are receiving negative returns, especially in the current bear market.

As of October 18th, 2017, autonomous NEXT recorded a record high of 226 global hedge funds focused on trading cryptocurrencies, up from 110 global hedge funds recorded previously. Assets under management are valued between $3.5 and $5 billion. Since 2016, due to the public’s increase in crypto-market awareness the the need for such services has experienced a rapid growth.

To put it into perspective of the general markets, there are more than 9500 mutual funds operating in the USA alone, while the total number of open-end funds worldwide as of 2016 was estimated at 110 271. Total assets under management were valued in trillions of USD.

Over the next 2-5 years, the blockchain hedge fund market will become more mature, as of now it is still in its infant stage, though expanding rapidly. Therefore, currently there is a sizable gap to be filled between the general markets and blockchain hedge funds.

Currently, every investor is confronted by several key problems posed by the market.

To highlight a few:

- Regular investors lack the required knowledge and tend to act irrationally

- The market is plagued by scams (3 million $ stolen every day)

- Most of the investors report negative returns

- 90% of ICOs have already failed

- Projects providing no value are funded

- Potentially good ICOs lack proper funding to start their activities

- The market lacks confidence from conservative investors and institutions

- Low profitability/service fee ratio in the crypto mining industry

For 1.5 years together with the team we were running trading experiment.

Our trading portfolio was divided in to 4 parts:

30% Long Term – blind investment on top 20 crypto assets with weekly rebalancing for 6 month period.

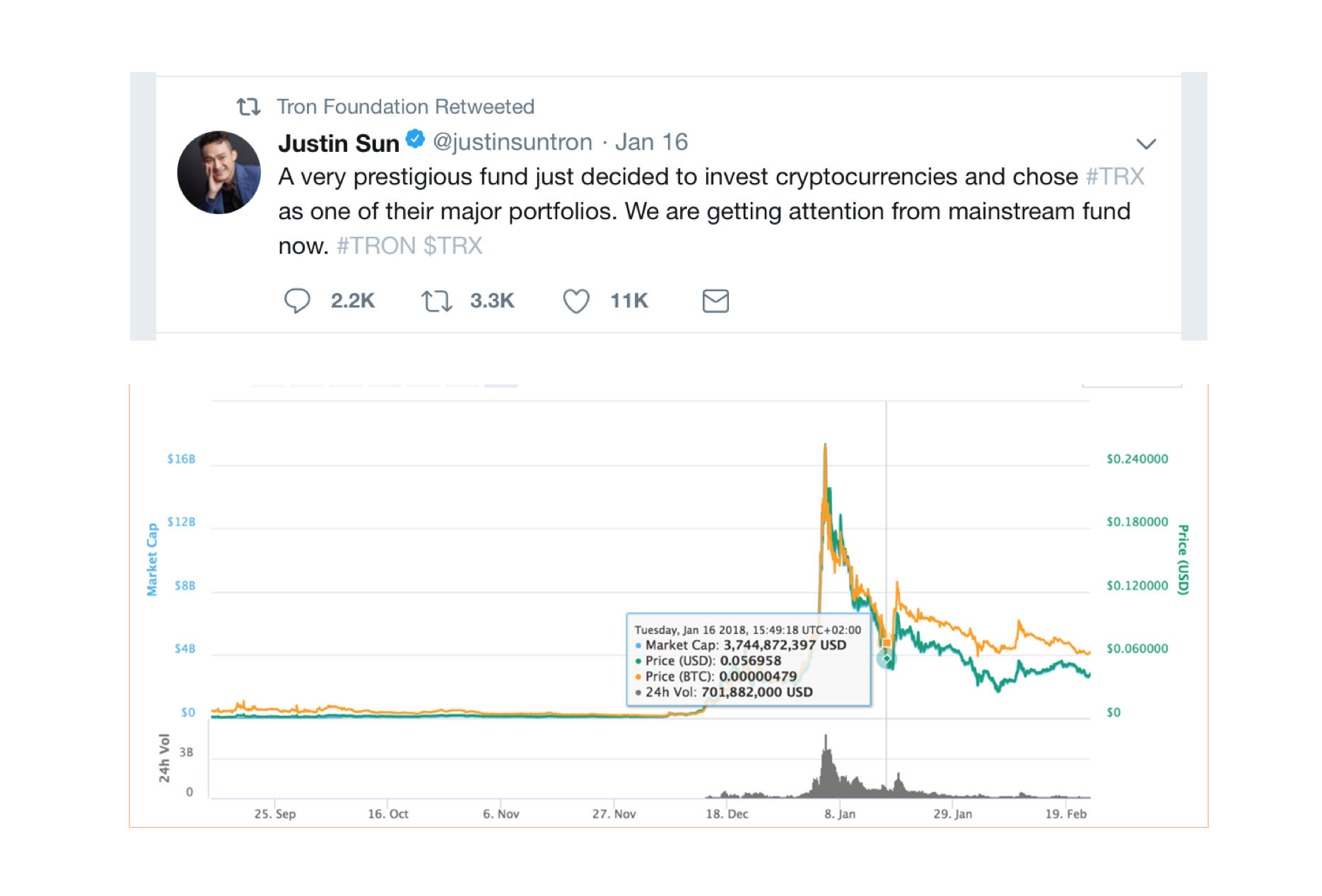

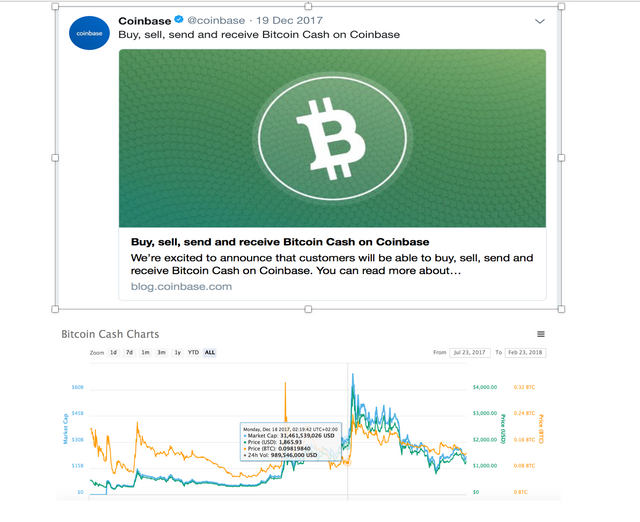

30% Short Term – Actively managed part of the portfolio. Since the crypto is mainly news driven market at the moment, it creates opportunity for certain positions that generally creates positive returns if timed correctly.

Several examples of how certain news are affecting product price:

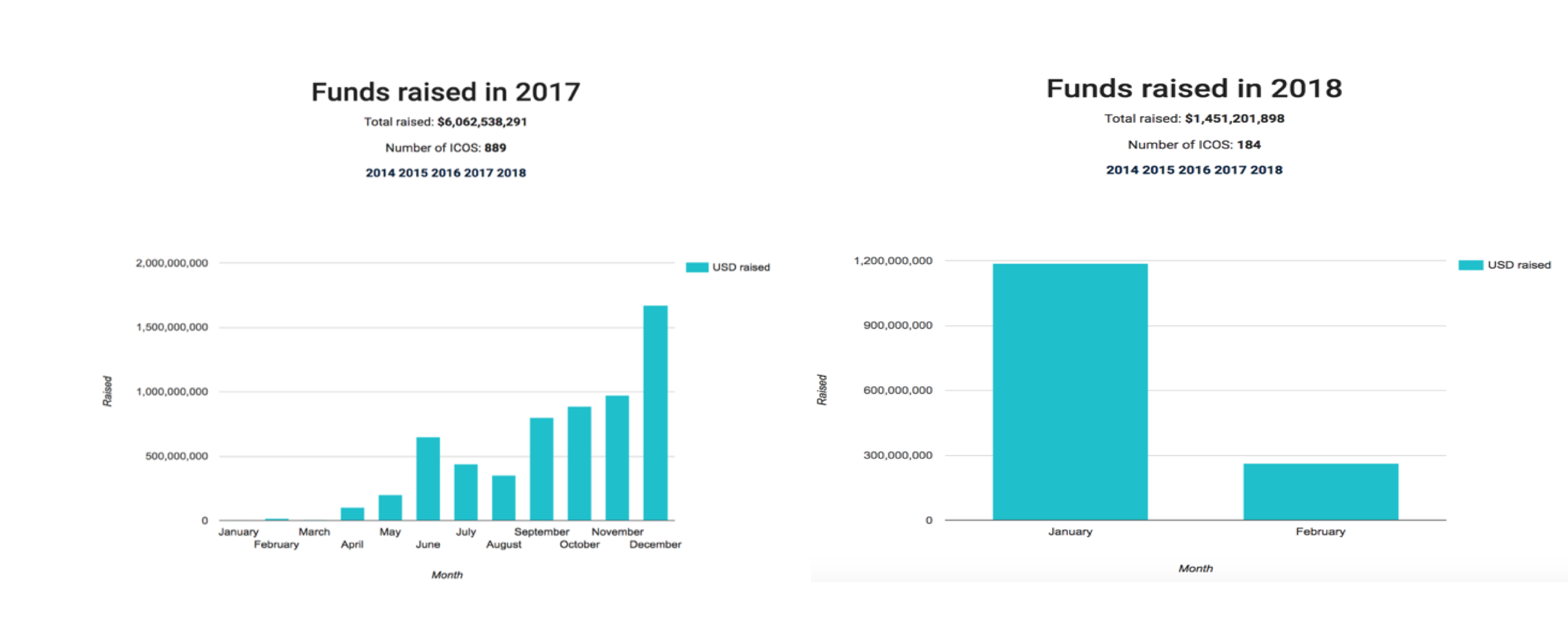

30 % ICO - The most risky and volatile part of the portfolio. The biggest gains of our portfolio was generated by the ICO. Since the ICO market is rapidly growing every month since 2016, it is vital to participate in token sales. However the research regarding ICO’s requires understating the crypto markets, law, both macro and micro economics.

ICO Market growth:

10% Mining – Crypto mining from long term perspective had shown les volatile and positive returns. Part of our portfolio was dedicated on cloud mining, however only significant amounts are worthy to invest due to high service fee/profitability.

Such crypto portfolio brought positive results. The goal was to outperform bitcoin returns. In fact such trading strategy brought 2200% returns on investment. While blindly investing on bitcoin 1.5 year ago would brought around 1000% ROI.

Would you guys be interested in the project which would aim on providing highest quality fund services for regular investors?

1 Token would represent portion of the fund, the token value would be backed by other assets.

Blockchain allows to monitor fund activity 24/7 and allows to be 100% transparent fund.

Each quarter tokens holders will receive dividends, to their wallets.

wow damn maybe should have stayed with my day job lol

Congratulations @rubensin! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last announcement from @steemitboard!

actually yes, trading in such a volatile and brand new tech, may be harmful a bit for evolution of the tech in a right direction

Scammers are flooding the market with fake ICOs, that causes lots of regulations - it might be positive thing for more conservative investors.

Due to scams - Facebook, Google, Twitter have banned ICO, Wallet, Exchange related ads on their platform. So right now it is quite difficult to attract and enlight people about this technology.

And since people are investing so blindly without proper due diligence it is obvious that majority are receiving negative returns especially in current bearish market.

Another good example of irrational trading was indicated by Carter Thomas.

"The Centra co-founders were just arrested by the SEC and people are buying the dip" (Bitconnect case)

Congratulations @rubensin! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!