Liquidity Network- Bringing Scalability to the blockchain

There is one constant thing about the blockchain so far; with each problem comes another problem and with each solution or achievement comes another problem.

So far, cryptocurrencies and blockchain are increasing in popularity and gaining public notice but I am afraid the technology has not been able to keep up with the demand. It has not been able to scale up to expectations and demands.

Now, that is, the blockchain lacks scalability.

Why this?

The blockchain businesses use blocks-like ledgers to process bunch of transactions. However, in the early days of their development, the maximum size of these blocks were very limited like for Bitcoin, it was just 1mb. 1mb! And presently, these blocks are not just scalable enough to contain more records as fast as they should.

How does this lack of scalability birth another problem?

Let’s think of the Blockchain as a ledger, register or a chain of several blocks(block-chain?)

Now, this register contains several blocks(just like pages) where each block has several transactions. As soon as a block has been exhausted with transactions, it has to be added to the register before starting to record new transactions on the next block.

However, before a block can be added to the register or chain of blocks, a processing called Validation has to be done to make sure the transcation is legit. For Bitcoin, block validation takes about 10 minutes.

Now that means lack of scalability=slow speed right?

And there are transaction fees too.

Miners(nodes who process transactions) are always incentivize with fees in other to process transactions in a block ASAP.

Funny enough, there are no fixed rates, so it is up to you to decide how much you have to pay to incentivize the miners enough to process your transaction quicker amidst thousands of transactions to be processed. Miners always look at transactions that yield bigger rewards and process them first, so the better the incentive, the faster the transaction.

If there are enough transactions with higher transaction fees than yours to fill a block, the wait can last for hours if not days.

To move up your transaction, you definitely have to pay more.

Now we can see that Lack of scalability = slow speed = expensive transaction fees

Lack of scalability makes blockchains slow, and therefore, too expensive for mass adoption.

The paradox is, the most wanted mass adoption of the Blockchain would mean more transactions but then more transactions means the network will become slow, making it expensive; a hurdle for mass adoption.

However, going back to why the blockchain isn’t scalable and the 1MB bitcoin block size, ironically, this was designed to make Bitcoin very secure, yet it hasn't helped the network become future-proof.

Remember I said with every solution comes another problem?

There are some many data of transactions of payments that are to be processed in a block but at the onset with 1MB capacity? Presently, at max, Bitcoin can only handle seven transactions per second(7 TPS)

Nevertheless, Bitcoin and Ethereum(the two biggest blockchain players) have to scale in order to make blockchain mainstream. Even with a TPS of 15, Ethereum have noted that with their present processing power, their infrastructure will not be able to cope with the influx.

So why can’t the capacity be increased?

Unfortunately, this isn’t as simple as it sounds. This is because any proposal for an upgrade in a blockchain ecosystem has to have the support of miners, developers, businesses and other stakeholders before it can be passed and this could take months or sometimes, the idea is relegated.

However, few months back Bitcoin Cash initialized (BCH), successfully made an upgrade which multiplied four times its block size to 32MB. This was done in order to meet pressing demands and add new features but in a wider sense, it didn’t not do only that.

These changes make operating full nodes more expensive, and this in turn could deprive the blockchain of its biggest and most distinctive identity which is decentralization. This upgrade will incentivize a significant number of individuals and organizations to buy more hardware and build huge mining farms, despite the fact that Bitcoin is supposed to be the most decentralized blockchain. As a result, most of the hashpower is now controlled by a very small number of organizations. This is currently happening where electricity is cheapest: China, therefore risking government intervention.

So now, upgrade in block size can be = Expensive transaction cost and centralization

However, so far a more stable solution has been found and that has been the leverage of payment channels to malinger using the blockchain for all transactions, thus, reducing the workload and congestion on the blockchain. This also carries the advantage of being very fast, scalable and cheap since most of the work is done off-chain.

These payment or micro payment channels allow users to make multiple Bitcoin transactions without committing all of the transactions to the Bitcoin block chain.

Payment Channels work this way:

Imagine Mr. A and B want to make a transaction on the Ethereum blockchain.

Now instead of carrying out the whole transaction on the Ethereum blockchain and relying on the speed and scalability of it, what they could do is create a peer to peer channel on-chain but do the transactions of the channel off-chain, apart from the last one -the settlement part.

Mr. A and B have to agree afore time, the same exact amount of Ethereum tokens they will put on this channel. After they agree on the deposit which will be probably equal to the amount they want to transact with. They can send multiple signed transactions between them in both directions off-chain, while a ledger between them is updated with the latest state of the transaction.

When the two parties decide to close the channel, only the final state of the transactions between the two is broadcasted to the blockchain.

This implies that, the blockchain is only used to close and open channels.

An example of such network is Raiden and Lightning. Raiden is named after a Japanese god of lightning to symbolize how fast the transactions can be.

Raiden Network

The basic and simple idea of the Raiden Network is to malinger the blockchain consensus bottleneck by leveraging a network of payment channels which allow to securely transfer value off-chain. Off-chain simply means anything off the blockchain. Although it is still being worked on, the Raiden Network is an off-chain scaling solution, enabling near-instant, low-fee and scalable payments.

Lightning Network

This is a sort of secondary layer that operates on top of a blockchain and is similar to Raiden.

Lightning is a decentralized network using smart contract functionality in the blockchain to enable instant payments across a network of participants.

Lightning is said to have TPS rate in millions and billions with incredible low fees.

These formats, if applied well, can be ideal for micropayments as well which may now free up the blockchain for more substantial transactions.

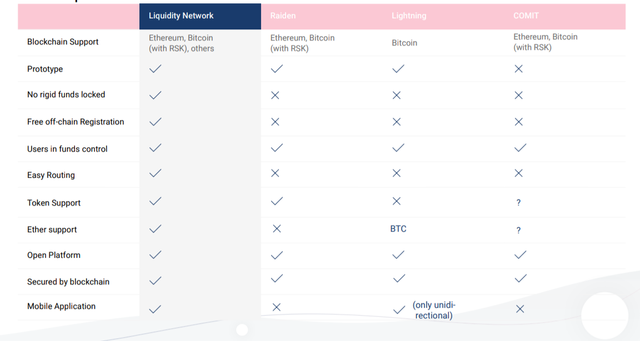

However, even networks that uses payment channels like Raiden, Lightning and Comit have major setbacks.

Here are the setbacks:

It is actually expensive and at the same time can’t be generally used by everyone for large-value transfers. This affects first time users and non-coin owners most. For instance, if two parties want to transfer 5000 eth on the Raiden or Lightning network, each node on the route should have at least 5000 eth of deposit time the setup is made. The probability for this happening is very low, making it impossible to use these networks for large-value transfers.

Routing of transactions over multiple hubs are error prone and complex. The routing is used this way; user A can send a payment via a node C to user B, if payment channels are set up between A and B, and between B and C. This do this, User A sends a transfer to User B through Node C, and locks it with a secret, generating a hashlocked transfer. He also puts a time lock in case C proves to be malicious or goes offline, so that in the end A has the possibility to know if his transfer won’t be valid.

It operates tokens as rigid collateral as they are all locked up.

Hubs actually lack the liquidity to run on.

For networks like Raiden, no one wants to trade or invest in tokens that may turn out as shit coins. People only need liquid assets such as ether.

This model doesn’t really have a reasonable incentive, rather, it can lead to a centralized network where wealthy institutions will create larger nodes through high deposits to make a profit on transfer fees, isolating the smaller nodes from the network.

Lastly but not definitely not the last problem, users don’t actually want a many-to-one unidirectional channel like the one Raiden offers, no, they want a many-to-many bidirectional channel.

However, this does not erase the fact the this payment channel model is the most promising for a sustainable future for the blockchain.

When it comes to financial transactions, it still holds brightest hope for the future of the blockchain if applied in a different way with less problems. After all, no system is without it own problems: we don’t live in Utopia.

The Liquidity Network is an ecosystem of hubs that solves these problems.

The Liquidity Network

.png)

This is a trustless, non-custodial off-chain payment hub or intermediary that increases the number of participants and transactions that can be carried over an open and decentralized blockchain, while significantly reducing costs. It makes the blockchain scalable by increasing the number of participants and number of transactions.

The Liquidity Network beats other models as it supports millions of users securely, reduces transaction costs and is enabling the mainstream adoption of blockchain.

The Liquidity Ecosystem or Architecture is built from a combination of two novel academic innovations: the Liquidity Hub NOCUST and REVIVE. We are going to talk about these two later in this article.

Moreover, it is important to bring to our knowledge that the ecosystem of Liquidity Network is divided into the network and the exchange.

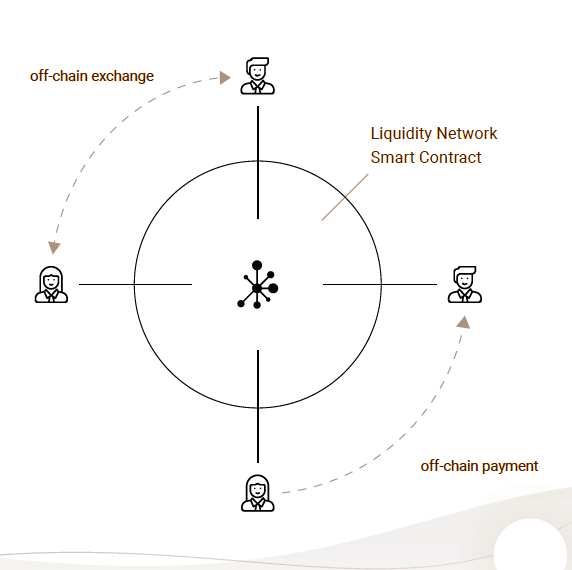

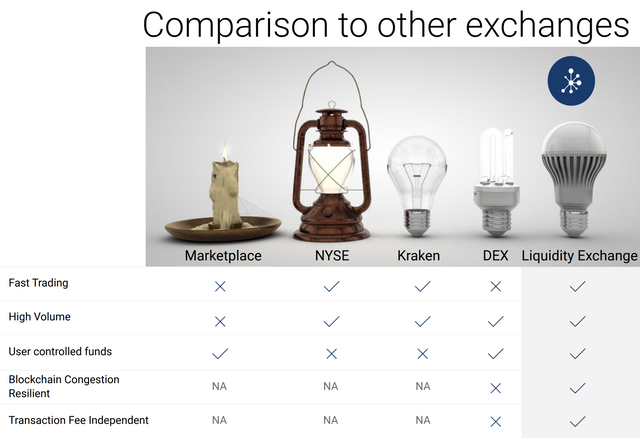

The Liquidity Network Exchange(Liquidity Exchange)

This is a non-custodial off-chain exchange designed to operate within the Liquidity Network ecosystem. The Liquidity Exchange does not hold any user funds while the atomic swaps take place.

Since the exchange uses payment channel and is off-chain, it is resistant to the infamous congestion of the blockchain and excessive transaction costs. It uses the off-chain centralized systems to make the blockchain scalable.

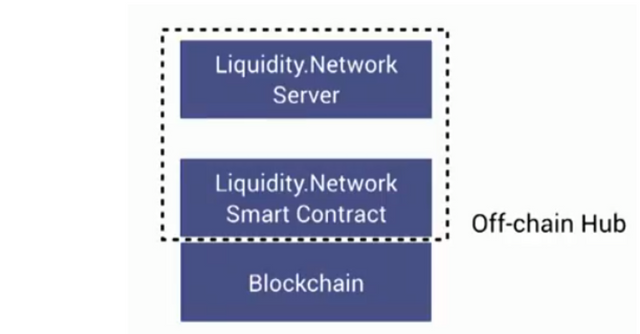

The Liquidity Network Architecture

Liquidity Network Nocust Hub

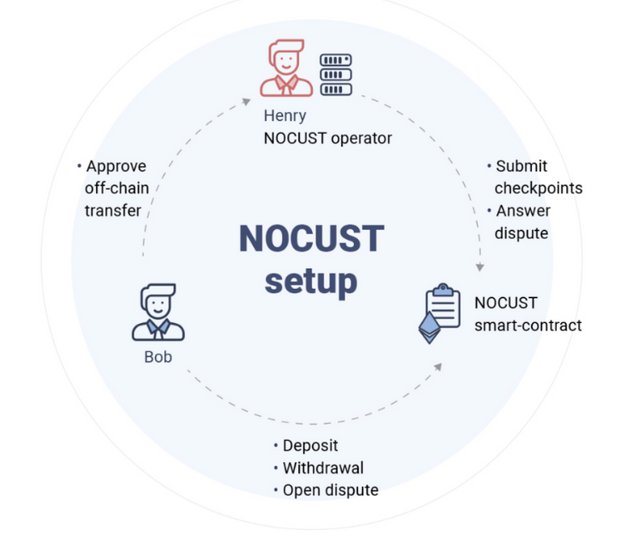

NoCust is an simply acronym for "No Custodial".

The Liquidity Network Nocust offchain Hub by is a P2P payment system where members of the hub are their own custodian.

When you keep money with the bank, you trust them to keep it. When you keep your assets or use Liquidity, YOU still hold your assets, thus, Liquidity is a trustless network. In Liquidity, you are the custodian, keeper of your own assets. Not any hub, person, operator or bank.

Users ensure the safety of their assets with a private key.

These payment hubs are interconnected in a way just like a network of Lightning peers, in a pattern to provide redundancy and users can send payments across the hubs in a trustless manner.

The Liquidity Network on the blockchain offers a very good security, thus, ensuring safety of fumds. Users funds on the network on a particular hub are always accessible and can be sent to other users on the hub.

NoCust makes use of the power of an intelligent contract as a root of programmable trust. Now, a payment hub is composed of two important components; an intelligent contract in the blockchain and a payment hub operator. The operator is a single person who runs a server but holds no funds in the hub.

This technology makes interconnection a better reality for hubs. Two users are eligible to be beneficiaries of transferring funds outside the block chain. The fact of being able to make transactions outside the block chain gives the benefit of having very low rates for the costs of such transactions. The off-chain is what allows users to enjoy fast and economical transfers.

It can be said that this model solves the scalability problem, offers instantaneous payments due to its ‘NoCust' nature and it eliminates expensive fee cost.

Categories of Offchain Transactions

(1) Two party payment channels: As the name implies, here the transaction can occur between two users. This model is commonly used by other payment channels system like Raiden. In the Two party payment system, funds are allowed in a single direction and one of the two users must deposit some coins which will serve to secure the maximum amount of funds allowed through the offchain channel as I explain earlier. Now this pattern is known as Uni-directional two party payment channel because it goes in one direction. There is also the Bi-directional channel offered by Liquidity Network where funds can be sent by any of the two parties and one of them must deposit some collateral.

Amidst all this, Liquidity offers more. Still under the two party payment channel, there is yet another pattern named Linked payment channels. Here, the transacting parties are usually separated from each other though and both of them must deposit some collateral. Routing is a factor in this pattern.

Lastly, in this first category, more than two parties could still indulge in of the above sub-category arrangement.

(2) N-Party Payment Hubs: This is a unique feature of Liquidity Network that doesn’t require complex routing or collateral refilling. In this pattern, more users than two can participate in transactions. The transaction fees are very cheap and it has high TPS.

The N-Party payment has advantages over other payment channels that uses only two-party unidirectional payment. These merits are:

•Faster transfers

•Less costly transfers

•More user participation

This whole NoCust model has been about users holding their assets. Why is this important?

It is a trustless system. The users don’t need to trust anyone with their assets.

Instant accessibility for assets owners.

It can’t be stolen

Users can take extra security measures to ensure better safety of their money.

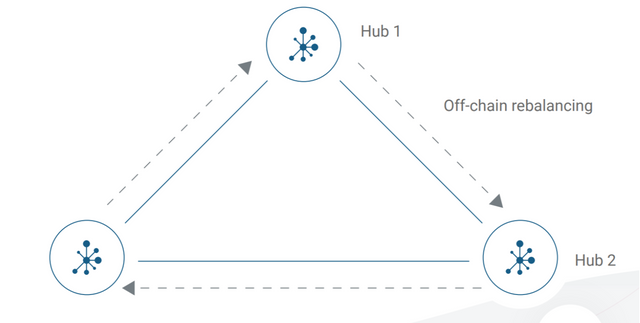

Now, let's look at the second Liquidity Network architecture component that ensures that offchain transactions are rebalanced offchain

Revive

This is the second component of Liquidity Network that effectively rebalances transactions offchain. Most offchain payment channels limit the rebalancing of funds on the blockchain. Offchain transactions that are validated Onchain go a long way in degrading the blockchain, rerouting it back to scalability and speed problem. Thus, the Revive is introduced by the Liquidity Network.

It performs the important work of rebalancing offchain transactions onchain.

The Revive technology helps to rebalance the payment channels without coming Onchain. This is done Offchain by Revive to ensure the blockchain handles less work thereby ensuring scalability.

Moreover, this rebalancing is costly if done Onchain, so Revive ensures that users don’t have to pay extra for rebalancing by doing it at a very cheap rate Offchain.

REVIVE is also independent of the payment channel, that is, it can be applied to different underlying payment networks and if all the rebalancing participants are honest, rebalancing with Revive is FREE. So, in synopsis, Revive increases the transaction scalability of block chains without permission by reducing the frequency at which reimbursement of the channel in the chain is necessary.

Liquidity and Centralized servers processing transactions.

Bitcoin processes 5-7 TPS(Blockchain)

Ethereum processes 13-15 TPS(Blockchain)

Visa processes 24000 TPS(Traditional OffChain)

Those facts above explains why Liquidity is leveraging the speed of the centralized servers for it’s speed and uses Blockchain for security, a feat that none has achieved for financial blockchain application.

The Blockchain wasn’t built to handle large volumes of data due to security issues, so this is a novel idea to utilize centralized servers. So here, centralized off-chain servers gives speed and scalability while the blockchain offers security and transparency.

Liquidity Network Simplified Routing Design

Unlike Lightning and Raiden Network, Liquidity Network employs very simple routing designs in order to ensure optimal performance. Simple routing ensures that the two or more users of different hubs can send and receive payments since the hubs are interlinked. This increases transaction speed yet reduces transaction cost.

What differentiates Liquidity Payment Network from other payment platforms?

•The Liquidity Network enable the payment of any member of a payment hub by another member at zero transaction fees.

• The Liquidity Network makes instant and off-chain channel establishment possible. This implies that there are no prior crypto needed and OffChain registration enabled.

• Unlike Raiden and Lightning networks, the Liquidity Network uses simple routing designs avoids complex routing that topologies.

What differentiates the Liquidity Exchange from other exchanges?

• The Liquidity Exchange has the ability to perform instant off-chain swaps without holding custody of users’ funds.

• It is resistant to excessive onchain transaction fees by making it offchain.

•The infamous congestion of the blockchain notwithstanding, the Liquidity Exchange can still function under such circumstance while giving a more stable and professional financial service. This also ensures scalability.

•Instant Off-chain swaps

• Matches trading speeds of popular traditional centralized exchanges.

• The Liquidity Exchange is a payment center that allows bidirectional transactions between people.

Decentralization of The Liquidity Network

The Liquidity Network was built to be a redundant decentralized ecosystem housing a network of hubs.

According to the liquidity whitepaper, these questions determines if a system of network of this type is centralized.

Who owns the funds?

Other Networks: A certain person or entity keeps custody of funds. Sometimes, it is kept within the network built-up, thus, risking theft or fraud.

Liquidity Network: Liquidity Network is noncustodial. No hub, no hub operator keeps the funds. Through the use of a private key, a user owns his funds at any time.

How redundant is a system?

Other Networks: These enable moderate, little or no redundance.

Liquidity Network: The Liquidity Network has been designed to enable hubs interconnect, just like a network of Lightning peers, in a pattern to provide redundancy.

Can a central entity censor?

Other Networks: Users don’t exhibit much sovereignty with Hubs and their operators like in the Liquidity Network.

Liquidity Network: A hub can choose to not forward payments to any user. If that were to happen, the user can simply remove his funds from the hub’s smart contract, which the hub operator cannot prevent. The user would then join another hub.

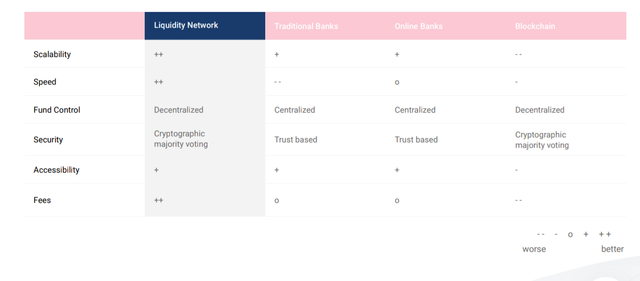

Liquidity compared to other Exchange solutions

Liquidity compared to other offchain solutions

Liquidity compared to other payment

.png)

The Liquidity Exchange is visibly scalable while still carrying out instantaneous, safe transactions.

Some advantages and features of the Liquidity Exchange are;

It enables micro-payments

and Small Value

Transfer (SVT) .It has negligible transaction costs.

No rigid locked funds

Any member of the community can be paid with these allocated funds, anytime.There are enhanced transaction privacy features.

Instantaneous payments of cryptos.

There are no custodian of funds. Payments and Exchanges are secured by the blockchain technology and funds are owned by the user at any point.

Simplicity of design. Not error prone and no complex routing.

Flexible Fees

There is security of payments. Payments are secured by the blockchain.

The system is generic, that is, it is portable to any smart contract blockchain as it is built on the Ethereum blockchain.

Actions in the ecosystem are auditable(Transparency).

There has been a Peer Reviewed Research carried out on it. Papers published in the biggest academic IT Security conference (CCS 2017).

Use Case Scenarios

The Liquidity Network can be greatly used for airdrops. This will eliminate the issue of cost and custody of funds by one person amongst others.

It can also be used for Gaming, Micro payments, Pay Per View, Digital goods, Rental Services(AirBnB, Uber, etc), Digital Payments, Instant Token Swaps, Noncustodial Offchain exchange, several blockchain applications, etc.

Let’s build a use case out of one of these.

MICROPAYMENTS and IoT

The blockchain is on the frontier of becoming the best payment infrastructure of the upcoming machine-to-machine economy called Internet of Things(IoT). It is estimated that IoT may increase in number and this will increase communication between devices, thus, an increase in commercial transactions. However, there is a limitation to this. The blockchain is slow, not scalable, costly and won’t be able to handle the volume of data that will be induced by the IoT. It is also known that the cheaper the cost of transfers become, the more use cases emerge.

Luckily for us, that’s why Liquidity Network is here. With Liquidity Network, not only will the blockchain be scalable and fast but micropayments can be used to get fine grained access to APIs, bandwidth, computing power, storage, electricity, basically any infrastructure within and beyond the IoT and even extended to entertainment contents and website. Recently, lots of anticipated DApps heavily rely on micropayments between users in the network to incentivise cooperation and there is no other system that will perfect the future of the blockchain with IoT other than Liquidity Network.

The same goes for content or entertainment such as webpages, gaming, video or audio streaming.

Conclusion

The Liquidity Network is changing how people look at the blockchain. It is merging two giants together to form a formidable financial platform. It is the first of it kind to have these unique features.

Yes, the blockchain wasn’t built for large volumes of data processing. We can’t change that but we can’t still ignore the glaring potentials of the blockchain too for big data.

Liquidity Network offers a way around, won’t you love to try it out?

The Liquidity Token

This will be used by users to get access to premium features on the network and won’t be necessary for everyday activities.

Watch my video about this project below

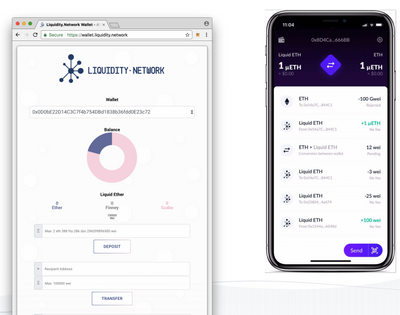

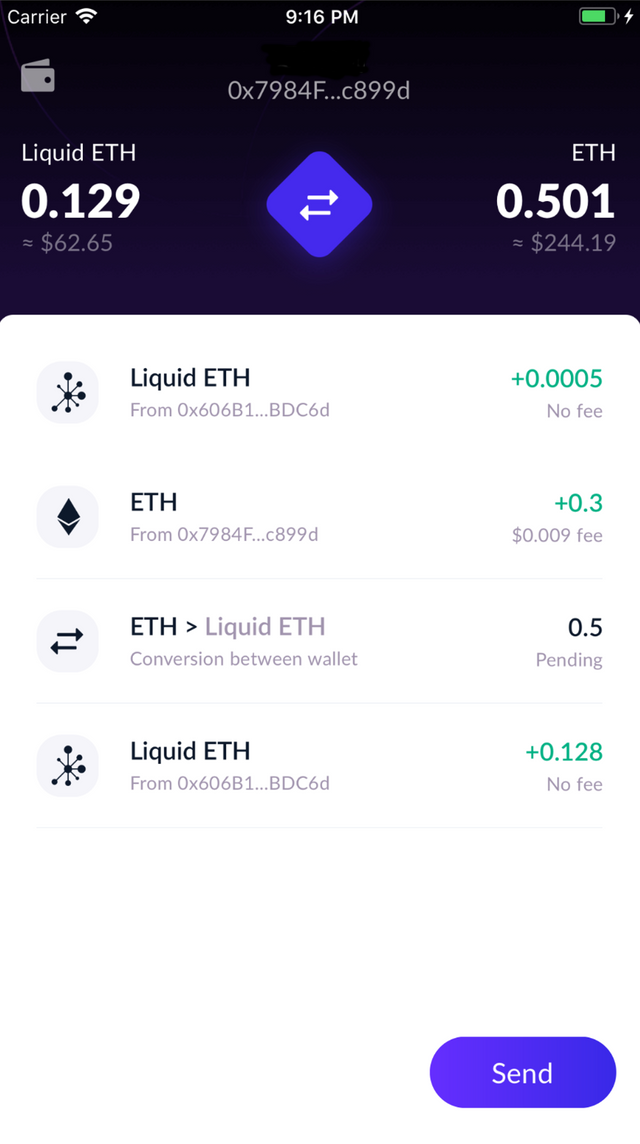

Liquidity Wallet

It supports Desktop and mobile wallets

Watch the official video below

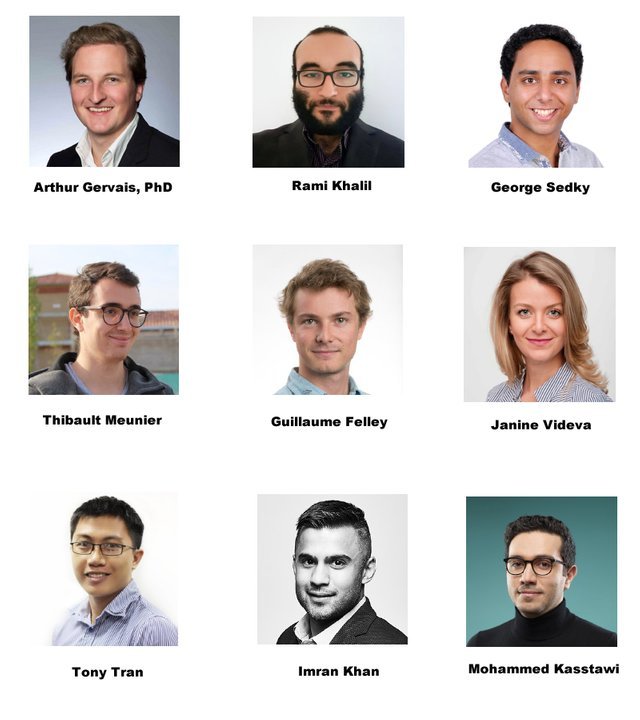

The Team

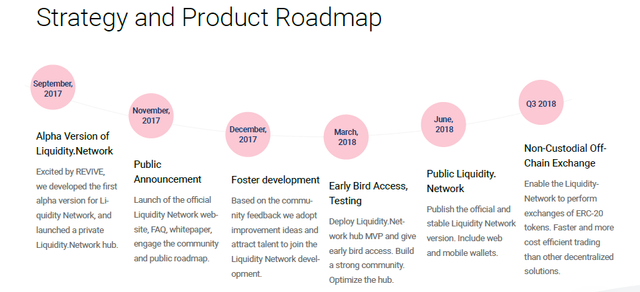

The Roadmap

Note: Pictures not sourced, were gotten from the sites of Liquidity and are licensed for use in this contest

This sponsored contest is organised by @originalworks. Click here to check out the post.

Liquidity Network Wallet

Liquidity Network WhitePaper

Liquidity Network NOCUST Paper

Liquidity Network REVIVE Paper

Liquidity Network Apple App Store for IOS

Liquidity Network Google Play Store for Androids

Liquidity Network Telegram Group

Liquidity Network Telegram Announcement

Liquidity Network Twitter

Liquidity Network Github

Liquidity Network Blog

lqdtwitter2019

lqd2019

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Congratulations @rexdickson! You received a personal award!

Click here to view your Board