Crypto and sex

OMGNo!

The failure by Stripe to provide services to OMGYes, a site the provides education in relation to women’s sexual pleasure, illustrates the difference between fintech and crypto. Fintech is the cool, slightly hippie version of the traditional financial system. But … it is still the traditional financial system. The Collison brothers from Limerick, Ireland who created Stripe seem to personify fintech: incredibly intelligent, disruptive, well-intentioned billionaires. Despite personally wanting to fund OMGYes, the traditional financial system that controls Stripe said no. The crypto system is fundamentally different: there is no middleman to tell you what you can do with your money (as long as it is legal, of course). No government, no bank. The decision is up to you. Payments go from you to the recipient.

Economists use the term “repugnance” to describe activities that have a moral element to them, such as the sale of sex items. Many banks and financial intermediaries do not allow their customers to make purchases they deem repugnant, even if they are legal. A good example is provided by the fintech company, Stripe, which facilitates payments. Here is an excerpt from their website:

“Why can’t we work with some businesses?

Behind the scenes, we work closely with payment networks (such as Visa and Mastercard) and banking partners across more than two dozen countries. Each institution has strict legal regulations that govern them and specific rules about the types of businesses they do and do not work with.” Footnote 1

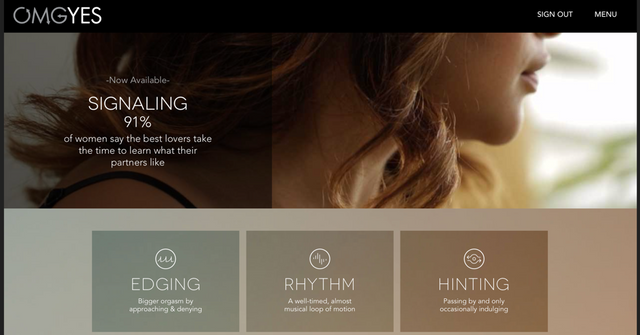

One such business they declined to provide financial services for is OMGYes, which provides educational videos in relation to women’s sexual pleasure. Here is what Stripe had to say about why they declined to provide services to OMGYes:

"The business approached us and we were eager to work with them, but after a month of deliberations, our financial partners did not agree. Instead, because the website has explicit tutorials, it still falls under the umbrella of unsupportable businesses. While we were not able to persuade our financial partners this time around, we will continue to holistically look at and advocate for businesses that sell adult products and services.”

One the one hand, you could perhaps say: well, they wanted to do the right thing. On the other hand, you might say: well, the end result is that they didn’t (couldn’t) do what they felt was the right thing. The traditional financial system just doesn’t allow it. You might also say: if it is my money and it is legal, why does some financial services company decide for me what is morally acceptable or not? Using nice terms like “holistically” and “advocating for businesses” doesn’t change the fact that they said OMGNo to OMGYes. Footnote 2

Finally, here is what Stripe says,

“As a result, the decision to support a business is not solely up to Stripe; it involves the various financial companies in the credit card processing chain.”

You want to know what the difference is between the traditional banking system, including “fintech” companies like Stripe, and the crypto system? Well, here it is:

In the crypto system, the decision to support a business is solely up to you.

It is your money and it is your moral value judgement.

In the future, people will decide what is morally repugnant to them and what is not. Increasingly, they will decide that banks and the system that enables them are repugnant.

In the future, when the crypto system replaces the traditional banking system, constraints due to “repugnance” (for legal activities) will cease to exist.

Danika Lyon, Industry Relations, Stripe Inc. “Why some businesses aren’t allowed.” 12 August 2016. As sourced from: Al Roth economics blog, guest post by Stephanie Hurder. 28 August 2018.

Of course, even if it doesn’t change the end result or the fact that it contributes to enabling the traditional financial system to decide morality for you (I know, what a joke), at least Stripe should get some credit for being open and honest about the decision process. You won’t find many articles like this on bank websites that say: well, we would have liked to have provided services to this customer, but, you know, the traditional financial system finds education about women’s sexual pleasure repugnant. Meanwhile, check out our services to strip mining companies in Africa, here ….

Robert Sharratt

Robert is part-Canadian, part-British, somewhat autistic and lives in Geneva. He is going to link the crypto system to the real economy and create a better banking model, or die trying. His interests include mountain-climbing, chess, piano, programming and distrusting authority. In his early career, he was an M&A investment banker in London, then in private equity, and then moved to Switzerland to invest his own money. He holds an MSc degree in Finance from London Business School.

Twitter: @ReassureFin

LinkedIn: https://www.linkedin.com/in/robert-sharratt-1887a4129/