A history of money

The story of money is the story of human evolution.

Our ancestors’ development of money was driven by our biology and our values. The history of money can be separated into two parts:

(1) A period where money had an explicit link to value. This period existed from the dawn of money in Neolithic times, as humans started to cultivate crops and domesticate animals, and lasted for most of the rest of human history.

(2) A recent period, where this explicit link has been broken. This period followed the rise of precious metal depositories (the forerunners of modern banks).

Money arose, essentially, as an extension of memory.

As our ancestors evolved, they assumed increasingly specialised roles in society. Some might concentrate on making footwear, others to tending livestock, others in raising crops. Money represented the concept of value created through specialised effort, which was used by the group and then, later, exchanged with others through trade. Small groups remembered that the makers of footwear had done their part earlier, when the meat came in from a hunt. We acquired the concept of stored memory to shift value across time periods. Between groups we learned to exchange valuable items, either at the same time or with one group giving food now in return for a promise to receive food in the future from the other group. As we specialised further and repeated exchanges across time, this gradually led to the concept of a standard of value, as barter exchange become too complex for us to remember. This was the first step towards money and a standard of value for exchange existed amongst communities in Mesopotamia and along the Nile River by ~3,000 BC. Footnote 1

A standard of value was necessary before any other aspects of money could emerge.

Exchanges of valuable items needed to be comparable and many societies used what was most available, such as wheat or barley. Footnote 2 In Ancient Rome, cattle (pecus) become a standard of value, from which we get the word pecuniary. These standards of value also had other rudimentary, secondary characteristics useful for money: they are (somewhat) divisible, portable, durable, etc. and also their supply is naturally limited.

Due to the rarity of double coincidence of wants, barter probably never really existed outside of small groups that didn’t want for much. As human groups became larger, people conceived of value in relation to a common standard (like barley); this allowed the emergence of a medium of exchange. So, a goat herder could sell a goat to a shoemaker, even if he already had enough shoes; the shoemaker could simply pay in barley. The goat would be valued according to a standard of value, measured in barley. Even if the goat herder didn’t want barley he could accept it as payment, as knew that he could use the barley as a way to buy something else he wanted. Barley also allowed him to buy a variety of items or to spend some now and keep the rest for future purchases.

Any medium of exchange implies that the item is also a store of value, otherwise it would not be accepted in exchange. Barley is a store of value, as no one can magically create a huge supply of barley. A paper currency that is subject to inflation is a poor store of value, as it is worth less every day; therefore, it is a poor medium of exchange (because who would really choose it, if it is constantly declining in value?).

Through a process of evolution, our ancestors developed the concept of money.

Essentially, money reflects the memory of something valuable that was created by our efforts, like raising livestock or making shoes. It allowed us to specialise and exchange items of value, so we were all better off. Money is often defined using complex language, but it only has two simple, common-sense characteristics:

(1) Money needs to be scarce.

(2) Money needs to be accepted by others as having purchasing power.

Money co-evolved with our understanding of sacrifice.

Humans gradually learned that sacrifice today could mean more of something tomorrow. Some of our earliest writing dealt with loans from those who had surplus grains to those who presumably had the ability and inclination to put the grains to productive use. Seeds planted today, rather than eaten with a crop, could mean more next season. Borrowers could repay lenders from what was brought forth by their efforts: when the grain harvest was brought in, a certain percentage was given to those who had sacrificed. Loans and interest due were recorded on tablets and quoted in money Footnote 3; this usually happened at temples, which were principal meeting places for the community. Many societies set limits on interest rates, had rules for times when the harvest failed, etc. Footnote 4 Sacrifice, a form of savings, and productive use of the savings, benefitted both parties. A primitive economy grew bigger: more land was brought under cultivation, more animals were raised. Savings (sacrifice), recorded as a form of money, led to a better existence for humanity.

Money itself has no intrinsic value.

Gold, US dollars, bitcoin, etc. have value only to the extent that they are scare and are commonly accepted to purchase goods and services. Money is a symbol, a representation of purchasing power; it is not valuable in itself. Footnote 5 If aliens show up tomorrow and want to sell us a cure for cancer, they are unlikely to take gold bars in payment. Undoubtedly, their home planet also has the element Au (gold), caused by the explosion of neutron stars a few billion years ago, and they are not likely to value it very much. Probably they would find it amusing that we spend time digging up, refining and then guarding gold. They might think that if we didn’t waste our time like this we might have discovered a cure for cancer ourselves.

Since money has no intrinsic value, it must be trusted.

When you create something of value (for example, by making shoes, or selling your time to your employer), you need to trust the money you get in return for your effort. You need to trust that what you are getting in exchange will give you the ability to purchase things, now or in the future. The basis of all good money is trust, just as it is the basis for all good human relationships.

Precious metals emerged as the global money in many places.

Where precious metals were present geologically most societies adopted them as money. Footnote 6 Why did this happen, in an uncoordinated manner, around the world? Most importantly, because precious metals are scarce. This allows something that has no intrinsic value to act as a symbol that retains purchasing power over time. Footnote 7 This led to groups of people accepting that precious metals represented a store of value, which could be used as exchange for goods or services in ever distant trade. So, by definition, they had purchasing power; their common acceptance was a benefit for the real economy. The global acceptance of precious metals meant that their value was not tied to the actions of specific nation states.

Precious metals had other, common-sense characteristics as a representation of value: they lasted a long time, were hard to damage, could be divided into smaller units, each unit had the same value as any other, etc. Their value was based on their weight. Eventually, probably in Lydia, Footnote 8 precious metals were made into standard units called coins, to facilitate commerce. Since they come from distant, exploded stars they were rather hard to counterfeit. In addition, primitive humans, unlike us today, probably used gold and silver because they liked shiny things with a bit of bling to them.

Precious metal depositories led to the creation of modern banks. It was the end of an era for what our ancestors would have considered “money”.

Gold and silver were concentrated in the hands of governments and guilds, who acted as producers, issuers, and depositories. As carrying gold and silver around was sometimes inconvenient and risky, precious metal depositories issued paper IOUs to their customers, depositors like merchants. These paper IOUs, backed by the value of precious metal, could be used as a more convenient form of making purchases; the IOUs themselves began to circulate as a form of money. The depositories learned that not all customers demanded access to their gold or silver at the same time. This presented an opportunity to make loans using paper receipts for more than the total amount of precious metal that they physically held. In this way a “fraction” of the value was kept in reserve and the rest could be lent out to borrowers. Footnote 9

Borrowers, doing something productive in the real economy, had an obligation to repay the lender a greater amount than was lent to them, secured against their real economy assets. This allowed the depository to earn a significant lending profit from each reserve amount. Of course, there was a risk as well: what if all customers came in and wanted their gold back? However, the real risk to the depository was relatively low: obligations were covered either by gold in storage or by real asset collateral. As further security, loans were also backed by the expected future cashflows of the productive use of the lent “money”. What became crucial was not the gold on deposit, but rather the confidence that users had in the depository. This confidence made the difference between a successful and an unsuccessful depository, not the ability of users to see how much gold really existed behind the scenes. Modern banks use exactly the same model as the depositories from history.

If you want to solve the greatest mystery in modern economics, and help remove the cancer that is the extreme variance Footnote 10 in the business cycle that metastasises every 1-2 decades, here is the question to ask yourself: are the gold and the IOUs the same thing? We know that no money has any intrinsic value. The gold is a symbolic representation, a token, that represents value. The IOU is a token on a token. They both have purchasing power. So, is there any difference between them? Let’s see if we can solve this mystery once and for all.

Money and banking are inextricably linked.

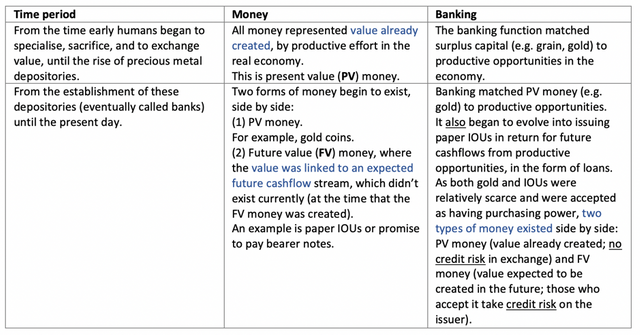

The history of money can be broadly divided into two periods, as set out below.

Although this was an evolution, it led to a decisive change in what money meant to humanity:

The rise of modern banking broke the historic link where money represented the memory of something valuable created.

Want to know more about what money really is? Follow me.

P. Einzig, Primitive Money: In its Ethnological, Historical and Economic Aspects, 2nd edn., London, Pergamon Press, 1966. M.Powell, ‘Money in Mesopotamia’, Journal of the Economic and Social History of the Orient, vol. 39, no. 3, 1996, pp. 224-242.

Amongst the earliest recorded civilisations to use money were the Sumerians. By the time they codified a standard of value, this was still expressed in barley, although silver had become the main medium of exchange. R.F. Harper, The Code of Hammurabi, Chicago, 1904, p. 37. S.Homer and R. Sylla, A History of Interest Rates, 4th edn., Hoboken, John Wiley & Sons, 2005.

Einzig, op. cit.,p. 206.

Homer and Sylla, op. cit.

Some items were used as money that have value in themselves, like barley or cigarettes, but, when used for an exchange purpose, their value was their scarcity and purchasing power, not because you could eat or smoke them. If the goat seller, for example, just wanted to buy barley, he probably would not have gone to the shoemaker.

The earliest form of precious metal money in Mesopotamia was originally copper. In Ancient Rome it was the aes rude, which was copper or bronze. In Indonesia, tin was used in trade and Sparta used iron. Eventually, gold and silver became more prominent. Einzig, op. cit.

Precious metals did not have consistent global pricing until the emergence of modern logistics, but acceptance of precious metals by diverse civilisations facilitated exchange amongst groups and, eventually, nations. In many ways, gold and silver were a global money for most of human history: they were scarce and they were accepted as having purchasing power.

From the Greek historian, Herodotus, The Histories. R. Cook, ‘Speculations on the Origin of Coinage’, Historia, vol. 7, no. 3, 1958, pp. 257-262.

This is *double spending(: the depository had gold on deposit from the customer and, at the same time, lent some of this gold to a borrower. The original gold is the only representation of value created in the real economy. Actually, depositories (banks) spend much more than twice. A 10% fractional reserve ratio means that ~9x the original “value” deposit is created in paper IOU money, in purchasing power.

Of course, some volatility is to be expected and at certain amount does, in fact, provide valuable information to participants in the economy. A natural amount of volatility is beneficial to the economy, as it gets rid of dead wood and makes the overall system stronger. Here, we refer to excess variance, the exponential effect of bank credit money on a natural process and also its abnormal impact on asset pricing.

Robert Sharratt

Robert is part-Canadian, part-British, somewhat autistic and lives in Geneva. He is going to link the crypto system to the real economy and create a better banking model, or die trying. His interests include mountain-climbing, chess, piano, programming and distrusting authority. In his early career, he was an M&A investment banker in London, then in private equity, and then moved to Switzerland to invest his own money. He holds an MSc degree in Finance from London Business School.

Twitter: @ReassureFin

LinkedIn: https://www.linkedin.com/in/robert-sharratt-1887a4129/