LIQUIDITY NETWORK. EXCHANGE PLATFORM OUT OF THE CHAIN, SCALABLE, SAFE AND EASY.

Every day we act more through technology; the simplicity, security and support that this entails is essential to participate in the world today. Blockchain public networks such as Bitcoin or Ethereum have amply demonstrated that they are secure networks, and that is why the market capitalizations of both have already reached billions.

As blockchain networks become popular, the number of transactions grows exponentially, causing thousands of transactions to accumulate waiting to be added to the blocks in the chain. With this saturation, high network commissions arrive, which are the payments that users make to the miners so that their transactions are included preferably in the next block. The higher the commission, the faster the transaction will be included in the next block. Consequently, making changes in these platforms has become very expensive (as well as risky) simply because you have to work with a large number of participants who also have different interests.

These problems of scalability of the blockchain networks and the high commissions that these generate, make the transactions unviable, because the network commissions far exceed the amount of these. For this reason the blockchains with more participation, such as Bitcoin or Ethereum, are beginning to experience some of their technical limits of operation in some aspects of their implementation, which makes it difficult to reach more users who, although the blockchain technology would benefit them, can not that the capacity of the network to carry out transactions is running low.

Nowadays, the advancement of technology must give Blockchain solutions more effective to solve the main problems that these networks present, such as scalability, the speed with which operations are carried out and the problems of commission payments at the moment of make a transaction.

Let's expand a little more the concepts that are introduced in the topic!

PAYMENT CHANNELS

A payment channel is a means of transaction outside the block chain, in which two people commit funds in one direction and are paid between them by issuing payment commitments established by the parties, avoiding having to wait for confirmations of the underlying blockchain.

PAYMENT CHANNELS NETWORK

We can say that a payment channels network is formed at the moment that there are two or more payment channels created in conjunction with a common user among them. When this happens a user can send a micropayment to another user outside their payment channel using one or several normal connections.

For example, if a user named Dana opens a payment channel with Ricardo and Ricardo has an open channel with Luis, and Luis has an open channel with Julia, then Dana can send money to Julia using the other users (Ricardo and Luis ) as means, in the way small commissions are paid to those who helped the transaction to be completed.

PAYMENT CENTER

A payment center is a point of connection of several payment channels in conjunction with its members. The payment center is the system that allows transactions between the users of the payment center using an intelligent contract that will be the one that provides the connection between the chain of blocks and the user. Otherwise it is the traditional payment channels, where the funds are not blocked between two people, that is, they do not use smart contracts, but rather they are instantly available to all the members of a center.

Well now!

Liquidity Network is a payment center network, built on Ethereum that solves the problems of scalability and routing of existing block chains such as Bitcoin and Ethereum. The main objective of Liquidity Network is that it reduces transaction costs and in turn improves privacy, all while supporting the decentralized nature of the block chain and does not require a trusted third party.

It is a work network that functions as a financial intermediary in which operations can be carried out with payment channels developed by the same users. In this way, you can avoid using the Ethereum network every time you want to perform an operation.

One of the properties that Liquidity Network has is that every time a channel created between two users is closed, the operation is registered within the Blockchain, this allows two or more pairs of users to keep a private accounting book between them which significantly increases the user's privacy. Transactions are only made between two pairs being saved as a single operation.

The Liquidity Network and exchange design revolves around an intelligent contract. For example, a user who is joining a channel within the Liquidity Network can process their funds with another member within the channel and outside the block chain at relatively low costs. The funds are accessible to thousands of users within the system and are insured by the Blockchain, which is why users can not steal the allocated funds.

Liquidity Network is based on the Ethereum block chain and solves the problems of existing payment channels:

- There are no funds blocked and the funds allocated can be used to pay any other member.

- The funds in Liquidity.Network are owned at all times by the respective user and are controlled by the chain of blocks Ethereum.

- There is no loss of time. You can send and exchange cryptos instantly.

- Operates with simple routing designs, avoiding the complexities that Lightning faces.

- Free channels with a simple design.

- All actions can be auditable.

- Private transactions.

- The payments and exchange are made outside the chain without custody, however, they are insured by the Blockchain.

- Flexible rates.

- Portable payment channels to any Smart contract.

Liquidity Network uses two powerful tools

NOCUST and REVIVE

Nocust provides a mechanism within Liquidity Network payment centers that gives people complete ownership of their funds, creating trust between users as it does not require the need of a third party. The Nocust solution mainly solves the problems of scalability and high commission rates for each transaction. Nocust allows its users to perform transactions outside the block chain. It has the advantage of having an instant transaction confirmation and zero commission costs. It can also reduce the load on the block chain and, therefore, can scale to billions of transactions per second.

BUT HOW DOES NOCUST WORK?

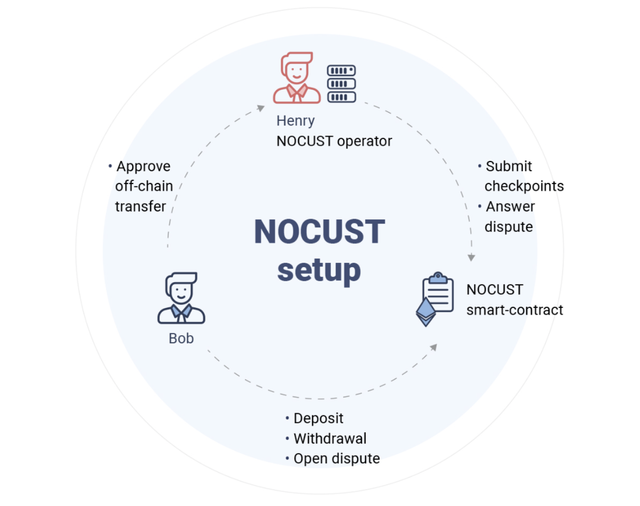

Nocust uses the power of an intelligent contract to build trust among users. Nocust within a payment center consists of an intelligent contract and a payment center operator who is a person who manages a server that for this use case we will call him Henry.

Now, suppose that the user Bob wants to use the payment center to perform an operation, for this he deposits his funds in the intelligent contract in order to have his Ethereum available in the case he wishes to transfer them. In effect, Bob wants to send his Ethereum out of the chain to Diana, another user of the same payment center. In this case Bob communicates with Henry and when Henry approves the payment to Diana will be made immediately without waiting time and without commission fees.

It is important to highlight that all user funds are grouped and stored in an intelligent contract, users can deposit or withdraw their funds within the contract. As Henry is a person who can suffer any inconvenience the user can recover their funds by requesting a withdrawal from the intelligent contract.

In addition to this, the smart contract uses a list of all the account balances of all users called checkpoint. A payment center in the Ethereum network expects a checkpoint from Henry every 36 hours. This is for the purpose of demonstrating the safety and reliability of the Nocust mechanism.

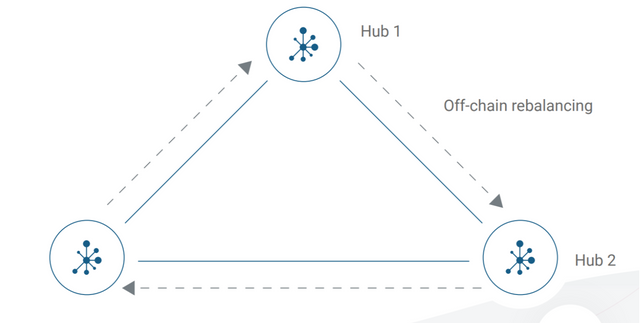

REVIVE is an integral part of the Liquidity Network and allows the different payment centers to rebalance their respective balances. In other words, it is the solution that allows a set of arbitrary users in a network of payment channels to move their funds securely from one channel to another outside the block chain.

There is the case of users with multiple open payment channels, for example, a channel that could remain open in an ice cream parlor, while another could pay for internet service, usually have to "rebalance" the channel through chain transactions every time a channel runs out of Ethereum.

Revive, on the other hand, allows money from the ice cream parlor channel to be sent to the internet service channel if their funds run out. In this sense, instead of reimbursing a channel (which incurs expensive transactions in the chain), a user should be able to take advantage of their existing channels to rebalance a poorly financed channel.

The movement of funds may seem insignificant, but each optimization may matter, especially at a time when chain-rate transactions increase (and could increase further if cryptocurrencies become more popular).

IS LIQUIDITY NETWORK DECENTRALIZED OR CENTRALIZED?

It is centralized in the sense that an operator is the one who manages many users at the same time through a server. And it is decentralized because any number of centers can be added to the network.

The cryptocurrency markets have evolved a lot since their appearance. We can refer to EtherDelta which was one of the most popular decentralized exchanges in the cryptocurrency market, however, it suffered like all chain exchanges from a very slow transaction speed, plus it seemed intimidating to beginners due to its complex interface.

Another case is that of Mt. Gox, which was the most popular exchange page in the first half of this decade, managing 80% of the market shares, however, it proved to be an unreliable exchange due to the fact that he discovered that more than 700,000 bitcoin had been stolen in 2014. Liquidity Network allows exchanges with instant transactions, where user funds are insured by the chain of blocks, transactions are faster and commissions are not very high.

LQD is the Liquidity Network token, the objective of the network team is to integrate the token into the ecosystem to create an open and competitive market for the processing of payments within the network. Users who participate in the network will not have to use Liquidity LQD token for regular use. The tokens will allow participants to pay for ancillary services such as channel monitoring and access premium network features. The Liquidity Network team is investing in the pursuit of legal experience and compliance to ensure that the sale of the Token complies with the regulation.

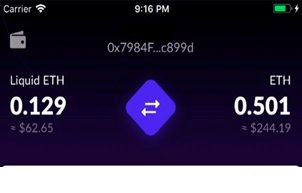

One positive aspect of the Liquidity Network is that right now on your mobile device, IOS or Android! You can download the Liquidity Network portfolio in a very easy way and you can take it wherever you want.

The Liquidity Network system provides a secure and intelligent solution in relation to existing exchanges, as well as being a simple, scalable, private and transparent network. It is built on the chain of blocks Ethereum, designed to support millions of users and thus achieve a general adoption.

With the use of the Nocust mechanism, the problems of security of funds, circulation of funds, exchange of funds and transactions of funds that affect all types of users are solved. In addition, the Revive solution allows payment centers to rebalance their channels outside the chain, which increases scalability over regular payment channels.

As you can see, this is another innovative exchange service that has been created with the aim of continuing to help the world of cryptocurrencies grow. For many people it was somewhat tedious to have to use a Blockchain to make their payments, with this new method is something quick, simple and with many advantages for the user.

This is my Video

Liquidity Network Website

Liquidity Network Wallet

Liquidity Network WhitePaper

Liquidity Network NOCUST Paper

Liquidity Network REVIVE Paper

Liquidity Network Apple App Store (IOS)

Liquidity Network Google Play Store (Android)

Liquidity Network Telegram Group

Liquidity Network Twitter

Liquidity Network Github

Liquidity Network Blog

Twitter link

https://twitter.com/ninoska46878387/status/1083130973582184449

lqdtwitter2019

If you want to participate, enter

https://steemit.com/crypto/@originalworks/2500-steem-sponsored-writing-contest-liquidity-network

lqd2019

.png)

.jpg)

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Dear @norkamoran

I just visited your account to see if you published anything new only to realize that you seem to give up on Steemit? :(

Hope you're not done with this platform yet.

Yours,

Piotr

Congratulations @norkamoran! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!