The Digital Wild West

THE DIGITAL WILD WEST

Why are scams so prevalent in cryptocurrency?

Is it all simply down to a lack of regulation?

SCAMMERS GONNA SCAM

Human beings have been scamming each other ever since we placed value on goods and services and established the basic systems of exchange. Whether that was Neanderthals swapping rocks for fresh kindling or the token-based value transfer systems we know and love today, we’ve always tried to place value on the goods or services in order that we, as a provider, may benefit from their sale.

This has inevitably led to the “humans gonna human” scenario, meaning there will always be people who want to shortcut or even circumvent the process of providing or delivering valued services, but would still like to reap the rewards as if they had done so.

Scams have existed for years in the “real world” so it only stands to follow they would be present in our digital world as well, however the rapid adoption of the internet by mainstream society has allowed scams to grow and become more and more elaborate and intricate over time.

First, they came through the bulletin boards, then it was websites and email using malware, phishing and cloaking, then we add to that social media such as Facebook and twitter & Instagram and you have a huge and fertile user community on which to establish a base of operations.

CHARLES PONZI

The term “Ponzi scheme” was reputedly coined after the system popularised by Charles Ponzi, an Italian immigrant to America in 1919, which he ran for just over a year before being caught out and shut down, although, there has been suggestion that Ponzi himself was inspired by similar schemes, which were ran previously in the late 1890’s by William F Miller (a Brooklyn bookkeeper) and another operating in France around 1910-1911.

At that time, the U.S. postal service, had developed international reply coupons that allowed a sender to pre-purchase postage and include it in their correspondence. The receiver would take the coupon to a local post office and exchange it for the priority airmail postage stamps needed to send a reply.

Ponzi’s scheme, was basically to use agents to purchase these coupons overseas and mail them to him, where he’d then sell these to leverage the arbitrage value and pass that profit onto his “investors”, allowing them to realise profits of 50% in 45 days or 100% in 90 days, during which period their capital was “locked in”.

https://en.wikipedia.org/wiki/Ponzi_scheme

*does any of this sound familiar? (swap “international reply coupons” for “crypto coins” and viola…)

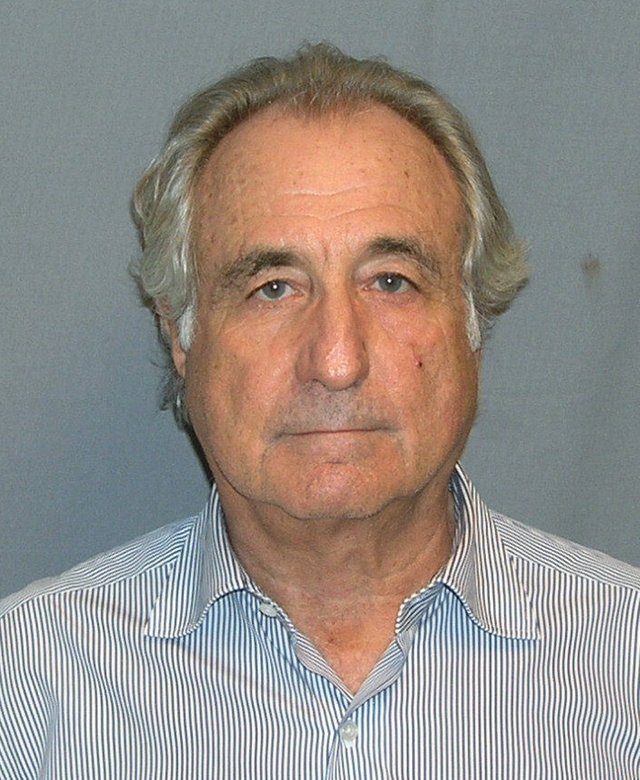

BERNARD LAWRENCE "BERNIE" MADOFF

born April 29, 1938, he is a notorious American fraudster and a former stockbroker, investment advisor, and financier.

He is the former non-executive chairman of the NASDAQ stock market and the admitted operator of a Ponzi scheme that is considered the largest financial fraud in U.S. history. Prosecutors estimated the size of the fraud to be $64.8 billion.

In 1999, financial analyst Harry Markopolos had informed the SEC that he believed it was legally and mathematically impossible to achieve the gains Madoff claimed to deliver. According to Markopolos, he knew within five minutes that Madoff's numbers did not add up, and it took him four hours of failed attempts to replicate them to conclude that Madoff was a fraud.

https://en.wikipedia.org/wiki/Bernard_madoff

WHAT IS A “PONZI”

A Ponzi scheme (also a Ponzi game) is a fraudulent investment operation promising unusually high or consistent (or both) returns, with little to no risk to investors, where the operator generates returns for older investors through investments made by new investors, rather than from legitimate business activities or profit of otherwise legitimate trading. For both Ponzi schemes and similar pyramid schemes, eventually there isn't enough money to go around, and the schemes unravel.

The classic scheme by Ponzi, has been recreated on steroids through a combination of:

Easy value transfers via blockchain technologies such as bitcoin

Rapid escalation and growth through social media and viral marketing

Desensitisation to actual value through layered replacement systems (tokens)

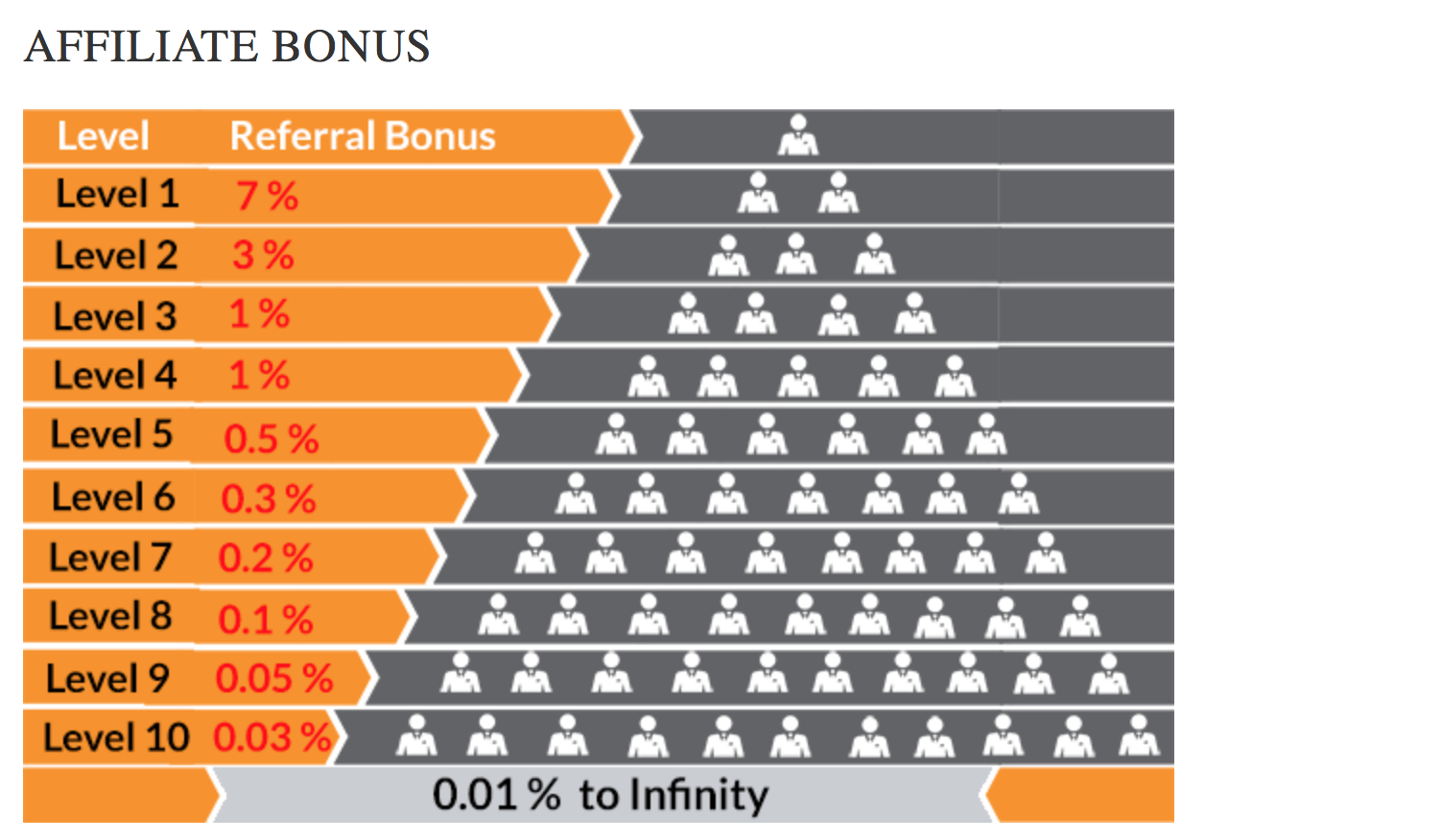

The scheme is also dependent on you recruiting more people thereby creating the “pyramid” which these Ponzi’s are also referred to. The more people you recruit that deposit capital, they more you make on your own investments.

WHY CRYPTO?

Recent cryptocurrency Ponzi schemes such as Bitconnect, Davorcoin and USI-Tech (to name but a few) are easy pickings for scamsters, but as the title of this blog post suggests, I want to try and identify why that is.

Does it purely come down to a lack of regulatory control or is there more at play in the process?

In my opinion, it’s less driven by a lack of regulation and more so driven by hype and peer influence, most of these schemes (in the online and real worlds) require a steady recruitment of “new investors” in order to become even remotely sustainable for a period, which social media is excellent at, stick a picture of a cat holding a bitcoin and you’ve just gone viral, sadly. ☹

Couple this with the fact a lot of people think that Cryptocurrency “isn’t real money”, which even though they bought it with real, actual, hard earned dollar, they seem to almost immediately disregard the actual value and just play with them as “tokens”. This makes them far more likely to “play” with that pot and invest in schemes and ICO’s that have no intrinsic value or promise a ludicrous and unsustainable return on investment.

The platforms that are operating in the crypto space often have attractive, professionally made websites and back office management tools that make users feel they are investing in a solid platform.

IT’S ALL BECAUSE IT’S UNREGULATED, SILLY

Some may argue that the prevalence of scams in the cryptocurrency space is purely down to the fact that the market is un-regulated, unlike the main stock markets where laws do exist to regulate traders and service providers.

Personally, I don’t believe that to be the case, the highly regulated financial services market still accommodates scams, they’re perhaps easier to identify and close, but ultimately, they still exist, and new ones crop up all the time.

A lot of these schemes re-brand themselves as “multi-level marketing” because somehow, that’s NOT a pyramid?

Regulations don’t solve problems in themselves and need to be enforced, and this is where I think our first hurdle would come in trying to create regulatory legislation for cryptocurrencies.

Currencies all use different protocols, have different agenda’s and are not all created equally. Take the difference between Bitcoin and Ethereum as a use case, how would you regulate these? One is merely a value store and exchange mechanism, the other can be pretty much anything a developer wants it to be, including being another cryptocurrency through ERC20 tokens.

Ethereum transactions are essentially costed on computational expense which needs to be incurred to process a smart contract by the nodes on the network, which can vary from contract to contract and may incur chained contracts and often, advanced features that the Bitcoin block chain just can’t, nor was even designed to support.

Should that then mean, that we must create tiered legislation to accommodate all current and future use cases of anything that uses a blockchain? (*I don’t fancy penning that bill, personally).

PEER POLICING

The very nature of decentralization suggests that it is not the job of the law makers and governments to impose regulations on cryptocurrencies, but rather the job of the very people that are involved in the space and are actively using the currencies and platforms, in other words, the decentralised users themselves.

Most cryptocurrencies have a public ledger, that ledger is immutable (meaning once written it can't be modified), therefore the evidence of said business activities of these HYIP's is very easy to identify, if any in fact exists.

If you look at a website that claims to make you a millionaire in 140 days just for investing just a tiny amount of Bitcoin, remember what I said about immutable evidence and ask yourself these questions:

Is there any record of their claimed activities such as mining, swing trading and claimed arbitrage activities on the blockchains?

Do they claim they are mining, if so, do they show up as active in the (fully public logs) of the mining pools they claim to use or is there any record of their own mining pools?

Do they have proven mining hardware?

Do they pay out in the same currency you paid in with? (for example, do you transfer BTC or $ to a “placeholder token” such as Bitconnectcoin or Davorcoin?

Is that transfer of capital protected? (in that If the site fails, will it be returned in the original coin or the token replacement?

What are the terms and conditions, especially with regards to capital release?

Do they provide any audits of their activity?

Do they offer a referral incentive for recruiting new members?

Does it sound too good to be true?

If all the above questions are answered satisfactorily and none raise any suspicions, you could perhaps proceed with an investment, however that simple acid test will render pretty much every current cryptocurrency HYIP (High Yield Investment Plan) uninvest able, before you even sign up.

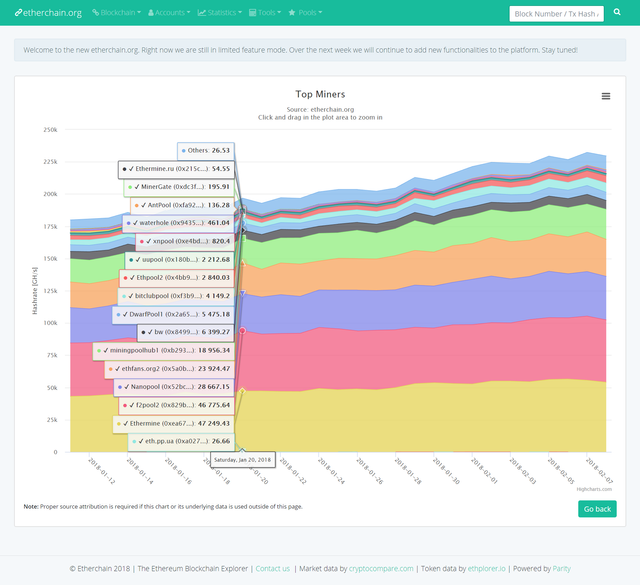

You can check the activity of various mining pools and their high-volume miners by visiting Ether Chain and going to the charts section. This has charts for all sorts of things, but the one here is the last 30 days mining activity. *That’s the beauty of blockchains, they’re public and immutable.

*You can do this for almost all crypto currencies, Bitcoin, Litecoin, Ethereum etc. even the privacy coins like Monero can still leverage some useful information

https://www.etherchain.org/charts/miner

TRADE TO THE MOON

HoDL’ing and Trading are still the best and safest ways to grow your crypto currency, for many reasons

By holding your own coins, you always have access to make plays on your portfolio. If you tie your assets into long term plans, you can’t react to any market swings as you don’t have your coins.

"But that’s what the HYIP does, they make their profits from my capital and kick some back to me"

NO! they make profits from your capital and kick you back meaningless tokens, you still need to convert them to an actual coin and withdraw it to react to swings.

Margin trading alt coins will almost certainly always return you a higher long-term yield than any HYIP promises to, this is just a fact.

By buying into a lending platform, your wealth is in their “token” not in your original coin, so you must rely on their token holding its value against the market as well as the value of the actual coins.

Buy smart, do your research. I can’t stress that enough, read the white paper for the project in detail, follow the team and the project on social media, ask them questions, figure out if what they claim they are doing is being done and if they are currently on schedule according to their roadmap.

Cryptocurrencies are just like any other stock proposition, look at who’s behind the project, what track record do they have in the space.

Does their white paper have a genuine purpose, and does it have a unique value proposition that makes you think that it could capture that target market or create a niche for itself?

FINALLY

Well, that’s about my two-bob’s worth on it, cryptocurrency isn’t any different to investing in any other assets really, if you do proper due diligence on the things you’re thinking of buying into, then you should for the most part, be OK.

Of course, there can be exceptions to a rule, where perhaps silly and meaningless coins persist beyond everyone’s expectations (*Doge anyone?), but these are exceptions rather than rules, from my experience.

Regulations (if necessary) should be wholly driven by the decentralised community and not surrendered to a law maker or government.

Swing trading and HoDL’ing are the best strategies to increase your overall portfolio strength.

If you found this article useful or interesting why not give it an up-vote?

If you want to buy me a coffee, feel free to throw me some change, it is always very much appreciated

- BTC: 1H5RNAYqpad5jMMz1ySeGDLFQJeiyFtSe8

- BCH: qzrm8lq80mrwhx2nwxdp85m52rywmswltvheq2dwed

- LTC: LV8sA94pzjt3qnD5KGuWmv1pCjJYdD44jR

- ETH: 0xd3F17aF348819AB306CBdf4Da2f81E72f01cE3Bb

- LUX: LRKuRphiNXF41Wx6azDQPRoDrZ9hsCvjGN

Thanks for Reading

Coins mentioned in post:

followed

Upvoted ☝ Have a great day!

Thanks hotpacks, much appreciated