Stick to the extremes.

Drown Out The Noise

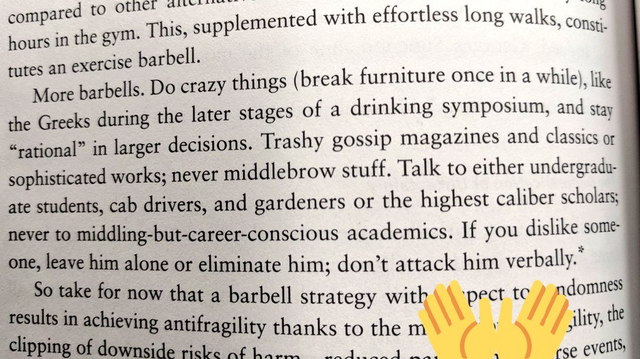

I'm reading the book Antifragile: Things The Gain From Disorder, and there's a passage that stuck out to me. While this passage can apply to all walks of life, I feel like this passage is especially important in the crypto trading space.

The barbells the author is speaking of, is a metaphor for the methodology in which you should consume information or participate in any pursuit. You should consider the shittiest information and the best information only. Your consumption of content then would be disproportionately reflective of the high tier and the low tier, leaving most of the middle leftover. This serves two purposes. By reading the best information, you've now exposed yourself to the cutting edge. By reading the worst information, you've been exposed to counter information--which will increase your ability to differentiate information quality. However, the most important part of reading the trashy information, is that you will be exposed to rare gems. The diamonds in the rough.

Every once in a while, the trashy gossip magazine will be the first to break a major story. Every once in a while, a cryptotwitter shit post, will expose you to the next 100x gem. Every once in a while, reading homeopathic or pseudoscientific information will expose you to the next intellectual landmine waiting to go off.

The idea is simple. If you want to trade well, do not listen to the crowd. When you're trading, you are either amongst the few winners, or you get dumped on like the losers. Here's a little secret: Most people will end up being losers

If you read a bunch of things that "sound correct" from a lot of average/credible sources, you're mostly going to get average information. This is the crypto equivalent from listening to CNBC: Fast Money. The information is mostly credible. What Brian Kelly is telling you at the time of the broadcast, is not wrong. If he's pointing out the downtrend on Coinbase, or if he's talking about how great of an investment Ripple (XRP) is, he's not lying to you. The problem is not the quality of the information, it's the mediocrity of the information. The accessibleness of the information.

In a market, you either are early to the party, or you get dumped on.

If you get a call from CNBC: Fast Money, 2 million other people hear that information as well. If you consider the Pareto distribution and 20% of those 2 million people act on the information(400,000 people), then you just showed up late to the pump. You will likely buy the top, and that's all she wrote.

The solution? You should stick to very high quality information, that's often unaccessible or difficult to understand, or you read shitposts on crypto twitter. Occupy the margins.

Congratulations @mrxlvii! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your Board of Honor.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last announcement from @steemitboard!