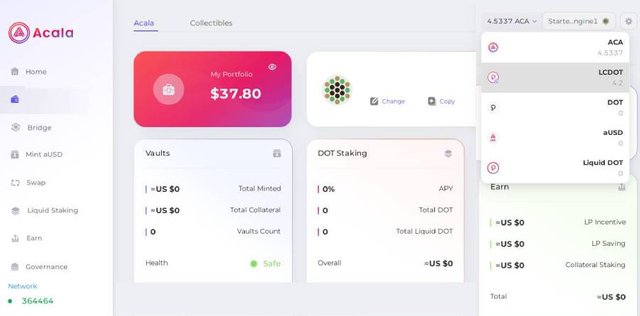

Acala Platform’s DEFI functions have rolled out with early adopter program participants checking it out!!

One can try out the Acala app - https://apps.acala.network/

Acala DEFI ignites to life with token distributions that happened on Jan 25th

A few days back, I shared about Acala Defi already having been ignited to life on Polkadot as a parachain. This happened on Jan 25th as ACA tokens and LCDot tokens were visible in our respective accounts in Acala.

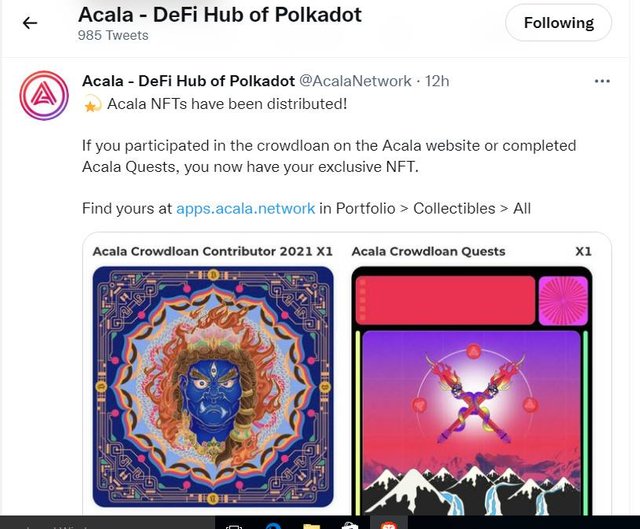

Some time later, we DOT crowdloan contributors of Acala also received something very cool, as we received our Acala artist NFT ofcourse.

Acala's Tweeter tweet

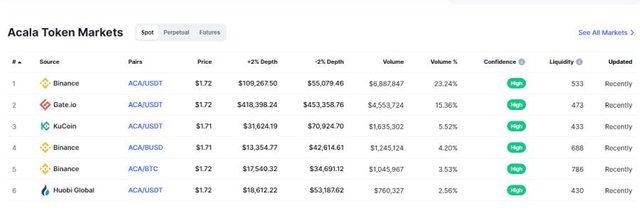

ACA tokens listed on major exchanges

I found that the ACA tokens that I earned by contributing my Dot to the Acala crowdloans was listed in crypto exchanges as well. Now, ACA tokens can be bought from major exchanges like Binance, Kucoin, Gate.io, Huobi which is good!!

Acala DEFI activities kick started keeping Acala DEFI enthusiasts busy!!

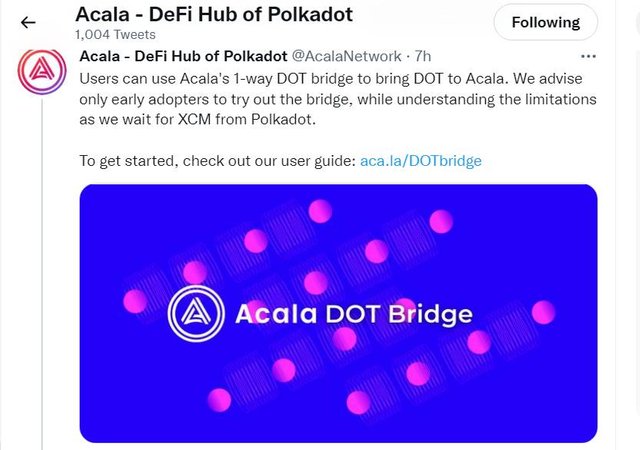

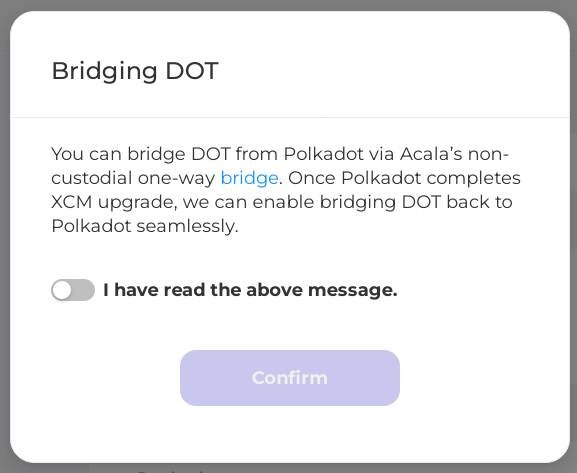

One way bridge to bring DOT from our Polkadot to Acala accounts

Soon we, the Acala Defi community, had lots of DEFI tasks to do, as Acala’s DEFI components soon started getting activated one by one every day from this week.

First, the Acala team made it possible for us to bring our DOTs from our accounts held in the Polkadot Relay Chain into our accounts in the Acala network. This was possible because of the one way bridge Acala made to bring DOT from the Polkadot Network, it’s one way as from here the DOT can’t be sent back to Polkadot now until Polkadot network’s XCM cross-chain messaging functionality gets activated.

Those trying out Acala Platform now should enrol themselves on Acala’s early Adopter program

Acala has recommended only early adopters to try Acala Defi for now, as the platform is evolving with new components getting activated phase by phase now. I am no advanced DEFI user but I am trying Acala Defi now using my real crypto assets, so far it’s been fine for me.

My Acala DEFI activities

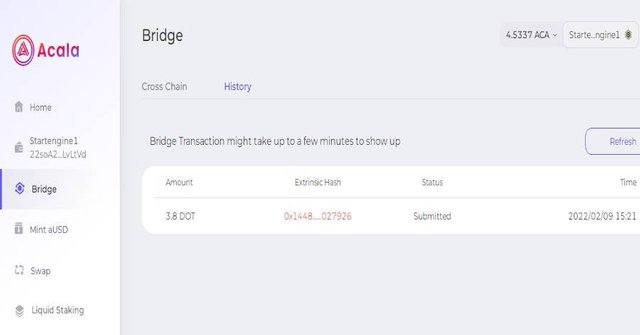

Brought DOT to Acala account using the one way bridge

I have succeeded in bringing my DOT from Polkadot to Acala using Acala’s bridge and they arrived without any issues!!

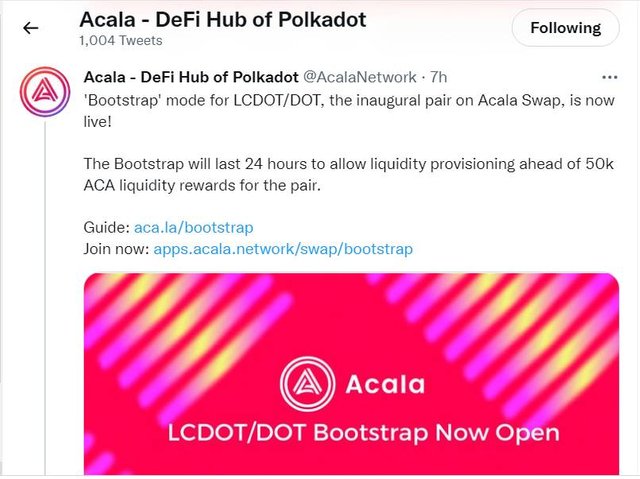

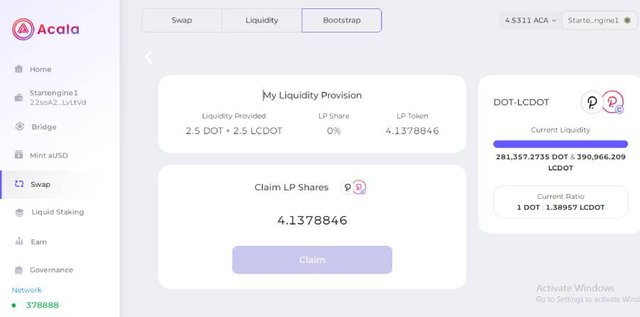

Provided liquidity for DOT/LCDOT pairs in the Bootstrap period

After this, Acala introduced the bootstrap program where we can provide advanced liquidity to liquidity pairs before swapping for the pairs gets enabled in the platform.

The first Bootstrap event happened for DOT/LCDOT pairs. So I provided liquidity for that pair within the bootstrap time period and got liquidity rewards which I again staked to earn ACA rewards, which I am sure is the familiar DEFI mumbo jumbo we users are used to from our experience in other AMM (Automatic Market Maker) platforms too.

Provided liquidity for DOT/LCDOT pair when bootstrap for the pair was initiated

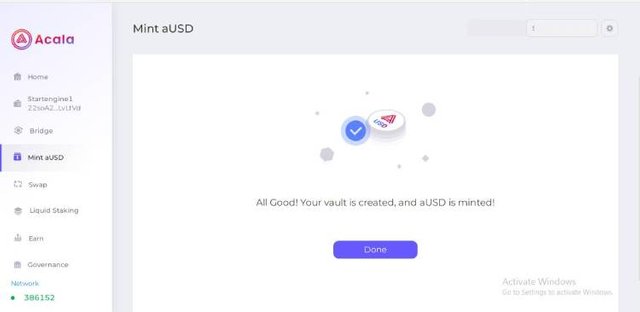

Minting Acala’s stablecoin the aUSD

Apart from this, I ventured to mint aUSD which is the Acala dollar stablecoin.

This is a decentralised stable coin that can be minted by providing your DOT based assets as collateral for now. Later, more cross chain cryptos will be accepted to collaterise and mint the aUSD.

aUSD is a very important currency in the Acala platform, as Acala’s vision is to have aUSD used for various economic activities of the platform from lending, transactions etc.

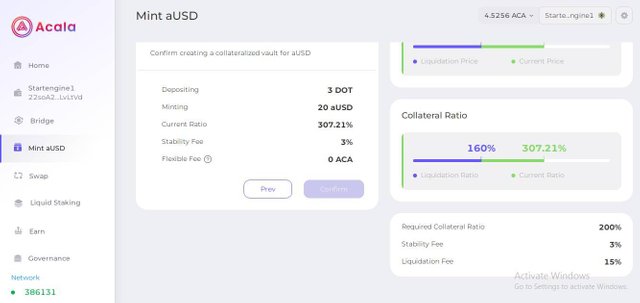

Over collateralized stablecoin aUSD that holds risk of collateral liquidation

Minimum collateral required to mint aUSD should be 200% greater than the value of the aUSD being minted

However, when I was minting this aUSD stable coin, I kind of felt that it is unstable(: … what I mean is I have to mint aUSD by providing DOT based collateral(DOT, LCDot) that is 200% more than the value of the aUSD I am minting as my stablecoin currency.

If the value of my DOT collateral falls to a level where it is 160% more than the value of the aUSD stablecoin I have minted, then my DOT collateral can be liquidated.

I can return back the aUSD stablecoin I have minted and get all my collateral back anytime though.

This reminded me what a DEFI newbie I still am, because I find it weird that I make a stablecoin that’s unstable when the value of my crypto collateral drops, and use it for all major DEFI activities in Acala. I am still not comfortable to do much in Defi with an over collateralized stablecoin.

I wish the liquidation threshold was lower like it can be 70% more than the value of the minted aUSD token, surely not 160%!!

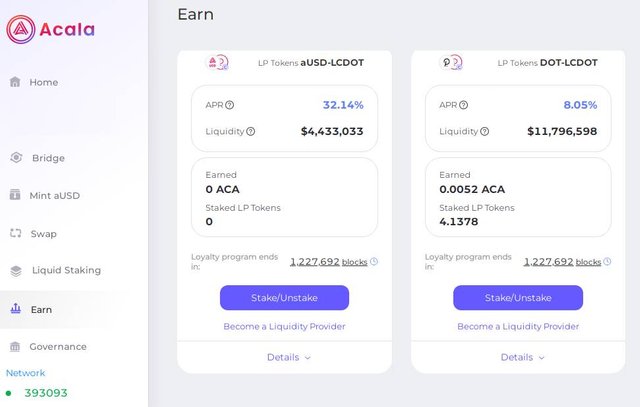

Plans to use minted aUSD for providing liquidity to Bootstrap pair ACA/aUSD

Anyway… I am keeping my minted aUSD stablecoin for now, so that I can use it for participating in another Bootstrap when the ACA/aUSD pair is introduced in Bootstrap where I can provide liquidity, earn LP rewards which I can stake to earn more ACA rewards.

Earning ACA rewards by staking those LP tokens I earned for providing liquidity to the DOT/LCDOT pair during the bootstrap mode

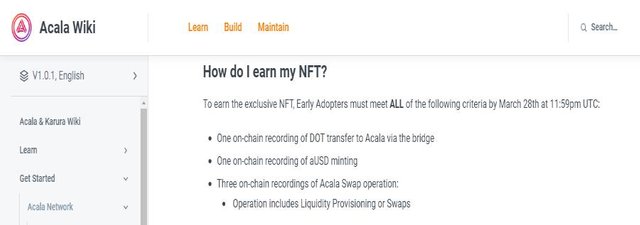

Acala’s eligible early adopter program participants get rewarded with Acala NFT again

Well, this was all I tried in Acala. I have enrolled in Acala’s early adoptor program as eligible early adopters who complete certain DEFI activities in Acala get an Acala artist NFT.

Thank you for reading. Happy Weekend everybody!!