Three Cryptocurrencies Outside the Top 10 Worth Considering (Part 1 — Telcoin) (6.8.2018)

Based on CoinMarketCap, there are about 1,700 Cryptocurrencies in circulation, and thousands more approaching, or are at the ICO stage. It is not uncommon to find yourself not knowing which cryptocurrency(ies) to invest in, or HODL. The market is undoubtedly overflowing with cryptocurrencies, which would consequently give more reasons for skepticism and doubt. However, if you dig around a little bit more, and due your due diligence and own research, there are some gems out there. Not those that will make you a quick buck or two, buck ones that will actually push the drive for mass adoption and blockchain progression. This 3-Part Article will feature three cryptocurrencies outside the top 10 that I personally have belief in.

Disclaimer

This is not financial advice nor does it intend to be one, either directly or indirectly. This is also not an attempt nor does it intend to appear as an effort to shill the Cryptocurrencies mentioned in this article. This post merely serves as a opinion of a cryptocurrency newbie.

Telcoin (TEL) — Disrupting the Remittance Industry

In brief, as stated in their website, Telcoin aims to connect with “…mobile networks globally, enabling easy conversion between telecom mobile money, prepaid credit and postpaid billing platforms…”. Their approach is simple, to reach the unbanked, or those without bank accounts, via their mobile phone (ie. mobile money). Especially in poorer countries, people are more likely to have a mobile phone than basic amenities, let alone a bank account.

(i) Financial Inclusion for the Unbanked

Fortune.com — the World Bank Group World Development Report 2016 titled Digital Dividends noted that access to mobile phones is more likely than access to toilet or clean water:

["…despite the fact that 7 out of 10 of the world’s poorest 20% have a cellphone, basic measures of progress — like economic inequality levels or the share governments with free and fair elections — have not shown any progress."]

The Businessinsider noted in their article dated 30.8.2017 that 2 Billion people worldwide do not have access to bank accounts or financial institutions and that 20% of the unbanked receive wages in cash. A number of daily transactions like paying bills and fees are done in cash. This is a commonplace in 3rd World or Developing countries.

Telcoin aims to overcome this problem by partnering with telecoms and leveraging mobile money infrastructure, which means you only need your mobile phone to send and receive money where the recipient will be able to “withdraw” or receive the money in cash form from a designated outlet, more or less like an ATM or a Bank, without the need for a traditional bank account.

Telcoin’s whitepaper notes:

["Telcoin will be instantaneous and far more convenient, traveling directly from mobile money to mobile money — and instantly spendable by the recipient. Initially users will be able to use partner wallets on both sides, to convert money into and out of mobile money and to send Telcoin."]

On a personal level, I know quite a number of people who do not have bank accounts, but it is always the assumption (and rightly proven) that he or she has a mobile phone, and these days, almost always a smartphone. Some may even have two or three mobile phones but no bank accounts. This may be due to the hassle dealing with banks, or a lack of trust, but this aspect will not be discussed here.

So, it is a no-brainer that Telcoin’s approach, if it can truly deliver unrivaled convenience, is a sure-winner as access to mobile phones has truly become something that almost everyone in every tier of society can achieve, whereas the ease and eligibility to have a bank account has remained rather stagnant throughout the many years.

(ii) Tackling the High Costs of Remittance

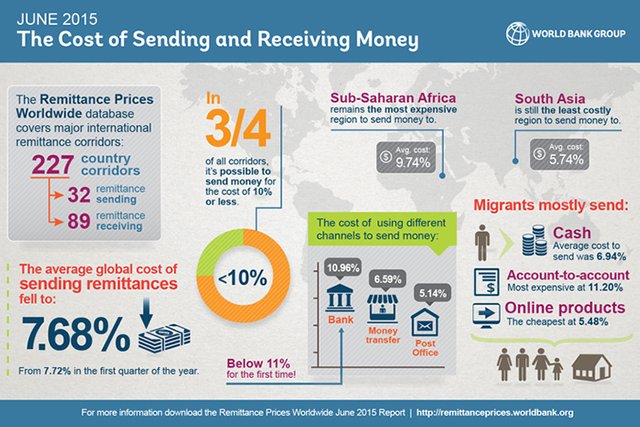

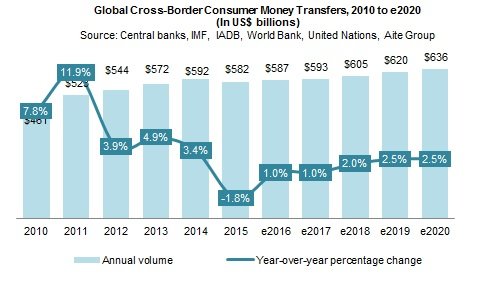

The remittance industry is a multi-billion dollar industry and many may not know it, but cross-border transactions costs a lot of money. The World Bank estimates that remittances to low- and middle-income countries was at $466 Billion in 2017 [$429 billion in 2016] and global remittances, including flow to high-income countries increased from $573 billion in 2016 to $613 billion in 2017.

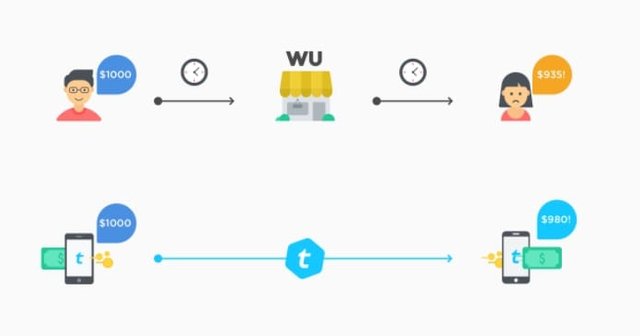

Telcoin, in their Whitepaper, have transparently noted that they “…expect to be able to deliver remittances at an average of less than 2% cost, including fees and any currency exchange spread.” or in other words, 2% cost, all in. The Whitepaper also notes that “…from mobile money or telecom credit to Telcoin, a transaction fee of 0.5 percent will be applied.” This may raise a few eyebrows and questions as to why is there still fees charged, but this is necessary to compensate for operational costs.

Telcoin notes:

["For a US$200 remittance, a user would only pay a $2.25 fee, or 1.125%, significantly less than the global average cost of remittances which stands at 7.42%"]

Stephen Cecchetti, Kim Schoenholtz noted in their article on voxeu.org titled “The stubbornly high cost of remittances” that:

["…despite the remarkable technological advances of recent decades, remittances remain extremely expensive. The virtues of domestic payments systems like Zelle, an inexpensive, bank-run means for person-to-person transfers up to several thousand dollars, are very clear (Cecchetti and Schoenholtz 2017b). The marginal cost of using Zelle is zero — that is, for customers of the bank, there is no charge.

Cross-border remittances are far from costless. On average, the charge for sending $200 — the benchmark used by authorities to evaluate cost — is $14. That is, the combination of fees (including charges from both the sender and recipient intermediaries) and the exchange rate margin typically eats up fully 7% of the amount sent. It is less expensive to send larger amounts, with the global average cost of sending $500 at just under 5% (World Bank 2017b). Even so, the aggregate cost of sending remittances in 2017 was about $30 billion, roughly equivalent to the total non-military foreign aid budget of the US!"]

So that leaves us with a remittance fee of $2.25 with Telcoin, and $14.00 for current cross-border remittance for a transaction of $200.00. Assuming a person sends $200 to his or her family abroad every 2 weeks, that would amount to monthly fees of $4.50 with Telcoin, and $28.00 with current cross-border platforms, a whopping $23.50 difference a month, and $282.00 per year. While these numbers may appear insignificant for some, it is pertinent to note that global remittance is used mostly by low- and middle-income individuals, to whom every dollar matters.

(iii) Obstacles — Regulation & Risks

Being a multi-billion dollar industry, it is no surprise (or would not come as a surprise) that regulation and scrutiny are on the top shelf. And compliance with the regulations that are in place will be no easy feat for Telcoin.

Remittance companies, big and small, have all (or still are) faced difficulties in this industry, finding the constant squeeze by regulators and banks. Interamericana Express, a remittance service company that handled a lot of transfers to Mexico run by Fernando Lopez, saw business dwindling as banks and regulators took a strangle-hold on cross-border money transfers, as money laundering became an increasingly concerning issue.

Big companies are not free from scrutiny as the New York Times wrote that Bank of America and JPMorgan Chase both stopped their own low-cost remittance services in 2014 and in 2015, Citigroup had to fork out a whopping $140 million to regulators for failing to safeguard against money laundering

The question that is posed to Telcoin is what can (and will) they do to overcome these obstacles. Telcoin places compliance as a top priority as it is the gateway to win the trust of not only the customers, but also networks and regulatory authorities in every country in which it intends to operate in. Their Whitepaper noted:

["Telcoin considers compliance a top priority for establishing trust with consumers, networks, and regulatory authorities. Compliance will generally address any factors that contribute to the integrity and marketability of Telcoin. Most prominent will be that the network perform some acceptable degree of “know your customer” (KYC) compliance. Basic monitoring and enforcement in accordance with international conventions on anti-money laundering (AML), counter financing of terrorism (CFT), and fraud management (FM) will be expected of every participating mobile network."]

Further, Telcoin acknowledges the difficult that is compliance, and they plan to offer products to telecoms to use as a means to manage anti-money laundering as well as fraud. These compliance tools will be developed in-house and Telcoin is dedicated to hiring more talent, as the case may be, to ensure that compliance in every aspect, is strictly met.

(iv) Reasons for Belief & Bullishness

Telcoin has only been up and running, publicly, for a few months, having ended their ICO in December of 2017. And while they don’t feed on hype, they have done a tremendous amount of work behind the scenes. From their latest Newsletter dated 24.7.2018 [link below], a few points of great interest are as follows:

(a) Plans to initiate application for any required authorization to operate in Tunisia, Algeria, Uganda, Kenya, Tanzania, Philippines, Indonesia Australia, Canada, Singapore — Q3 of 2018;

(b) Support of transfers between Telcoin and Mobile Money, including proof of concept demonstration for at least 3 countries— Q3 of 2018;

(c) Telcoin is available on a third and forth large cryptocurrency exchange — Q3 & Q4 of 2018;

(d) Telcoin is integrated in the mobile app of a partner operator, allowing their users to buy and sell Telcoin in addition to being able to perform cross-border remittances — Q1 of 2019;

(e) Telcoin Foundation project initiation with major aid/non-profit organization partner — Q2 of 2019

Further, the team has just concluded its visit to Canada with meetings with FINTRAC (regulator for Money Service Businesses) and the OSC (Ontario Securities Commission)on 4.8.2018 and 5.8.2018, respectively in their pursuit for greater and better regulation compliance.

(v) Recap & Conclusion

To recap, Telcoin’s pros and cons are as follows:

Pros:

- Financial Inclusion for the unbanked via mobile devices;

- Significantly lower remittance fees (in an ideal world it would be zero); and

- Solid team and great work in only 8–9 months, with philanthropy in sight

Cons:

- In a compliance-ridden, regulation-scrutinized industry where small players get eaten alive; and

- With product-testing still a few months away, people will be banking on Telcoin on faith, rather than a working product

(vi) Conclusion

Telcoin undoubtedly has a huge challenged upon them, but no great victory is without an equally great challenge. With the team behind the project, there is very little doubt that this will be one impressively successful project. Hopes are in allowing more people, of every tier in society, to be financially included, a Telcoin just might be the answer everyone has been looking for.

Original Article Written on: https://medium.com/@normanprima/three-cryptocurrencies-outside-the-top-10-worth-considering-part-1-telcoin-5da368123046

Congratulations @mikeshashimi! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!