Asia's demand for physical gold and how cryptocurrency can be one of its solution

Source: [Digital Gold}(https://steemit.com/@digitalgoldcoin)

The latest report from LBMA shows that Asia has become one of the biggest markets for physical gold. Not only in China and the Indian sub-continent, the demand for gold has also steadily increased in the far East Asian countries. This trend makes Asia not only the biggest consumer but also the fastest growing region in terms of gold demand. Most of the trend has been attributed to the fast economic development and wealth increase in many Asian countries. Not only did it change the market demographics, but also affects the huge demand for physical gold over the decade.

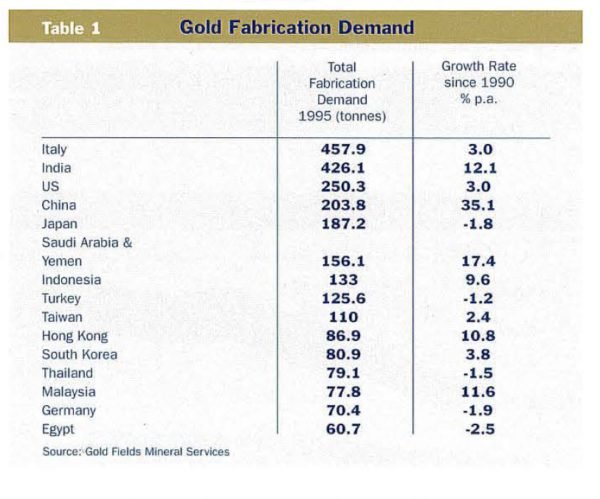

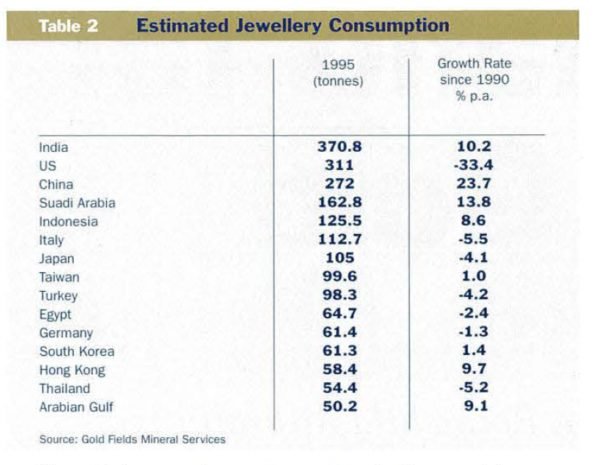

Based on Table I below, it is clear why Asia is an important region for the gold market. The data suggest that Asia contributes to more than 50% of gold demand, showing at least 8 countries as the biggest consumer of gold since the '95s.

Source: LBMA Report

If we look at this data in another way, we can conclude that gold demand has increased by 66% (from 1,955 to 3,257 tonnes) from 1986. At the same time, Asian demand for gold also increased at least by twice, changing from 667 to 1,491 tonnes.

LBMA further stated that Asia has also become a focus for the base metal market due to its high growth rates over the past decade when it is compared to the developed countries. While the focus itself has increased, it doesn't mean that Asia is now the biggest market for base metal demand. According to LBMA, in the base metal commodity market, Asia only represents around 30% of the global base metal demand. If we add Japan to this calculation, then the demand increases significantly to more than 46%, increasing by more than 10% compared to 1986.

It might be surprising for some people, but this is understandable when we look at why Asia is so interested in gold. According to analysts, Asia's gold interest is mainly driven by traditions (where gold has been historically proven in times of emergency such as drastic inflation) and the lack of alternative investments. In conclusion, Asia strongly believes that gold is valuable and will likely continue to increase its demand, but at the same time, if a better alternative arrives, there is a chance that they'll consider choosing it, hence the question of sustainability arrives.

Source: LBMA Report

The huge demand for gold is a great opportunity for sellers and investors to offer gold-related products to the Asia region. At the same time, retail investors need a great alternative to reduce the risk of sustainability by relying too much on physical gold. Because the demand for gold likely won't change that much, investors can change the way they offer or buy gold from the market, such as by buying gold-backed tokens offered by third-party services like Digital Gold.

Since 2017, the demand for crypto is also increasing in the Asia region. Customers no longer need to fear scams as long as they select a reliable partner to invest in crypto. Digital Gold can help in this case, by offering gold-backed tokens where they can own gold without spending more fees. This will reduce the reliability of physical gold (by moving it to digital gold), while at the same time opening up opportunities to trade gold for other investment assets as quickly as possible.

This article is written by joniboini.

Yay!👍 We collecting more Crypto. Reshared your post🔁