Prediction markets are hot AF right now.

With prediction markets like Augur, Cindicator, KryptoLoop and a few others coming online, it’s easy to see how useful the ‘wisdom of the crowd’ method is becoming to forecasting the future events.

#LeverageTheFuture

Prediction markets are an advantageous tool for helping those that seek insights to help leverage the future. Governments use them to figure out the probability of certain events. Casinos use them to make money (go figure) and traditional financial markets use them to drive investor returns. In all cases, they offer the event creators and the participating forecasters insights that they wouldn’t get anywhere else.

Just in case, you aren’t sure what a prediction market is, the simples explanation is the best. They are information gathering platforms. Participants submit their prediction on any sort of event and (in some cases) put their money where their mouth is by backing up their claim with their hard earned cash.

What’s more interesting to see come to fruition is the intersection of blockchain and prediction markets. The platforms arising today and leveraging the blockchain and crypto foundation in order to provide transparency, security and cheaper access for the general public.

Smart analysts leverage prediction market data.

Prediction platforms are treasure troves of data and when accurately assessed, provide the reviewer with sentiment details, probability of the forecasted event and act as curation tool for identifying possible super forecasters or investment opportunities.

Prediction markets come in two distinct flavors.*

Market-specific prediction platforms are market specific. (I hated writing this sentence because of it’s redundant nature and yet I had little alternatives to it).

Anyway, as an example, the Chicago Mercantile Exchange runs a Futures desk for commodities, bonds and other financial instruments. Traders bet on future price movements by taking out contracts for a specified date in the future and should they exceed the strike price, they take the difference.

Incidentally, if you are a weather junky, commodity futures traders have a superb record of predicting accurate weather forecasts because they have to understand meteorology in order to know when or if commodity prices will be impacted by weather.

Other niche prediction markets include the Hollywood Stock Exchange to forecast which movies will have a big box office debut, while ventures like KryptoLoop leverage the ‘wisdom of the crowd’ to forecast crypto prices and give traders valuable market sentiment analysis to help them improve their ROI.

The general prediction markets are the Augurs, the Cindicators and the Gnosis platforms that allow anyone to create an ‘event’ and solicit forecasts for that event from either a specific group of forecasters or leverage the crowd to derive at an answer.

Let’s review the two flavors of prediction markets in more depth using Augur and KryptoLoop as our case studies.

Crowd Driven Crypto Price Prediction Engine

KryptoLoop uses the wisdom of the crowds' method to help traders asses market sentiment. They do this by collecting traders forecasted prices and aggregating them to find the average and the standard deviation (i.e. the range from the mean).

A specific example would be around forecasting bitcoins price over a weekly, monthly and yearly range.

They have asked thousands of traders/analysts and investors what they think BTC will be trading at the end of July and end of the year and came up with a pretty easy way to see where traders heads are at. Here’s a sample of the results below.

Traders and investors alike digest all sorts of information every day about the market. When they come to KryptoLoop all that knowledge get’s distilled into a single price prediction. Because they ask thousands of people to price predict over a weekly, monthly and yearly time frame, the insights users derive are of market sentiment, i.e. they help traders keep their finger on the pulse

Analysts on the platform are incentivized by receiving points that they get when they forecast early and accurately. This method assures that their is skin in the game and KryptoLoop will be converting the users points into Tokens during their ICO in the winter of 2018. Tradable tokens will be used to acquire premium services, i.e. access to super forecasters and their premium content for trade recommendation and market analysis.

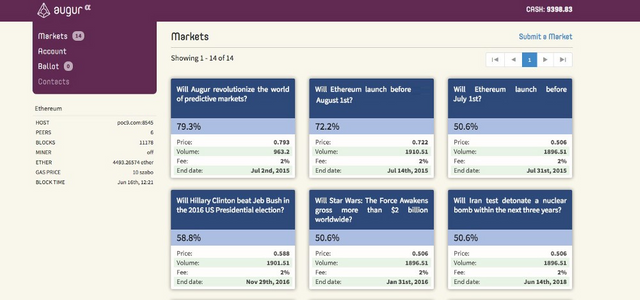

Augur and the General Prediction Markets

General Prediction Markets

Augur, on the other hand is a general prediction market that allows anyone in their network to create an event and request forecasters to submit their answer. These events can range from political appointments to inner company product development and have been shown to benefit policymakers from private and public sectors.

All trading of prediction events is done in Ether. REP (their token) must be held only by those who create the event and act as reporters for that event. Users can earn fees from engaging in these activities.

All in all, the prediction platforms coming on the market help everyone. Traders and investors benefit by increasing their token portfolio value and their ROI, while decision and policymakers benefit by improving their services and products.

Leverage the future and be kind to each other.

I love you,

— Iggs

Find me on Twitter under @iggsloop

Hey interesting article! I put my predictions in kryptoloop also, nice platform :) simple and elegant

Congratulations @kryptoloop! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Congratulations @kryptoloop! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!