Crypto crackdown? That's a lot of hype, too

Wild price swings are par for the course in the hypervolatile cryptocurrency markets, but what happened on Jan. 16 and 17 wasn't a mere swing, dip or correction. It was a bloodbath.

A perfect storm of market conditions — a massive bull run that saw the cryptocurrency market skyrocket from $147 billion in early October to more than $827 billion three months later, followed by red-flag headlines that warned of regulatory crackdowns to come in countries around the globe — caused a crash.

In hindsight, a crash was inevitable. What surprised many was its severity.

Within hours, bitcoin, Ethereum and other top coins had shed more than 25% of their value. When Asia woke up — late afternoon on the East Coast — the panic selling grew worse, and bitcoin fell below $10,000, barely half of its December high. By Wednesday morning, investors on Reddit and other social media sites were wondering, with a combination of awe and terror, whether the crash was finally over — or whether a prolonged bear market was just beginning.

The mid-January crash, from which digital assets have yet to fully recover, was another sign of just how susceptible the global, round-the-clock cryptocurrency markets are to negative press — especially when that press involves the threat of regulatory action.

Finance experts from Jamie Dimon to the Nobel Prize-winning economist Joseph Stiglitz have predicted in recent weeks that the government would come down hard on cryptocurrencies—and now regulators from the United States to South Korea appear to be getting ready to do just that.

In early January, Securities and Exchange Commission Chairman Jay Clayton joined with lawmakers to issue a statement endorsing a warning from state regulators about the risks of cryptocurrency. Last Friday, Treasury Secretary Steven Mnuchin told an audience at the Economic Club in Washington that the Financial Stability Oversight Council, which is responsible for monitoring risk in the financial system, had formed a working group focused on the evolving asset class.

"We want to make sure that bad people cannot use [cryptocurrencies] to do bad things," he said.

In Asia, the world's hottest market for digital coins, China appears to want to eliminate the digital currency trade altogether, including pushing bitcoin miners out of the country, while South Korea is openly mulling its own ban.

But all the saber-rattling only begs the questions: How much can regulators do to rein in the excesses of this new asset class? What can't they do? And how will banks respond?

Experts say it's unlikely that authorities in the West will try to ban bitcoin — if such a ban were even possible to enforce.

"Everybody thought that the regulators were going to smother bitcoin in 2013, and that didn't happen. And it probably won't happen, because regulators are not some monolithic entity," said Marco Santori, a partner and head of the blockchain practice at the New York law firm Cooley.

"They're people who got into this job because they want to do the right thing," he added. "No one wakes up one morning and decides, 'I want to smother an industry, and so I'm going to be a regulator.'"

A 'regulatory platypus'

Nor, it seems clear, does anyone wake up and wish for the regulatory headaches of digital currency. Bitcoin, explains Santori, is a "regulatory platypus," not fitting neatly into any of the familiar asset categories.

The Commodity Futures Trading Commission ruled in 2015 that bitcoin is a commodity, thereby arrogating to itself the power to oversee bitcoin derivatives such as the futures contracts that began listing in December on two exchanges, CBOE Global Markets and CME Group. But the Internal Revenue Service taxes bitcoin as property and most state regulators require bitcoin businesses to be licensed as money transmitters, just as if they were handling cash. Yet it's also true that bitcoin is open-source software, which is to say code, information — a product of the internet, not the financial world.

Things get even more complicated when considering the larger world of blockchain tokens, which fall into two basic camps: utility tokens and security tokens. The former are meant to serve some useful function on a software platform or network, while the latter are primarily investment vehicles.

One obvious security token is BCAP, issued last year by venture capital firm Blockchain Capital to raise money for its new fund. Each token represents a fractional ownership in the San Francisco-based firm's fund. In order not to run into trouble with the SEC, Blockchain Capital limited U.S. participation in its ICO only to accredited investors — those making an annual income of at least $200,000 or who have a net worth exceeding $1 million.

"No one wakes up one morning and decides, 'I want to smother an industry, and so I'm going to be a regulator,'" said Marco Santori, partner and head of the blockchain practice at New York law firm Cooley.

But the picture isn't always so black and white. "Not everything that is speculative is a security, and not everything that people invest in — even if it's not speculative — is a security," Santori said. "The [SEC] chairman has already gone on record to say that there are token sales that do not create investment contracts. There will be a world of security tokens and non-security tokens."

In the U.S., the test for determining whether something is an investment contract is called the Howey Test. It boils down to the idea that a transaction constitutes the purchase of a security if it is an investment of money in a "common enterprise" from which the investor expects profits, and those profits will derive from the efforts of others. Bitcoin, Ethereum and at least a handful of other digital currencies don't meet the requirements.

"When a network is sufficiently decentralized, and truly blockchain-powered, it's hard to establish the common enterprise prong" of the Howey Test, said Peter Van Valkenburgh, the research director at Coin Center, a Washington nonprofit that specializes in the public policy issues facing bitcoin, Ethereum and related technologies. "It would be absurd to call the gold industry, writ large, a common enterprise, and therefore claim that gold is a security."

The same is true for bitcoin. But the younger and more niche and more centralized a coin is, the harder it is to argue that it isn't a security.

In December, the SEC stopped an ICO and forced the company behind it, Munchee, to refund investors. Munchee had planned to use the proceeds to build a blockchain-powered food review service, and had led investors to expect a future increase in the value of their tokens.

"Sometimes I liken it to religion," Van Valkenburgh said of the lines being drawn between various projects. "Judaism is totally real, Christianity real, Islam real. Mormonism is getting real, but it's a little weird—it was created in America. And Scientology? Hmm. Hmm. Not to disparage anyone who might be a Scientologist, but you know, the [founder] wrote science fiction and then he wrote a religious text."

The question, said Van Valkenburgh, is "Does this [religious text] have sufficient weight to make it something different?"

Regulators are 'not the CIA'

The simple fact is that while multiple agencies each have a claim on cryptocurrency, none will be able to get their arms entirely around the burgeoning industry. Even the SEC "can't go outside of their statutes," said David Drake, founder and chairman of LDJ Capital. "They're not the police department, they're not the FBI, they're not the CIA."

But how did it come to seem that drastic action by regulators was necessary or inevitable?

One answer is the "irrational exuberance" the head of South Korea's central bank last month noted among digital currency speculators. Blockchain mania has grown to such a fever pitch in recent weeks that companies with no ties to the technology have been able to inflate their stock price simply by adding "blockchain" to their names, just as companies benefited from adding ".com" to their names in the late 1990s.

Whereas most investors in the 2014 crowdsale that bootstrapped Ethereum were people who understood and appreciated the technology, that is no longer the case with investors in new token projects. Many founders are taking advantage.

"Wild promises are being made and a lot of nontechnical people are buying the token simply because they believe it's going to go up in value," Van Valkenburgh said.

That leaves people open to scams. One company, BitConnect, a digital-currency exchange and lending platform, halted operations this week and saw the value of its token plummet to a mere 5% of the value it had held on Monday, as users complained on social media of being ripped off.

"We want to make sure that bad people cannot use [cryptocurrencies] to do bad things," said Treasury Secretary Steven Mnuchin.

Bloomberg News

Industry observers echoed their concerns. "BitConnect was a known Ponzi scheme, pumped over the past year on the basis of a 'greater fool' willing to buy the token at a premium," Lucas Nuzzi, an analyst at Digital Asset Research, told Bloomberg.

BitConnect's website was working again on Thursday, and the price of Bitconnect's coin had recovered dramatically since the drop. It was up 96.3% by late Thursday afternoon. Criticism of the company has continued unabated, however.

The SEC has already shut down one digital currency investment scam, charging the company, PlexCorps, and its founder with soliciting millions of dollars from investors on false promises of a quick 1,354% profit. It likely won't be the last such company targeted for enforcement action, says Van Valkenburgh.

"Now, will they be able to stop every possible token sale that is a security? No. They just don't have the resources," he added.

That means a tidal wave of enforcement isn't coming. But the actions already taken, plus perhaps a few more to come, will likely "chill these markets appropriately, and it will change the way the [tech industry] thinks about these things," Van Valkenburgh said.

Even so, the idea that Washington will eventually stamp out cryptocurrencies once and for all, said Santori, "is patently and demonstrably false. The technology will not be regulated; applications of the technology will be regulated."

Because of the fine distinctions involved, Santori added, "regulators are not the ultimate arbiters. The courts and the banks are. The banks will eventually fall in line with the courts. But in the meantime, some banks will be less risk-averse and some will be more risk-averse."

Crypto on credit

Indeed, some banks aren't waiting to see what Washington regulators or the courts decide. Capital One has stopped allowing its customers to use credit cards to buy digital currency through Coinbase and other companies.

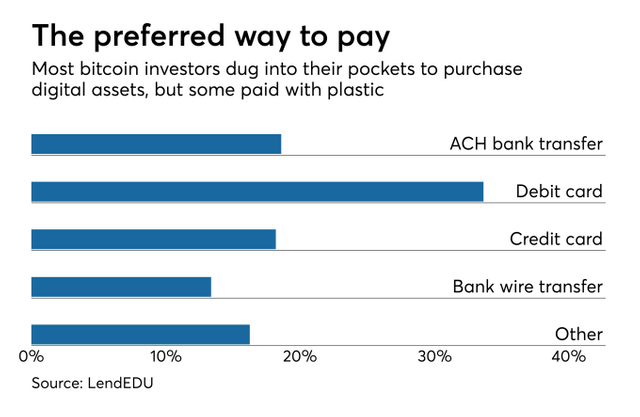

As the price of bitcoin increased 1,000% last year, buying bitcoin on credit became a popular but incredibly risky means of acquiring digital currency. Card purchases are quicker than a wire payment or ACH transfer, which during a bull run might mean the difference between making a killing or missing out. According to a recent LendEDU survey, a little more than 18% of bitcoin investors purchased digital currency with a credit card, and about 22% of those investors didn't immediately pay off their card balances.

Nearly 90% of those who bought bitcoin on credit planned to clear their balances — accumulated by purchasing bitcoin — by using the expected profits from the sale of their digital currency. One can only imagine what a downturn like mid-January's might have done to that plan — and how long it would take customers to initiate chargebacks or file complaints with the Consumer Financial Protection Bureau.

Reached for comment, a Capital One spokeswoman said in an email that the bank had "started declining credit card transactions to purchase cryptocurrency due to the limited mainstream acceptance and the elevated risks of fraud, loss, and volatility inherent in the cryptocurrency market."

"Capital One continues to closely monitor developments in cryptocurrency markets and exchanges and will regularly evaluate the decision as cryptocurrency markets evolve," she added.

Such actions mirror Visa's recent shutdown of cryptocurrency debit cards in Europe — until recently an increasingly popular means of spending digital wealth at ordinary merchants. But refusing to serve a customer base as young, tech-savvy and vocal as cryptocurrency users may be asking for trouble.

In South Korea, where major banks recently declared they would no longer serve bitcoin exchanges after authorities began investigating them for possible money laundering, a petition has been started on the official website of the nation's presidential office arguing against stringent regulation. The petition has since collected more than 200,000 signatures.

Drake, who still believes the cryptocurrency market will reach a total value of $1 trillion by this summer, said he hopes authorities in the U.S. and elsewhere "will learn from the finance minister of Korea not to make rash comments that will make markets crash."

Regulators the world over are in an unenviable position, Santori added. "They have it really tough. If they stand idly by, people get hurt. If they act too quickly, then they can impede the development of a potentially new and innovative industry," he said. "They have to be surgical."

An example of the opposite approach is the broadly written BitLicense regime, which affects digital-currency startups in New York state. Widely loathed in the industry, the regulation forced a number of companies to stop serving customers in New York.

What if there were to be an international BitLicense? Germany and France are advocating for joint regulation of digital currencies by all of the Group of 20 nations, and Bruno Le Maire, France's finance minister, is on record as saying he doesn't like bitcoin. While competing policy goals make such a measure unlikely, it isn't out of the question.

Done right, Drake thinks regulation could make investors feel more comfortable putting their hard-earned money to work in the cryto-asset market. Already the floodgates are opening. Coinbase and other cryptocurrency exchanges have added millions of users in the past few months. But rapid growth comes with a downside: The influx of new entrants was primarily responsible for the epic scale of the crash this week, Santori said.

"They're what my trader clients call 'weak hands.' They haven't been through the wringer of 100 different reported crypto bans before now, like [old-timers] have."

Bears return to hibernation — for now

By Thursday morning the cryptocurrency market was recovering strongly. But among investors fears of a bear market lingered.

"I'd be careful about buying a lot right now," wrote one member of a Reddit board devoted to Ethereum traders. "Crypto can do anything but I'd bet we will see more a general bearish trend at least for the next week or so. I'm bullish on the three-month window but bearish on the three-week [window]."

Others expressed concern that the closure of BitConnect could give rise to yet more lawsuits and legal restrictions. In the meantime, banks will have to decide whether it's in their best interest to serve this market.

But while regulators may have their work cut out for them when it comes to fighting rampant speculation and preventing digital currency from being used for money laundering and drug trafficking, existing laws should be adequate to the task, says Van Valkenburgh.

"I don't think they actually need to do any kind of land grab to do that kind of work," he said. "They've already got [the power] if they want it."

What a read. I found the timing of the crypto crack down "weird" as it happened at or near expiration day of bitcoin futures where the day price change limits are no longer enforced allowing for profits on price moves of over 20%