Investors rush for cryptocurrency — average profitability ICO is 1320% Translation Google

The news of the day

Report from VC Mangrove Capital suggests that the average yield of 204 ICO is 1320%.

Such data arise amid growing interest from hedge funds and investment banks to the cryptocurrency space with more than 55 hedge funds specializing in them.

According to the latest report, blind investment in each ICO, including those that failed, led to an average yield of 1320% for investors.

The venture capital company Mangrove Capital Partners says:

"If everyone blindly invested 10 million euros in ICO each, including a significant number of failed, this would lead to profitability at 13.2 times".

Michael Jackson, former chief administrator of Skype and partner at Mangrove, wrote the report and analyzed the data 204 ICO "known results" — those that have tokens now actively traded on the exchanges as well as those that failed.

The findings of Jackson shows why many institutional investors — from hedge funds to investment banks is now seeking in the cryptocurrency space.

About ICO

ICO is a new way of funding startups through the issuance of digital tokens that can be sold online. Tokens ideological and structured in the same way as the earlier cryptocurrencies — bitcoin and Ethereum, a network which is actually used to run most ICO. These new digital currencies are sold for real money, used to Fund the development of start-UPS.

Tokens or coins are usually associated with startups. That's how Mangrove describes the process:

"Service stream music can sell subscription tokens before the launch [of the platform] and accumulate customer base, motivated to promote the service, as soon as the product begins to operate, partly because the cost of tokens will grow."

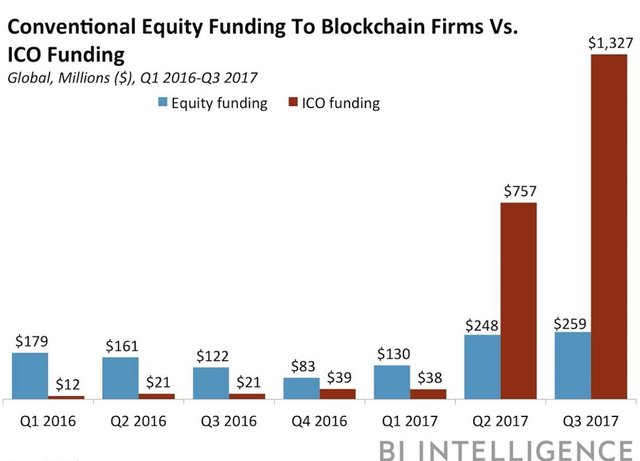

In 2017, the ICO's popularity grew, and they attracted more than $2 billion, the Company applied to the blockchain and ICO, significantly outperformed venture capital firms received the largest funding source

However, regulators around the world have warned that investment in ICO are risky and unfounded. Although some coins are exploding in price, the market is characterized by huge volatility. UBS recently stated that the space is in the "speculative boom."

Despite these uncertainties, many investment banks and hedge funds begin to show interest in investing in ICO and cryptocurrencies.

"Hedge funds and mutual funds are considering the possibility of cryptocurrency"

Etienne Brunet, a London venture capitalist, who has studied the market for the ICO, told Business Insider:

"Over the past year or so in the cryptocurrency space have been crazy profitability".

"Institutional investors took a long time to go from "what is" to the word "think we should invest," he said. "First of all, venture capitalists were interested in investing in the ICO. Now institutional investors, ranging from hedge funds and mutual funds, quickly assess their 'cryptocurrency' opportunities."

Hedge funds and other active investors are floundering in post-financial crisis amid growing ETF (ETFs) and other passive investment schemes. Hedge funds generally lagged behind the simple index funds in the decade after the crisis.

The attractiveness of cryptocurrency assets for active investors is that they do "pledge alpha" — returns above the market average. Brunet, Executive Director of the investment Fund Illuminate Financial, said:

"We have hedge funds that have a mandate that is more free than others, and they begin to buy coins. And it is, after all, is what they are looking for."

Analytical FINTECH firm NEXT said in August that it is known at least 55 cryptocurrency hedge funds. Recently Mike Novogratz, a former Manager of the Fortress, announced plans to create a cryptocurrency hedge Fund to $500 million, and on Wednesday Blockchain Capital of San Francisco has announced plans to raise $150 million, part of which will be invested in the cryptocurrency.

About Goldman Sachs

Recently, there have been reports that Goldman Sachs is considering creating a unit for trade in bitcoin. This follows from the August notes for clients:

"Institutional investors are becoming increasingly harder to ignore digital currencies".

Brunet says that Goldman Sachs announced interest in bitcoin as "an important milestone".

"If you are a big Fund, you can't just to be accepted by the exchange, because the required number [of cryptocurrency] is too high, and the liquidity of the exchanges is not as high as traditional stock exchanges such as Nasdaq," said he. "Institutional investors need OTC broker to buy and sell the required amount of cryptocurrency".

Goldman Sachs could fill this role. However, there are other problems on regulation and market infrastructure such as storage and settlement, says Brunet. Regulatory status of many of the crypto token is also unclear.

However, Jackson wrote in his report: "After ICO will be regulated, they will be able to radically change the way companies attract growth capital and have a profound effect on venture capital and investment banking community."

The Brunet said, "Now people see bitcoin and Ethereum as a new asset class. However, for other coins it is still quite speculative".