Why your token is likely a bad investment & why Bitcoin scalability is secondary

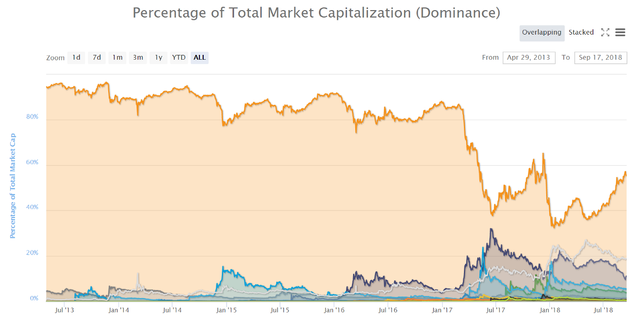

Bitcoin dominance in orange

Setting aside the volatility of cryptos, one of the key paradoxes that is hardly ever addressed when people throw money at various crypto projects is this:

When I invest in a token, I am hoping someone in the future will want to buy it at a higher price to use the platform. However, why would anyone buy my tokens to use the platform if the price of the token keeps increasing as I expect it to?

This seemingly simple question lies at the heart of crypto valuations and is inseparable from the the decentralized future as envisioned by many crypto enthusiasts. Without an understanding of this, any money going into crypto is essentially blind money, regardless of how well the project team executes their stated goals.

At the core of this confusion is the lack of distinction between the core use case of a platform's token as well as a general surface understanding of what purpose money actually serves. As mentioned here, due to the complexity surrounding cryptos, people tend to group all cryptos into a single basket regardless of the differences in implementation. Coupled with the abstract nature of value, many people just settle for simplified and seemingly logically consistent analysis models without further thought about its actual applicability in specific use cases. The key among this is the belief that "higher network usage implies higher network value" which says nothing of who actually captures the value generated by the network.

There have been many amazing articles (links at the end) which have gone into detail about this (a.k.a. 'Token Velocity Problem') and this is not one of them. Instead, my goal is to avoid as much of the technical jargon and ultimately answer the questions raised in the title by shedding some light on the following observations:

- The likelihood of a user using, trading, or holding a token is dependent on the extent to which the token acts as a store of value, medium of exchange, or utility. (i.e, is it more like gold, cash, or coupons?).

- The total value of a network is more a function of how much users are willing to pay per token rather than the total amount of activity on the network. A network will be unable to scale if cost of using the network rises linearly with token price.

- The benefits generated by the blockchain will accrue to the users in the form of cost savings, meaning that such value is not captured by the network itself but is rather a lower out-of-pocket cost for users.

- Given the public nature of blockchain protocols, each chain will not only have to compete with competitors but also face forking risks. Given similar functionalities, users will likely utilize the one with lower costs leaving little margin for profits above the required cost to run the service.

- Store of value functionality will tend to be naturally monopolistic as the larger the proportion of value captured in a single asset, the smaller the potential impact that remaining assets will have. Transaction costs and throughput for such an asset, as long as reasonable, is secondary.

What do you use money for?

Money is the solution to all of life's problems until you have too much of it. It empowers us to live the life that we want as we can buy the rest of life's necessities with enough money. As such, we strive to stash as much of it so that we will be able to face whatever the future throws at us. We store it in banks to keep it safe and only take out as much as we need. The amount of cash withdrawn is a fine balance between making our daily transactions more convenient and the fear of losing it (or for some, the fear of spending it).

How money keeps us out of trouble

How money keeps us out of troubleHence, depending on what we want to do with it, money has different uses:

- As a store of value, we want the confidence and security that our dollar today is worth a dollar tomorrow.

- As a medium of exchange, we want it to be convenient for us to use on a daily basis.

- As a utility (think redeemable coupons), we do not even want to know that there was money involved, we only need the product/service promised.

It is important to note that the above characteristics are driven by our needs and therefore applies to any form of money regardless of the technology behind it. As long as there is a need to quantify the world around us, new innovations around money (which we use as a value estimate) will push towards making life better for its users. Cryptocurrencies carries on this tradition by enabling money to be programmed as well as flattening the hierarchical structure around current value streams.

The confusion arises because there has never been a point in human history where people were exposed to so many forms of money (monetary bases) in such a short period. Moreover, prior to this, many people in the modern world were never forced to contemplate the utility of a stable currency nor even hold a different currency. Needless to say, hardly anyone was prepared with the necessary knowledge to truly assess the complexity of each of these new cryptocurrencies which presented itself as freestanding monetary bases. What then transpired was a fierce unregulated competition among cryptocurrencies to capture a larger proportion of global value streams ('money') based upon who had the best promises or rumors.

In it for the tech

Without really understanding what a network's token is used for, people's faith in blockchain technology became deeply intertwined with simpler metrics such as market cap, transaction volume, and token price. As a result, when trying to determine the 'real' value of the token, the argument usually went something like this:

The market cap of this token now is only $10 million while the value of the industry that it is targeting is worth $10 billion so I can expect the price per token to increase ~1,000x due to limited supply. The network also has double the number of transactions compared to the next best competitor so it should be worth minimally twice the competitor's value if not more due to network effects.

Underlying this argument is the assumption that the token in question will, at a minimum, maintain its value during the holding period so that it can be sold in the future. Although all currencies do display this store of value quality to a certain extent, for the large majority of cryptos, their core use case is not as a store of value but rather as a token that grants them the ability to use the platform in question. This is a key distinction that has to be made when buying a token as it essentially determines whether you are holding a token based upon an 'intrinsic' property of the token or holding based on the belief that someone be willing to pay more for the right to use the platform.

Destroyer of market value, deliverer of real value

Regardless of transaction costs, if your token just enables usage of the network and you believe it is worth the same as current enterprises, there is no benefit to the consumers as they will still have to pay the same prices for what is essentially the same service. Even if the costs saved or new money coming through blockchain technologies is so significant such that you could still gain a profit while the users save on their costs, you are essentially replacing the middlemen in what is supposed to be a decentralized solution.

Given that blockchains are supposed to 'get rid of the middlemen', the only time that holding such tokens should generate any profit is when doing so helps to secure or stabilize the network. This is what many tokens try to achieve using different variations of the staking protocol where a user with a large enough stash will be able to stake his tokens on the network in order to get an interest. Getting this right is a fine balance as it essentially plays with the supply and demand for a token.

It must be noted that Proof of Stake greatly reduces the computational resource required to secure the platform and therefore significantly reduces the proportion of network value going to miners or token holders. Moreover, having more people hold the token reduces the circulating supply but does not necessarily reduce the transaction volume of a platform. In fact, this lack of liquidity could actually end up hindering network growth.

Taking a step back to look at the bigger picture, the public nature of blockchain protocols will also ensure that users, instead of investors, of the token will be the one to derive the most surplus from this technology. As the chain could easily be split, carrying along all the original chain's data with it, users will eventually migrate to the chain with the lowest cost, given similar functionalities.

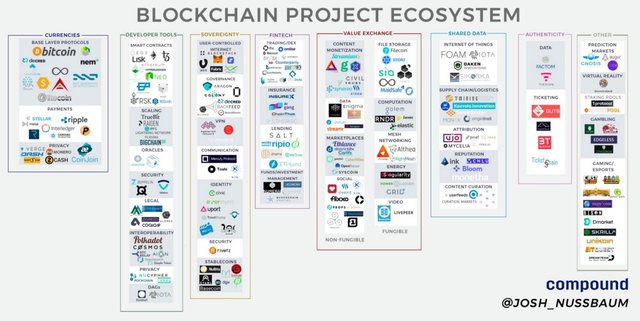

Number of different chains

Additionally, the above does not take into account that public protocols facilitates competition through open and inexpensive experimentation. The result of this is that there will likely be increasingly specialized protocols, each lowering the cost for users through eliminating any unnecessary costs from the platform. As such, the interest to be gained from securing a network will likely converge to a fraction above the actual costs with little room for additional profits. Making things worse for investors is that failure rates in this space will be extremely high with majority of the 'winning' protocols having yet to be created. Good for the users, not so much for investors.

What will people use the token for?

Given that the technology itself is set to transfer much of the surplus to the users, the question that then needs to be asked is how would the users actually use the token. The different ways society uses money now will provide a glimpse into how individuals will approach the tokens of the future. As was hinted above, people generally require money to exhibit different characteristics based upon the situation.

We store money in the bank for security even though we end up paying a lot through lost interest (look at the difference in interest paid when we borrow from the bank compared to when we lend them our money). We buy property with money in the hopes of having a nest egg even though we end up paying extra through mortgage payments and lost liquidity. We exchange money for gold when we lose faith in the government even though gold has very limited uses.

Difficulties of having too much money

We carry cash in our wallet so that we can trade whenever we want even though we risk losing the cash. We use different cards in different situations to accumulate benefits or save costs even though it is inconvenient to do so. We transfer money into various company/mobile wallets so that we can more easily access their services even though we lose out on any interest payments. We buy redeemable coupons or kickstarter products so that we can save through bulk buying or early access even though it means our money gets locked up until we get the service/product.

One of the main outcomes of the above is that the use case will determine how long we want to hold value in that particular form. We place money in the bank because we don't intend to use it anytime soon. We buy financial assets if we have enough capital so that the value stored can weather future inflation. We trade for gold as a hedge against future calamities. On the other hand, we would only carry enough cash as necessary for the next few days or transfer just as much as needed to other accounts/coupons so that we don't lock up our money and lose out on interest payments. As such, our store of value needs will be closely intertwined with the holding period.

Consequently, people will tend to hoard store of value forms while minimizing the time as well as amount for medium of exchange or utility forms. This effectively means that the less the medium acts as a store of value, the more likely we are to trade it only when we require access to the platform. As such, the costs of using the platform becomes the determining demand factor for such tokens. If the token price and transaction costs are not decoupled, the network will not be able to scale. Even if completely decoupled, the token's value will only grow linearly with the demand for the underlying utility and as covered in the section above, market dynamics are constantly pushing the costs of such utility downwards.

It can be argued that there might be a single cryptocurrency that successfully competes as both a store of value and medium of exchange due to the specific advantages the technology has over monetary store of value as well as specific payment forms. Nonetheless, given the competitive nature of crypto's protocols, it is more likely that society will choose to store value in a particular asset while continuing to take advantage of increasingly specialized protocols suited to particular use cases. This is even more so considering the progress that we have seen around cross-chain swaps or inter-chain operability. With reduced friction converting between tokens, users would have less reason to hoard non store of value tokens.

What does this all mean?

Given the amount of competition among token protocols, most tokens will likely be a bad investment due to the difficulties of identifying a 'winner' and the fact that market dynamics essentially places a hard cap on the token if it has no store of value characteristics. These same forces are also why payments functionality in a store of value asset is relatively trivial compared to the assets ability to be resilient to changes. It is interesting to note that, of the potential use cases for cryptos, store of value functionality comes with the least technological risk. Bitcoin (BTC), the most likely candidate for this pure store of value asset, has consistently prioritized resiliency and is already at a stage where it has been tested in the real world.

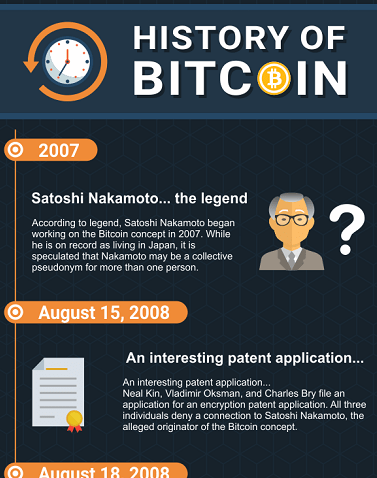

A great detailed history dive here

This is not to say that people will continue using BTC if transaction costs and confirmation times skyrocket but rather it is much harder for a token to become a store of value than it is to become a medium of exchange. BTC, in its current state, already meets the requirement of a store of value asset albeit needing some tweaks to its payments function going forward. Meanwhile, other tokens are still trying to define or meet a much more complex and specialized use case. This is why, relative to other tokens, BTC seems like a better investment, especially if holders keep all the forks of BTC as a hedge.

The profitability of a token will be heavily dependent on its token model which determines the extent to which users would want to hold it. This will also be heavily influenced by its specific use case. For example, privacy tokens might have higher transaction friction due to privacy and anonymity requirements resulting in longer holding periods. Crucially, this model will have to be set within a framework of the current network value versus the enterprise value of its centralized counterpart minus the middlemen costs. Of course this framework assumes that the utility of the token matches its counterpart's exactly and captures all the value for that utility.

Ultimately, public blockchain technology is set to transfer a significant proportion of utility to the users rather than to token holders or miners. This will come at the expense of traditional businesses hence why corporates are wary of this technology. John Pfeffer summarizes it nicely:

Cryptocurrency's performance advantage over incumbent forms of money is:

(a) strongest and most obvious as a monetary store of value; (b) stronger for some, but far from all, payments; and (c) differentiated as a unit of account for a few select purposes.

As such, aside from a monetary store of value, cryptos will likely function in coordination with rather than replace many of the centralized solutions found today. Cryptos will democratize access to different value streams as well as pave the way for new forms of value generation. This is an exciting future that we are building but it won't come about by just throwing money at promising project teams. There is definitely some profit to be made from investing in such teams early and providing them with the required capital to realize their product. However, in order for blockchain technologies to scale and achieve it's true potential, investors must realize that, unlike current business models, the benefits of the platform will also have to be distributed.

For those interested in diving deeper into the rabbit hole, I highly recommend the following (especially the first one which helped me put a lot of my thoughts into words):

Thanks for reading. I would love to know your thoughts so please feel free to drop a comment. :)

Congratulations @kaishinaw! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPHello @kaishinaw! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko

Congratulations @kaishinaw! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!