You are viewing a single comment's thread from:

RE: Congratulations! You are about to survive the longest bear market in Bitcoin's history!

Yes I believe for this metric, they take the high and then the low to define how long it lasted. There was roughly 9 months of sideways trading after the bear market hit the lows though.

@jrcornel, most of the people who write articles for the mass media are not traders/ financial analyst. So, they don't understand very well what a Bear market means. I have worked in this area (financial sector) for the last 13 years (mainly as a financial analyst). So, I have work with the mass media as well. So, I am a bit familiar about it and how it works ...

Posted using Partiko Android

Good to know. Lets see if your projections line up with mine...

Based on what happened in 2014-2015, we could expect to see bitcoin start going up again around August of 2019, if the time frames work out to be roughly the same.

What do you see?

@jrcornel, thank you for asking me about my point of view... You know... I can talk for hours.

Let me try to explain you briefly my point of view on the current situation. The price decrease in 2013/2014 and the subsequent bear market was due to the Mt.Gox case, etc. It was not a problem of the Bitcoin itself. It was due to lack of infrastructure to buy and sell/ and to keep your crypto. I think you understand what I mean. Now, we have thousands of crypto exchanges, different kind of wallets, hardware wallets, etc. So, the infrastructure for trading crypto and for storing crypto is well developed. But, the problem now is the Bitcoin itself. Namely, the scalability issue. The next bull run will start when it is clear that the scalability issue of Bitcoin is going to be solved. At the moment it is not clear, when the scalability issue will be solved. It could be that the Lightning Network would be able to solve this technical problem of Bitcoin. But, the LN is still in its early phase of development... We will see. Still there is no solution to the scalability issue of Bitcoin on the table. So, I think this time we will have to wait much longer...much longer. We will see. Of course it would be nice if all of sudden some brilliant minds solved the scalability issue of bitcoin ...Then the price would skyrocket.

Btw, I stared making videos for DTube on a daily basis. I am doing daily Cryptocurrency Market overview. Tomorrow I will discuss this topic, thank you for giving me the idea :). Actually I have talked about it last year in the spring, in the summer, in the fall (I talked about the scalability issue), but because DTube videos are being deleted in 2 months, it would be nice if I mention it again tomorrow.

If you have questions, just ask me.

Interesting thoughts, though I don't fully agree. I think bitcoin can go up WITHOUT ever being a viable global currency. Gold is an $8 trillion dollar market. In my opinion, bitcoin does everything gold can do, only better. If bitcoin takes just 10% of gold's market, we are looking at $800 billion market, or roughly 12X where it is currently. If bitcoin takes 50% of the market, which I think is possible, that would be roughly 70X the current price. I think bitcoin can go way up just by being a better store of value.

The Bitcoin lightning network works, I have used it and anyone can. But its not widely adopted because of the bear market. The exchanges and many websites are not accepting the lightning network since it involves a significant upgrade that needs a lot of effort with little rewards. The rewards of the upgrade are small because the transaction fees have dropped significantly because of the bear market. I think the lightning network will be widely adopted when its needed and that's when the network has heavy traffic and high fees. So you can consider the scalability issue solved.

Btw, you can even run your own lightning node for like $300. Easy peasy. But you can't profit off it because there is not much traffic on Bitcoin lightning network.

@waleedtee, have you used the Wallet of Satoshi for the LN?

Posted using Partiko Android

No, but it looks like a great initiative ! I've been using "Electrum wallet" for LN

Ah ok. I will have a look at it. I used to use the Electrum wallet.

Posted using Partiko Android

Electrum is good as a main wallet on a laptop/desktop for big transactions. It is more secure because you can set up a multi-signature wallet which works like two-fator authentication (you get a code on your phone + password ). Also, on Electrum you get to choose the transaction fee/speed as you like. If I am not in a hurry, I choose the lowest transaction fee even if it will take hours to complete. This is why its good for big transactions as the fee becomes significant for big amounts.

According to our calculations, the market will move up in March / individual races of some altcoins already show themselves. Soon everything will start ......!

I could see that as well. I am cautiously optimistic that the next bullish phase starts in the Spring of this year, or roughly August.

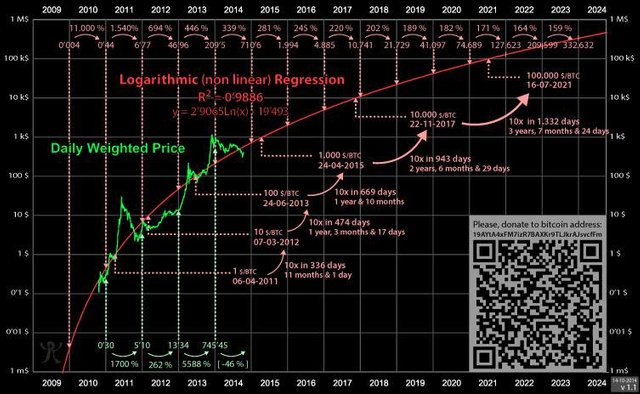

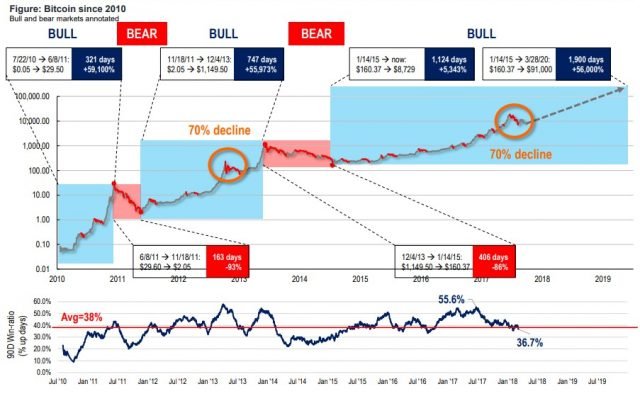

I looked at the bear market of 2014/5 and compared toady's bear phase and it looks like we have a little while longer to go. However, I have seen graphs and stats that say for each new cycle it takes proportionally longer for bitcoin to complete a cycle. So the next coming bull run may not match the past cycle but may take longer than ever before, based purely on the nature of bitcoin and not on any fundamentals or news or events. I'm no expert, these are just graphs I've seen by others.

Is that completely true? Each cycle has taken longer? Looking at the charts with a quick glance it doesn't appear that is the case... at least not going back to the very first bull/bear markets.

Hi there, @jrcornel, I respect your experience in the market and am keen to learn from your experience. I found these charts referring to bitcoin's price cycles. Can you perhaps give an opinion on them?

![Bitcoin price prediction log graph til 2024.jpg] )

)

(

![Crypto bull bear phases graph.jpg] )

)

(

They are really old charts, no?

Good point, they are quite old, though the second one shows price up to Q2 2018, and shows how each cycle in bitcoin gets longer and longer.

I guess it all depends on what you define a "cycle" as. In this case it looks as though there has only been 3 cycles in Bitcoin's history according to the charts. I see about 6 or so, but that is just me. :)

Aha, I understand, thanks for clarifying that.