Federal Reserve says Altcoins are why Bitcoin keeps going down

The FED released a report on why the price of bitcoin keeps going down, and one of their findings was quite interesting.

According to the St. Louis Federal Reserve, the proliferation of altcoins has been one of primary depressors on bitcoin's price.

Specifically, they had this to say:

“While Bitcoin's price is not likely to fall to zero, the prospect of a flood of Altcoin competing with Bitcoin in the wealth portfolios of investors is likely to place significant downward pressure on the purchasing power of all cryptocurrencies, including Bitcoin.”

Why do they think this exactly?

According to the report, there is basically a finite amount of money that is interested in investing in bitcoin and cryptocurrencies.

In their view, if these other altcoins did not exist, much of that money would likely find its way into bitcoin, giving it a higher price than it has currently.

Therefore, instead of bitcoin being worth about $120 billion currently (the total crytpo market cap), it finds itself worth about $60 billion.

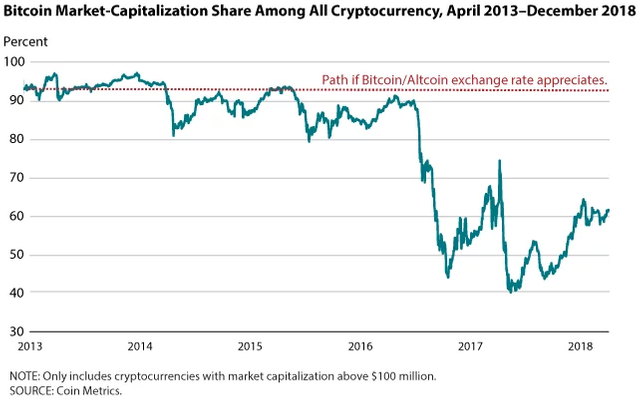

As we can see, bitcoin has been slowly losing its stranglehold over market share as altcoins have been proliferating:

According to the FED, if the creation of altcoins continues at its current rate, then the price of bitcoin will be severely limited compared to what it might be worth if they did not exist.

Which, when you think about it, makes a lot of sense.

Not quite the whole story?

Sometimes altcoins bring investors into the market.

There is an argument to be made that as these altcoins fill nitches that bring new users and investors into the market, then these new users likely also venture into bitcoin.

They may have never have ventured into bitcoin at all if that particular altcoin never got them into the market in the first place.

So, while I mostly agree with their findings overall as it relates to altcoins and bitcoin's price, I don't believe it tells the entire story.

Stay informed my friends.

Follow me: @jrcornel

Too much competition 😩😩😩

I do wish there were higher barriers to entry for these things in general.

That is really fucking stupid. Yes, if no alt-coins existed, then Bitcoin would be worth more...but unless that amount was exponential, it would still not be worth that much. And what of use? Bitcoin is getting better...but that's also thanks to alt-coins and the development spurred by them. We all remember when Bitcoin was near it's height and nearly useless. If you did not have it already in an exchange, it was difficult to get it there.

And part of why Bitcoin is worth so much is "alt-coins" bringing people into the market. And many of those alt-coins have serious worth due to their use. Many are not but "alt-coins" but valuable in their own right for alternate uses. They are more than just stores of value. We are speaking on one such alt-coin, in a way.

It sounds like the words of a fool that doesn't understand anything. "If there was no food but grain it would be the most popular food there is!"

Haha yep. Though I could make the argument that as some of these altcoins gain real utility and pull lots of money in, they may help attract more money into bitcoin than there would have been initially.

Oh yes, I think so. Bitcoin was near useless at the height of the last moon. It will be better this next moon thanks to changes adopted in it. Those changes are in large part thanks to alt-coins. Alt-coins have become the proving ground where updates are implemented and eventually adopted by the major coins.

If it had continued to moon, it would have gotten worse. Now it will reach new heights, eventually, and much of that will be thanks to alt-coins, doing development, and bringing in new money that will invest in the coin they believe in, as well as bitcoin and others.

Yep, exactly.

.

The logic here is sound though. Honestly sounds like the most reasonable explanation of the current ongoings in the crypto community.

Posted using Partiko iOS

This is an interesting observation! And I’m certainly glad other altcoins exist for more diversification. I wonder if bitcoin will still exist later on

Posted using Partiko iOS

Congratulations @jrcornel! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Makes sense really, pretty basic, the question is which ones will survive and catch people's imagination or actually be useful.

Posted using Partiko Android

Any thoughts?

Hmm, would businesses have a voluntary use of currency, or use whatever the state tells them to for "regulations"?

Depends on where you live.

While it sounds logical, it also assumes that all of these altcoins are worth much which we know that not to be true. More than half will be worthless after some time. In fact, we have already seen the move as bitcoin dominance got up to almost 60% from its 33% lows!

Posted using Partiko iOS

Yep, that is correct.

Competition is alwasy good for any market. If we are loving the decentralization of what Bitcoin was giving us, why trying to centralize the crypto market by stopping altcoins from entering? Competition is beautiful.

Not to mention downward pressure on the US Dollar, the Fed’s own little ponzi gravy train. Looks like classic ‘divide and conquer’ FUD - “oh, Bitcoin and the alts are the ones who should be blaming each other”. Isn’t a simpler explanation just that a whole bunch of people exited the market after the initial speculation bubble burst, and general confidence in cryptocurrencies hasn’t quite recovered yet? On the bright side, for the Fed to state this, it means they are doing damage control on Bitcoin, which means they consider Bitcoin a threat to them - although any serious crypto investor knows this is definitely the case, and that they are right to be worried. Wonder if Russia has started dumping their USD reserves into Bitcoin like some sources have speculated? Wonder if emerging reports about foreign nations backing crypto projects to get around US sanctions have anything to do with this? In short, the Fed are a bunch of perfidious economic vandals (“quantative easing”, GFC etc) who should not be running a national economy the size of the US’s, but rather should be in jail. I would take anything they say regarding crypto and reverse it 180 degrees to get a better idea of what the truth might actually be.

🎙⤵️😄