All risk-free investments you can try on Binance as a beginner (and what’s the risk)

All risk-free investments you can try on Binance as a beginner (and what’s the risk)

You want to open a crypto exchange account. After some googles you notice that Binance is pretty good (In fact, Binance is the biggest crypto exchange in the world by trading volume), and wonder if you should just buy-and-hold bitcoin.

Well.. crypto-currency, in 2021, has many more to offer than just buy-and-hold. In fact, there are many risk-free investments that you can participate on decentralized finance just by holding your coins. The problem is, there are many ways to go wrong as well, especially for a beginner. The most common one is that you could send your ERC Token (e.g. ETH) to a different network, resulting a total loss, and would never be able to retrieve the coin again.

Fortunately, Binance has made a tremendous effort to folk (copy) the most popular and sophisticated decentralized finance applications, migrating them into Binance Exchange, making it safer and accessible to many beginners.

In this article, I would introduce the most common risk free investments you could make on Binance Exchange, specifically

Short introduction on the investment

How you can participate

Expected return

Why they make sense

What’s the possible risk that you could face

Table of contents

I have arranged items 3–7 from the easiest to hardest, though all of them are beginner friendly

Definition of “risk free”

Introduction to Binance Earn

Binance Saving

Binance Staking

Binance Vault

Liquidity swap

Neutral position arbitrage

Definition of risk free

There are 2 levels of risk free, in which I would phrase them as dollar level risk free and token level risk free.

Dollar level risk free is the true risk free return that a normal investor probably prefers. It simply means that the total USD value of your portfolio stay the same throughout the investment. On top of that, you will receive additional interest rate return.

Token level risk free, on the other hands, means that the total number of your token (e.g. Bitcoin) stay the same throughout the investment. On top of that, you will receive additional interest rate return.

Introduction to Binance Earn

As there are more and more investment options made available on Binance, they are consolidated under one place named Binance Earn, which you could access under Finance tab in Binance front page.

Binance Saving account

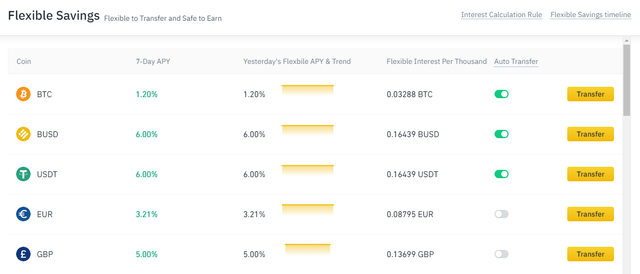

Binance Saving supports both Dollar level risk free and Token level risk free investment.

Binance saving is probably the easiest one to understand. You simply deposit your token into Binance saving, and receive a fixed interest rate daily as specified on the website.

Portal: https://www.binance.com/en/earn#flex-item

Return: 6% p.a. for stable coin (e.g. USDT / BUSD) / 1.2% p.a. for Bitcoin

You could transfer your token into saving account by simply clicking the transfer button, and you would receive interest payment on daily basis. Also, you could transfer money back from saving account to spot account at anytime immediately.

If you are certain that you won’t withdraw your money from saving account for a fixed period (7/14/30 days), you can apply for a Fixed Saving. You can still redeem early and transfer money back to spot account at anytime, but you will lose all the interest payment you received, should you choose to do so.

Why it works?

The most obvious reason is that many traders on Binance trade on margin, meaning that they need to borrow money from other users for leverage trading. Binance has a sophisticated margin system that control the maximum loss a leverage trade could occur, thus providing a risk-free environment for lend-and-borrow.

If you feel like you have spare cash, it is always nice to deposit them to Binance saving, and earn 6% p.a., a perfect dollar level risk free return.

What’s the possible risk?

One obvious risk is that Binance get hack / liquidated. This risk applies to every product I cover in this article so I won’t repeat again.

But another possible risk I want to highlight here is the legitimacy of stable coin token.

When you deposit USD to Binance, you need to convert it to eithe rUSDT / BUSD / DAI / USDC. These are what we referred to as a stable coin, which always peg to 1 USD. However, they might not be back by equal amount of USD and might face an audit risk should the regulator decides to step in and investigate.

The most recent movement includes STABLE ACT which attempts to regulate USDT. If the act is approved and Tether cannot provide sufficient prove on their USD holding, USDT could become worthless.

Binance Staking

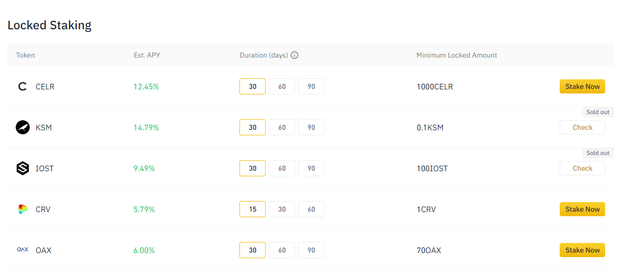

Binance Staking is Token level risk free investment.

If you plan to hold tokens for a longer term (say 1–3 months), you should definitely check out Binance Staking to see if your token is eligible to be staked and receive more tokens of the same kind along the way, known as proof-of-stake.

Portal: https://www.binance.com/en/pos

Portal for ETH: https://www.binance.com/en/eth2

Return: Depends on the token you are holding. For ETH, 10% p.a.. For some other popular tokens, like SUSHI and 1INCH, they provide 15–20% p.a.

Once you decide to stake, you will start to receive the same token as interest payment. You can redeem earlier at anytime, but you will lose all the interest payment you received, should you choose to do so.

Why it works?

Because many tokens, by design, requires other token holder to validate the transaction. Proof of Stake (PoS) concept states that a person can mine or validate block transactions according to how many coins he or she holds. This means that the more coin owned by a miner, the more mining power he or she has.

However, staking outside Binance often requires user to execute multiple smart contracts to get started, and has a minimum staking requirement. For example, ETH2.0 requires user to stake at least 32 ETH (as a validator). If your investment amount is small, it might not be viable to do this because the transaction fee (ether gas) of smart contract could often be very high in a bullish market. Therefore, using Binance Stake could save tremendous amount of transaction cost, as well as provide an error free environment for user to experience PoS.

What’s the possible risk?

For ETH specifically, when user stake ETH, Binance will tokenize it as BETH. User could choose to early redeem the ETH by converting the BETH back to ETH. However, doing this would result in roughly 5% loss, so you need to be 100% sure that you won’t redeem staked ETH before ETH2.0, which the ETA is unknown.

For other tokens, the only risk is the price volatility in the token that you are staking (maybe they would drop to 0 dollar before your staking period is over, just saying…..)

Binance Vault

Binance Vault is Token level risk free investment, specifically for BNB holder.

Portal: https://www.binance.com/en/bnbmining

Return: Depends, but at least 5% p.a. on BNB

According to the official FAQ, BNB Vault is a BNB yield aggregator. Depositing BNB means participating in Launchpool, Savings, Defi staking and other projects and at the same time gaining rewards.

Currently, the BNB saving provides 5% p.a., so its guarantee to have 5% p.a.

What is BNB? BNB is a Binance token that you could use to pay commission fee in trading, in return Binance would offer 25% discount in commission fee. What’s really cool about BNB is that part of the BNB Binance received from trading commission fee would be burned regularly. It implies that the supply of BNB would become lower over time. On the other hand, as more users register on Binance, the demand will increase over time. Simple economics told us that this could drive BNB price up linearly. If you are believer of Binance business model, you should definitely hold some BNBs.

Why it works?

Other development teams often want to have a partnership with Binance to promote their projects. One common way to do it is to accept BNB to ‘mine’ that token, this is known as Launchpool. On top of that, we also have BNB saving account, and defi staking. Combining all different kind of risk-free investments that you could do with BNB is termed as BNB Vault.

What’s the possible risk?

Price volatility in BNB.

Reward from launchpool could be lower than expected, since not all crypto projects can be successful.

Liquidity swap

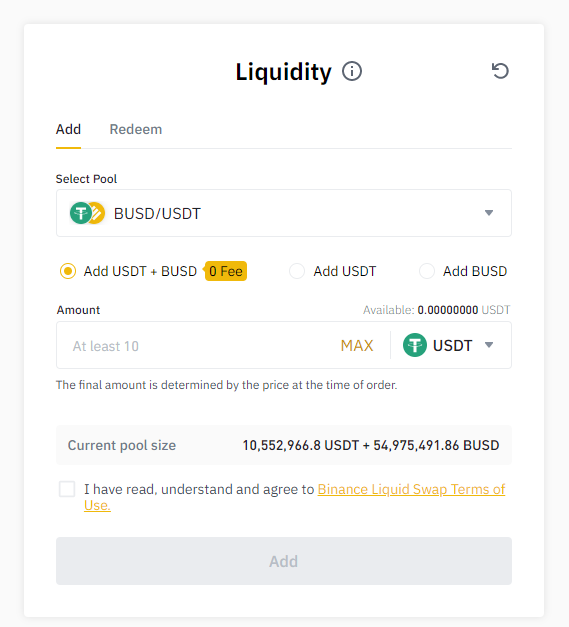

Liquidity swap / Liquidity Provider, often term as LP, supports both Dollar level risk free and Token level risk free investment.

Portal: https://www.binance.com/en/swap/liquidity

Return: 8% on BUSD/USDT, 12% on BTC/WBTC

Binance liquidity swap is a automated market maker (AMM) to facilitate crypto currency exchange. AMM would earn bid ask spread and commission income, distributing them back to the liquidity provider.

For example, when you choose to provide liquidity for BUSD/USDT pair, whenever other user trade BUSD/USDT, part of their commission fee would be distributed back to you!

To add liquidity, you only need to hold one of the token from such pair, and choose “Add USDT” or “Add BUSD”. Binance would help to convert 50% of your holding into a balanced holding pair, and start to use your holding to execute market making order.

Why it works?

In my opinion, LP is probably the most exciting application in 2020 decentralized finance (and still is in 2021). Imagine you want to exchange USDT to BUSD (or vice versa) or BTC to wBTC. These are the token pair that has the same face value, thus having a fixed exchange rate across time. Being a decentralized LP means that no one need to rely on Bank to do such foreign exchange transaction. YOU are the foreign exchange provider, isn’t that cool?

As a result, Binance has opened on some of the stable token pair as a way for user to be the market maker on the trading platform.

What’s the possible risk?

If one of the token suddenly depreciate against another, you will suffer from impermanent loss. You can read more here.

Neutral position arbitrage

This is not a investment product offered by Binance, but a trading strategy that offers Dollar level risk free.

The most common one is known as basis trade.

In a bullish market (vice versa in a bearish market), constructing a basis trade simply means that you open a long position on your spot account and a equal amount of short position with a futures contract:

Buy 1 BTC with USDT.

Open a short position of 1 BTCUSDT Future

Doing so, user could earn an interest rate income called funding rate from the short future position. To simply explain, in a bullish market, BTC future usually marks at a higher price than the spot price. In order for the future price to drop and converge with the spot price, Binance (and other cryptoexchange as well) will offer an interest rate that get paid out every 8 hours whenever you take a short future position.

If you hold the same amount of long and short position, you will establish a neutral position, earning a risk-free funding rate.

On the Binance Future trading platform, you could check out the next funding rate near the price. Binance also shares historical funding rate data on their website.

You could read more about neutral position trading strategy from the official Binance Blog.

If you are feeling excited to open an account on Binance, please consider supporting me by using Referral ID: TPM4YQWA, or simply use this link: https://www.binance.com/en/register?ref=TPM4YQWA, to register a new account. By doing so you will receive 10% commission fee discount on every trade. Thank you very much!