Do Bitcoin whales view crashes as golden opportunities?

Greetings, Readers! Step into our latest blog post

Bitcoin recently rebounded by 4.32%, climbing to $56,956, though it remains at its lowest point since late February amid increased liquidations and mounting market fear.

.png)

Major Reason for the sell off

Mt. Gox Repayments Begin

On July 5, the defunct exchange Mt. Gox initiated repayments to creditors using Bitcoin and Bitcoin Cash through selected exchanges, as confirmed by the Rehabilitation Trustee. This marks a significant milestone in the ongoing resolution of the exchange's legacy.

Government Sell-Offs

Bitcoin sell-offs by governmental entities. Since June 19, Germany and the US alone have transferred 17,788 BTC, valued at approximately $1.08 billion, to exchanges. Together, they hold a combined total of 396,210 BTC, worth $22.78 billion. These movements underscore governmental actions in managing their cryptocurrency holdings amidst market conditions.

Whale Accumulation Amid Market Volatility

Despite recent market selloffs, Bitcoin whales have capitalized on the opportunity to accumulate. Wallets holding over 10,000 BTC reached a six-year high in accumulation, significantly increasing their holdings. This accumulation trend is observed among both large exchange liquidity providers and smaller whale groups, indicating strategic positioning to absorb supply during market fluctuations.

.png)

Implications and Market Outlook

The accumulation by major holders suggests a strong belief in Bitcoin's long-term potential despite recent price volatility. This behavior aligns with a broader strategy to navigate market dynamics and capitalize on emerging opportunities.

Bitcoin's Price Action and Institutional Inflows

Bitcoin has shown resilience, recovering from recent lows to trade at $56,500 with a market cap of $1.114 trillion. Notably, institutional inflows into spot Bitcoin ETFs surged on Friday, with Fidelity leading the charge with a $143 million inflow. This influx reflects institutional confidence in Bitcoin's role as a store of value and hedge against inflation.

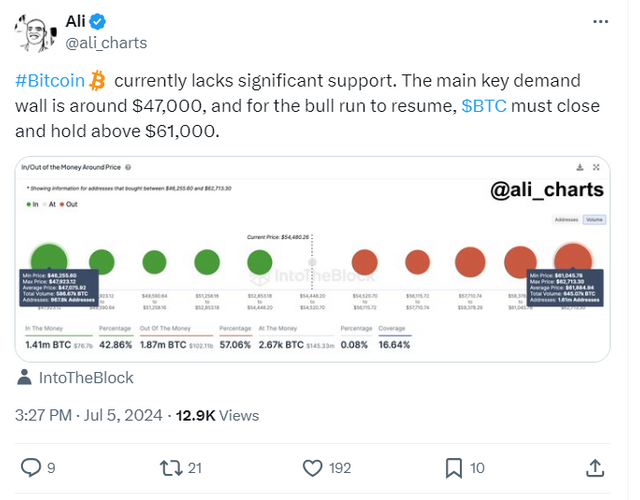

However, it will be interesting to see whether the Bitcoin bulls can seize the lead from here or if the bears continue to dominate. To relaunch the Bitcoin surge, the bulls must push the BTC price above $61,000.

.png)

Future Prospects

Moving forward, market attention will focus on Bitcoin's ability to sustain momentum above $61,000 and catalyze a renewed bullish trend. The accumulation by large wallets underscores a bullish sentiment and readiness to leverage market opportunities amidst evolving market dynamics and regulatory developments.