Banks move leasing contracts to blockchain..Hmmm...

Just read this story this morning, and was mildly optimistic that the banking cartels that control much of our lives, finally were becoming more transparent, in allowing Tennants & landlords to put their leasing guarantees on the block chain.

The trial which took place April this year, in trial involved the use of Distributed Ledger Technology (DLT).

However, whenever a Bank is involved in something so revolultionary, of course, you need to dig deeper.

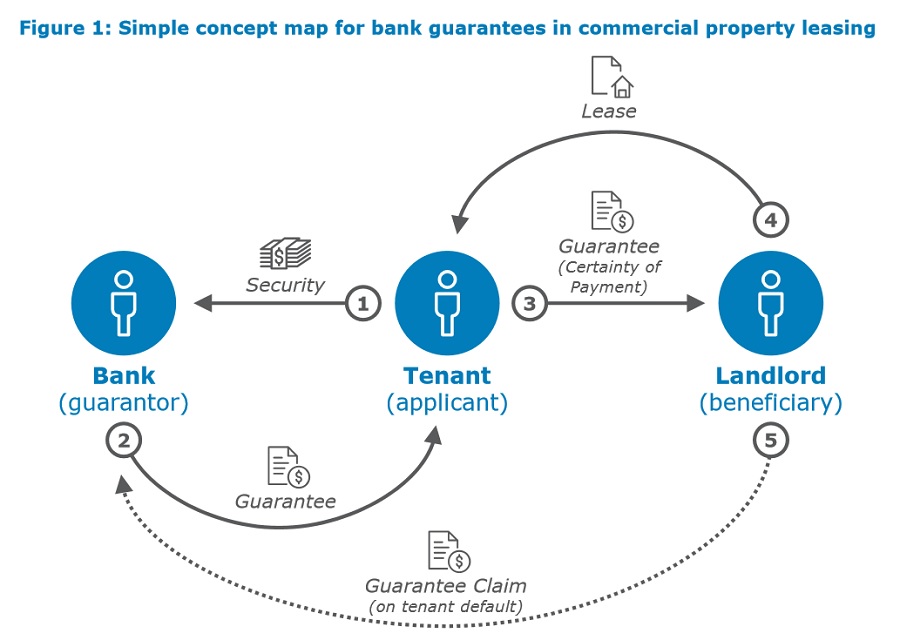

So, as per conventional blockchain, two parties mutually agree on a transaction and the keys are matched on the blockchain, and the value is distributed.

But not DLT. In true banking cartel style, they've found a way to weezel their way into the transaction - a transaction that safeguards the landlord against failure of a tenant meeting their rental obligations. Now why would a bank need to be party to this transaction, if it's on the blockchain? Hmm..

The story reports;

"Each party was also notified at each stage of the guarantee’s lifecycle, with the exception of demand payments — where the tenant was only notified once the bank had completed payment to prevent the tenant from “taking action to adversely affect the landlord’s right to claim against the guarantee”.

Simply because they now have forced their position into the transaction as being the final arbiter of a transaction, that normally wouldn't need to concern them.

It's not rocket science to me that Banks will move to this technology, they have to. But what we're witnessing here is possibly the start of a new crusade. What's next? Will we need the bank's permission to withdrawl the money we lend them? (ie the money we deposit in our bank accounts, that they then lend out, hoping we won't request it back, for margins to fill their pockets)

What will happen in the case of a run on the banks (as we've seen in Japan, Malaysia, Spain and Argentina in the past 2 decades) simply because banks have not received back your money that they leased to someone else for profit? In a digital blockchain world, they can simply deny signing the blockchain off and consequently denying you access to your own money.

To me, it appears there's a play in action here, I don't buy this.

haha upv. :)

It seems everything change as today's generation..have you noticed that? Economic system changed because of this cryptocurrencies.

I follow you, check out my latest post about

I failed many times but i never gave up, the result is incridible!

Great post @imrob makes for interesting times ahead. Looks like everything will be on the block chain soon 😜

kolschcoin? :)

Lol I think there is only one of those 🤣🤣

Interesting post @imrob. We all need to look a little deeper

We should make a crypto coin. Call it fuckdabank coin. Reckon we will make heaps because of the name.

That's an ICO I'd support!