World’s Central Banker: Bitcoin Challenges Heart of Central Banking

World’s Central Banker: Bitcoin Challenges Heart of Central Banking

General Manager of the Bank for International Settlements (BIS), Agustín Carstens, gave a talk at Goethe University in its House of Finance, Tuesday, 6 February in Frankfurt. Titled Money in the Digital Age: What Role for Central Banks?, the talk saw Mr. Carstens acknowledge “We have seen a bit of a shift, to issues at the very heart of central banking. This shift is driven by developments at the cutting edge of technology. While it has been bubbling under the surface for years, the meteoric rise of bitcoin and other cryptocurrencies has led us to revisit some fundamental questions that touch on the origin and raison d’être for central banks.”

As the central banker to the globe’s central banks, the BIS special drawing rights balance nears a quarter trillion in reserves. The body is made up of 60 member states, heavily weighted toward Europe with over half its membership. The Depression-era organization in its current incarnation is a collaborative body issuing stress tests, acting as a prime counterparty, and a trustee to the world’s central banks.

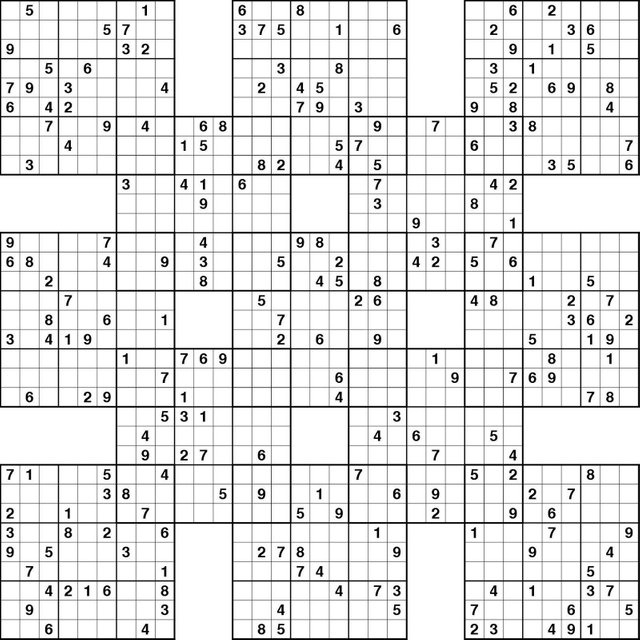

I opened this article in the hopes that it would be about the sudoku pictured... So if I read this correctly, crypto will be assimilated by the “Borg” as it presents a threat to the status quo. But where’s the sudoku?