Crypto is heading for another crash soon - and China isn't to blame

(Warning: Minor hyperbole ahead.)

There's a headline from ZeroHedge that's always stuck with me, and I think it's very representative of the cryptocurrency market at the moment.

When Your Banana-Guy Starts Trading Stocks, You Know It's Over.

Cryptocurrency is the new big thing in trading. Every day, your grandma and her bridge club friends are trawling CoinMarketCap and Reddit looking for the newest "investment opportunities" and "undervalued" cryptos. Buying into ICOs and altcoins, betting on the next big thing. A lot of HODLing. The problem with this kind of investing is threefold;

- It's not investing.

- It's emotionally driven.

- (Therefore) it's unsustainable.

Let me elaborate.

It's not investing, it's speculation.

Investing is defined by the great Benjamin Graham as follows:

"An investment operation is one which, upon thorough analysis promises safety of principal and an adequate return. Operations not meeting these requirements are speculative."

Graham's definition of investing requires sound analysis, and protection against debilitating losses - to achieve these sorts of protection, one must aim for adequate performance. "To the moon" is not an investment strategy. The current structure of the market is mostly supported by speculators, who gamble on securities being worth more later than they are now based on hype, empty promises, and most dangerously - emotion. A market of wannabe "get-rich-quick" schemers.

Go look at twitter for a bit. Search for $BTC, #crypto, and look at all the coins people are talking about. Many will be coins you have never heard of, and people will be putting thousands of USD into them. A good case study is Verge, ticker symbol $XVG. Let's take a look at the home page.

Well designed, sleek, buzzwords highlighted in blue... Let's scroll down.

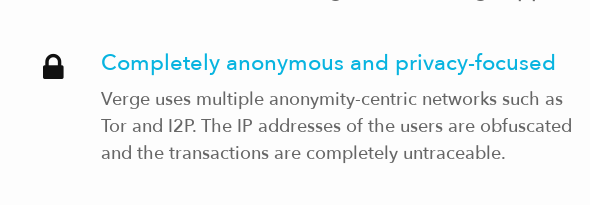

I've cropped the rest out (it's all marketing splooge), but this little box is pretty interesting...

Completely anonymous and untraceable? Sounds brill, how much is a single verge? Let me buy some from my nearest exchange.

The thing is, those statements are not entirely true.

Verge has no privacy.

The blockchain is completely public, and can be analyzed by anyone - there is no obfuscation of any sort, not even mixing, done with a transaction. The blockchain is essentially the same as Bitcoin.Verge is traceable.

Because of the public blockchain, every transaction is visible. Verge is no less traceable than Bitcoin, and due to the relatively low popularity, analysis is made easier. Hell, you can even see a rich list of who has the most Verge (however, at the time of writing, the site is down).Verge has anonymity (but not really).

Verge claims to be anonymous - this is only true in the most barebones sense. Your wallet's transactions are routed through the Tor network or over i2p, obfuscating your IP address. This is not however, anonymity. If somebody knows your wallet address, somebody knows what transactions you make, IP or no IP. The feature isn't even unique to Verge - You can do this with Bitcoin already.

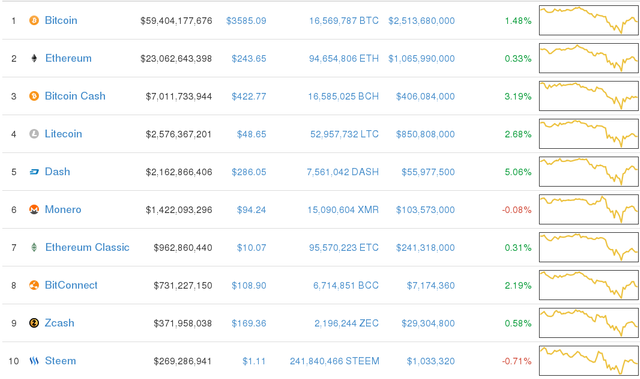

And yet, many people are buying into Verge, with effectively no prior research. It brings nothing new to the table, nothing even vaguely interesting, and yet people are buying it up - hell, if you remove premined and non-mineable coins it's 20th on CoinMarketCap.

Verge is just one example. Similarities ring true across hundreds of cryptos. Hordes of people are buying into useless coins with no future, with relatively large amounts of money, on the hope that they'll be able to flip it for more, later. Speculation is deadly for growth. 2000 called: They want their market back. Because there is no real value in these shitcoins and ICO tokens, the market is propelled to unsustainable levels, and the old adage holds true: What goes up, must come down.

Let me repeat:

This is not investing. This is dangerous.

The market is emotionally driven.

Everybody is looking for the next Bitcoin, i.e. a coin that costs nothing to buy and will experience nearly unprecedented growth over a period of n years. The majority of these speculators are not going to hold their cryptos or use them as intended (as currencies or commodities), but merely sell them when "the time is right". There is nothing inherently "wrong" or "immoral" about it, markets are fair game to all players involved. Unfortunately, however, this has lead to the entire cryptocurrency market being "pinned" to bitcoin - whenever bitcoin booms, everything else booms, and when it busts, again, everything busts. No crypto is being traded on it's own merits, except in unusual circumstances.

Notice the pattern?

Emotional trading makes for a volatile and risky market. Speculating based on emotion leads to serious losses and failure. Greed is the number one emotion that loses investors' money, and that's why Graham told us, aim towards adequate returns. The market is full of banana-men and stock-hawk investors. If you spend all your time reading stock news, worrying about losses that haven't occurred, panic-selling on minimal price drops, or jumping for joy over small bouts of unrealised profits, you may be an emotional investor and your portfolio may be a liability.

Not everybody can be a winner. There is no such thing as a free lunch.

The market is unsustainable

My last point can be summarised short, and sweet. The market is unsustainable in it's current condition. There is a bubble, but it isn't with Bitcoin. In five years, how many Ethereum clones do you think will have people mining (or staking)? We have $ETH, $NEO, $LISK, $EOS, $QTUM, $STRAT... Or what about the tens of "privacy coins", none of which match the technical ability of $XMR (Monero)?

There are hundreds of cryptos out there, and very few do anything different to any other. You really expect [Your Shitcoin Here] is going to be the game-changer? Remember Sturgeon's law - 90% of everything is crap. It applies to cryptos too. Do you think there needs to be, or anyone is going to use; a blockchain for in-game currency ($GAME), a fork of Ethereum basically nobody is going to use ($ETC), or an attempt to start a blockchain tracking deodorant usage and sales ($DEO)?

I'll admit, I made that last one up.

Take a good look at your portfolio. Will any of it still be around in 3 years?

I feel I should've tried to say a bit more in this article and perhaps go into more detail on my last two bullets, but I hope it gets the point across. This is my first piece, so if you have any criticism or corrections, please let me know in the comments. Thanks.

Thank you for expressing your thoughts. This should make us more alert of crypto investing. :)

Congratulations @gassedupoldman! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPNice write-up, especially for a first piece! :) You gained a follower. :)

Also liked the technical analysis in your first-and-only-so-far comment, as well! I have a background as a developer but am recovering from multiple concussions so I can't work at it any more.

Take care!

Interesting read, I think you hit the nail right on the head with your last statement, it's important to look into what need a coin is going to be fulfilling before investing in it. Is there a need? If not, maybe you should re-evaluate your choice. I haven't been following crypto for that long but I try to research any of the coins I choose to invest in.

I think that's the ticket right there, do your own research, and don't just jump on the hype train blindly, maybe the time for easy money has passed in this space as well.

great thoughts. but does this mean you don't own or trade any currencies or only the "unproven" ones?

my take at the issue is that cryptos and blockchains are essentially good and have perspective but not the hundreds (actually over a thousand) we see now - most of which are just derivative and speculative.

the thing to realise is that the market is very young and not matured yet - the oldest one (btc) has been around for only some 8 years. i.e. it still hasn't stood the test of time and the market is behaving erratically and in my opinion the air needs to clear in the coming months and years. it is an interesting look at e.g. coinmarketcap.com from 2 years ago and now - see how many currencies have since ceased existing and how many new ones emerged.

overall, however, I still see the potential in some of the basic and established ones, just can't quite tell where is the limit and when the potential will be realised (if I knew, i'd probably be a millionaire by now)

I don't trade for various reasons, however I do currently put my money in BTC, XMR, and GNT. I use BTC and XMR to buy things and GNT to HODL.

right, i do the same for btc, eth, ltc and kinda wonder if steem also has an investment future (probably the most speculative of them) :)