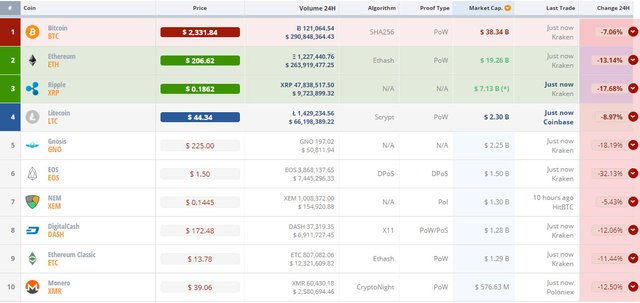

Looming Crypto 'Civil War' Sends Virtual Currencies Crashing, Ethereum Below $200

The notoriously volatile cryptocurrency, whose 160 percent surge this year has captivated everyone from Wall Street bankers to Chinese grandmothers, could be headed for one of its most turbulent stretches yet.

Blame the bitcoin civil war. After two years of largely behind-the-scenes bickering, rival factions of computer whizzes who play key roles in bitcoin’s upkeep are poised to adopt two competing software updates at the end of the month.

That has raised the possibility that bitcoin will split in two, an unprecedented event that would send shockwaves through the $41 billion market.

The community has bitterly argued whether the cryptocurrency should evolve to appeal to mainstream corporations and become more attractive to traditional capital, or fortify its position as a libertarian beacon; whether it should act more as an asset like gold, or as a payment system.

The seeds of the debate were planted years ago: To protect from cyber attacks, bitcoin by design caps the amount of information on its network, called the blockchain.

That puts a ceiling on how many transactions it can process -- the so-called block size limit -- just as the currency’s growing popularity is boosting activity. As a result, transaction times and processing fees have soared to record levels this year, curtailing bitcoin’s ability to process payments with the same efficiency as services like Visa Inc.

To address this problem, two main schools of thought emerged.

On one side are miners, who deploy costly computers to verify transactions and act as the backbone of the blockchain.

They’re proposing a straightforward increase to the block size limit.

On the other is Core, a group of developers instrumental in upholding bitcoin’s bug-proof software.

They insist that to ease blockchain’s traffic jam, some of its data must be managed outside the main network.

They claim that not only would it reduce congestion, but also allow other projects including smart contracts to be built on top of bitcoin.

But moving data off the blockchain effectively diminishes the influence of miners, the majority of whom are based in China and who have invested millions on giant server farms. Not surprisingly, Core’s proposal, called SegWit, has garnered resistance from miners, the most vocal being Wu Jihan, co-founder of the world’s largest mining organization Antpool.

“SegWit is itself a great technology, but the reason it hasn’t taken off is because its interest doesn’t align with miners,” Wu said.

While both sides have big incentives to reach a consensus, bitcoin’s lack of a central authority has made compromise difficult. Even professional traders who’ve followed the dispute’s twists and turns aren’t sure how it will all pan out.

Their advice: brace for volatility and be ready to act fast once a clear outcome emerges.

“It’s a high-stakes game of chicken,” said Arthur Hayes, a former market maker at Citigroup Inc. who now runs BitMEX, a bitcoin derivatives venue in Hong Kong. “If you’re a trader, there’s a lot of uncertainty as to what happens. Once there’s a definitive signal about what will be done, the price could move very quickly.”